History of the Phillips curve: Phillips (1958), Leeper (1960), Samuelson and Solow (1960). Samuelson’s Economics textbook, etc.

Importance of the Phillips curve.

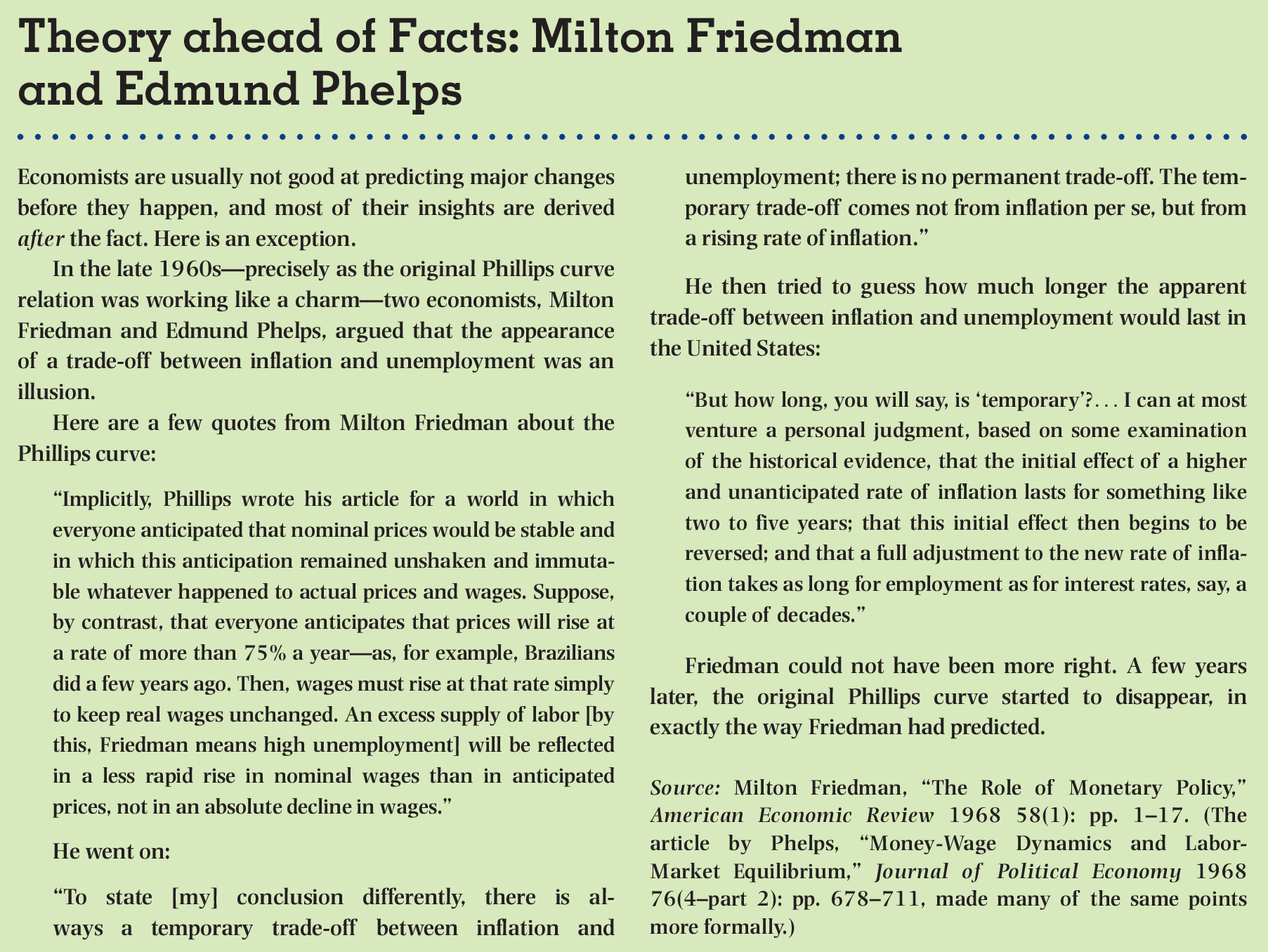

Old debates about the Phillips curve: neoclassical attack (Lucas, Sargent, Phelps, Friedman)

Contemporary debates about the Phillips curve: Uhlig 2010, Hall 2011.

November 26, 2020

Introduction

Links

There are several versions of these slides:

Before you read these, here’s some undergraduate material relating to the topic covered in this lecture:

Influence of Phillips curve

Main tenet of central banks’ thinking.

Even in the day to day language: “deflationary episode”. In fact, in previous times (unlike now), the most important symptom of a recession was a fall in prices. Samuelson and Solow transformed that into a relationship called the “Phillips curve”, also based on Phillips (1958).

Important in Undergraduate teaching, too. Mankiw’s tenth principle of economics, in his Principles book:

Main topics today

Teaching the Phillips curve

Chapter 13

History of the Modern Phillips curve

The sticky price model

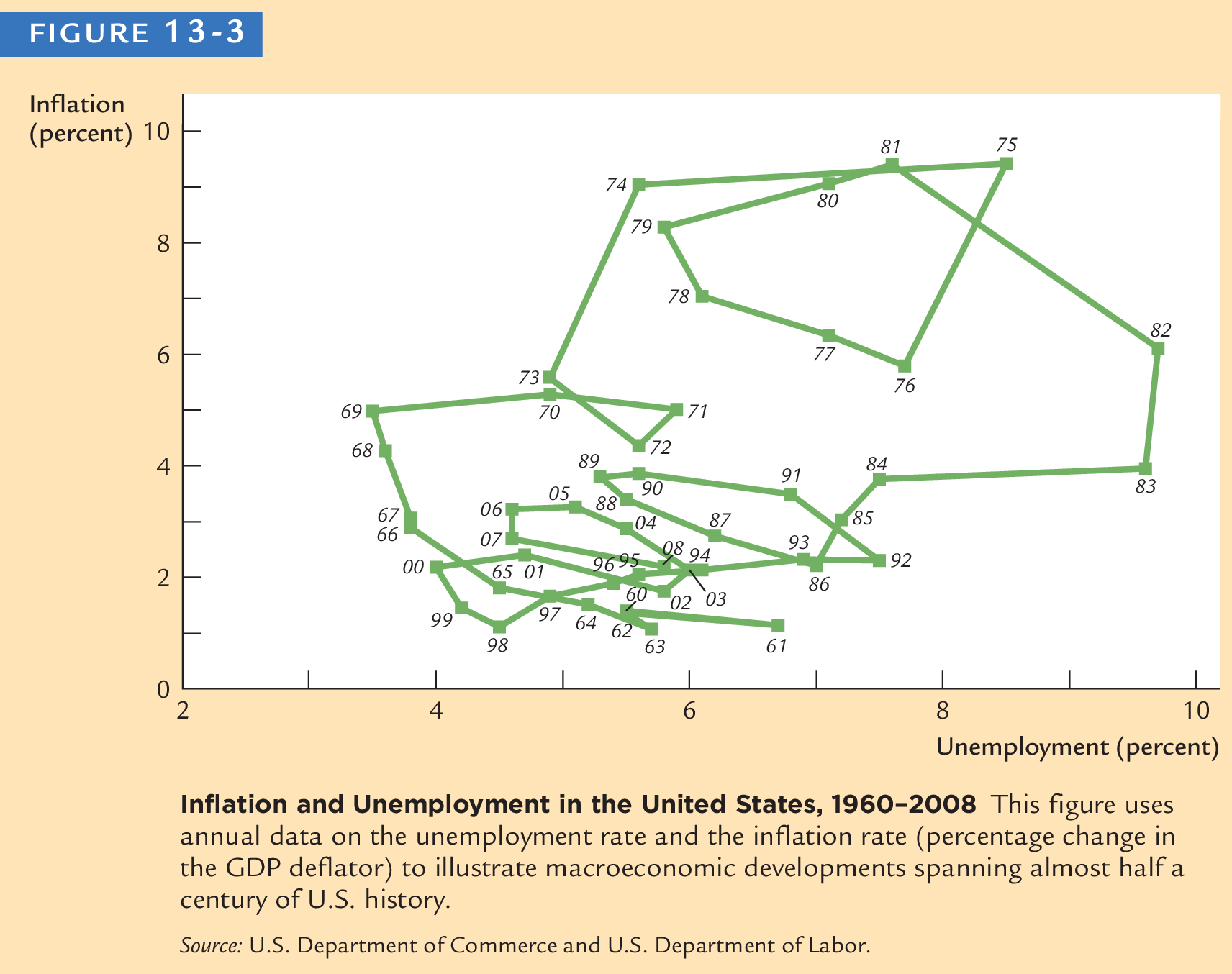

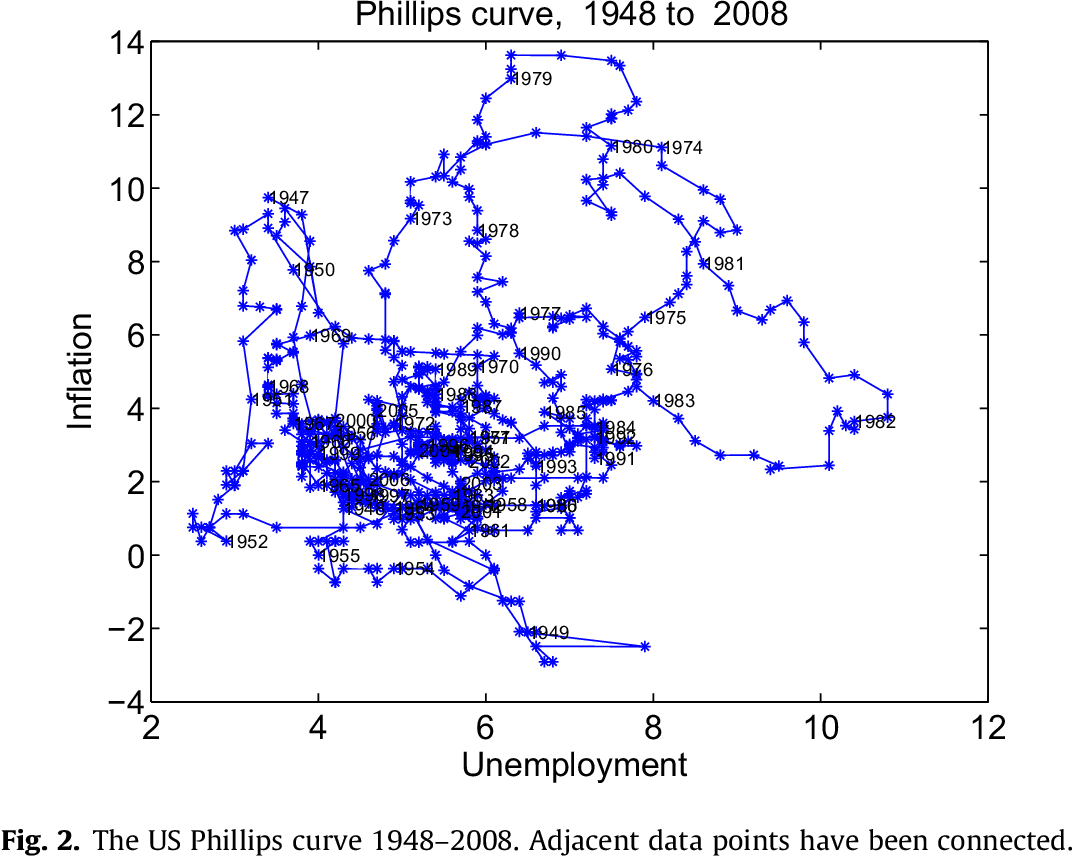

U.S. Correlation ?

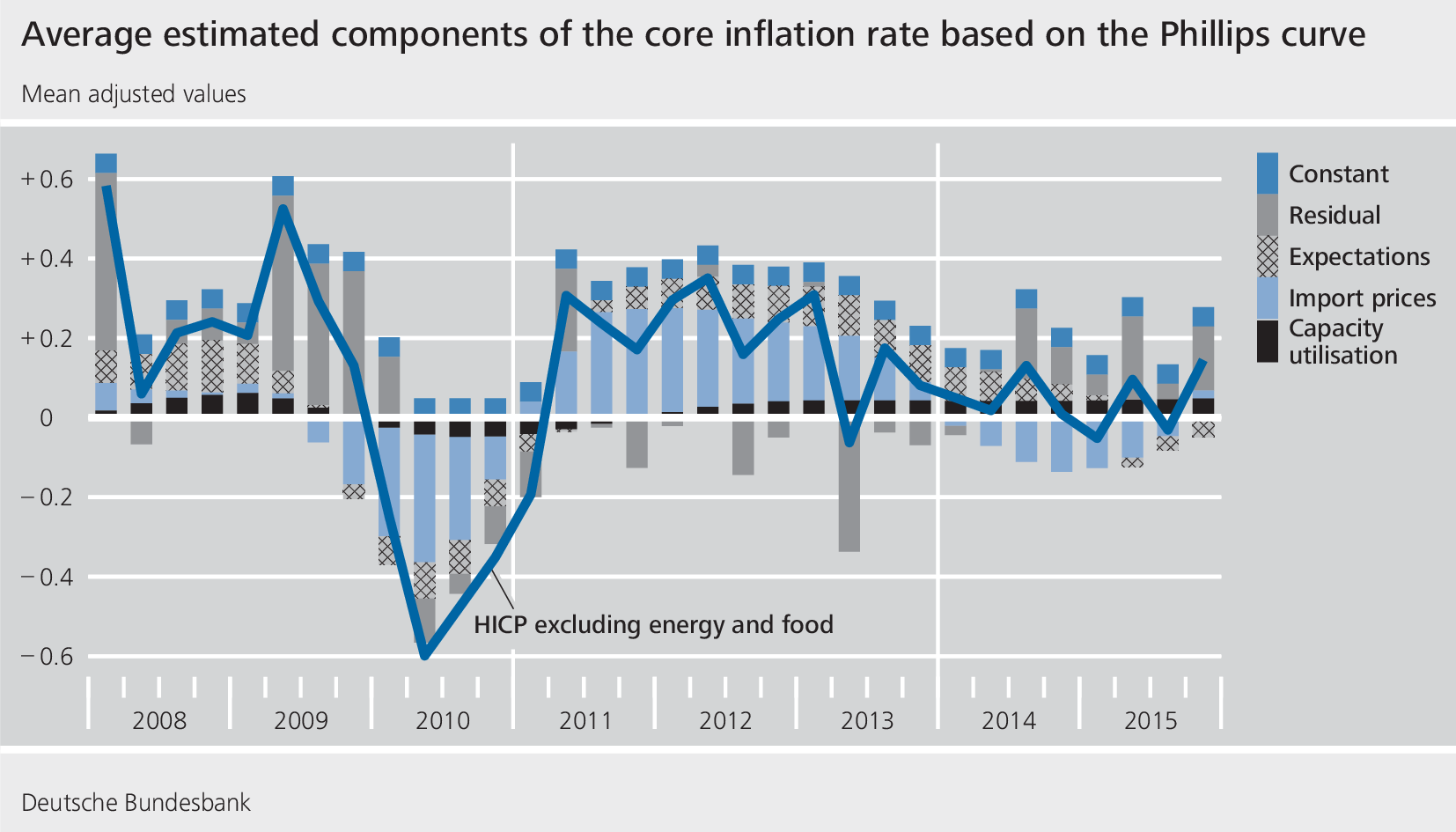

Importance of Import prices

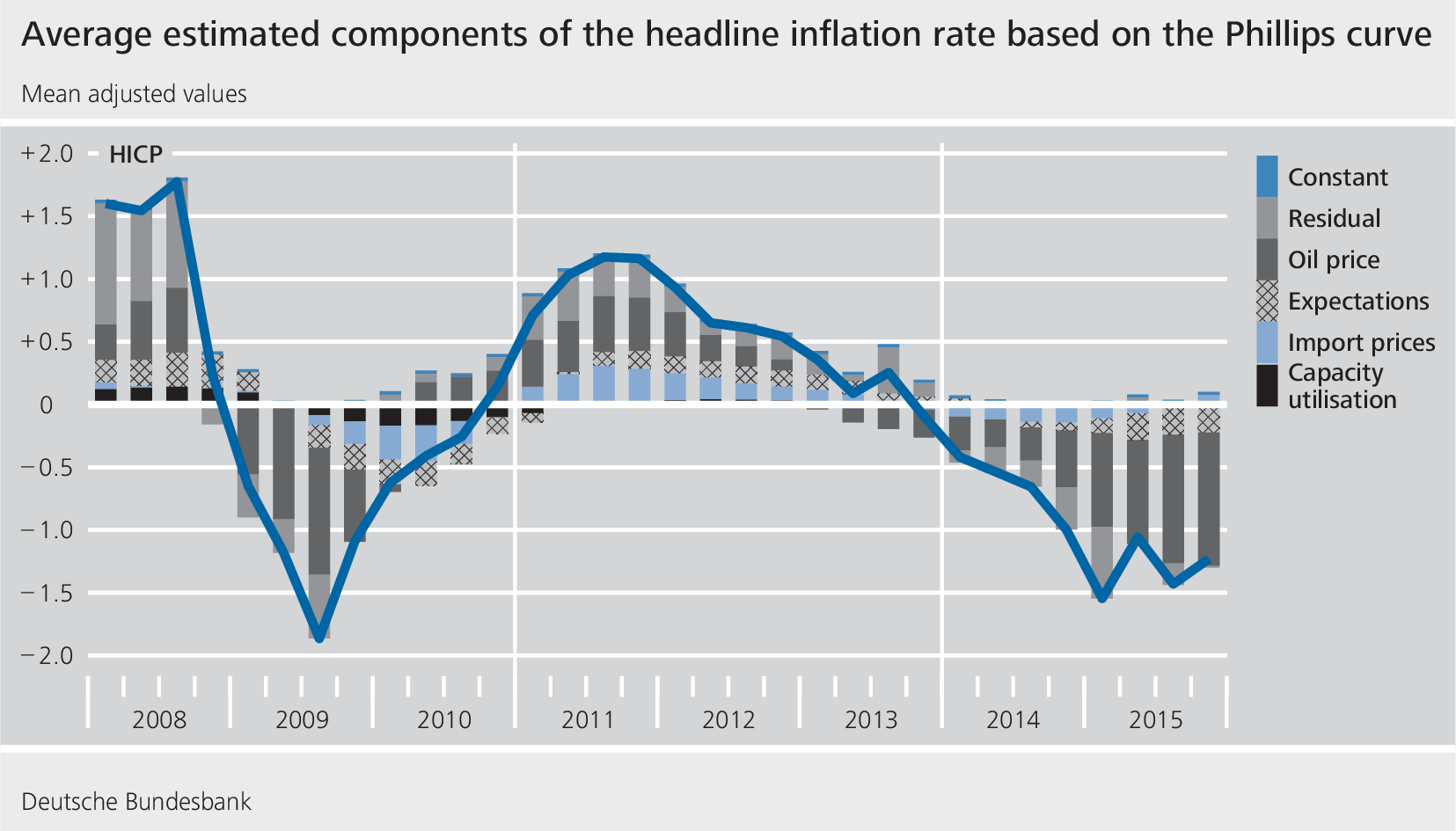

Bundesbank

Core

Headline

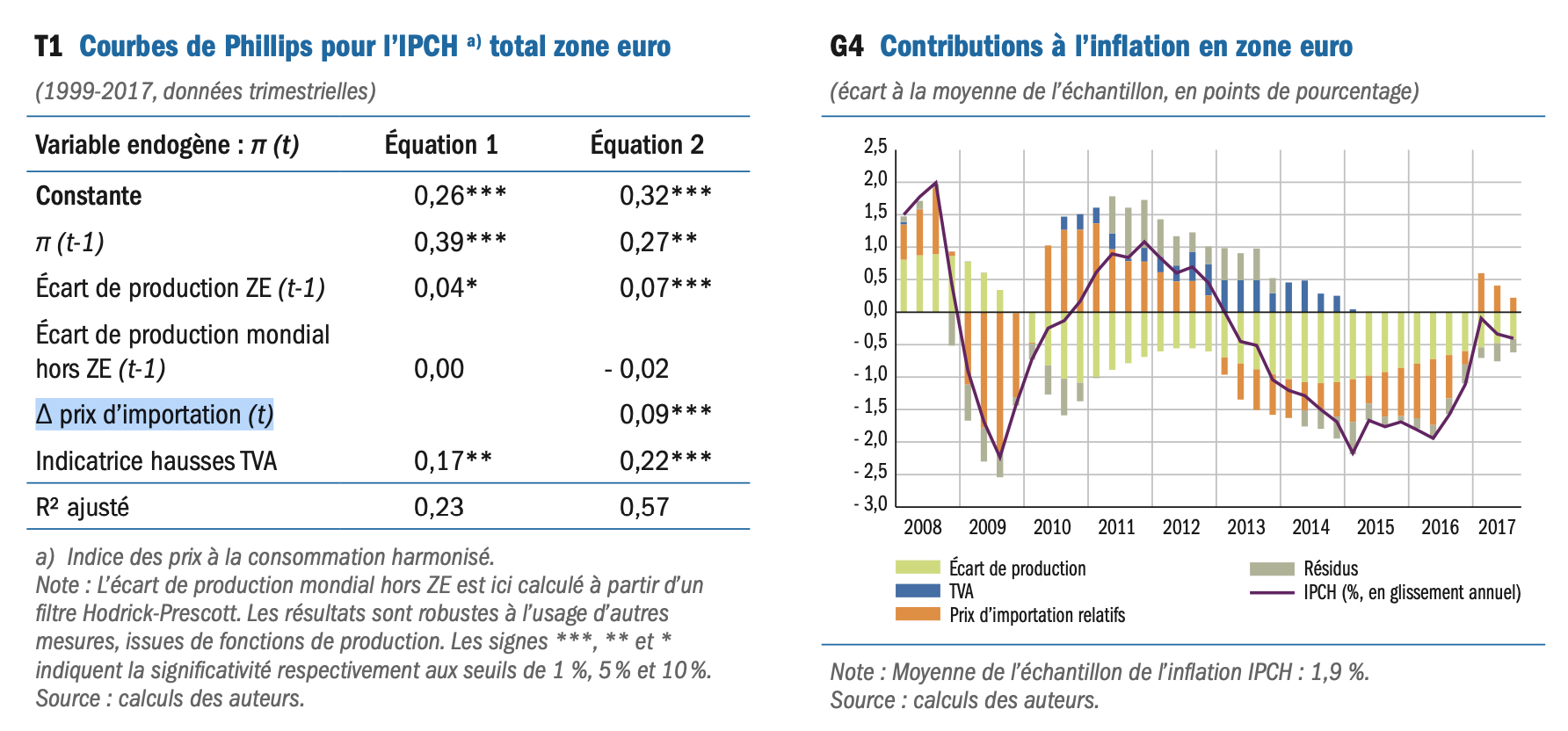

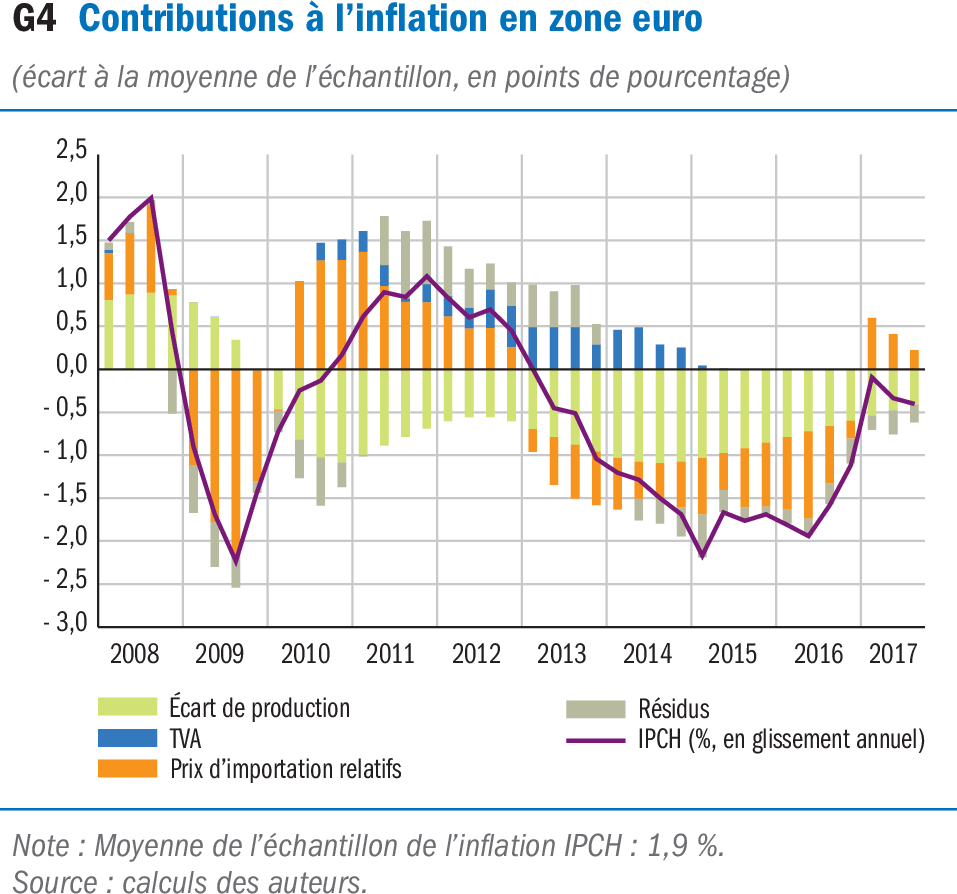

Banque de France

Core

The sticky price model

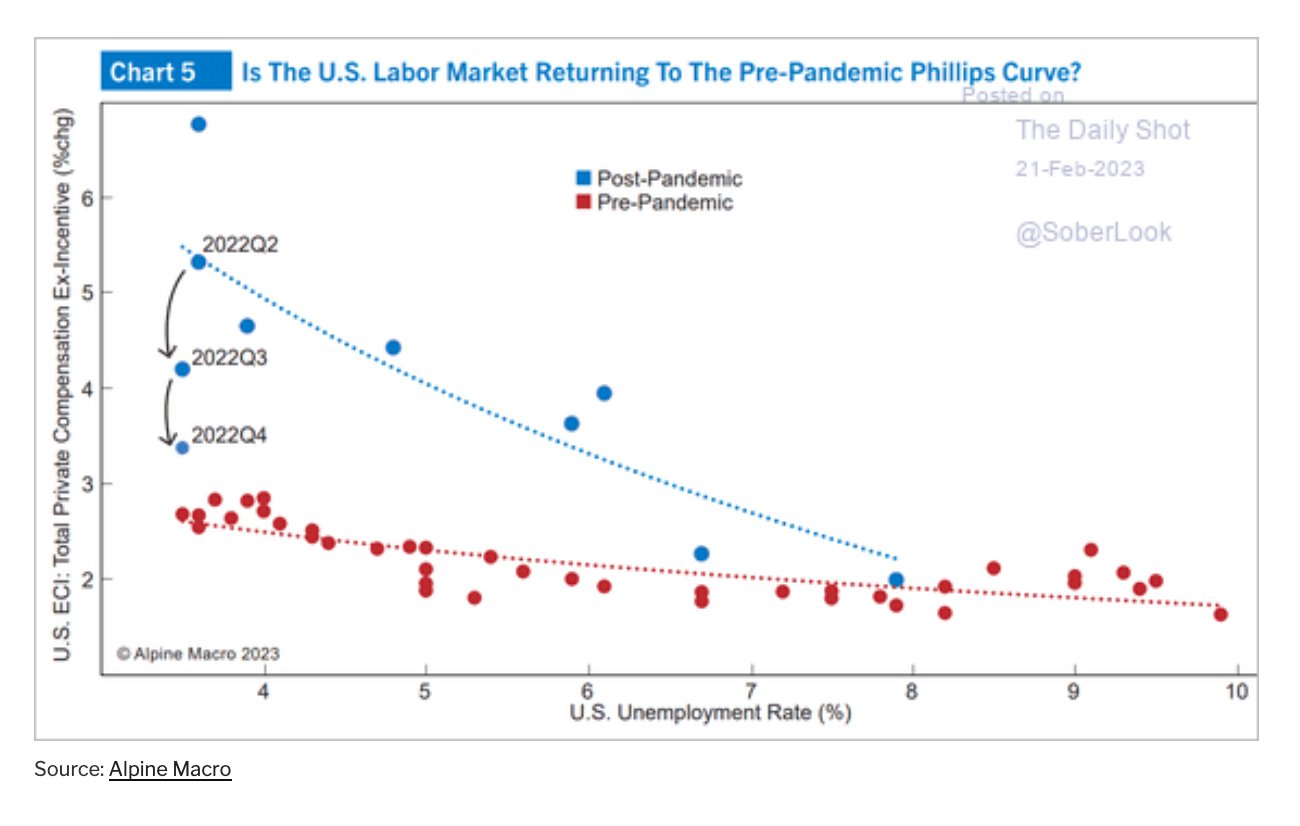

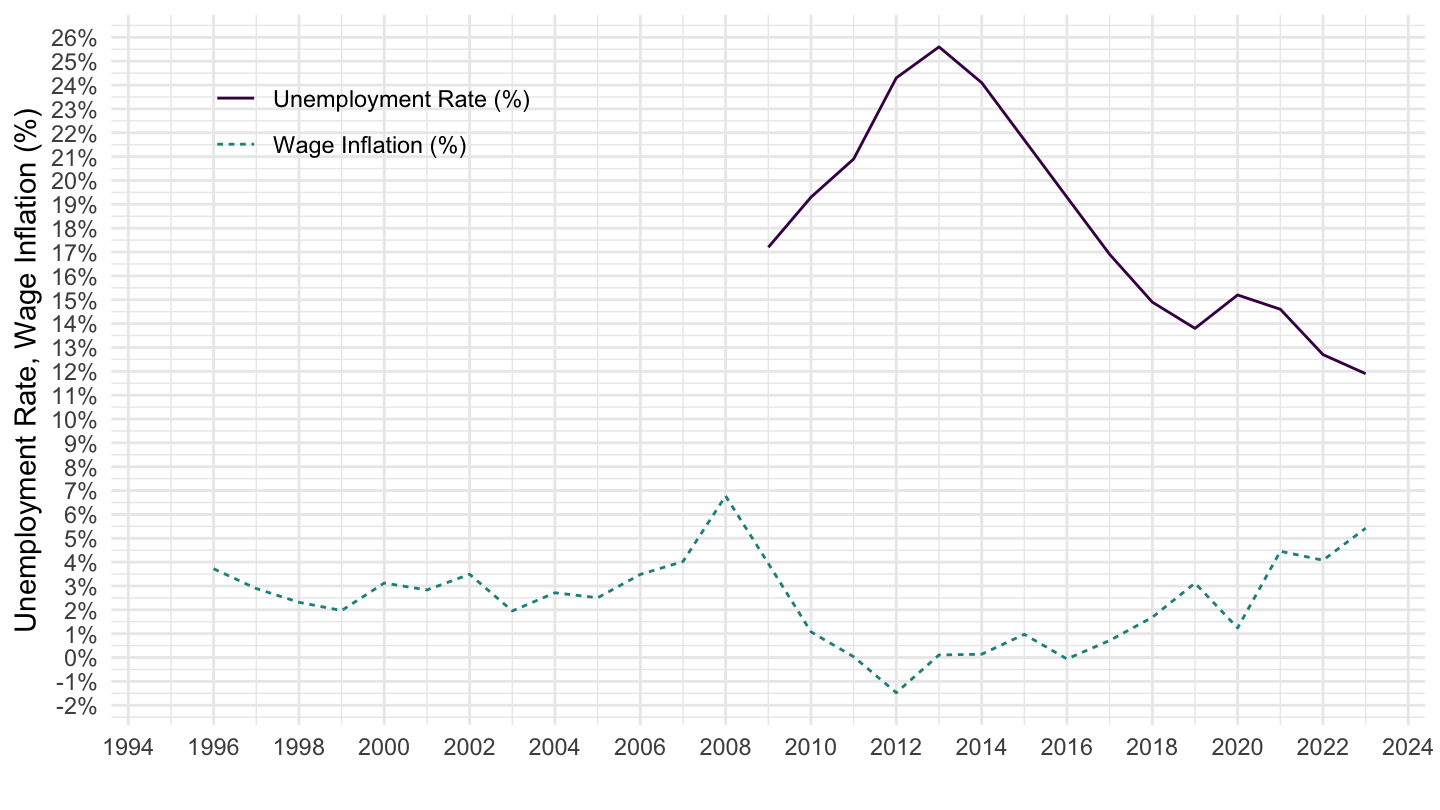

Some data on Wage inflation and unemployment

Italy

Germany

Spain

Examples

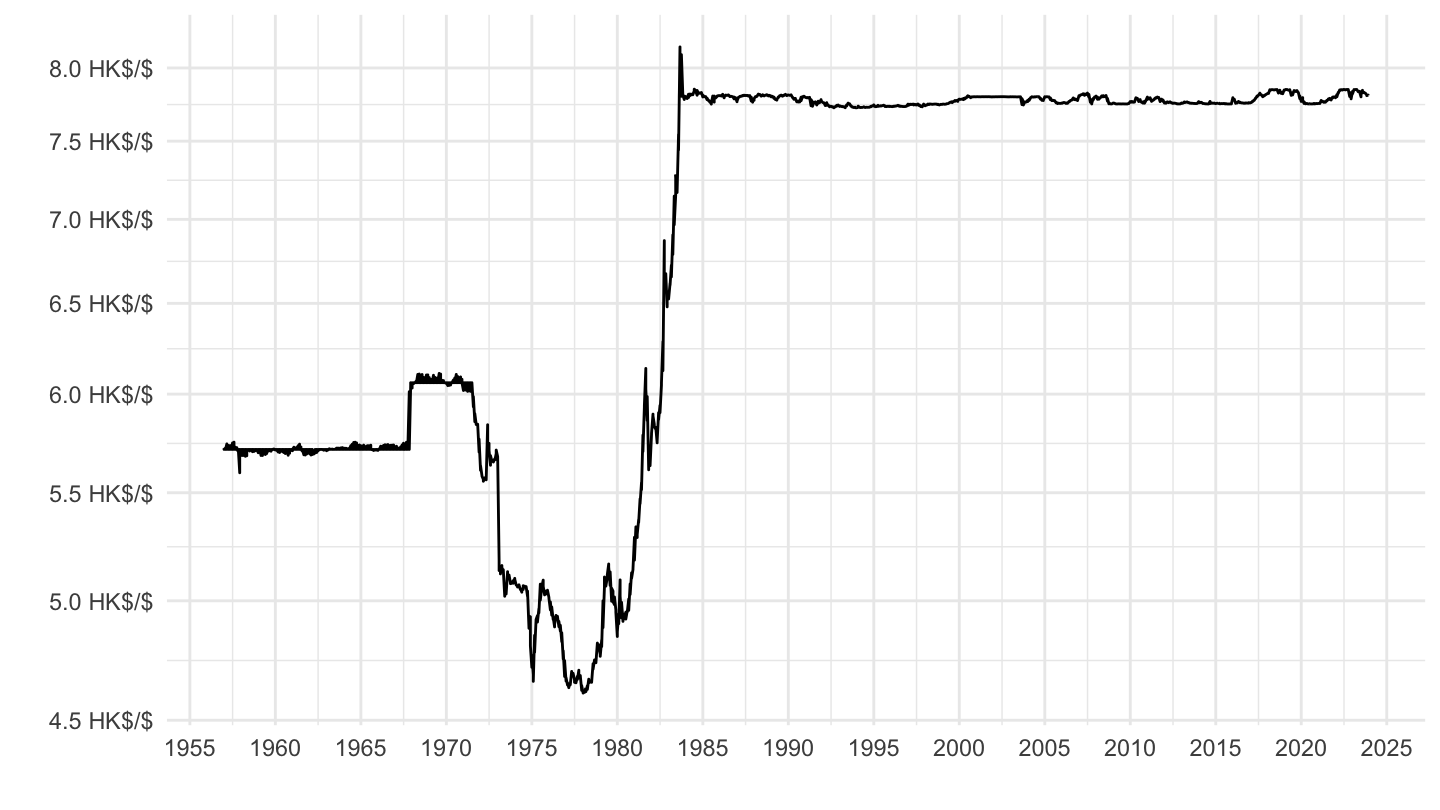

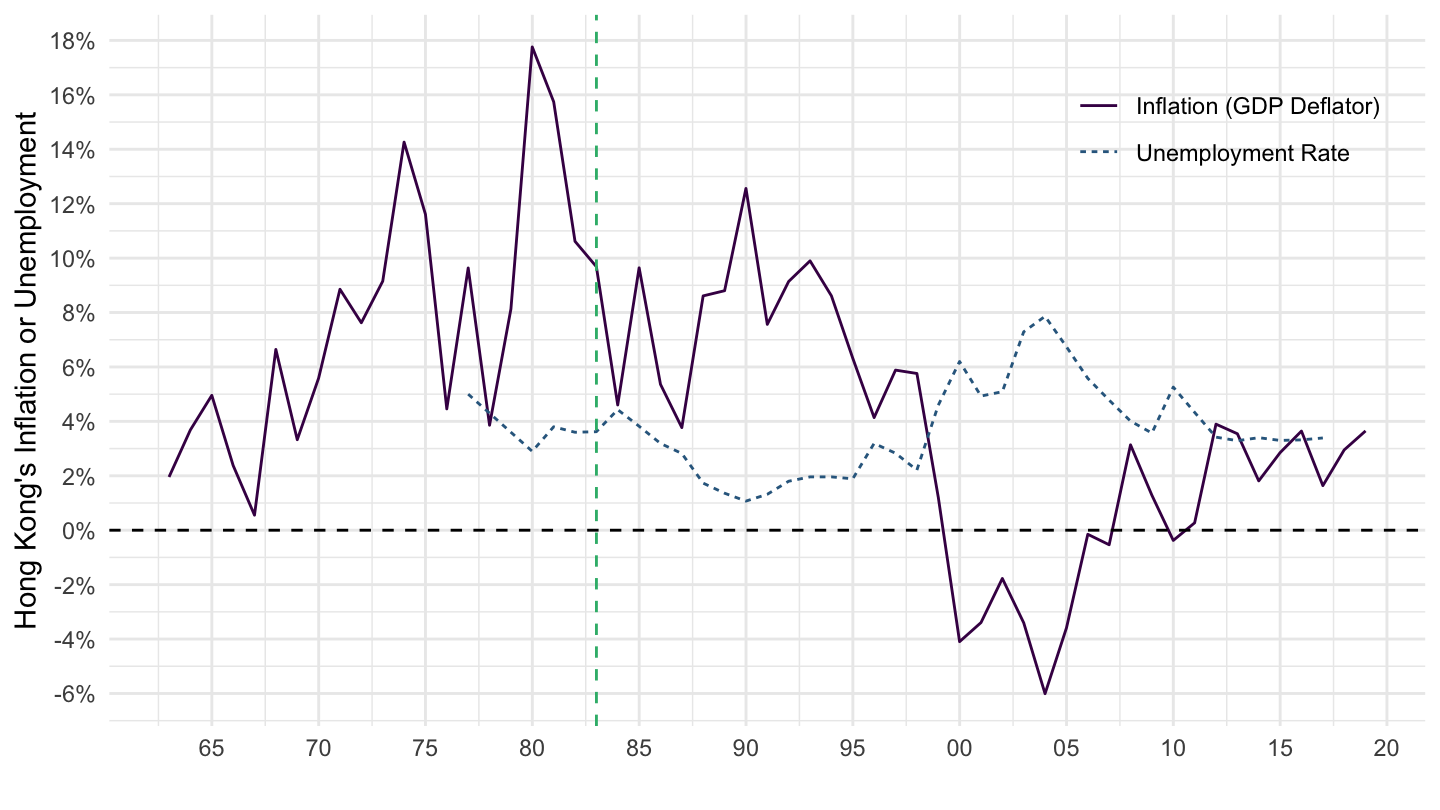

Hong Kong: Exchange Rates

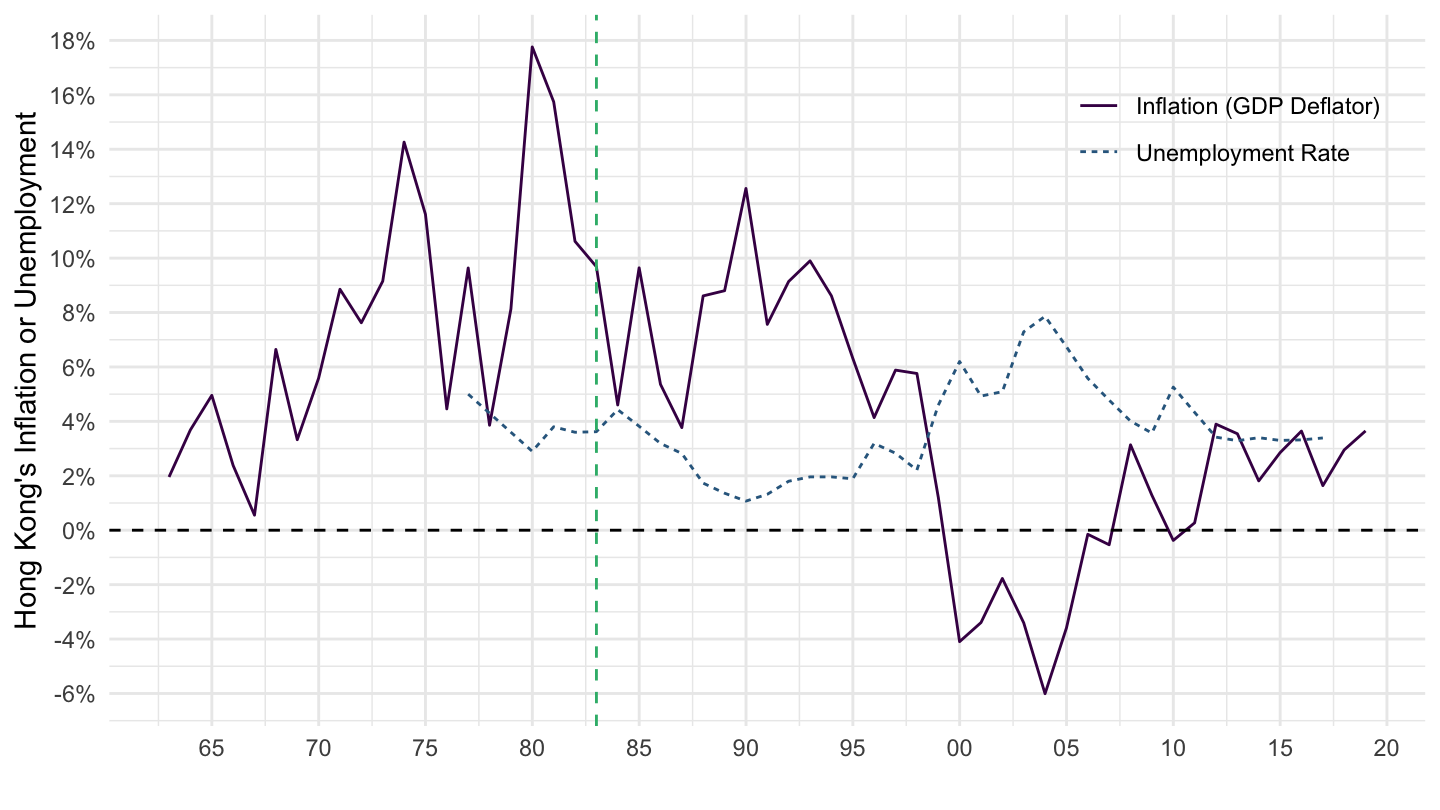

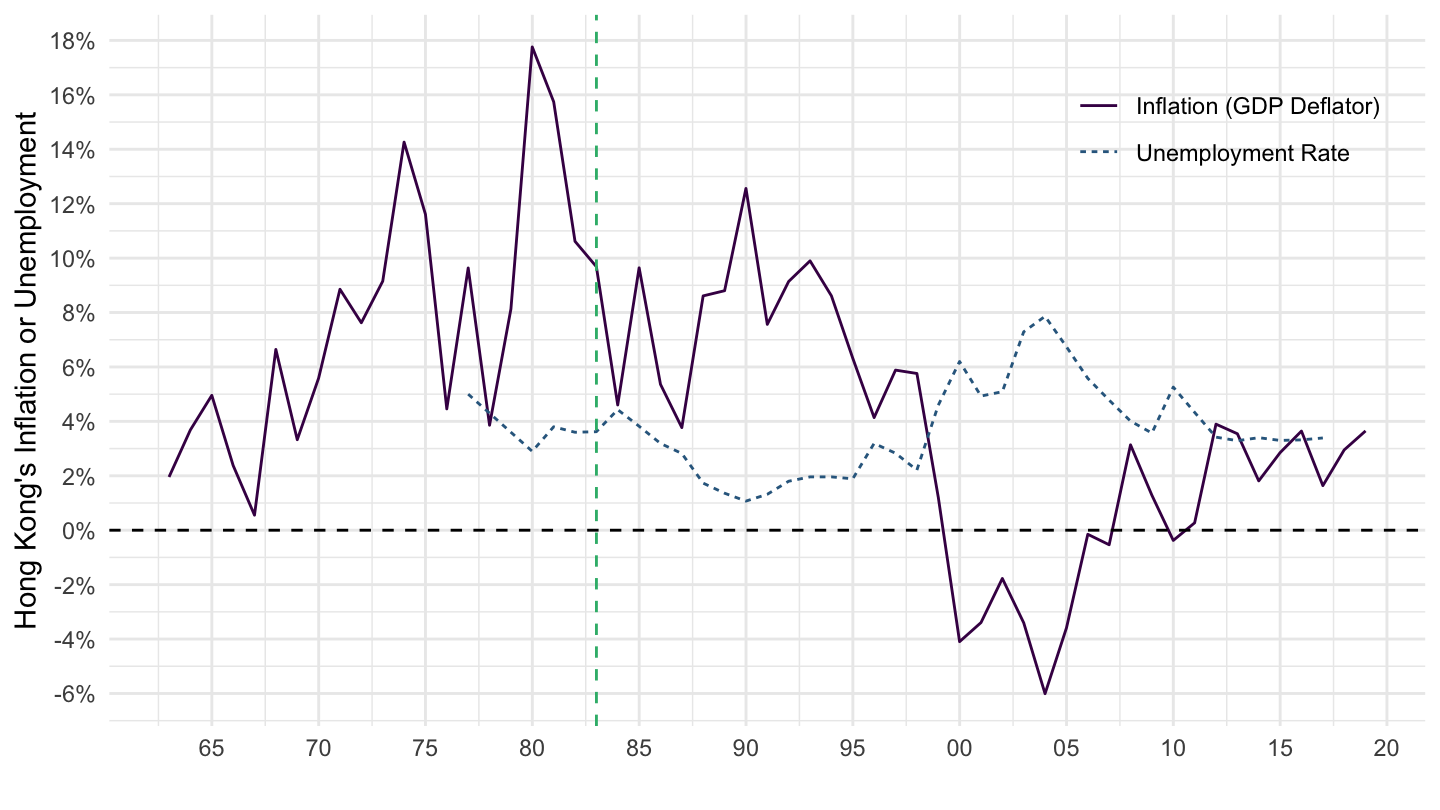

Hong Kong Phillips curve

Hong Kong: Flexible to Fixed Exchange Rate

Neoclassical Synthesis

My interpretation

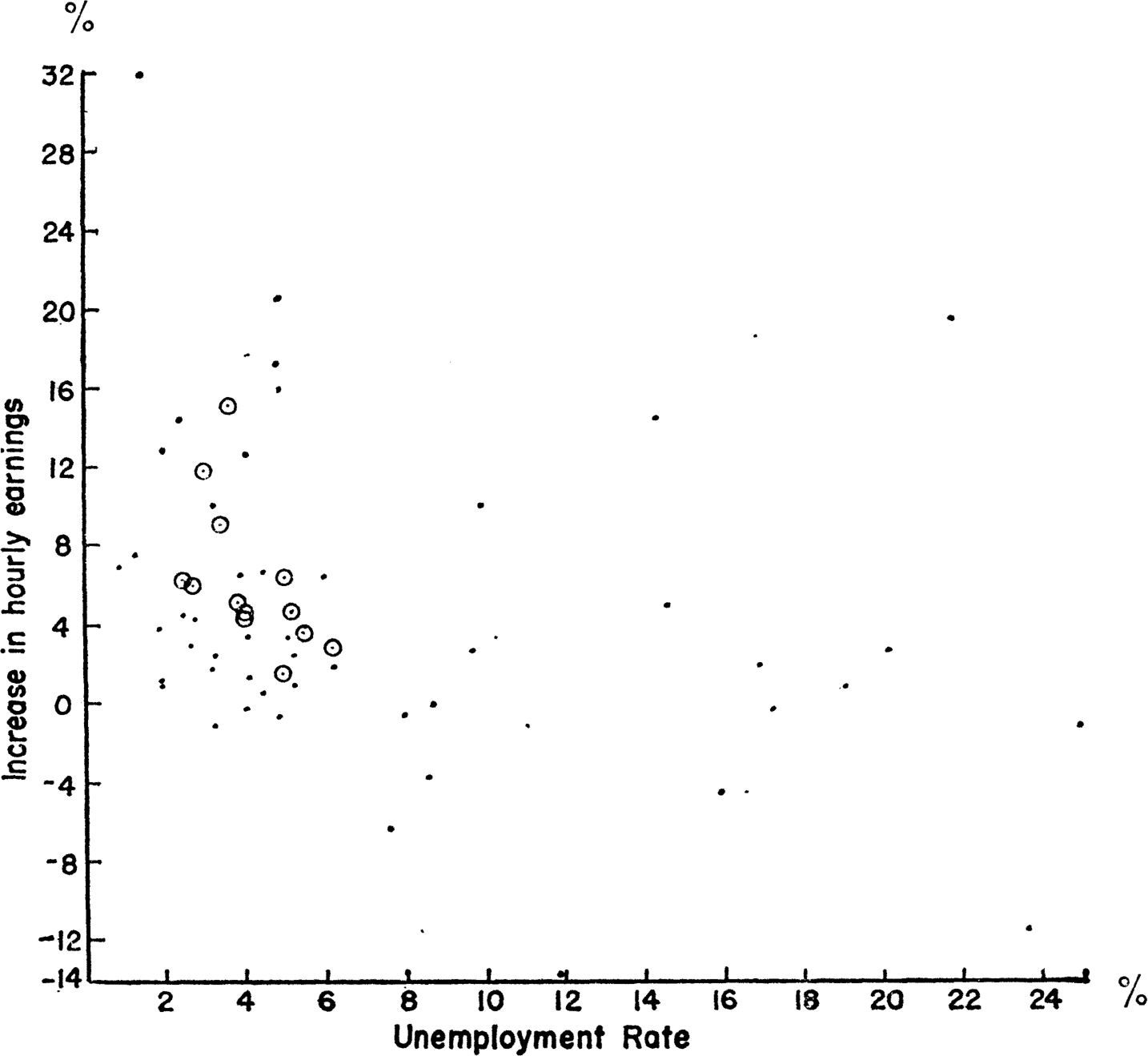

After the war, there was chaos: Keynes had been proved right by the experience of World War II, which had shown aggregate demand does matter.

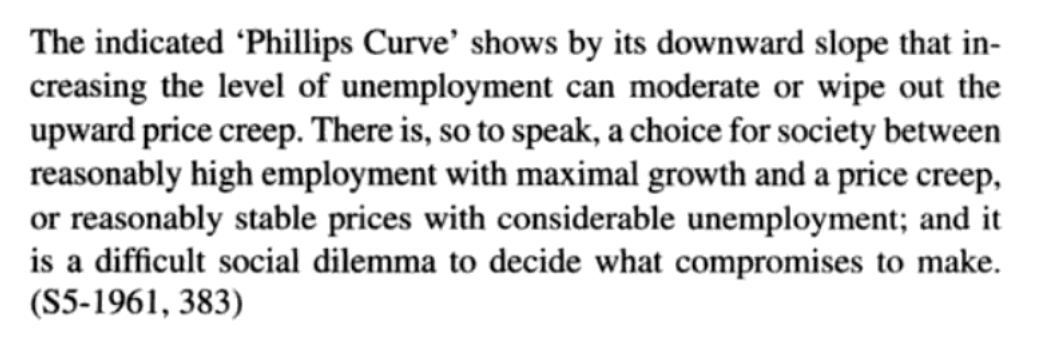

So Samuelson and Solow wanted to put a limit to Keynesianism, and choose some type of “middle ground”.

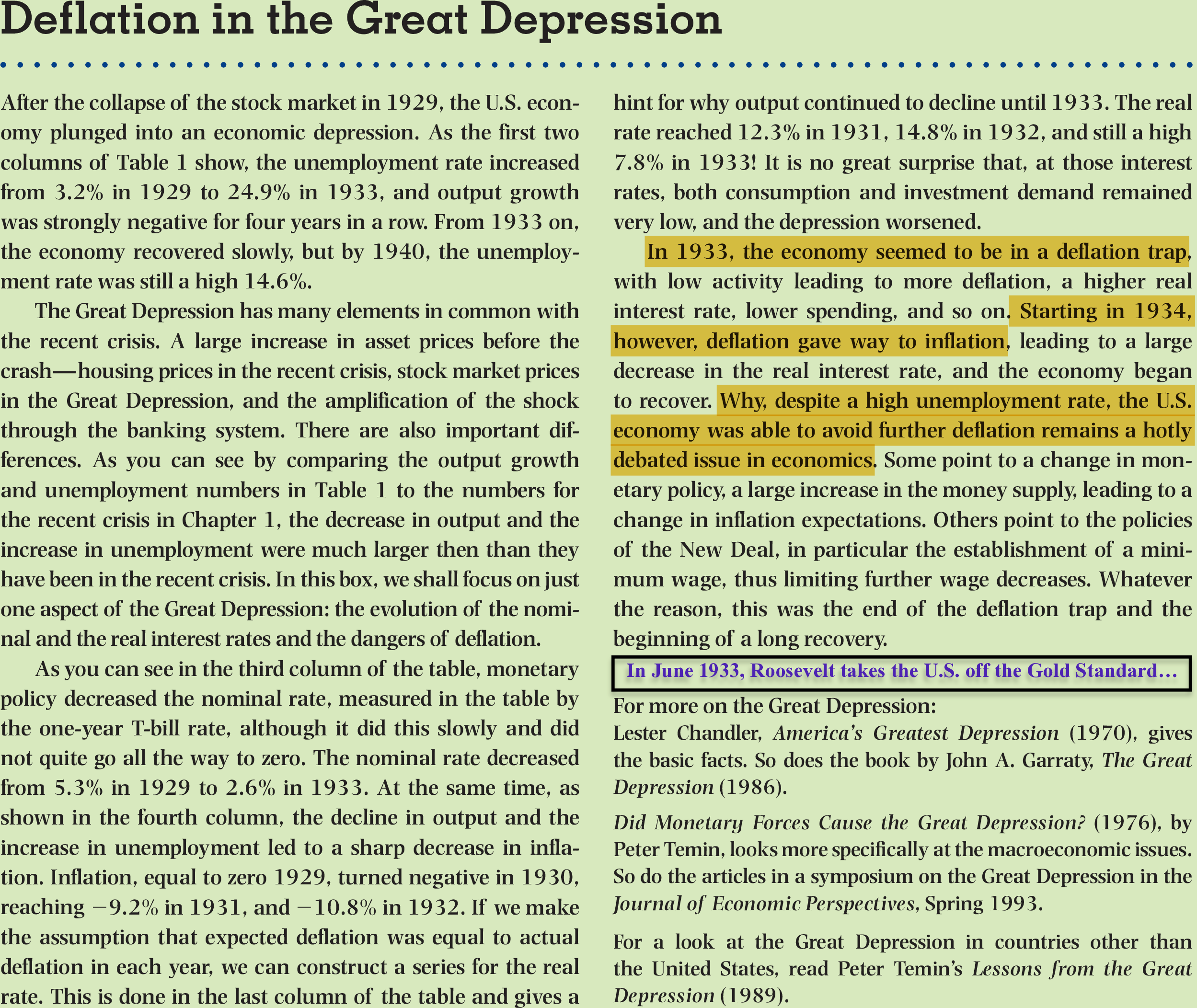

They found the Phillips curve, which according to them represented a trade-off between inflation and unemployment.

Neoclassical Synthesis, Sticky Prices?

Neoclassical Synthesis: Since Paul Samuelson and Robert Solow, the long-run is assumed to be the domain of neoclassical forces, while only the short-run is Keynesian (because of sticky prices).

Neoclassical synthesis defined by Paul Samuelson in the 3rd edition of his Economics textbook (1955, p. 212): “In recent years 90 percent of American economists have stopped being ‘Keynesian economists’ or ‘anti-Keynesian economists’. Instead they have worked towards a synthesis of whatever is valuable in older economics and in modern theories of income determination. The result might be called neo-classical synthesis and is accepted in its broad outlines by all but about 5 per cent of extreme left wing and right wing writers.”

Recently, the Phillips Curve has not been working at all in the U.S.: missing inflation in 2013-2019, missing deflation in 2007-2010, missing inflation in the late 1990s, stagflation in the 1970s, contrasting with always strong regional Phillips Curves.

Sticky Prices, Phillips Curve?

In Geerolf (2018), I argue that the Phillips curve exists under fixed exchange rates, not under flexible exchange rates.

I argue that the robust relationship is between unemployment and Real Exchange Rate growth (equivalently the relative inflation of non-tradable prices). This implies the Phillips curve in fixed exchange rate regime (as the price of tradables is fixed).

I reinterpret the post 1971 “stagflation”, and post 1933 “missing deflation” not as a change in inflation expectations, but as a switch from fixed to flexible exchange rate regimes. Alternative to the story which is usually told in textbooks of “theory ahead of facts” with Friedman and Phelps anticipating a change in inflation expectations.

In 1971, the U.S. switched from fixed to flexible exchange rates, from having a Phillips curve to having no Phillips curve.

1970s Stagflation (Blanchard’s textbook)

Economics, Fifth Edition (1961)

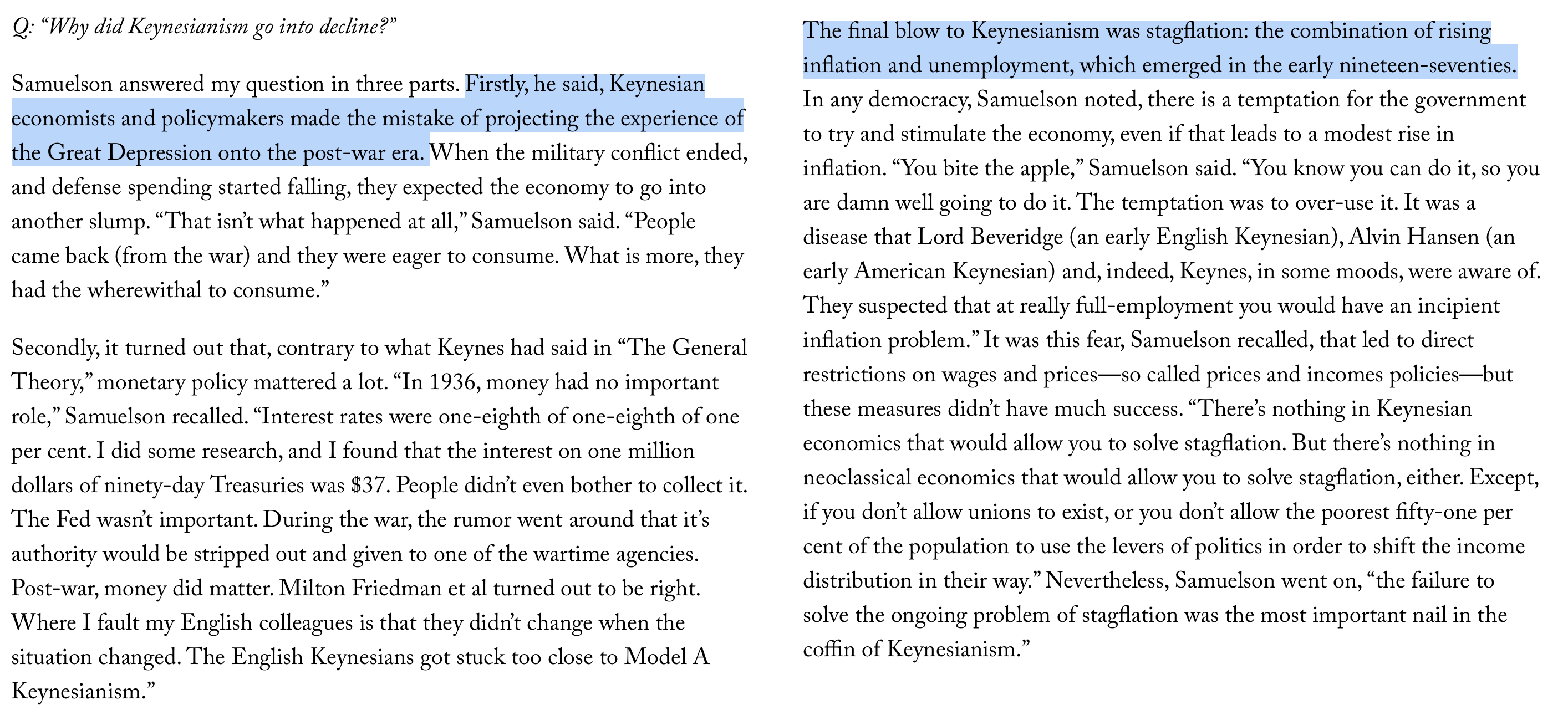

New Yorker’s interview of Samuelson

Samuelson

“The final blow to Keynesianism was stagflation: the combination of rising inflation and unemployment, which emerged in the early nineteen-seventies.”

“The failure to solve the ongoing problem of stagflation was the most important nail in the coffin of Keynesianism”.

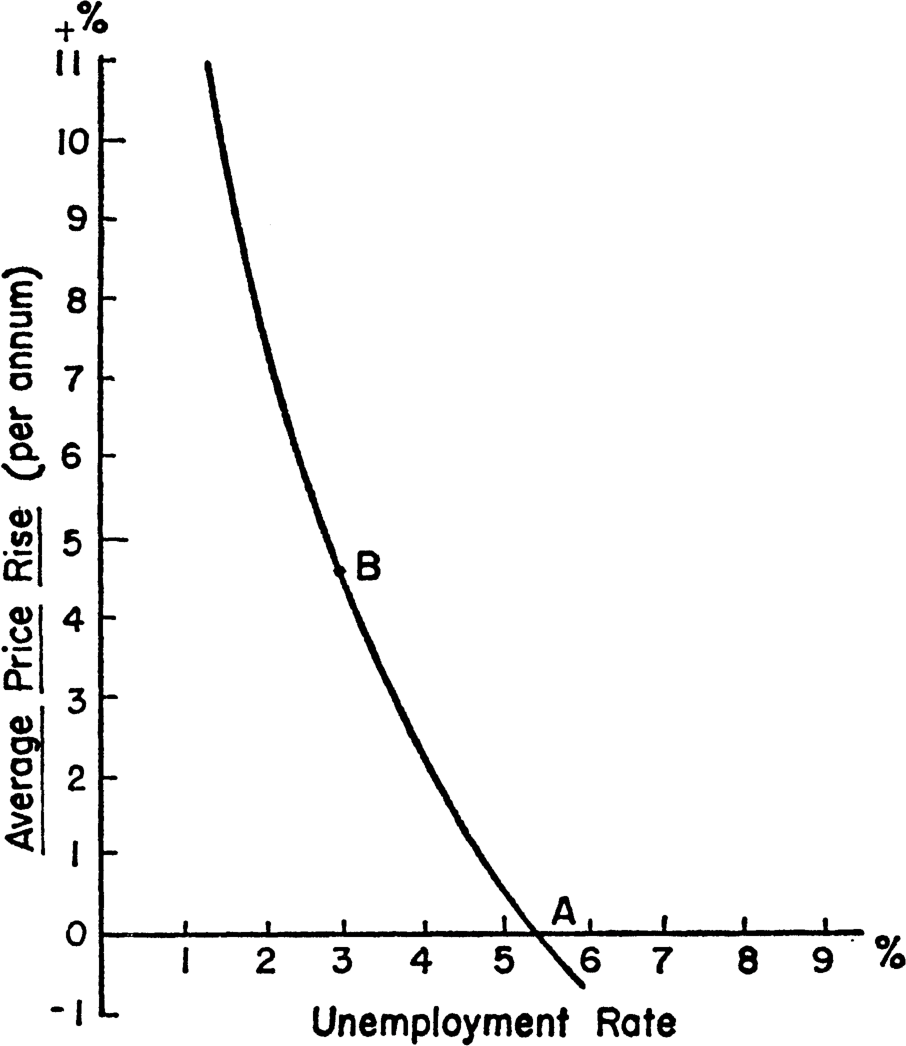

33-39 Missing Deflation (Blanchard’s textbook)

33-39 Missing Deflation (Blanchard’s textbook)

Wrong interpretation, I believe !

Something very important that also changed in 1971 was the exchange rate regime.

Also in 1933.

So probably, the reason why there was inflation during booms under Bretton Woods was that with a boom, there was a real exchange rate appreciation. Had the dollar been able to appreciate, then we would have had a “missing inflation” problem, just like the one we have today.

As a consequence, to me, the real trade-off (which Keynes was very well aware of, actually) is between “competitiveness” and growth: that is, the problem is that when you stimulate you tend to have a trade deficits.

So the trade-off isn’t between unemployment and inflation but between unemployment and trade deficits.

I think this describes quite well the dilemma currently facing the U.S. economy.

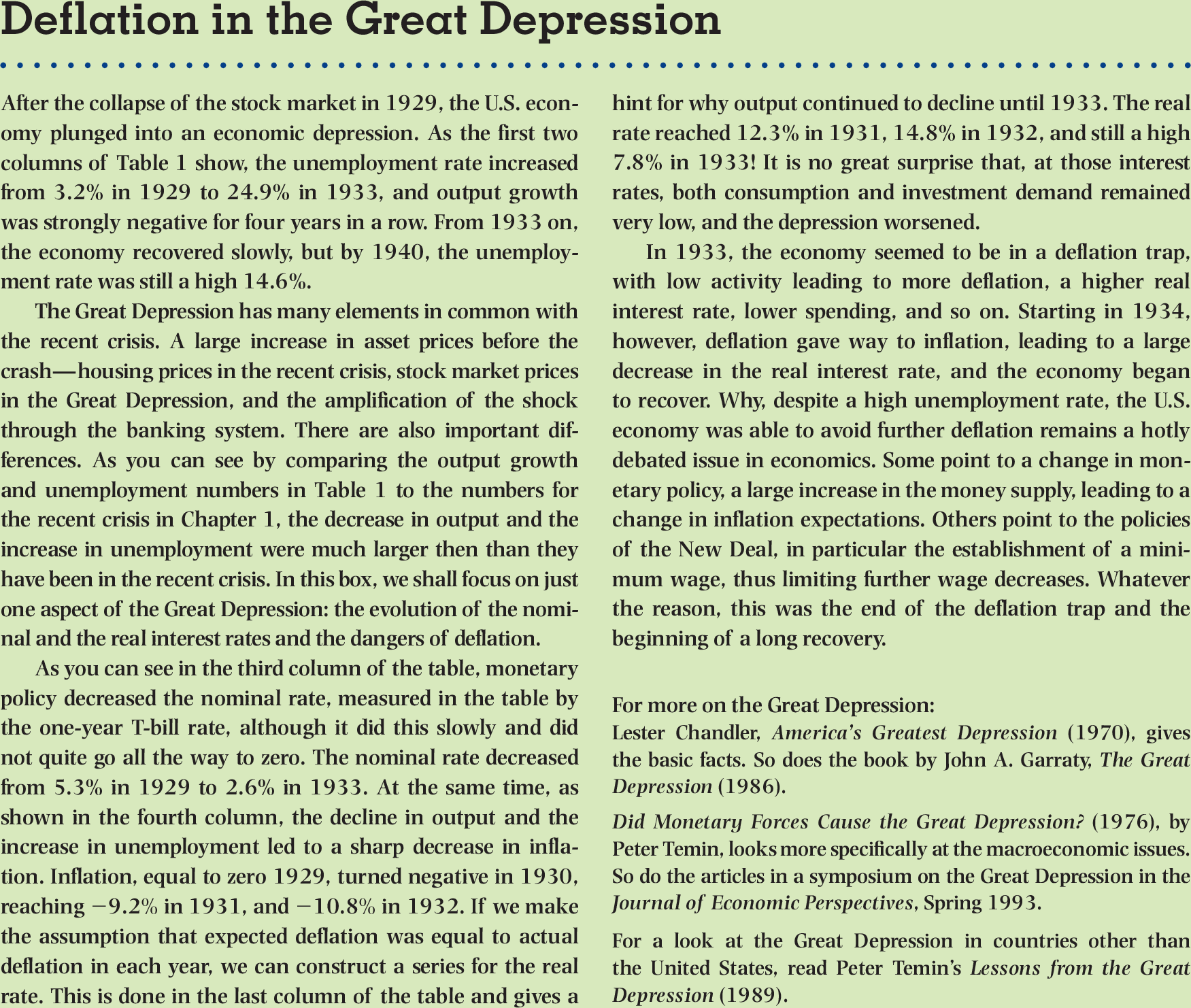

Samuelson, Solow (1960)

Data between wage inflation and unemployment

“Fitted” Phillips curve

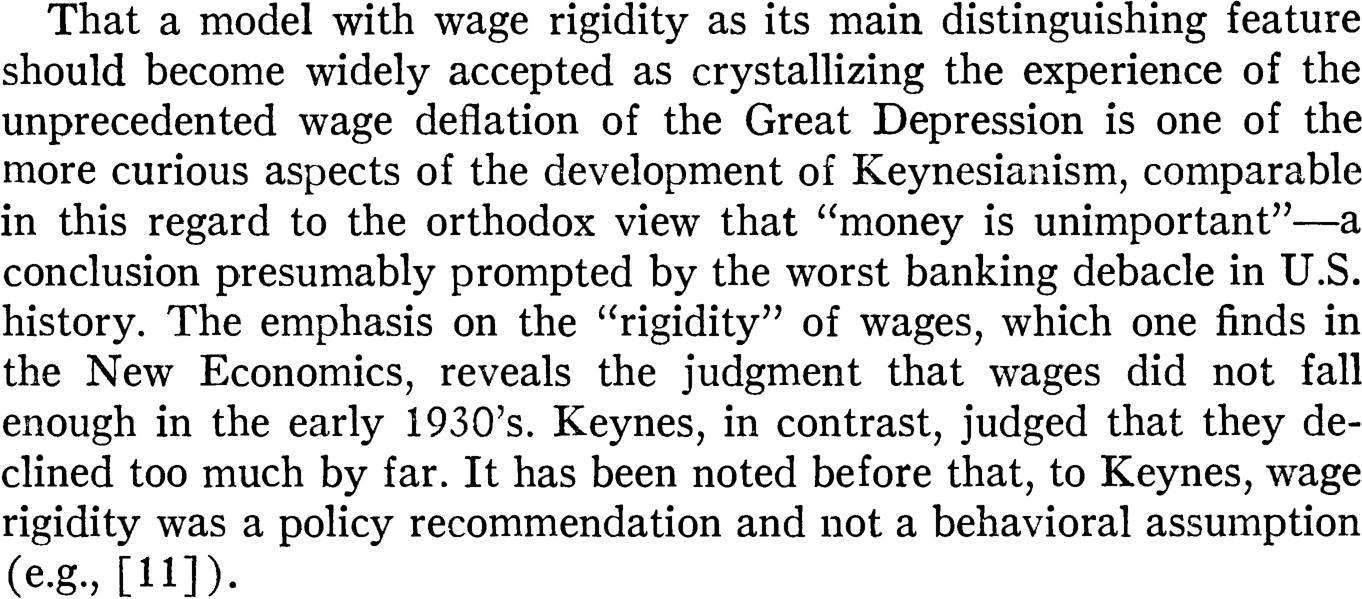

Missing Phillips curve in 1933-1941

WWI problems

Leijonhufvud (1967)

Wage Rigidity?

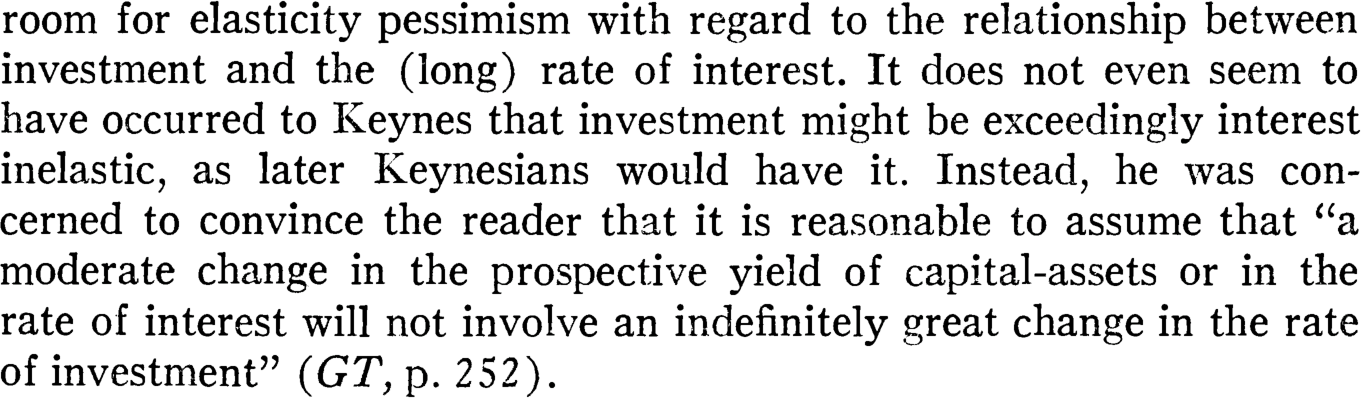

Interest Inelastic Investment?

Accelerator model of investment

Not a Keynesian idea.

Yet perhaps a better approach than sticky prices.

Robinson (1974) - Keynesian Revolution

What has become of the Keynesian revolution?

Treasury View

Deflation

“In those days (unlike now) the leading symptom of a recession was a fall in prices.”

Nazis

Political tendency of GT ?

Lucas (1976) critique

Phillips

Lucas and Sargent (1979) - After Keynesian Macroeconomics

Krugman - Stagflation was a revolutionary period

This crisis has gone longer than the stagflation of the 1970s.

It is worse. The human cost has been worse. Not a whole lot has changed.

Krugman

Keynesian Economics attacked on stagflation grounds

The fact that Keynesian economics was interpreted as resulting from sticky prices is important because it has led to attacks by freshwater economists.

One of the most well-known attack was a paper by Lucas and Sargent titled “After Keynesian Macroeconomics”.

In my view, Keynesian economics should perhaps never have been based on the Phillips curve, and so stagflation was not a particularly important “blow” to Keynesian economics.

Title of Conference Volume

Title of Conference Volume 2

After Keynesian Economics

Famous Quote

Growing prosperity of Kennedy-Johnson years

Summers (1991) - Should Keynesians Dispense with it ?

Presentation

Summers, Lawrence H. “Should Keynesian Economics Dispense with the Phillips Curve?” In Issues in Contemporary Economics, 3–20. International Economic Association Series. Palgrave Macmillan, London, 1991. pdf

Very insightful paper that Larry Summers wrote before he left academia for the policy world.

Harsh criticism of New-Keynesian economics for not being sufficiently grounded in empirics.

Many very good arguments: “While words like menu costs, and overlapping contracts are often heard, little if any empirical work has demonstrated any connection between the extent of these problems and the pattern of cyclical fluctuations.”

Best quotes

Even its friends must acknowledge that the textbook Keynesian view of aggregate supply possesses many of the attributes that Thomas Kuhn has ascribed to dying scientific paradigms.

Prominent Keynesians’ evaluations of the state of the field are destructive - being primarily comprised of attacks on the doctrines of the New Classical or monetarist schools.

Keynesian economics should aspire to more than Churchill’s defence of democracy as the best of bad alternatives.

Frequent ad hoc adjustments to account for embarrassing realities were a hallmark of Ptolemaic astronomy. It is sad but true that the half-life of various Keynesian views about the aggregate supply curve has been little more than a decade.

Thomas Kuhn

Not grounded in empirics enough

Half-life of AS Curve

Cross-sectional Evidence?

AD has persistent effects

x

x

Pearce and Hoover (1995) - The “taming” of the Keynesian revolution

Okun’s law and the Phillips curve = unknown to Keynes

Hansen’s negative review of Keynes

Importance of canonical textbooks

Bastard Keynesianism or Virgin Birth ?

3rd edition: neoclassical synthesis

8th edition

Saving and Investment

Big question is Aggregate Supply

Big question is Aggregate Supply

Stagflation becomes a problem

Samuelson as a technocrat: monetary cranks

Persistent stimulus is bad

1980-2010 Triumph of Inflation Targeting

2001 Akerlof

2001 Akerlof’s Nobel Prize lecture

2000 Leeson

No way it may be found

Catastrophe

“It was a political disaster because the stagflation episode allowed not only the Phillips Curve trade-off itself to be discredited but also Keynesianism itself”

“This was unjust and ilogical, for no one who understood either Keynes or The General Theory - or the world and how it works - could have been surprised at the emergence of stagflation.

2010 Harald Uhlig’s lecture at INET

Lecture at INET

Uhlig Phillips curve

Anatole Kaletsky Lecture INET

Main Points

It’s hard to do macroeconomics nowadays without having the Phillips curve back in your mind. It’s just not done. If it’s done it’s considered crazy or something.

Very hard to say “the emperor has no clothes”, because you all believe it has.

Everyone of us sees stuff in that picture.

There was a Phillips curve. Then the trade-off was exploited. Then there was stagflation.

It’s also very hard to see sticky prices.

Problems with Phillips curve

Really hard to say “the emperor has no clothes”.

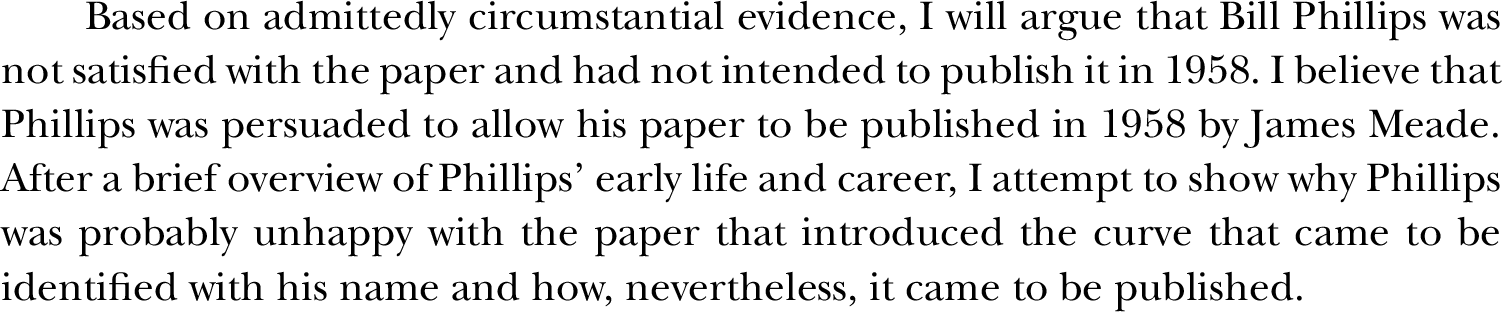

Sleeman (2011) - A Rushed Job ?

Title

Sleeman, A. G. “Retrospectives: The Phillips Curve: A Rushed Job?” Journal of Economic Perspectives 25, no. 1 (March 2011): 223–38. pdf / html

Thesis

Starting anecdote

A weekend’s work

Legacy

How the paper was submitted

Forder (2014) - Phillips curve myth ?

James Forder (2014)

Phillips Curve myths

- Book Review: myths and macro: macroeconomics and the Phillips curve myth by James Forder. pdf

Phillips curve is conspicuously absent

Relative trade-off between growth and Balance of Payments

UK Civil Service’s thoughts

Hall (2011) - The long slump

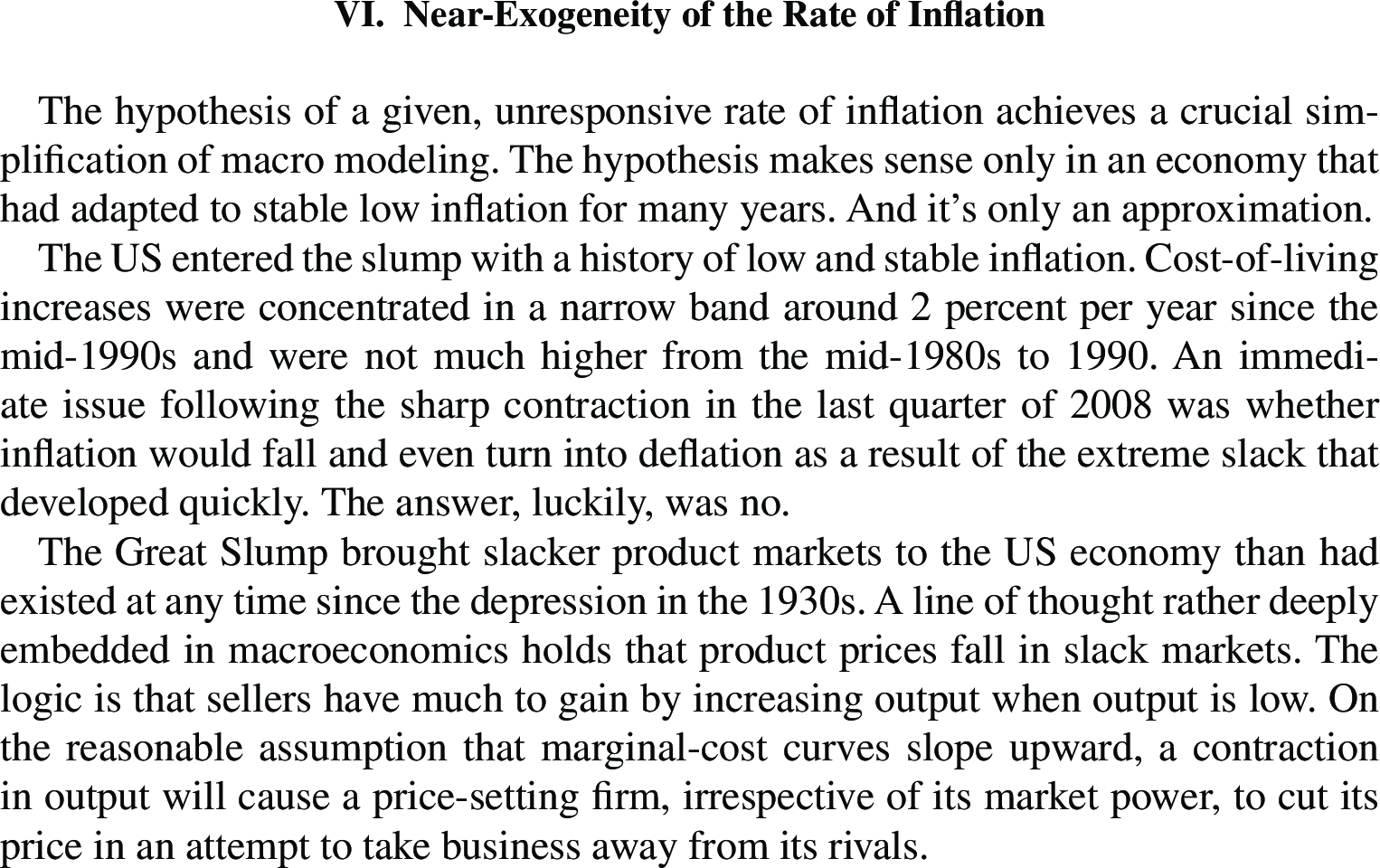

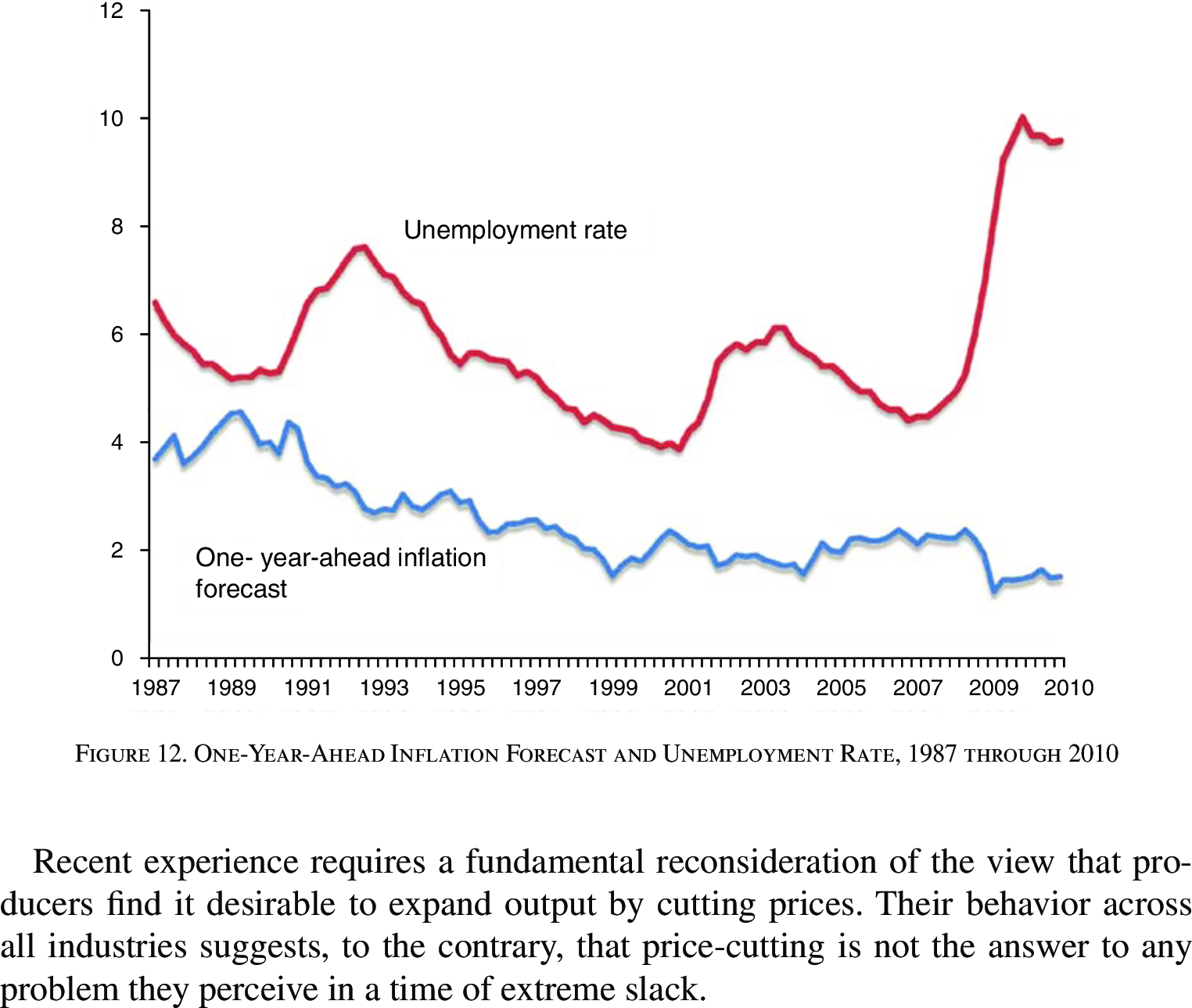

Near Exogeneity of the Rate of Inflation

Doubts on Phillips curve

2008-2020 Debates about the Phillips curves

Tarullo (2017) - Monetary policy without a working theory of inflation

Tarullo (2017) - Monetary policy without a working theory of inflation

Klein (2017) - Blanchard VS Brainard 1/3

Klein (2017) - Blanchard VS Brainard 2/3

Klein (2017) - Blanchard VS Brainard 3/3

Summers’, Blanchard’s about the Phillips curve

Furman, Blanchard

Faith in the Phillips curve

Reponse of Blanchard to Furman

Krugman (2018) - 2009, Missing Deflation Problem

Discussion on Bloomberg, July 13, 2019

Discussion on Bloomberg, July 13, 2019

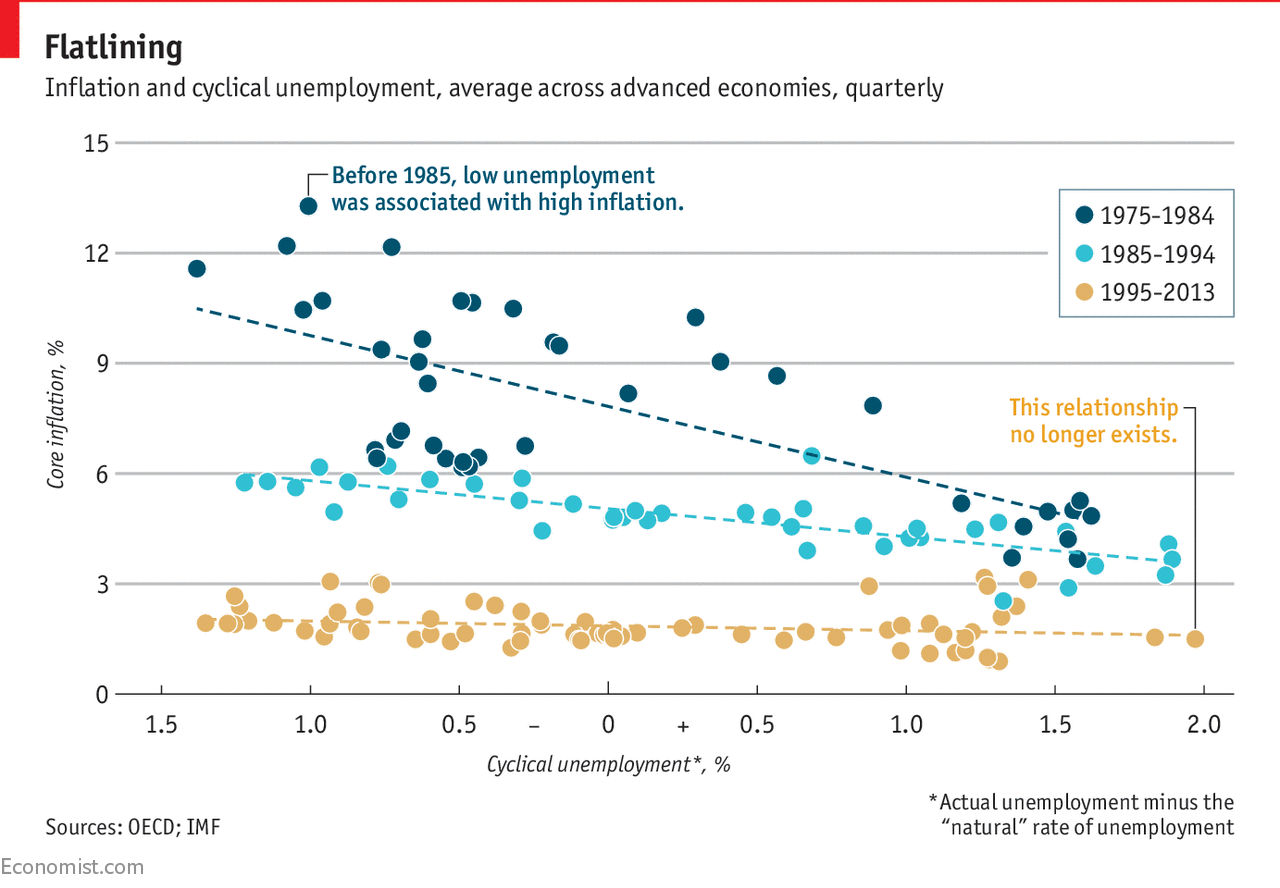

Big fall in unemployment with essentially no change in inflation.

Maybe labor market slack does not matter a lot for inflation (wages rise, profits fall), maybe we are not measuring slack correctly.

Central bank’s mandate is stable prices and stable employment. Can we even reconcile our entire approach to monetary policy if that tension isn’t there at all? (Dual mandate)

Yes, there is no reason the Fed should be responding to lower unemployment, if there is no relation between unemployment and inflation.

We can no longer make policy on the basis that there is a tight relationship between unemployment and inflation.

Costs of inflation

Long-run effects of aggregate demand shocks \(\Rightarrow\) Are prices really sticky at a 5-year horizon? (see Bils, Klenow (2004) but also Nakamura, Steinsson’s work)

Even according to New-Keynesian economists: the welfare costs of price dispersion (which are important in the New-Keynesian model) are very small.

Emi Nakamura: The Elusive Costs of Inflation

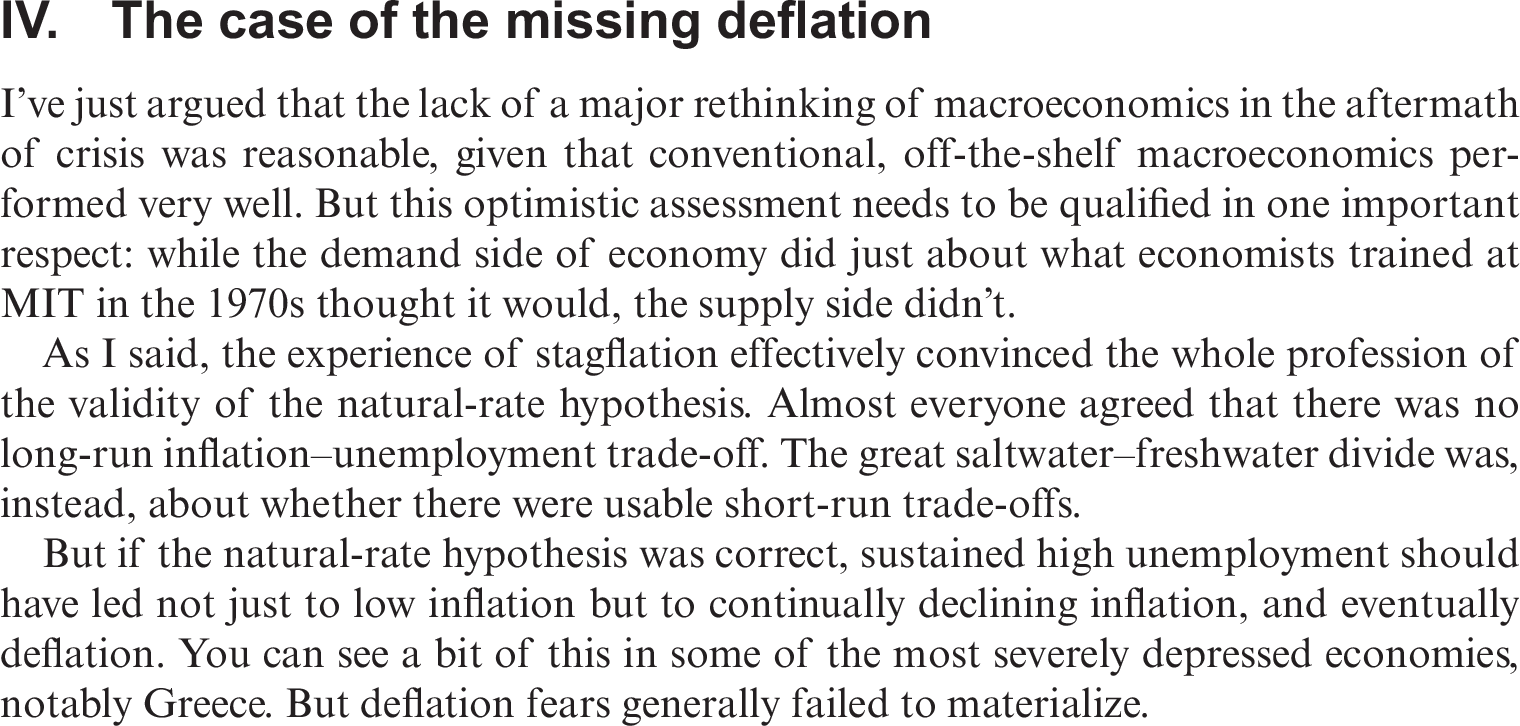

BIS: Time-varying slope

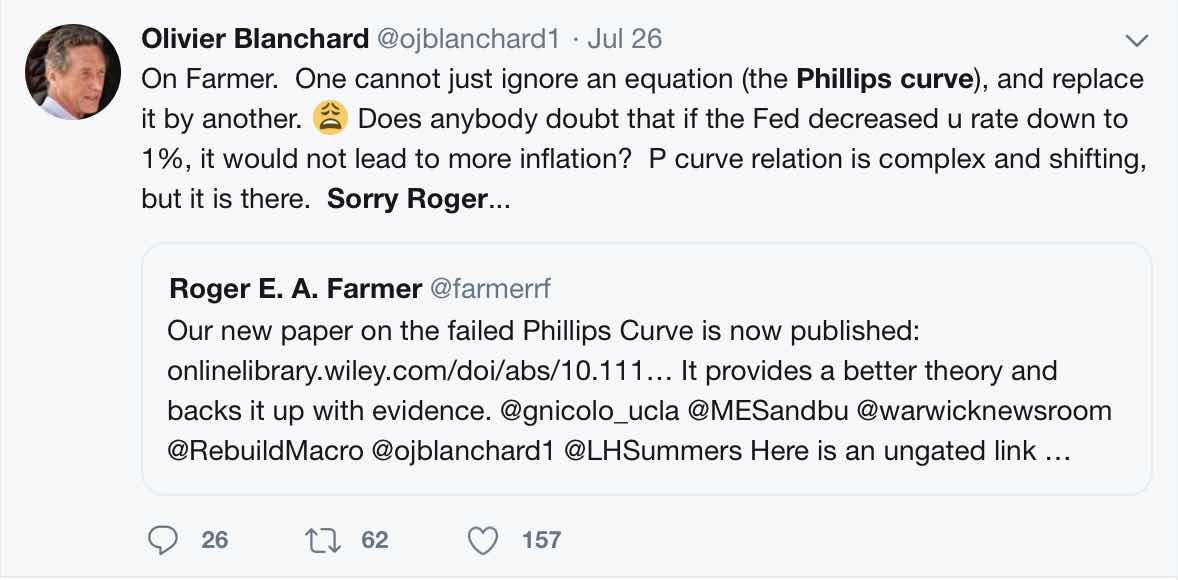

July 2019 Twitter wars: Blanchard VS Farmer

Powell

The Economist

Wage Phillips curve ?

Tentative conclusions

The Phillips curve:

Phillips probably did not have that much face in the Phillips curve.

It became widely accepted after it was introduced in Paul Samuelson’s textbook, and after Samuelson and Solow brought it to America.

Taming of the Keynesian revolution ?

Direct evidence that sticky prices have anything to do with the effects of demand shocks on the economy is actually rather weak:

These are the kinds of questions that can be answered using microeconomic level data.

However this is the basis for the long run / short run dichotomy that runs to today.

Krugman, Paul. 2018. “Good Enough for Government Work? Macroeconomics Since the Crisis.” Oxford Review of Economic Policy 34 (1-2): 156–68. https://doi.org/10.1093/oxrep/grx052.

Leijonhufvud, Axel. 1967. “Keynes and the Keynesians: A Suggested Interpretation.” The American Economic Review 57 (2): 401–10. https://www.jstor.org/stable/1821641.

Lucas, Robert E., and Thomas J. Sargent. 1979. “After Keynesian Macroeconomics.” Federal Reserve Bank Minneapolis Quarterly Review, no. Spr. https://ideas.repec.org/a/fip/fedmqr/y1979isprnv.3no.2.html.

Pearce, Kerry A., and Kevin D. Hoover. 1995. “After the Revolution: Paul Samuelson and the Textbook Keynesian Model.” History of Political Economy 27 (Supplement): 183–216. https://doi.org/10.1215/00182702-27-Supplement-183.

Summers, Lawrence H. 1991. “Should Keynesian Economics Dispense with the Phillips Curve?” In Issues in Contemporary Economics, 3–20. International Economic Association Series. Palgrave Macmillan, London.