I Problem Set 1 - Solution

I.1 Geometric Sums

Let us denote the geometric sum of interest by \(S\): \[S=\sum_{i=0}^n x^i = 1+x+x^2+...+x^n.\] The trick to calculate this sum is to multiply it by \(x\), which allows to get: \[xS=x+x^2+x^3+...+x^{n+1}.\] We can see that this is almost the same sum as the previous one except for the first term, which is missing, and the last term, which was absent from \(S\), therefore: \[\begin{aligned} xS&=-1+1+x+x^2+...+x^n+x^{n+1}\\ xS&=-1+S+x^{n+1} \end{aligned}\] This implies (for \(x\neq1\)): \[1-x^{n+1}=(1-x)S \quad \Rightarrow \quad S=\frac{1-x^{n+1}}{1-x}.\]

For \(S\) to have a finite value when \(n \to \infty\), we need that \(x^{n+1}\) stays finite. This happens when: \[\lvert x\rvert<1.\] In the knife edge case when \(x=1\), the sum goes to infinity since it is then equal to \(n+1\). If \(x=-1\), then the sum oscillates between \(1\) and \(-1\) and does not have a limit when \(n\) goes to infinity.

From question 1 and 2, we know that when \(\lvert x\rvert<1\), \(x^{n+1} \to 0\) when \(n \to \infty\), and therefore: \[\sum_{i=0}^{\infty} x^i = 1+x+x^2+...+x^n+...=\frac{1}{1-x}.\]

We just factor in \(x^m\) and then use the formula in question 1: \[\begin{aligned} \sum_{i=m}^n x^i &= x^m+x^{m+1}+...+x^n\\ &=x^m\left(1+x+...+x^{n-m}\right)\\ &=x^m\frac{1-x^{n-m+1}}{1-x}\\ \sum_{i=m}^n x^i &=\frac{x^m - x^{n+1}}{1-x}. \end{aligned}\]

The present discounted value of an infinite stream of incomes, which grows at rate \(g=2\)%, starts at \(y_0=90000\), if the interest rate is \(i=3\)% is: \[y_0+y_0\frac{1+g}{1+i}+y_0\frac{(1+g)^2}{(1+i)^2} + ...\] Using the formula found in question 3 with \(x=(1+g)/(1+i)\), we get: \[y_0+y_0\frac{1+g}{1+i}+y_0\frac{(1+g)^2}{(1+i)^2} + ...=y_0\dfrac{1}{1-\frac{1+g}{1+i}}=\frac{y_0(1+i)}{i-g}\] A numerical application gives (see Google Sheet): \[\frac{y_0(1+i)}{i-g}=\frac{90000 *(1+0.03)}{0.03-0.02}=9270000.\]

I.2 Taylor Approximations

We have: \[ (1+x)^n= \sum_{k=0}^n {{n}\choose{k}} \cdot x^k\] When \(x\) is small, all the \(x^k\) terms for \(k\geq 2\) are negligible, and therefore: \[(1+x)^n\approx 1+{{n}\choose{1}}x=1+nx.\] If you do not know what \({n}\choose{k}\) means, that is fine too. You can prove the same result using recursion. For \(n=1\), we know that \((1+x)^1=1+x\) (obviously). Assume that the approximation is true for \(n\), or that \((1+x)^n \approx 1+nx\), let’s prove that it is true for \(n+1\): \[ \begin{aligned} (1+x)^{n+1}&=(1+x)^n(1+x) \\ &\approx (1+nx)(1+x) \\ &\approx 1+(n+1)x + nx^2 \\ (1+x)^{n+1}&\approx 1+(n+1)x \end{aligned} \] which proves the proposition for \(n+1\). Thus, the Taylor approximation is true for any \(n \in \mathbb{N}\).

We have: \[(1+x)(1+y)=1+x+y+xy.\] When \(x\) and \(y\) are both small, then \(xy\) is negligible, which gives the result: \[(1+x)(1+y)\approx1+x+y.\]

Using the formula proven in Problem 1, we get that: \[\frac{1}{1+y}=1-y+y^2-y^3+...\] When \(x\) and \(y\) are both small, all terms of the product are negligible except for first-order terms: \[\frac{1+x}{1+y} \approx 1+x-y.\]

Denote the price level by \(p_t\) (that is, in dollars, the price of a representative basket of goods). Inflation \(\pi_t\) at time \(t\) is defined as the rate of growth of this price level between \(t\) and \(t+1\): \[\frac{p_{t+1}}{p_t}=1+\pi_t.\] If you leave one dollar at the bank, and if the nominal interest rate is given by \(i_t\), then you end up at the end of the period with \(1+i_t\) dollars at the bank. With this, you can buy a quantity of goods given by \((1+i_t)/p_{t+1}\). If you buy a quantity of goods at time \(t\), then you get a number of goods equal to \(1/p_t\). Thus, the rate of increase in your purchasing power if you leave your money in the bank is given by: \[\frac{(1+i_t)/p_{t+1}}{1/p_t}=\frac{1+i_t}{1+\pi_t}.\] An exact value for the real interest rate is thus: \[\begin{aligned} \frac{1+i_t}{1+\pi_t}-1&=\frac{1+0.01}{1+0.015}-1\\ &=-0.00492610837\\ \frac{1+i_t}{1+\pi_t}-1&= -0.492610837\%. \end{aligned}\] An approximate value from the above formula is: \[\begin{aligned} \frac{1+i_t}{1+\pi_t}-1&\approx1+i_t-\pi_t-1\\ &\approx0.01-0.015\\ \frac{1+i_t}{1+\pi_t}-1&\approx-0.5\%. \end{aligned}\] This is not such a bad approximation.

I.3 Growth Rates

Iterating on the formula: \[y_{t+1}=(1+g)y_t \quad \Rightarrow \quad y_T=(1+g)^Ty_0,\] allows to find the result: \[G = \frac{y_T}{y_0}-1=(1+g)^T-1.\]

Again, inverting the previous relation: \[G = (1+g)^T-1,\] allows to find: \[\boxed{g = \frac{y_{t+1}}{y_{t}}-1=(1+G)^{1/T}-1}.\]

Applying the previous formula allows to get (see Google Sheet): \[\begin{aligned} g &=(1+0.01)^{1/365}-1\\ &= 0.00002726155\\ g &=0.0027\% \end{aligned}\] You give up approximately $2.7 every day (your bank most likely is investing this money on your behalf, so you are rather giving this money to your bank): \[0.00002726155*100000=2.7.\]

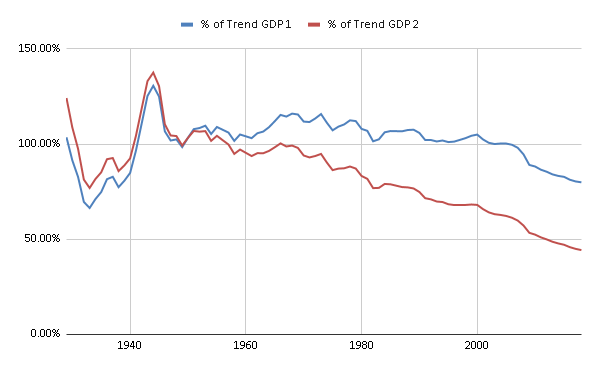

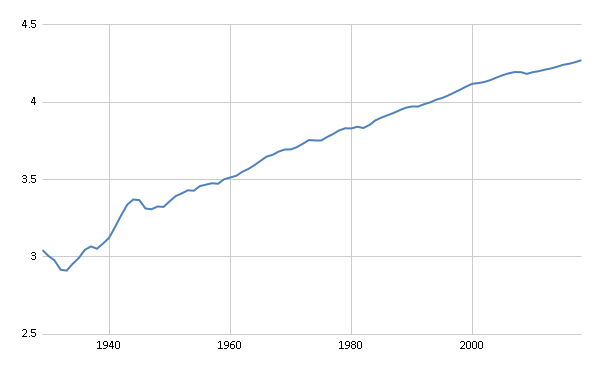

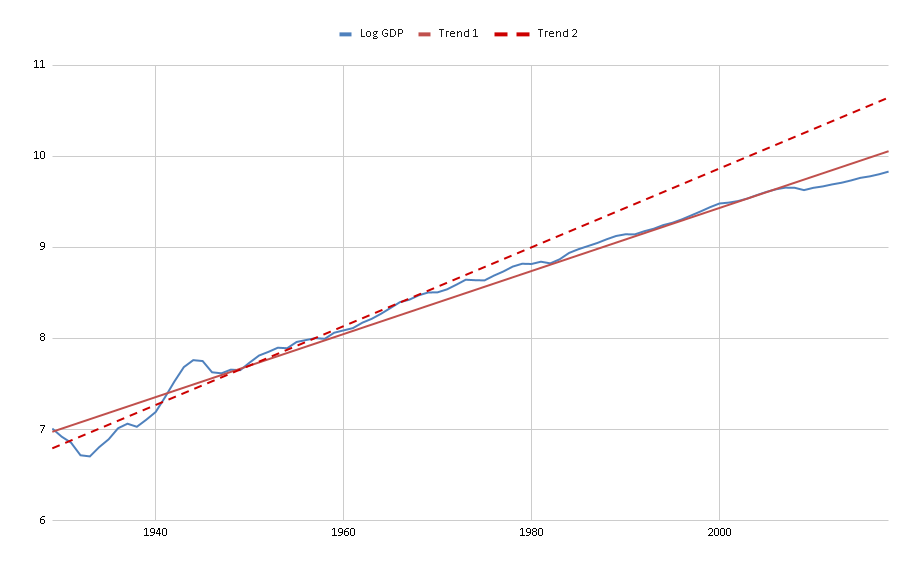

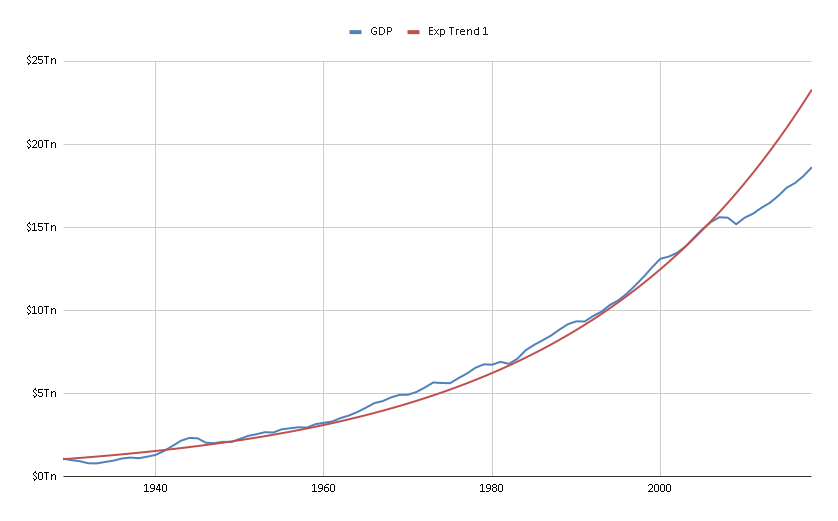

I.4 Replicating Figures 1.1, 1.2, and 1.3

See Google Sheet.

See Google Sheet.

See Google Sheet.

- See Google Sheet.

- See Google Sheet.

- See Google Sheet.