December 7, 2020

Introduction

Links

There are several versions of these slides:

If you want to know more, there also exists a more advanced version of these slides (Ph.D. Level) - this is absolutely not exam material:

Plan of the course

We’ll illustrate some macroeconomic history in:

United States

Japan

Europe

Germany

United States

U.S. Real GDP

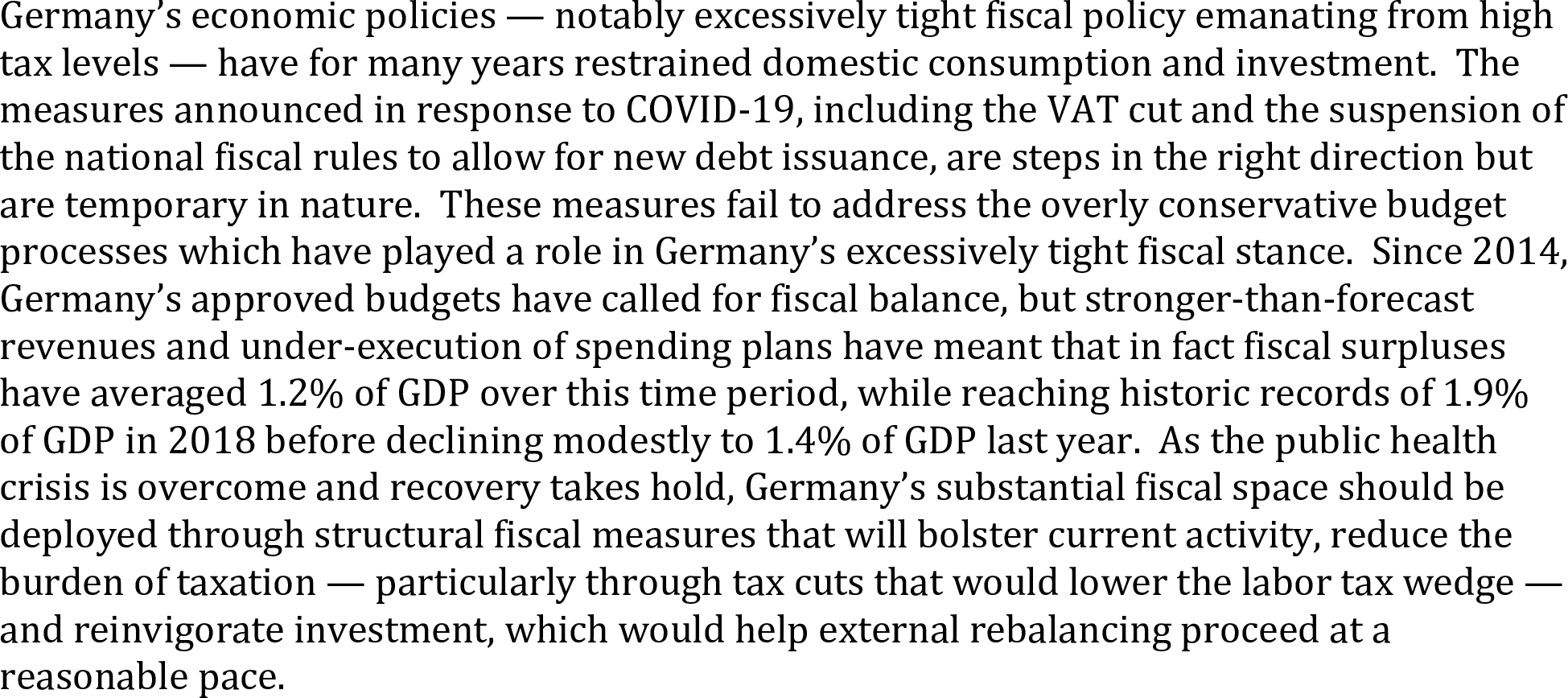

Shaded areas: NBER recessions.

World War II: large government purchases, loans to Europe (external demand).

1929: The Big Crash

End October 1929: The Big Crash

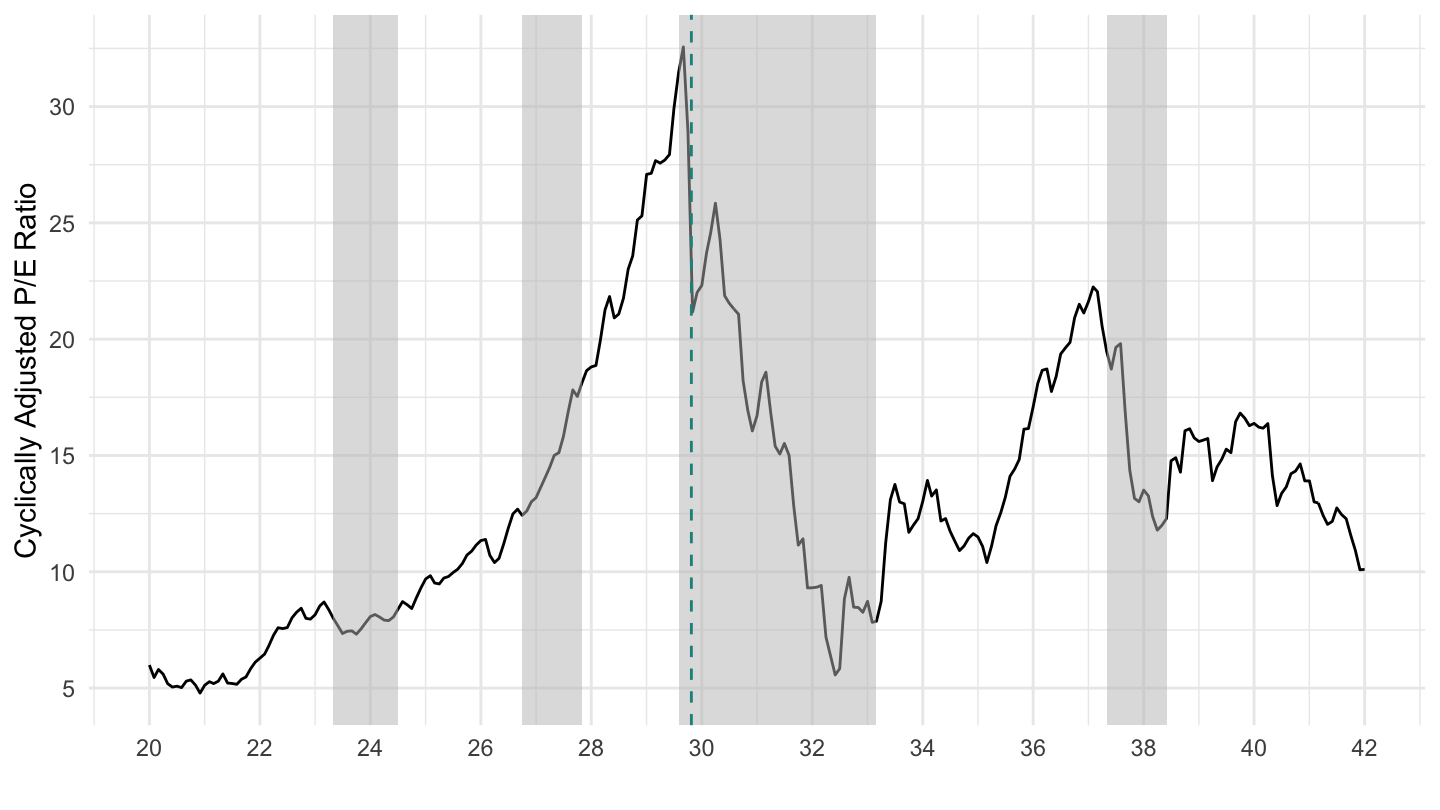

1973 Oil Shock

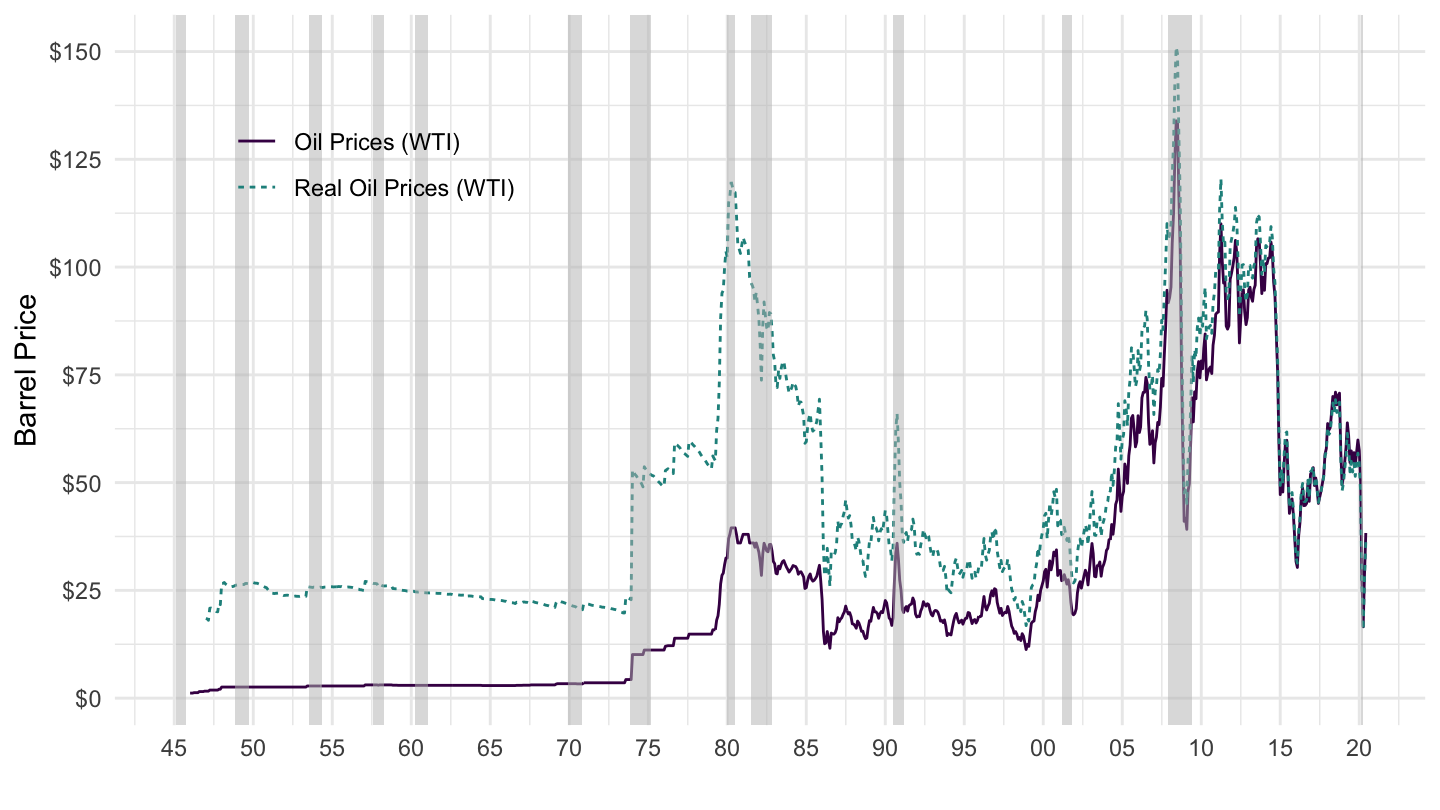

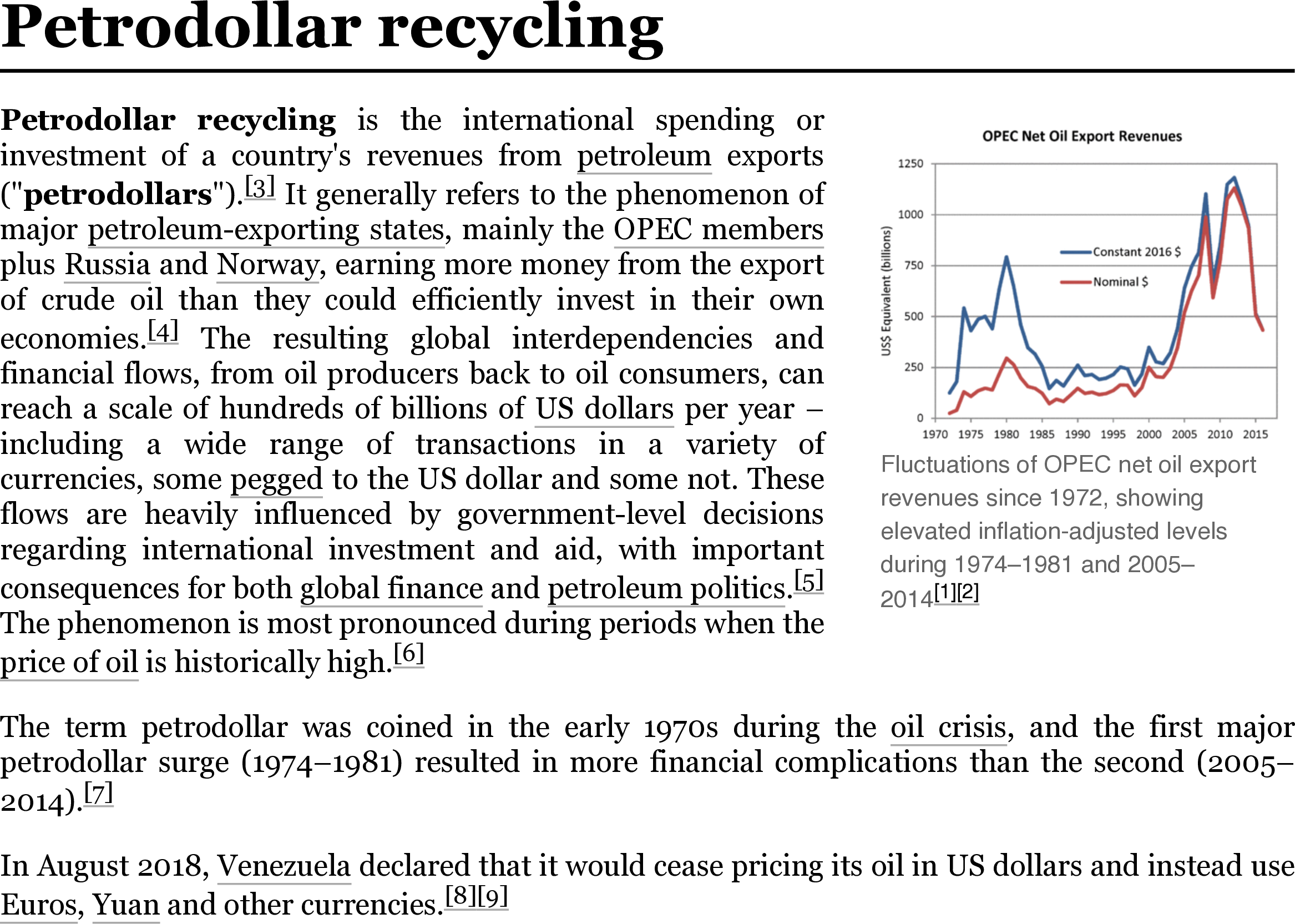

Effect on Oil Exporting Countries’ CA

Petrodollar recycling (Wikipedia entry)

Petrodollar recycling - Graeber (2011)

Petrodollar problem (IMF)

Go-go banking - Borrowers’ market (IMF)

China - U.S. Trade Tensions - Link between tariffs and devaluation

Japan

Sales Tax Increase: Abenomics

April 2014: When the government raised the tax to 8% from 5% in April 2014, a last-minute buying spree.

Subsequent pullback in demand caused a big downward swing in consumer spending.

Japan’s Sales Tax Increases

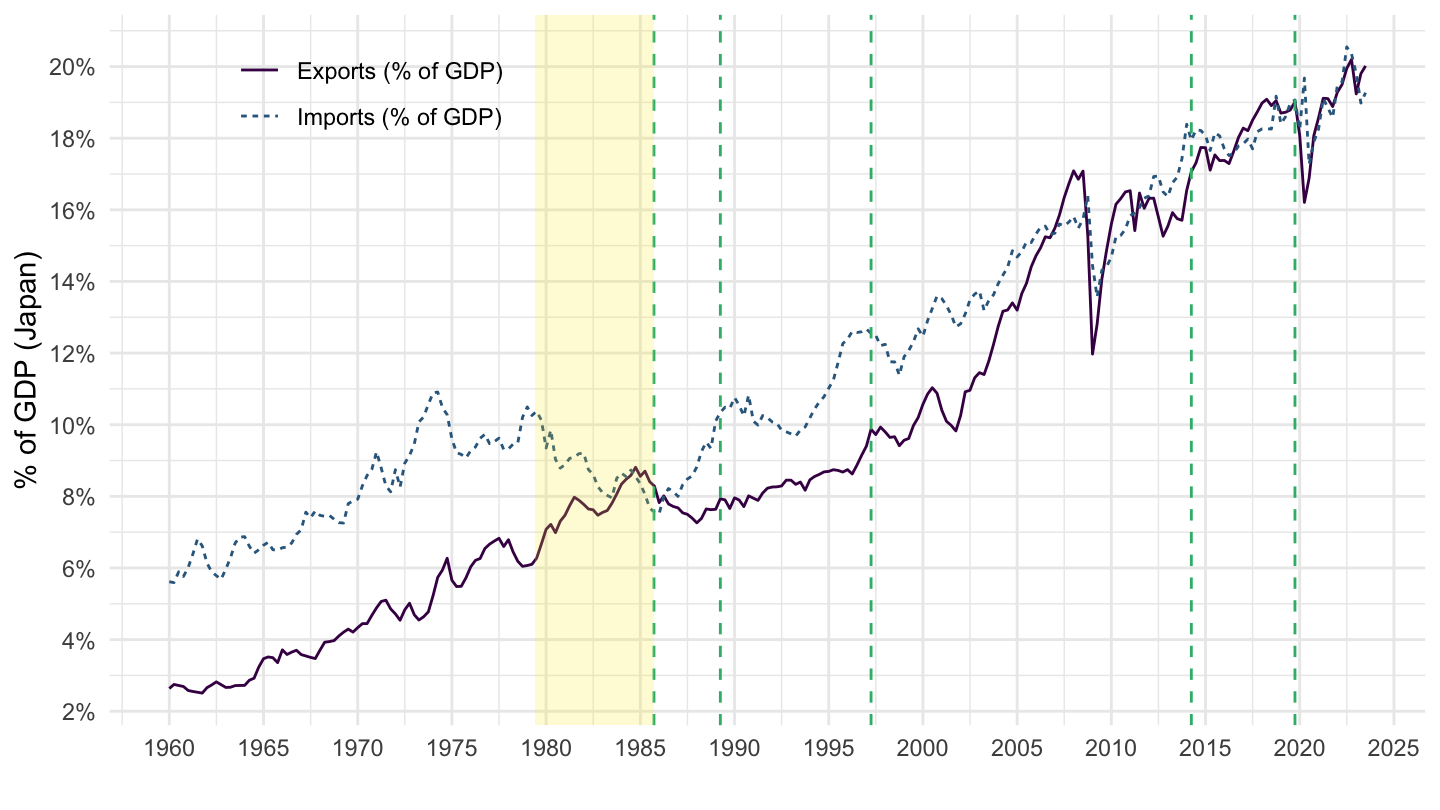

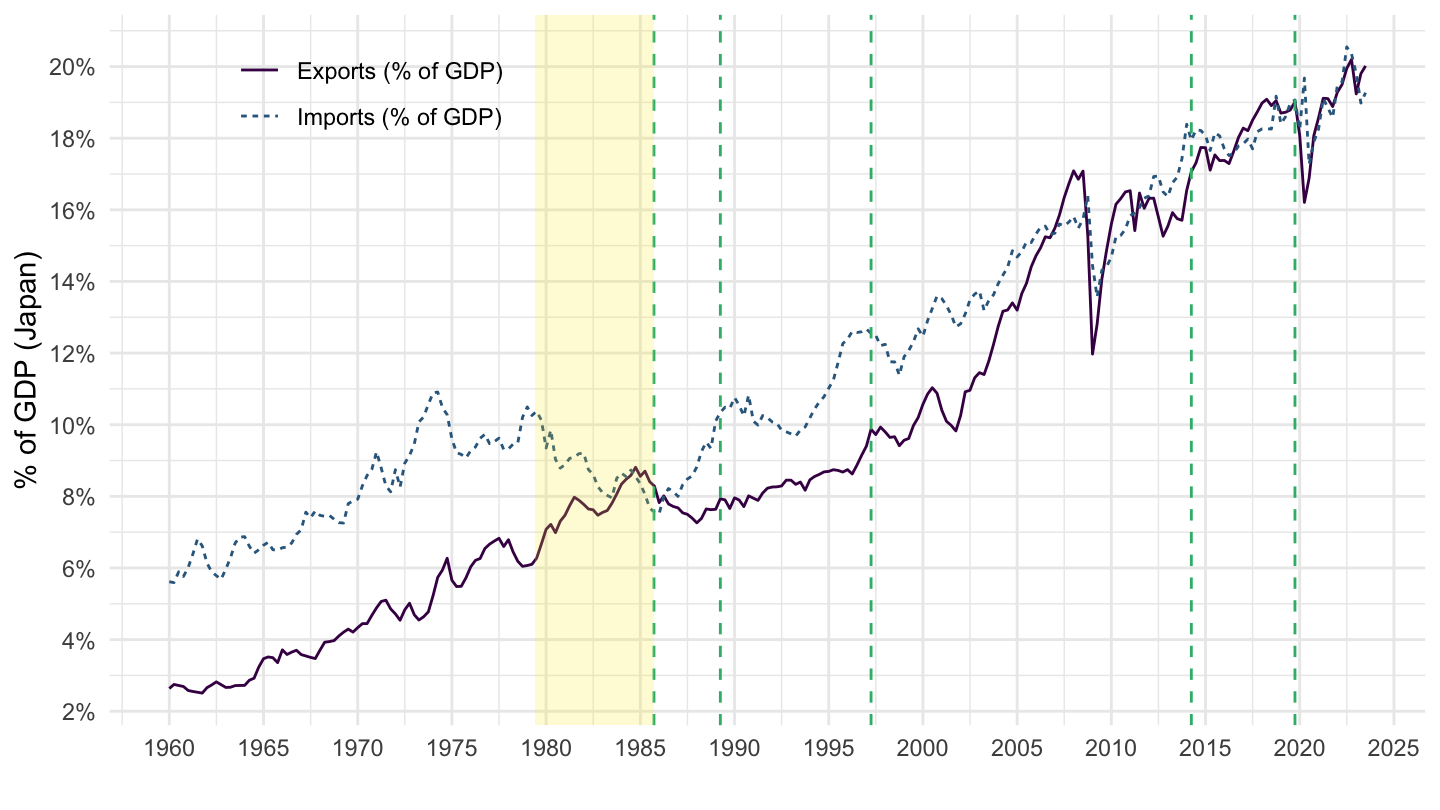

Japan: X and M (% of GDP)

What is Abenomics ?

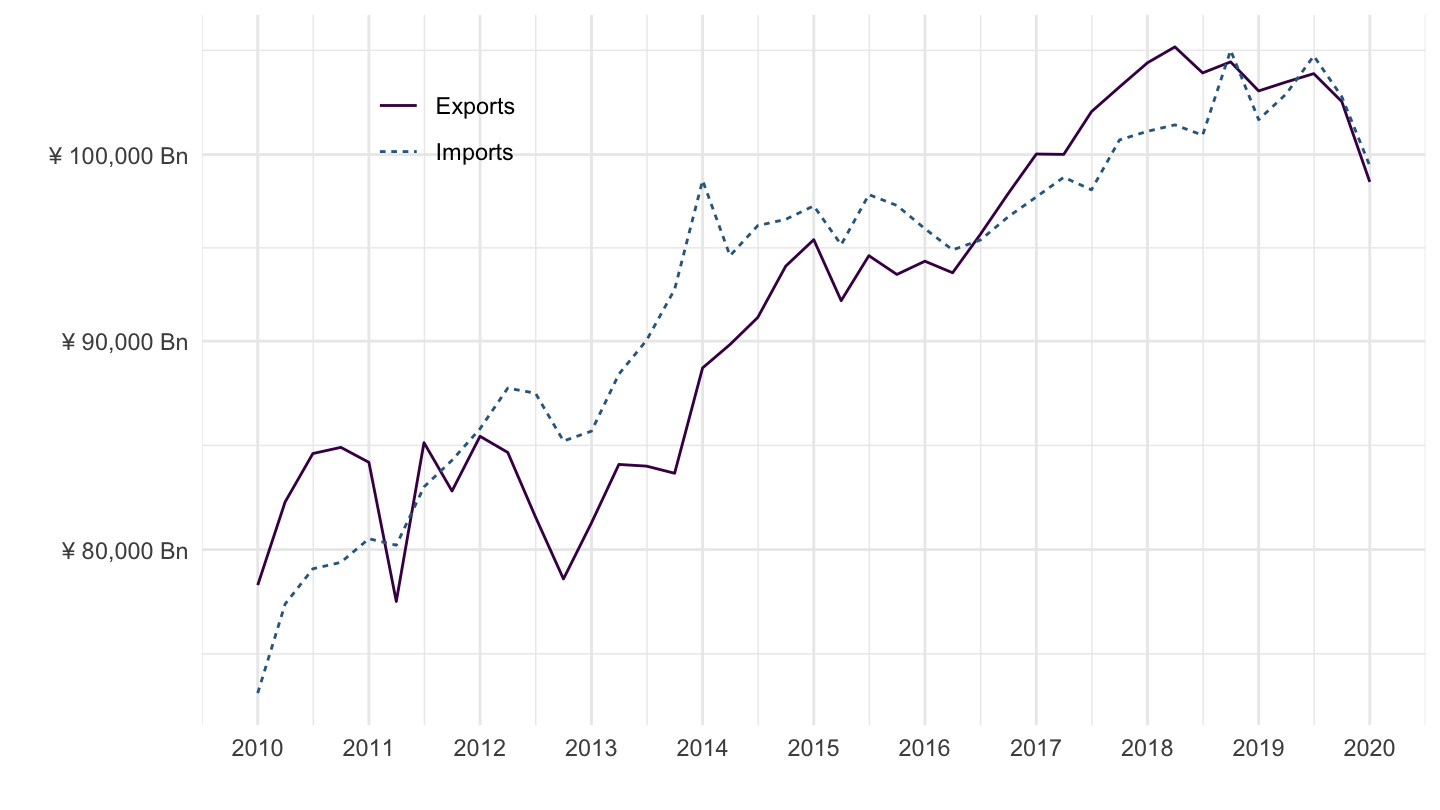

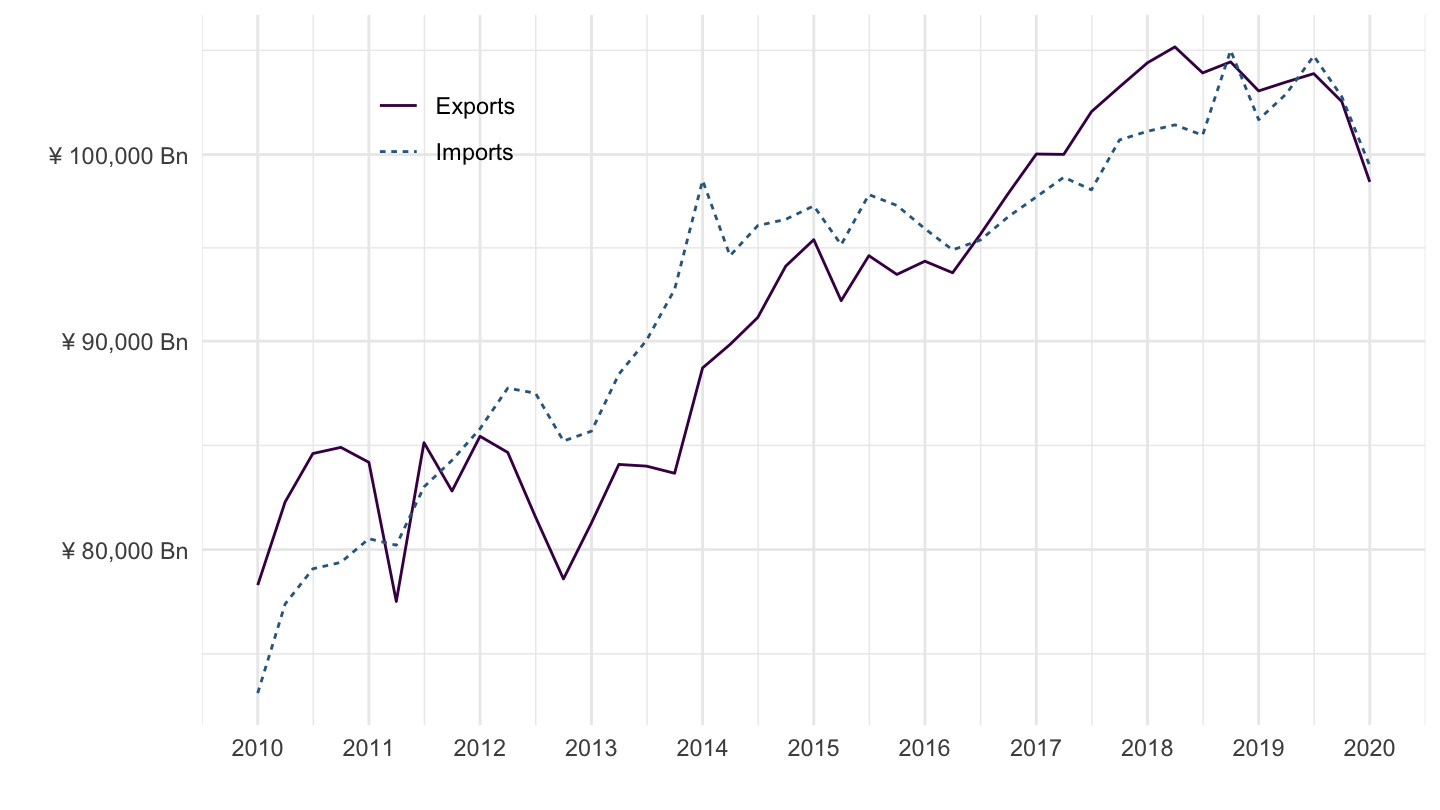

Japan: 2010-2020

Japan Exchange Rates

Japan: Abenomics

European Debt Crisis: 2011-13 Mistake

Trichet defends ECB rate increase

Trichet defends impeccable ECB record

Trichet defends impeccable ECB record

An amazing mea culpa from the IMF on austerity

An amazing mea culpa from the IMF on austerity

Lessons from Financial Assistance in Greece

Varoufakis and Schäuble

Varoufakis’ diagnosis in April 2015

7-year old winter of discontent

Design faults of the eurozone. Greek’s nation failings. \(\Rightarrow\) monster of a crisis.

Greece went to a period of Ponzi growth to a period of Ponzi austerity.

A glut of savings, generalized austerity leads the EU to export its crisis to the rest of the world.

Schäuble’s diagnosis

In Europe we have good reason not to provide financial assistance without demanding something in return.

A lot of people underestimate the problem of moral hazard.

Debt relief would not solve any structural problem. It would only weaken the incentives to carry out reform.

Any democratic system tends to take the more comfortable decision if you have the alternative to do so.

Wolfgang Schäuble: the Eurozone economy is expected to post positive growth.

Tsipras VS Merkel

Lessons from Financial Assistance to Greece

Germany

Schröder (center-left) wins over Lafontaine (left)

Context: Tony Blair elected in 1997 in the U.K.

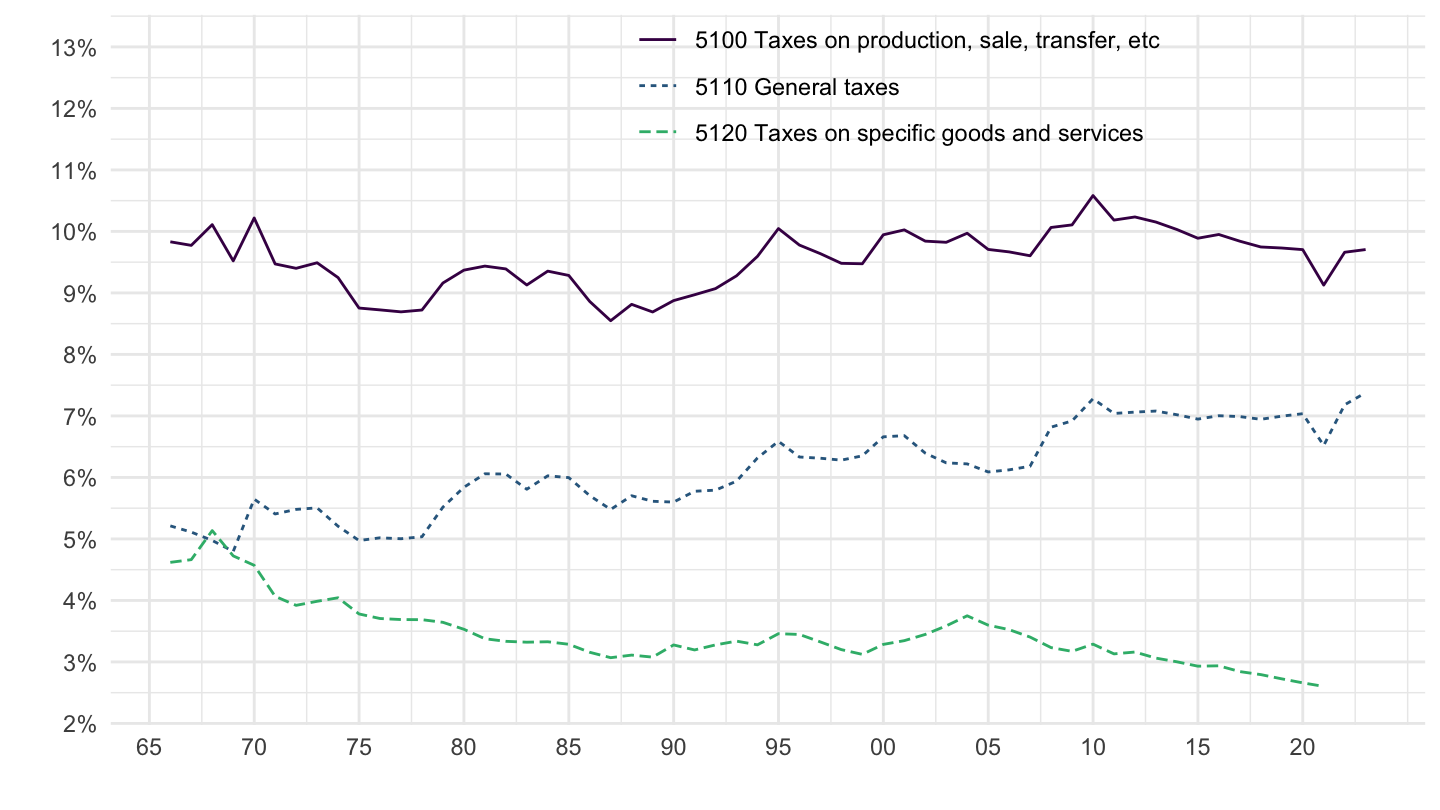

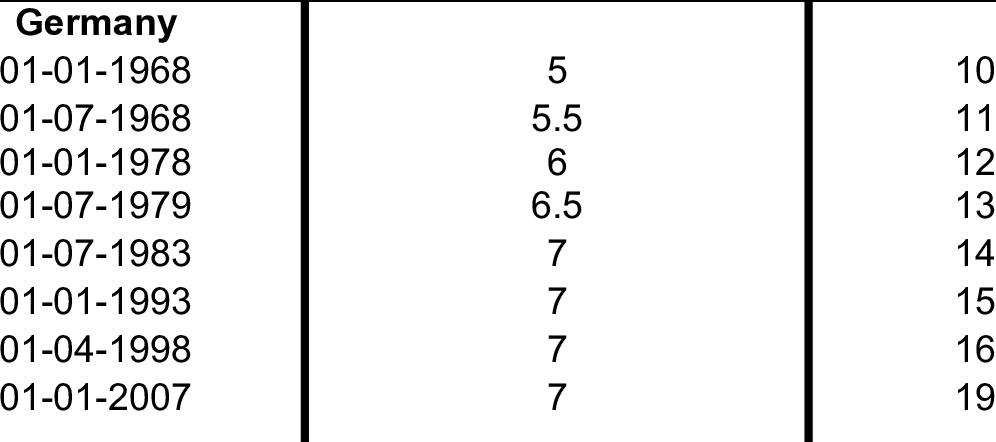

VAT Tax Increases in Germany

VAT Tax Rates in Germany

Germany’s VAT Tax Increases

Compressing Internal Demand (1998-2003)

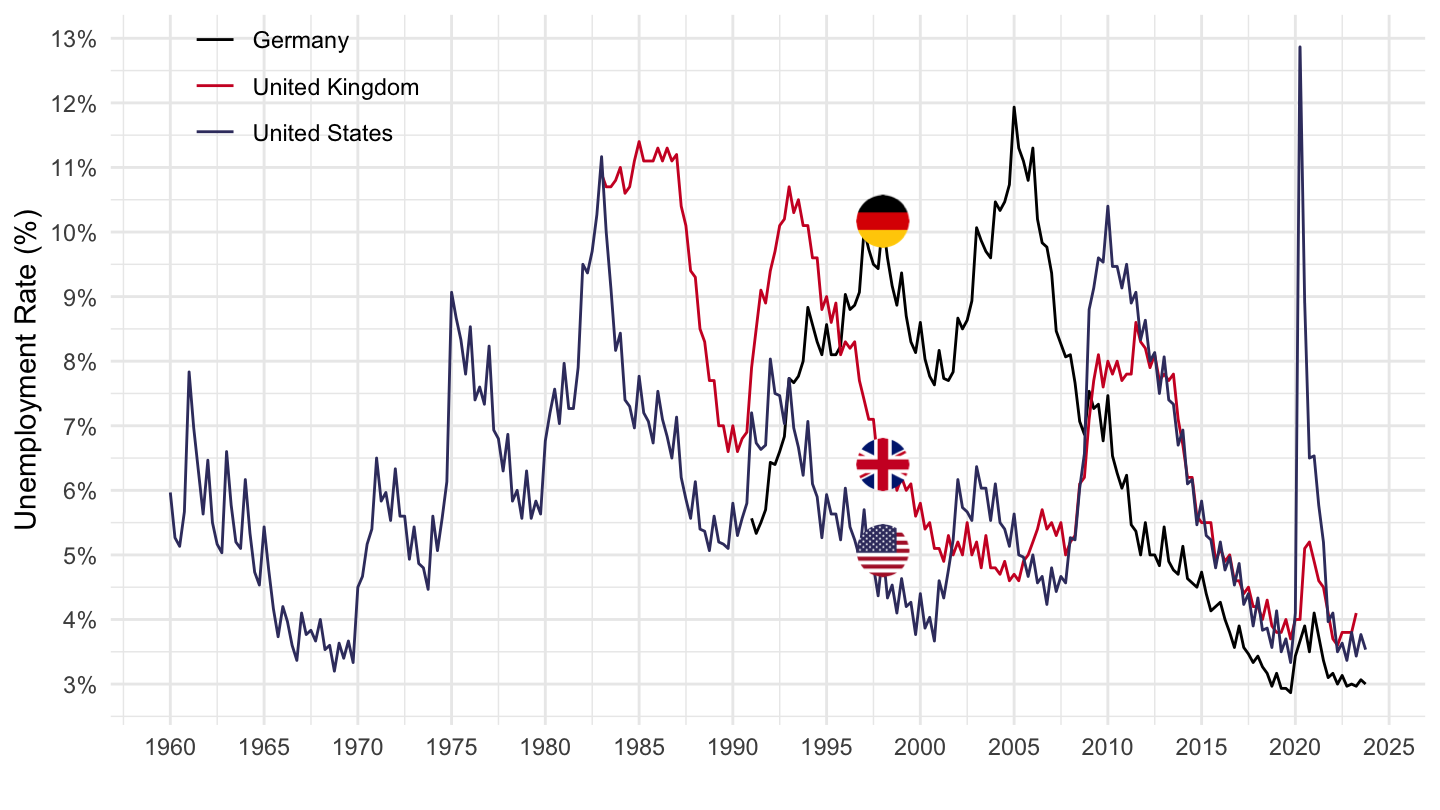

Unemployment in Germany VS UK, US

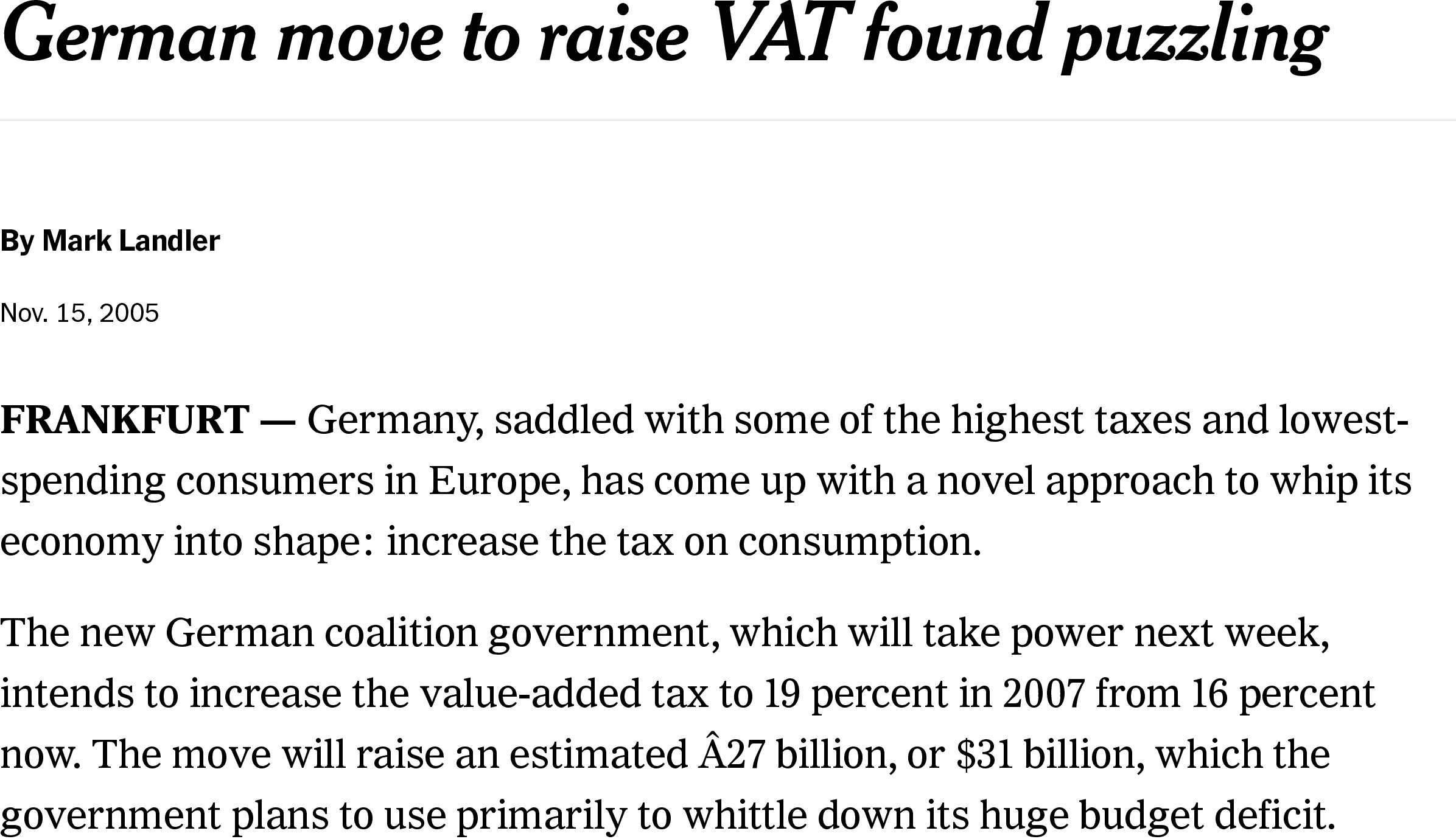

2005 VAT Tax Increase Found Puzzling

2010 - G20

Hands off our trade surplus

2017 - The German Problem

2017 - The German Problem

Germany’s trade surplus is a problem

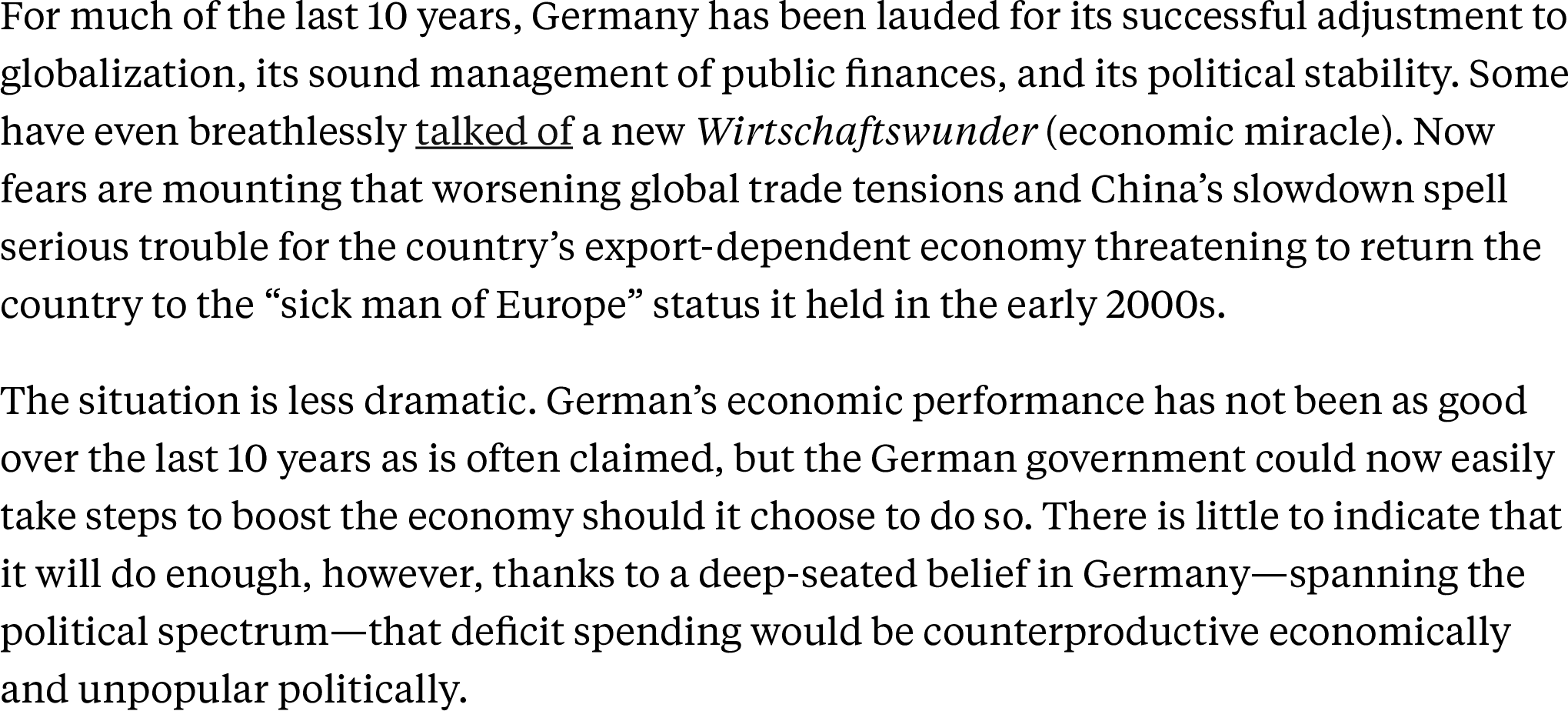

Tilford (2019): Germany is an economic masochist

An economic miracle ?

Germany’s export surplus

“The U.S. need to build better cars”

U.S. Treasury agrees with Tilford

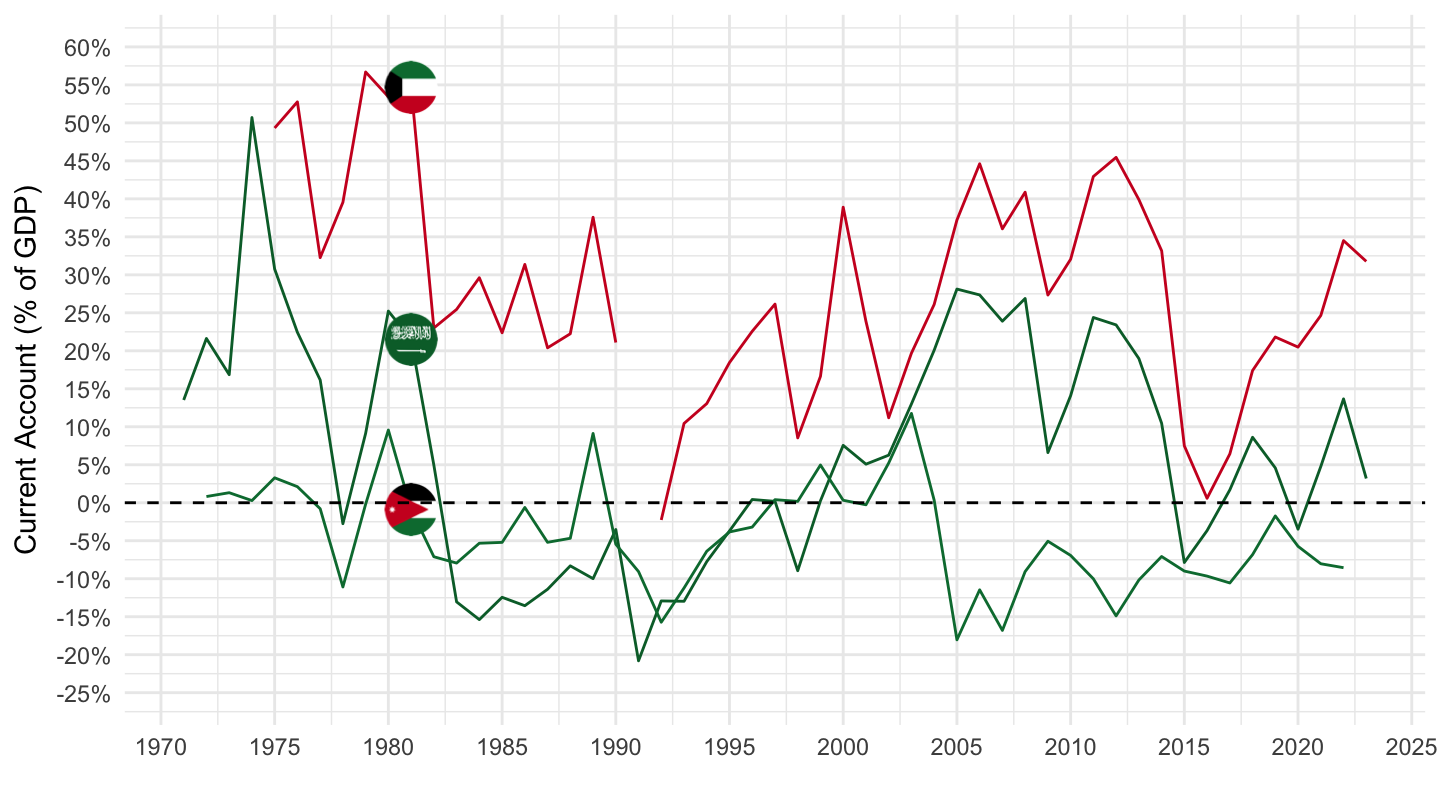

Germany’s CA Balance

Germany’s economic policies

Trump and tarriffs