Error in readChar(con, 5L, useBytes = TRUE) :

impossible d'ouvrir la connexionSupervisory Banking Statistics

Data - ECB

Info

Data on monetary policy

| source | dataset | Title | Download | Compile |

|---|---|---|---|---|

| ecb | SUP | Supervisory Banking Statistics | 2025-08-28 | [2025-12-13] |

| bdf | FM | Marché financier, taux | 2025-12-13 | [2025-12-13] |

| bdf | MIR | Taux d'intérêt - Zone euro | 2025-08-04 | [2025-12-13] |

| bdf | MIR1 | Taux d'intérêt - France | 2025-08-04 | [2025-12-13] |

| bis | CBPOL | Policy Rates, Daily | 2025-10-11 | [2025-10-11] |

| ecb | BSI | Balance Sheet Items | NA | [2025-12-19] |

| ecb | BSI_PUB | Balance Sheet Items - Published series | NA | [2025-12-19] |

| ecb | FM | Financial market data | NA | [2025-12-19] |

| ecb | ILM | Internal Liquidity Management | NA | [2025-12-19] |

| ecb | ILM_PUB | Internal Liquidity Management - Published series | 2024-09-10 | [2025-08-29] |

| ecb | MIR | MFI Interest Rate Statistics | 2025-08-28 | [2025-12-19] |

| ecb | RAI | Risk Assessment Indicators | 2025-08-28 | [2025-12-19] |

| ecb | YC | Financial market data - yield curve | NA | [2025-12-13] |

| ecb | YC_PUB | Financial market data - yield curve - Published series | NA | [2025-12-13] |

| ecb | liq_daily | Daily Liquidity | 2025-06-06 | [2025-12-19] |

| eurostat | ei_mfir_m | Interest rates - monthly data | 2025-12-13 | [2025-12-13] |

| eurostat | irt_st_m | Money market interest rates - monthly data | 2025-12-13 | [2025-12-13] |

| fred | r | Interest Rates | 2025-12-13 | [2025-12-13] |

| oecd | MEI | Main Economic Indicators | 2025-07-24 | [2024-04-16] |

| oecd | MEI_FIN | Monthly Monetary and Financial Statistics (MEI) | 2025-07-24 | [2024-09-15] |

LAST_COMPILE

| LAST_COMPILE |

|---|

| 2025-12-19 |

Last

Code

SUP %>%

group_by(TIME_PERIOD, FREQ) %>%

summarise(Nobs = n()) %>%

ungroup %>%

group_by(FREQ) %>%

arrange(desc(TIME_PERIOD)) %>%

filter(row_number() == 1) %>%

print_table_conditional()| TIME_PERIOD | FREQ | Nobs |

|---|---|---|

| 2025-Q1 | Q | 11879 |

| 2024-S2 | H | 1768 |

Info

- Data Structure Definition (DSD). html

TITLE

Code

SUP %>%

group_by(TITLE) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

{if (is_html_output()) datatable(., filter = 'top', rownames = F) else .}BS_SUFFIX

Code

SUP %>%

left_join(BS_SUFFIX, by = "BS_SUFFIX") %>%

group_by(BS_SUFFIX, Bs_suffix) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| BS_SUFFIX | Bs_suffix | Nobs |

|---|---|---|

| E | Euro | 332941 |

| PCT | Percentage | 110265 |

| LAF | NA | 30171 |

| Z | Not applicable | 14983 |

CB_EXP_TYPE

Code

SUP %>%

left_join(CB_EXP_TYPE, by = "CB_EXP_TYPE") %>%

group_by(CB_EXP_TYPE, Cb_exp_type) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| CB_EXP_TYPE | Cb_exp_type | Nobs |

|---|---|---|

| ALL | All exposures | 330007 |

| _Z | Not applicable | 113531 |

| N_ | Non-performing exposures | 17909 |

| ST2 | Assets with significant increase in credit risk since initial recognition but not credit-impaired (Stage 2) | 9632 |

| P_ | Performing exposures | 4492 |

| NFM | Non-performing exposures with forbearance measures | 4054 |

| PFM | Performing exposures with forbearance measures | 4047 |

| ST1 | Assets without significant increase in credit risk since initial recognition (Stage 1) | 1672 |

| ST3 | Credit-impaired assets (Stage 3) | 1672 |

| PCI | Purchased or originated credit-impaired financial assets | 1344 |

CB_ITEM

Code

SUP %>%

left_join(CB_ITEM, by = "CB_ITEM") %>%

group_by(CB_ITEM, Cb_item) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()SBS_DI_1

Code

SUP %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

group_by(SBS_DI_1, Sbs_di_1) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| SBS_DI_1 | Sbs_di_1 | Nobs |

|---|---|---|

| SII | Significant institutions | 371287 |

| LSI | Less significant institutions | 117073 |

SBS_BREAKDOWN

Code

SUP %>%

left_join(SBS_BREAKDOWN, by = "SBS_BREAKDOWN") %>%

group_by(SBS_BREAKDOWN, Sbs_breakdown) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| SBS_BREAKDOWN | Sbs_breakdown | Nobs |

|---|---|---|

| _T | Total | 284224 |

| AMC | Classification by business model - asset manager & custodian | 12162 |

| CWH | Classification by business model - corporate/wholesale lenders | 12162 |

| DEV | Classification by business model - development/promotional lenders | 12162 |

| DIV | Classification by business model - diversified lenders | 12162 |

| NC | Classification by business model - others/ not classified | 12162 |

| RCCL | Classification by business model - retail lenders and consumer credit lenders | 12162 |

| UNI | Classification by business model - universal and investment banks | 12162 |

| GSIB | Classification by size/business model - G-SIBs | 8798 |

| SL30 | Classification by size - banks with total assets less than 30 billion of EUR | 8798 |

| SM20 | Classification by size - banks with total assets more than 200 billion of EUR | 8798 |

| ST10 | Classification by size - banks with total assets between 30 billion and 100 billion of EUR | 8798 |

| ST20 | Classification by size - banks with total assets between 100 billion and 200 billion of EUR | 8798 |

| LORI | Classification by risk - banks with low risk | 8468 |

| MHRI | Classification by risk - banks with medium, high risk and non-rated | 8468 |

| SML | Classification by business model - small market lenders | 8468 |

| DOM | Classification by geographical diversification - banks with significant domestic exposures | 8444 |

| EEA | Classification by geographical diversification - banks with largest non-domestic exposures in non-SSM EEA | 8444 |

| NEEA | Classification by geographical diversification - banks with largest non-domestic exposures in non-EEA Europe | 8444 |

| ROW | Classification by geographical diversification - banks with largest non-domestic exposures in RoW | 8444 |

| SSM | Classification by geographical diversification - banks with largest non-domestic exposures in the SSM | 8444 |

| CSCB | Classification by business model-central savings and cooperative banks | 3694 |

| EML | Classification by business model-emerging markets lenders | 3694 |

COUNT_AREA

Code

SUP %>%

left_join(COUNT_AREA, by = "COUNT_AREA") %>%

group_by(COUNT_AREA, Count_area) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()FREQ

Code

SUP %>%

left_join(FREQ, by = "FREQ") %>%

group_by(FREQ, Freq) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| FREQ | Freq | Nobs |

|---|---|---|

| Q | Quarterly | 467552 |

| H | Half-yearly | 20808 |

REF_AREA

Code

SUP %>%

left_join(REF_AREA, by = "REF_AREA") %>%

group_by(REF_AREA, Ref_area) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| REF_AREA | Ref_area | Nobs |

|---|---|---|

| B01 | EU countries participating in the Single Supervisory Mechanism (SSM) (changing composition) | 231742 |

| AT | Austria | 12606 |

| BE | Belgium | 12606 |

| CY | Cyprus | 12606 |

| DE | Germany | 12606 |

| EE | Estonia | 12606 |

| ES | Spain | 12606 |

| FI | Finland | 12606 |

| FR | France | 12606 |

| GR | Greece | 12606 |

| IE | Ireland | 12606 |

| IT | Italy | 12606 |

| LT | Lithuania | 12606 |

| LU | Luxembourg | 12606 |

| LV | Latvia | 12606 |

| MT | Malta | 12606 |

| NL | Netherlands | 12606 |

| PT | Portugal | 12606 |

| SI | Slovenia | 12606 |

| SK | Slovakia | 12606 |

| BG | Bulgaria | 8552 |

| HR | Croatia | 8552 |

COUNTERPART_SECTOR

Code

SUP %>%

left_join(COUNTERPART_SECTOR, by = "COUNTERPART_SECTOR") %>%

group_by(COUNTERPART_SECTOR, Counterpart_sector) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| COUNTERPART_SECTOR | Counterpart_sector | Nobs |

|---|---|---|

| _Z | Not applicable | 381812 |

| S13 | General government | 28245 |

| S11 | Non financial corporations | 23371 |

| S14 | Households | 21779 |

| S12R | Other financial corporations | 11661 |

| S122Z | Deposit-taking corporations except the central bank and excluding electronic money institutions principally engaged in financial intermediation | 7430 |

| S121 | Central bank | 7399 |

| S1V | Non-financial corporations, households and NPISH | 6663 |

TIME_FORMAT

Code

SUP %>%

group_by(TIME_FORMAT) %>%

summarise(Nobs = n()) %>%

arrange(-Nobs) %>%

print_table_conditional()| TIME_FORMAT | Nobs |

|---|---|

| P3M | 467552 |

| P6M | 20808 |

Performance Indicators

https://www.bankingsupervision.europa.eu/banking/statistics/html/index.en.html

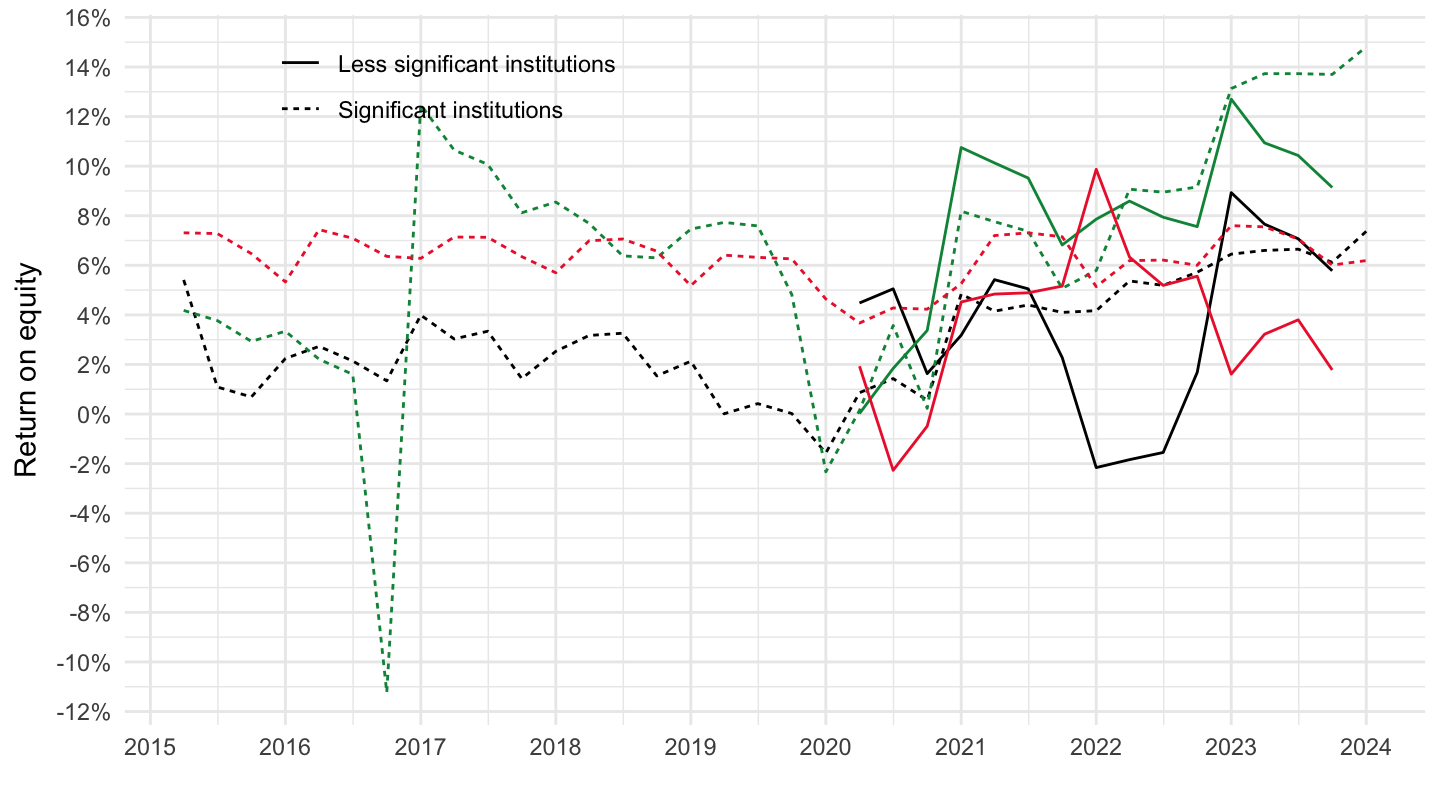

Return on equity

Graph

significant institutions (SIs) and less significant institutions (LSIs):

Code

SUP %>%

filter(grepl("Return on equity", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE"),

BS_SUFFIX == "PCT") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Return on equity") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(7) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-100, 100, 2),

labels = percent_format(accuracy = 1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

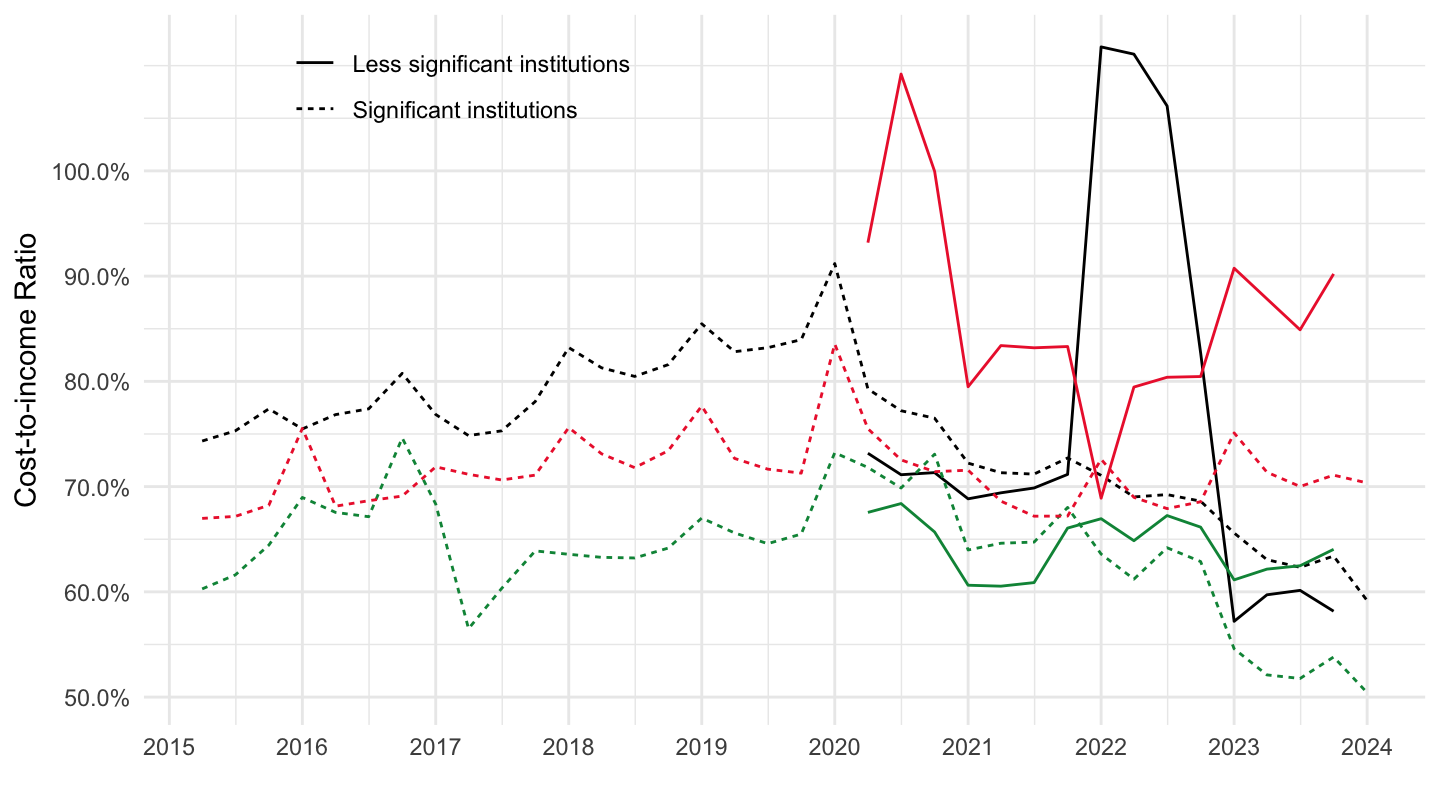

Cost-to-income ratio

Code

SUP %>%

filter(grepl("Cost-to-income ratio", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE"),

BS_SUFFIX == "PCT") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Cost-to-income Ratio") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(7) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 100, 10),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

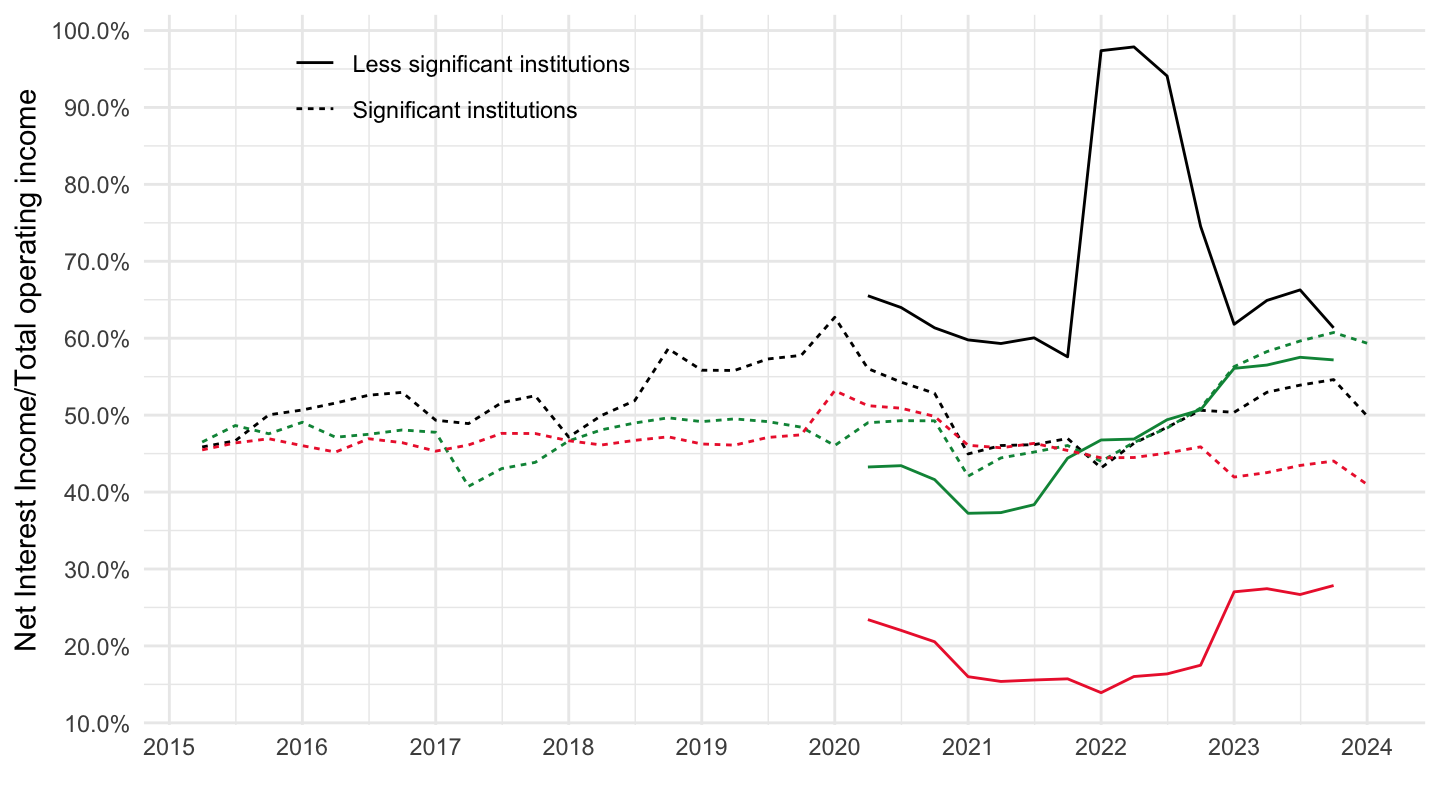

Net interest income

FR, IT, DE

Code

SUP %>%

filter(grepl("Net interest income", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE"),

BS_SUFFIX == "PCT") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Income/Total operating income") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(7) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 100, 10),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

FR, IT, DE, ES, NL, SI

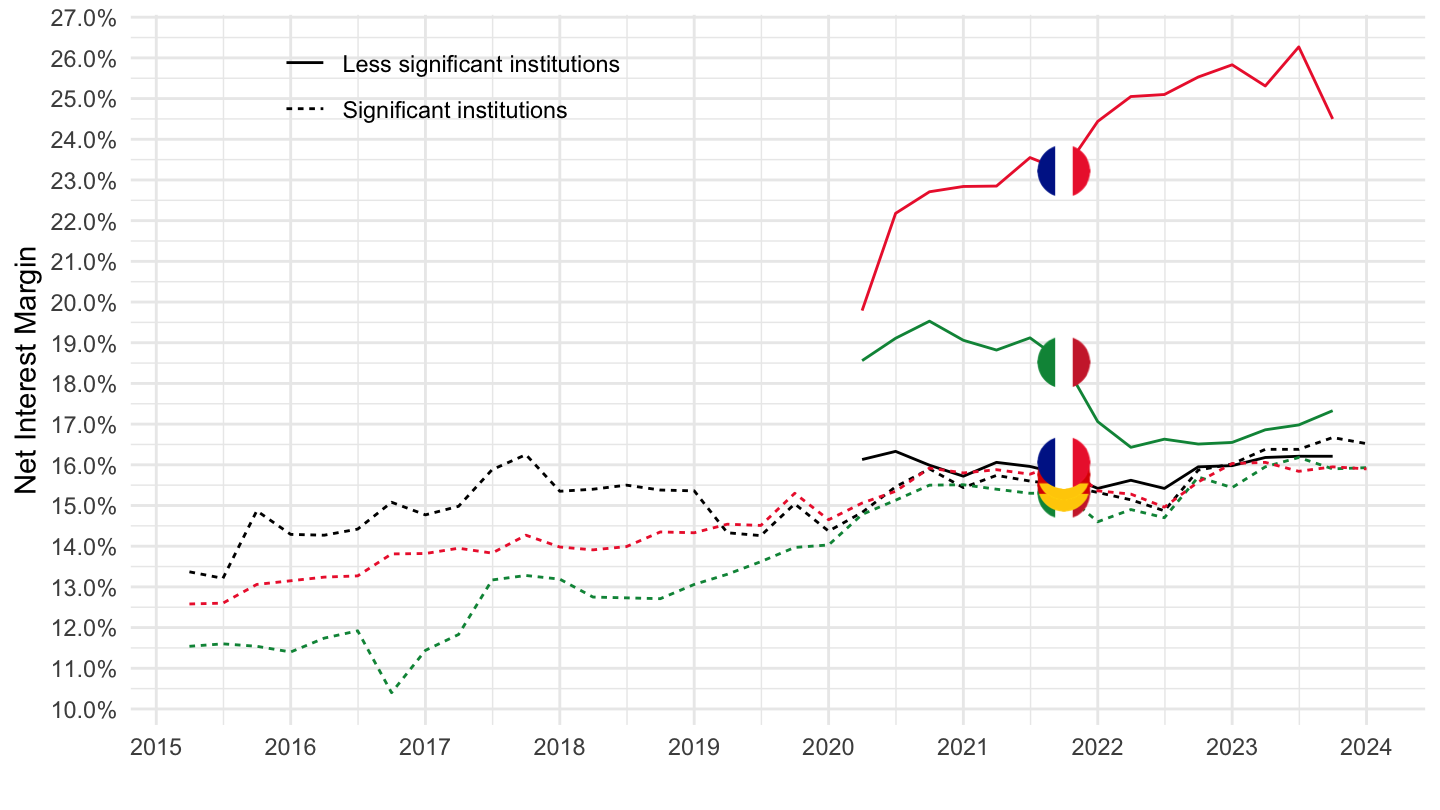

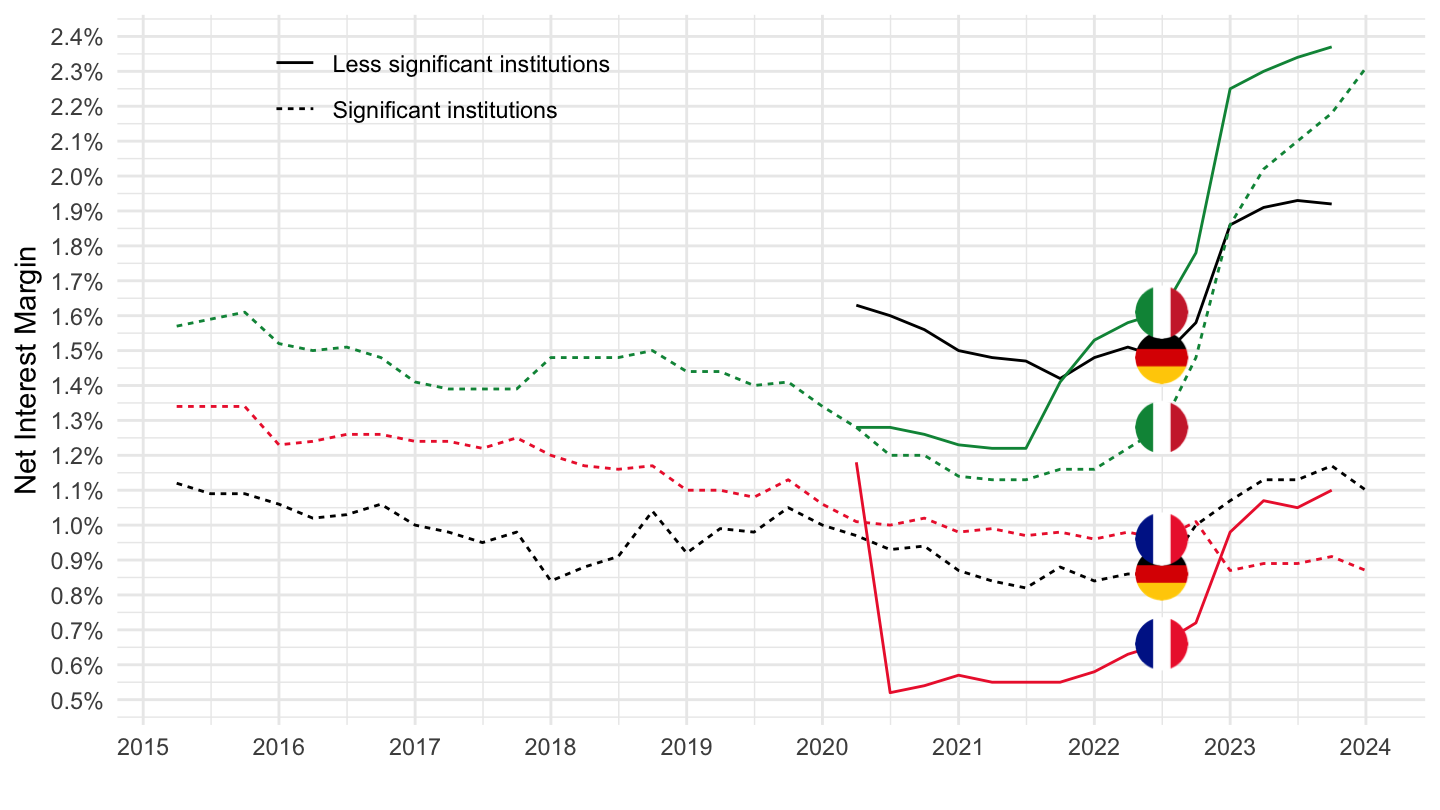

Net interest margin

FR, IT, DE

Code

SUP %>%

filter(grepl("Net interest margin", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Margin") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 50, 0.1),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

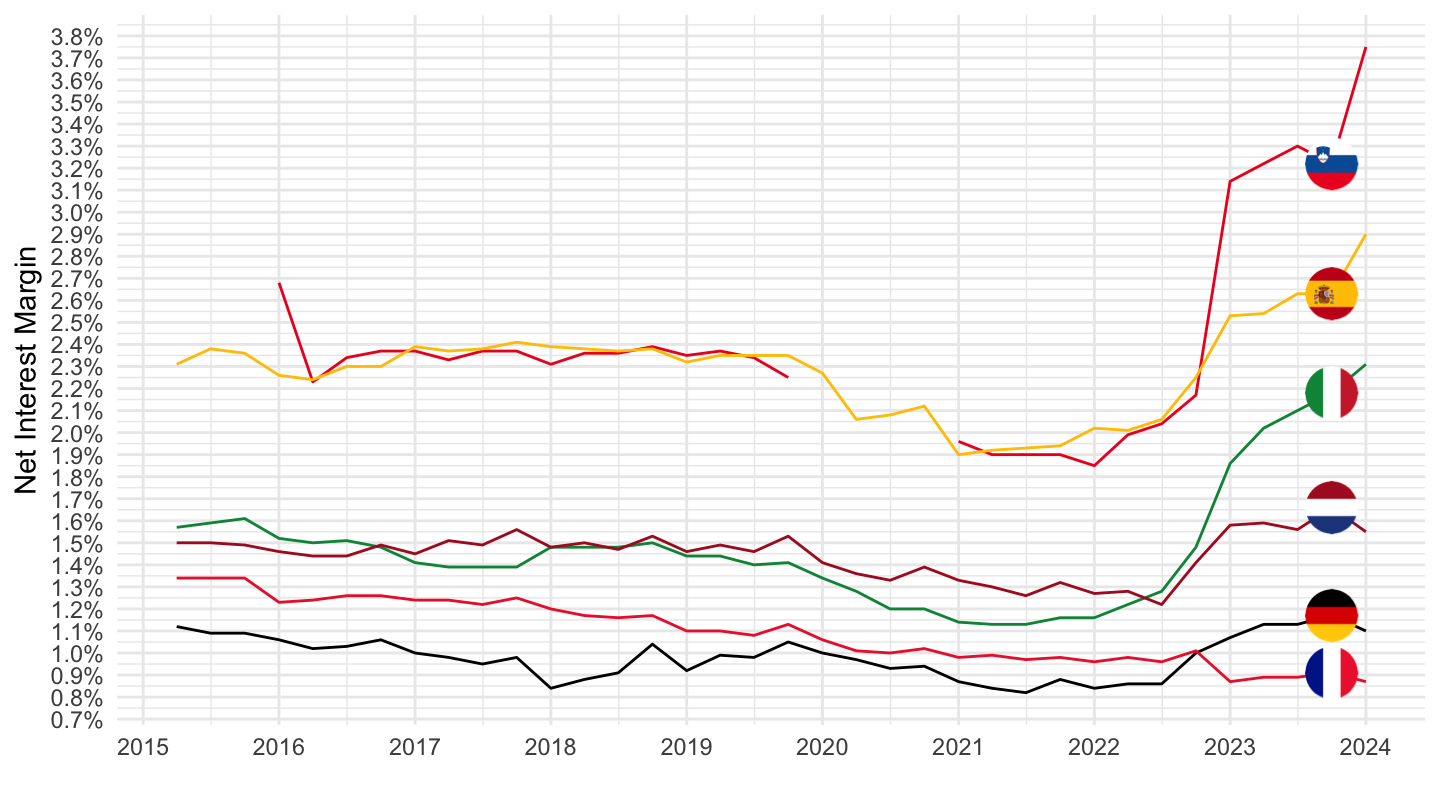

FR, IT, DE, ES, NL, SI

Code

SUP %>%

filter(grepl("Net interest margin", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE", "ES", "NL", "SI"),

SBS_DI_1 == "SII") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

quarter_to_date %>%

arrange(desc(date)) %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Margin") +

geom_line(aes(x = date, y = OBS_VALUE, color = color)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 50, 0.1),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

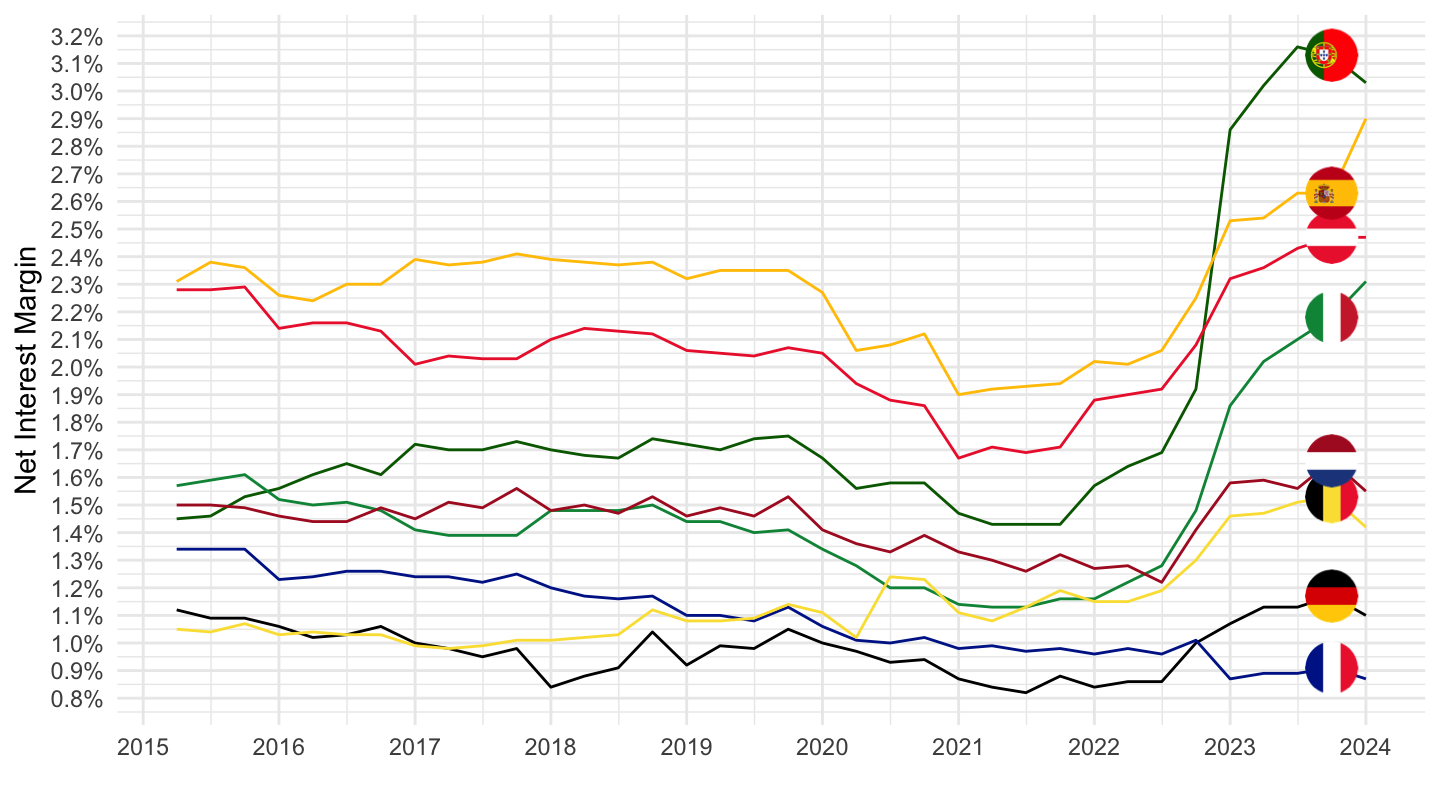

FR, IT, DE, ES, NL, BE, AT, PT

2015-

Code

SUP %>%

filter(grepl("Net interest margin", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE", "ES", "NL", "BE", "AT", "PT"),

SBS_DI_1 == "SII") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

quarter_to_date %>%

arrange(desc(date)) %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

mutate(color = ifelse(REF_AREA == "FR", color2, color)) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Margin") +

geom_line(aes(x = date, y = OBS_VALUE, color = color)) +

add_flags(8) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 50, 0.1),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

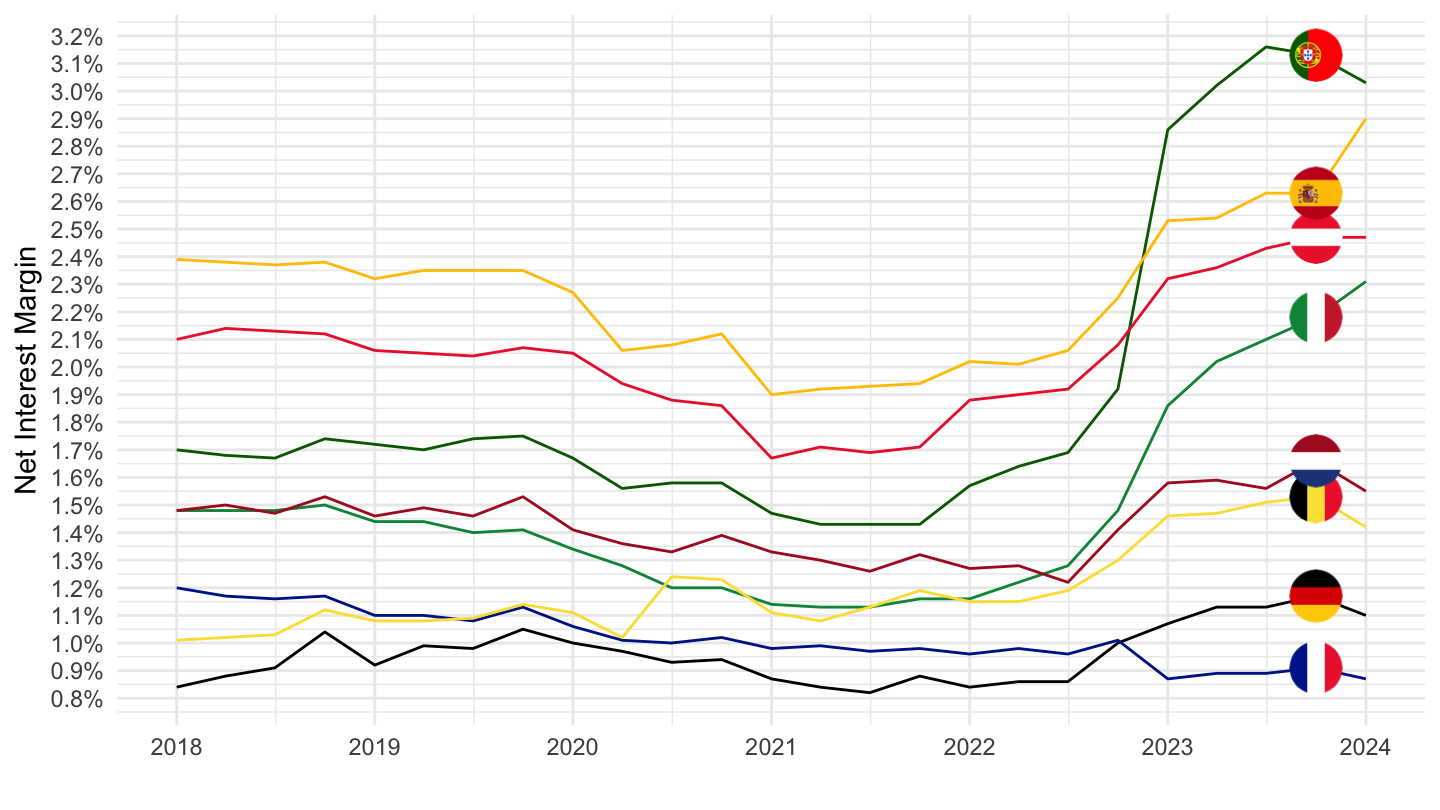

2018-

Code

SUP %>%

filter(grepl("Net interest margin", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE", "ES", "NL", "BE", "AT", "PT"),

SBS_DI_1 == "SII") %>%

left_join(REF_AREA, by = "REF_AREA") %>%

quarter_to_date %>%

filter(date >= as.Date("2018-01-01")) %>%

arrange(desc(date)) %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

mutate(color = ifelse(REF_AREA == "FR", color2, color)) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Margin") +

geom_line(aes(x = date, y = OBS_VALUE, color = color)) +

add_flags(8) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 50, 0.1),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())

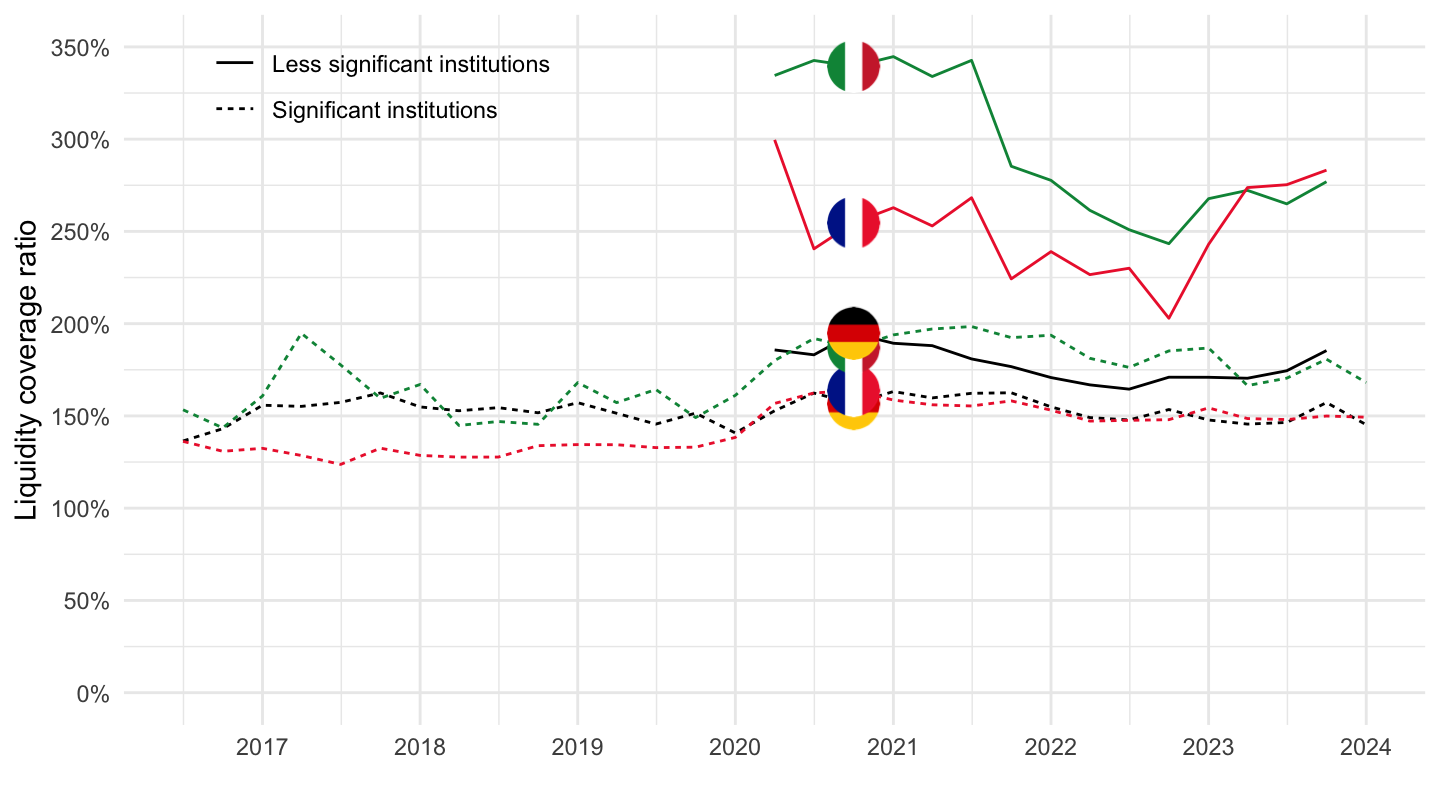

Liquidity

Liquidity coverage ratios (LCR)

The LCR is the percentage resulting from dividing the bank’s stock of high-quality assets by the estimated total net cash outflows over a 30 calendar day stress scenario.

Code

SUP %>%

filter(CB_ITEM == "I3017",

REF_AREA %in% c("U2", "FR", "IT", "DE"),

!(SBS_DI_1 == "_Z")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

arrange(desc(date)) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Liquidity coverage ratio") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(0, 500, 50),

labels = percent_format(accuracy = 1),

limits = c(0, 3.5)) +

theme(legend.position = c(0.2, 0.90),

legend.title = element_blank())

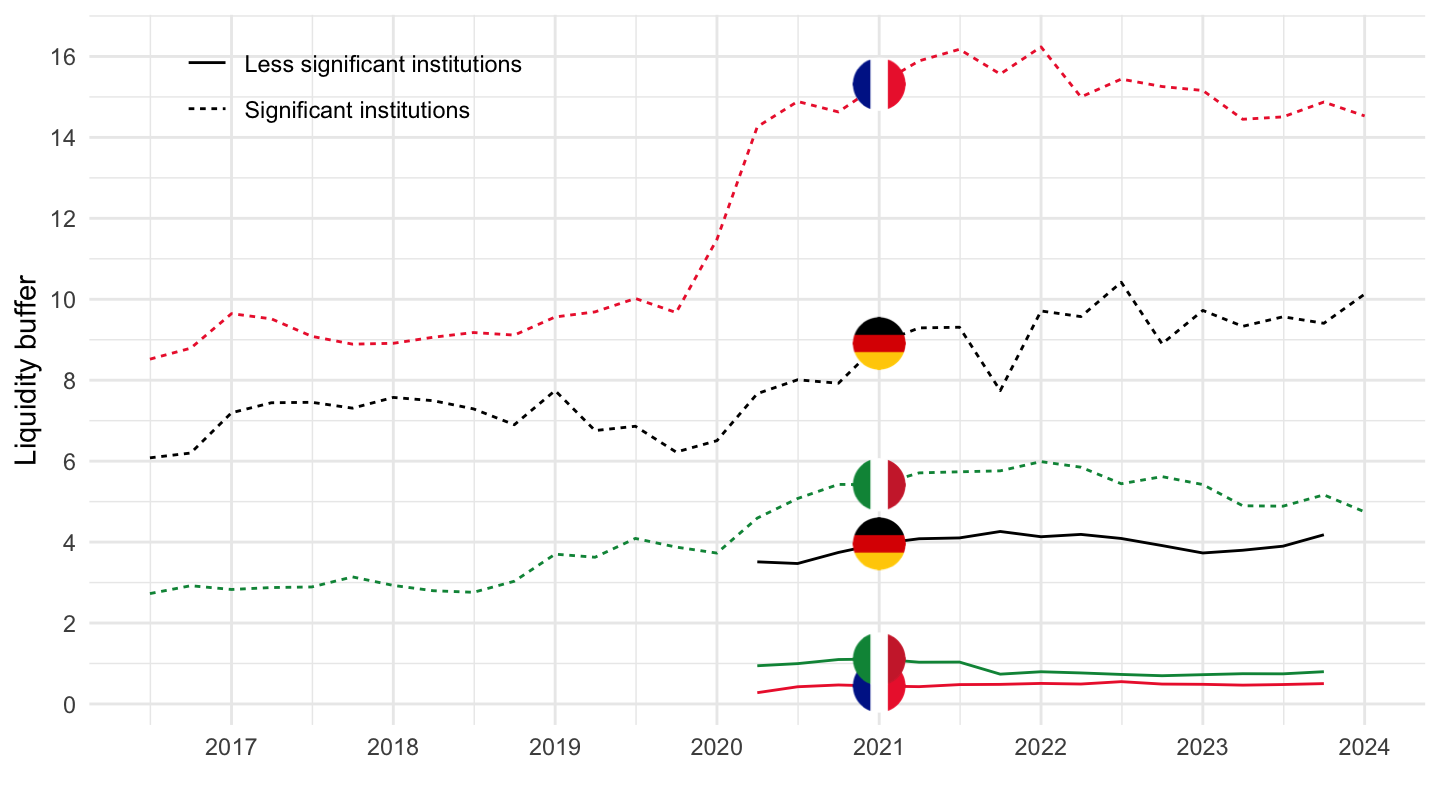

Liquidity buffer

Code

SUP %>%

filter(CB_ITEM == "A6310",

REF_AREA %in% c("U2", "FR", "IT", "DE")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

arrange(desc(date)) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Liquidity buffer") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = seq(0, 1000, 2)) +

theme(legend.position = c(0.2, 0.90),

legend.title = element_blank())

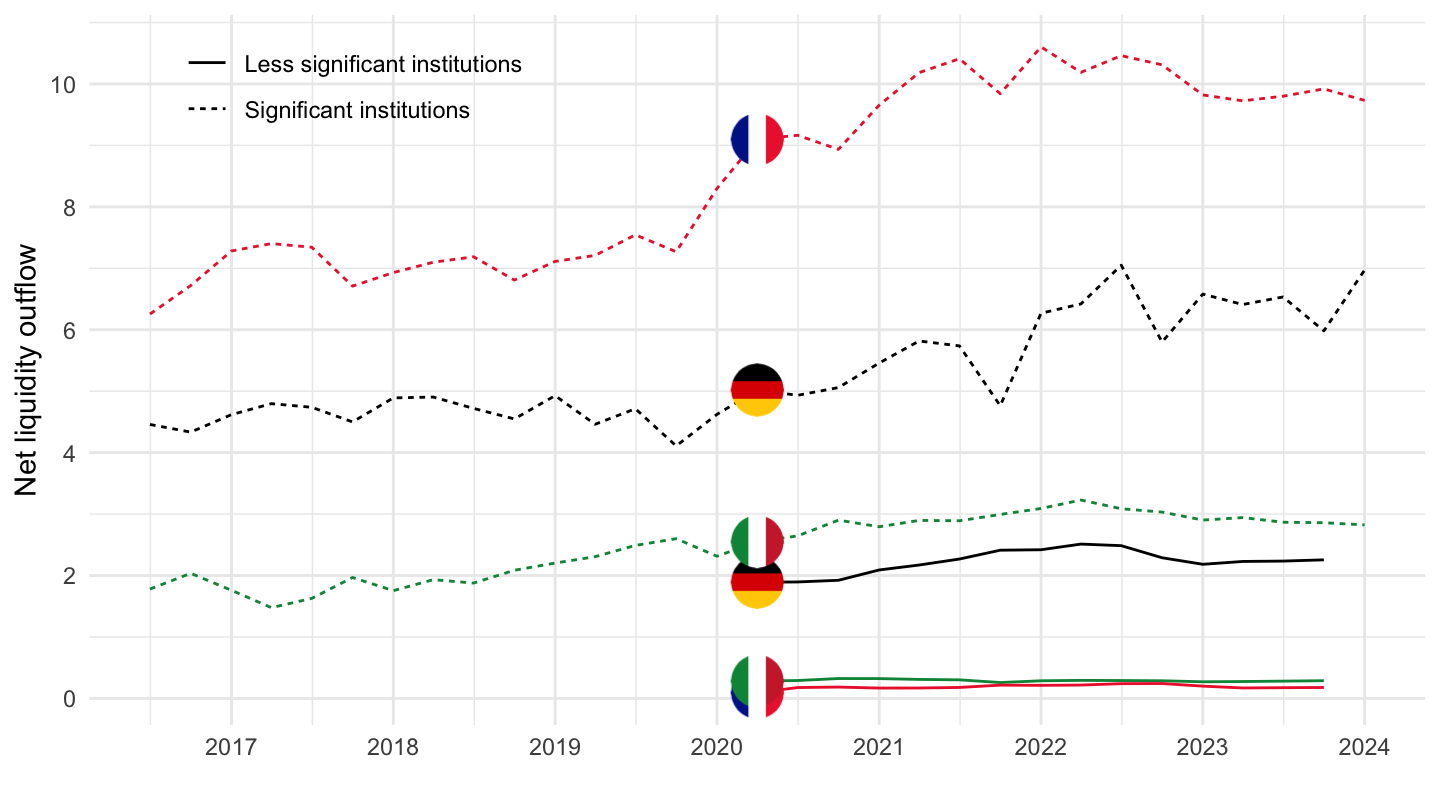

Net liquidity outflow

Code

SUP %>%

filter(CB_ITEM == "A6320",

REF_AREA %in% c("U2", "FR", "IT", "DE")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

arrange(desc(date)) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net liquidity outflow") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = seq(0, 1000, 2)) +

theme(legend.position = c(0.2, 0.90),

legend.title = element_blank())

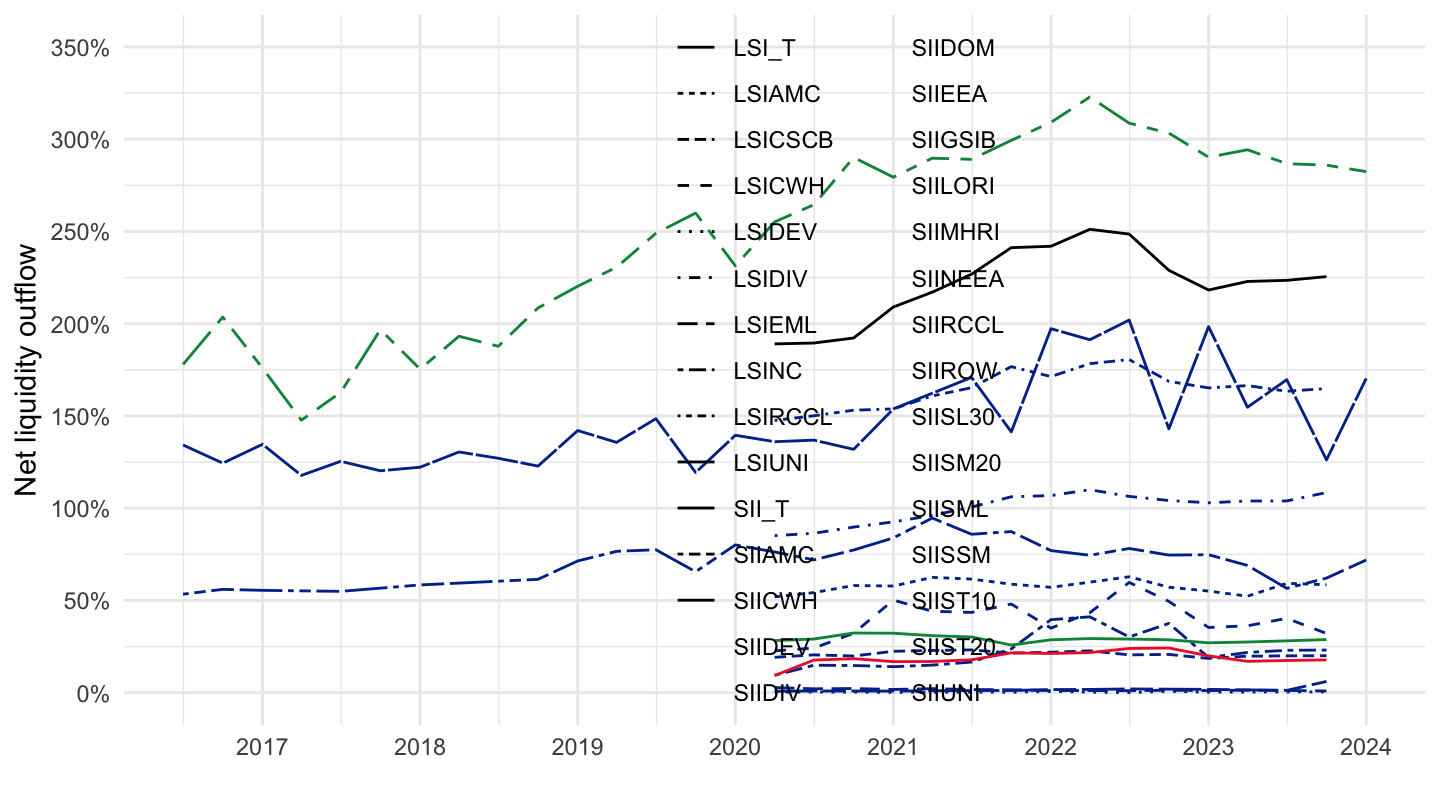

Net liquidity outflow

Code

SUP %>%

filter(grepl("Net liquidity outflow", TITLE),

REF_AREA %in% c("B01", "FR", "IT", "DE")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

mutate(OBS_VALUE = OBS_VALUE/100,

Ref_area = ifelse(REF_AREA == "B01", "Europe", Ref_area)) %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

na.omit %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net liquidity outflow") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = paste0(SBS_DI_1, SBS_BREAKDOWN))) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(0, 500, 50),

labels = percent_format(accuracy = 1),

limits = c(0, 3.5)) +

theme(legend.position = c(0.55, 0.50),

legend.title = element_blank())

Net Liquidity outflow - EU

B01 - EU countries participating in the Single Supervisory Mechanism (SSM)

Capital adequacy

Common equity Tier 1 ratio

Tier 1 ratio

https://www.bankingsupervision.europa.eu/press/pr/date/2023/html/ssm.pr2301114cb4953fd6.en.html#::text=The%20aggregate%20capital%20ratios%20of,capital%20ratio%20stood%20at%2018.68%25.

Code

SUP %>%

filter(grepl("Common equity Tier 1 ratio", TITLE),

REF_AREA %in% c("U2", "FR", "IT", "DE")) %>%

left_join(REF_AREA, by = "REF_AREA") %>%

left_join(SBS_DI_1, by = "SBS_DI_1") %>%

quarter_to_date %>%

select_if(~ n_distinct(.) > 1) %>%

left_join(colors, by = c("Ref_area" = "country")) %>%

mutate(OBS_VALUE = OBS_VALUE/100) %>%

ggplot(.) + theme_minimal() + xlab("") + ylab("Net Interest Margin") +

geom_line(aes(x = date, y = OBS_VALUE, color = color, linetype = Sbs_di_1)) +

add_flags(6) + scale_color_identity() +

scale_x_date(breaks = seq(1960, 2030, 1) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%Y")) +

scale_y_continuous(breaks = 0.01*seq(-10, 50, 1),

labels = percent_format(accuracy = .1)) +

theme(legend.position = c(0.25, 0.90),

legend.title = element_blank())