Mankiw mentions two schools of thought:

The Real Business Cycle View - eveything is determined by supply “you may passionately believe that the business cycle is driven by exogenous shocks to technology,” which he strongly rejects.

The New-Keynesian, “synthesis,” view - “aggregate demand” matters for the short-run (where the economy is Keynesian), but neoclassical forces dominate in the long run. He argues in favor of teaching that.

On my side, I lean towards a third school of thought, which argues that aggregate demand might actually matter even for the long run (it is the mirror image view, compared to that which argues that everything is determined by supply).

I have worked on this very intensely since I started my ph.D. in 2010 and defended my dissertation in July 2013 entitled “Bubbles and Asset Supply.” The first chapter argued that there was an excess of savings over investment in the world.

October 5, 2020

Presentation

Welcome to Econ 102

Econ 102: Macroeconomic Theory. (Intermediate Macroeconomics in most places)

Mondays and Wednesdays, 9:30-10:45am.

18 lectures, including this one - 1 Midterm (I think), 1 Day Off (Veterans’ Day on Nov 11)

Haines Hall, Room 39.

Office hours: Mondays-Wednesdays, 10:45am-11:45pm (Zoom), right after class.

Lectures are recorded.

Exams

There is no textbook for this class.

There are slides, class notes, problem sets, readings, movie clips.

Everything that I say in class is potentially examinable. It is important that you listen to class.

“Required Readings” are also potentially examinable, so you need to read those.

Dates

Please mark the following dates in your calendar:

- Monday, November 9, 2020 - 9:30 AM - 10:45 AM: Midterm Exam.

- Monday, December 14, 2020 - 8:00 AM - 11:00 AM: Final Exam.

Grading Schemes

There are two available grading schemes:

Scheme 1: Homeworks (10%) + Midterm (20%) + Final Exam (70%)

Scheme 2: Homeworks (10%) + Midterm (35%) + Final Exam (55%)

Homeworks

5 homeworks, to hand in before Monday on Week 3, Week 4, Week 7, Week 8, and Week 10.

Homeworks will be given on Wednesdays after the lecture (Week 2, Week 3, Week 6, Week 7, Week 9)

Graded on P/NP basis.

Need to be submitted to your respective TAs before Monday lectures.

Body of “Knowledge”

Intermediate-level treatment of macroeconomic topics.

Economic growth, business cycle fluctuations, open-economy.

Calendar 1/3

Oct 05. Lecture 1 - Introduction to Empirical Macro; National Accounting.

Oct 07. Lecture 2 - Consumption and Saving.

Oct 12. Lecture 3 - Investment.

Oct 14. Lecture 4 - The Paradox of Thrift.

Oct 19. Lecture 5 - The Multiplier.

Oct 21. Lecture 6 - The Labor Market and Unemployment.

Oct 26. Lecture 7 - Redistributive Policies.

Oct 28. Lecture 8 - Open Economy.

Calendar 2/3

Nov 02. Lecture 9 - r-g, Savings Glut.

Nov 04. Lecture 10 - Pensions; Overlapping Generations.

Nov 09. Midterm.

Nov 11. Veteran’s Day (No Class).

Nov 16. Lecture 11 - Asset Pricing, Bubbles, Financial Markets.

Nov 18. Lecture 12 - Public Debt.

Nov 23. Lecture 13 - Inflation, Monetary Policy.

Nov 25. Lecture 14 - Phillips Curve.

Calendar 3/3

Nov 30. Lecture 15 - Exchange Rate Regimes.

Dec 02. Lecture 16 - Competitiveness and Productivity.

Dec 07. Lecture 17 - A Macroeconomic History of the U.S, Japan and Germany.

Dec 09. Lecture 18 - 2007 - 09 Financial Crisis.

Is economics a science ?

I come from the hard sciences (physics in particular). Economics is not a hard science. Hence, you should take everything I teach with a grain of salt. (!!)

Economics and politics are intertwined. You are strongly encouraged to voice your disagreement & your concerns. It’s sometimes hard to distinguish facts from opinion.

Opinionated

It’s not just me. Generally, economists know much less than they pretend.

Many issues are disputed: public debt, the causes of unemployment, trade imbalances, etc.

I want to teach you modes of reasoning, more than answers.

Joan Robinson (1903-1983)’s Warning

Macroeconomics is hard to teach

Why is macroeconomics so hard to teach?, The Economist, August 11, 2018. Link 1 / Link 2

I will be emphasizing both what we know and what we don’t know for sure.

Macroeconomics is hard to teach

From The Economist:

Macroeconomics is difficult to teach partly because its theorists (classical, Keynesian, monetarist, New Classical and New Keynesian, among others) disagree about so much.

It is difficult also because the textbooks disagree about so little. To reach the widest possible audience, most cover similar material: a miscellany of models that are not always consistent with each other or even with themselves.

The result is that many professors must teach things they do not believe.

Churchill’s joke

Well-known textbooks

If you look at previous editions of these lectures / exams, you’ll see that I have used different textbooks.

In 2015-2016 i’ve used Charles Jones’ Macroeconomics textbook.

In 2018, I used Olivier Blanchard’s Macroeconomics textbook.

Mankiw (2019)

Main “schools of thought”

My teaching and my research

My own research has made me a little bit more original in my views than your usual instructor in macroeconomics: I am a Keynesian, but I am not a new-Keynesian.

Although, I am not alone: Larry Summers, for example, is a well-known defender of the secular stagnation views that I’ll be teaching in this course. The reason why I teach that is because I believe they explain the world much better.

In November 2013 Larry Summers, at the IMF Fourteenth Annual Research Conference in Honor of Stanley Fischer, argued forcefully in favor of “secular stagnation,” or the idea of an excess of savings over investment.

I will not only be teaching my “pet” theories I’ve worked on since my Ph.D. thesis, but I’ll also be teaching the more standard theories, so that you know how to read the press, as well as the problems that come with these theories.

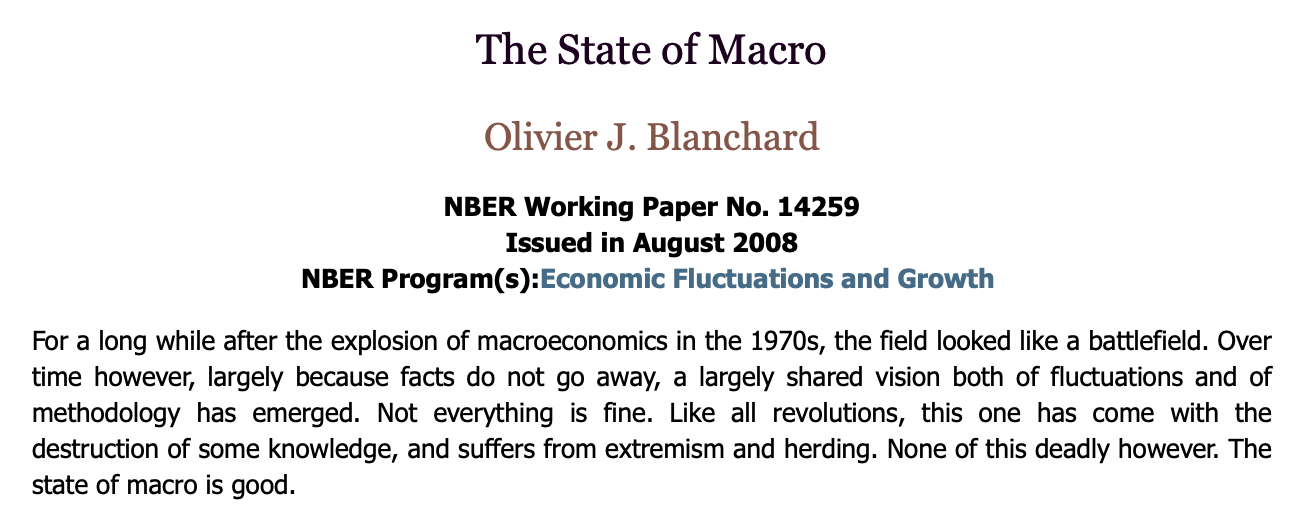

Olivier Blanchard in August 2008

“The state of macro is good.”

September 15, 2008: Lehman Brothers

Sept 09: How did economists get it so wrong?

Sept 09: How did economists get it so wrong?

Sept 09: How did economists get it so wrong?

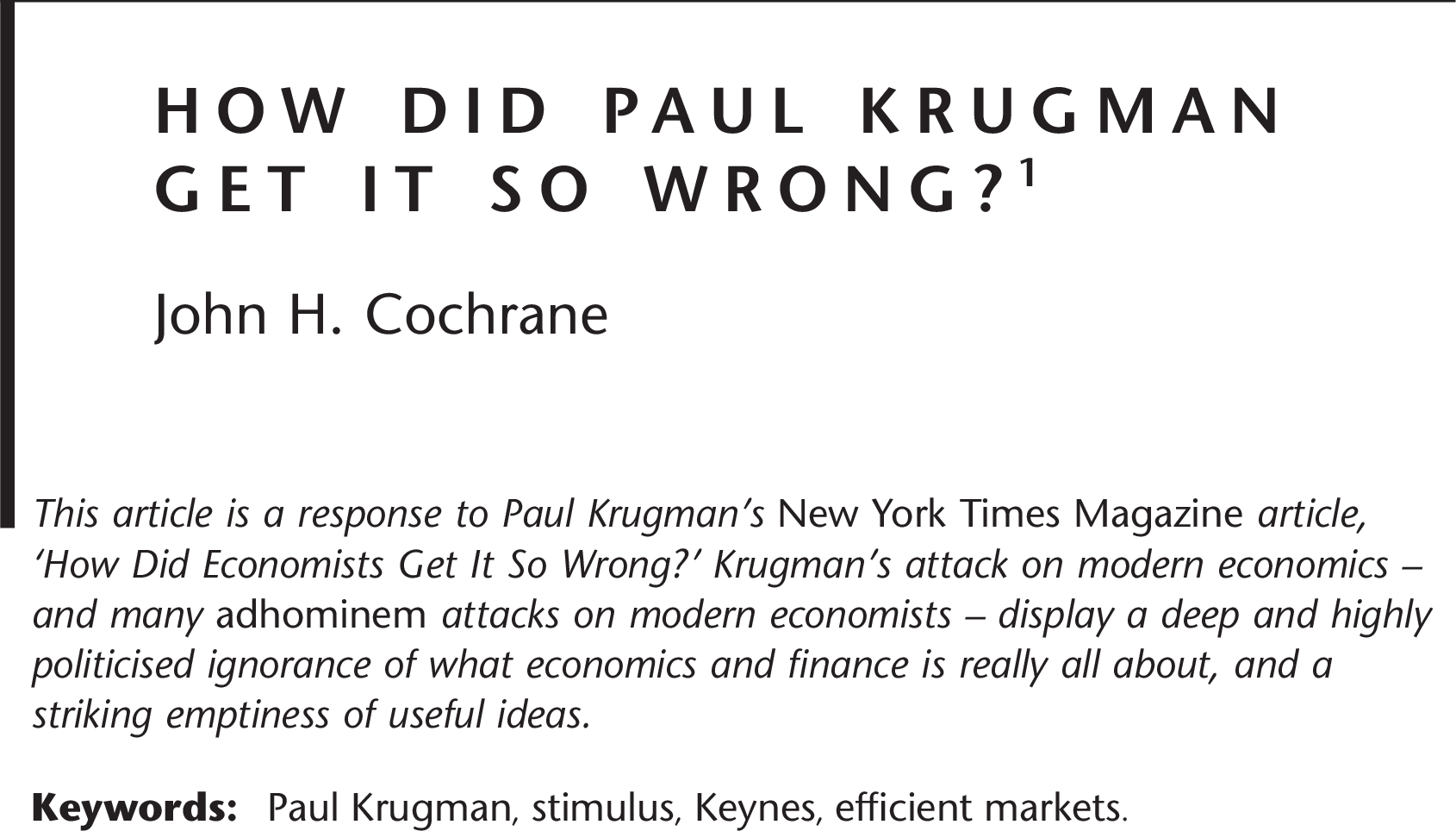

2011 - John Cohrane’s response

2011 - John Cohrane’s response

Mainstream views of macroeconomics

In the past, I’ve taught Intermediate Macroeconomics 2 times using Charles I. Jones’ textbook (Winter 2015, Winter 2016), once using Blanchard textbook (Spring 2018).

Since Fall 2018, I’ve started using my own material. However, I will try to follow Greg Mankiw’s guidelines and be an “ambassador for the economics profession.” I will tell you when what i teach you is not exactly mainstream.

In particular, I disagree with the sticky price interpretation of Keynesian economics, and do not believe in the Phillips curve. This view is taught in both Greg Mankiw’s textbook as well as in Olivier Blanchard’s.

Cost of the class is very low: simply buying “The Big Short” movie. (required for the class)

To illustrate this debate, I will now spend some time on how macroeconomists distinguish “cycles from trends” in macroeconomic time series.

Cycles and Trends

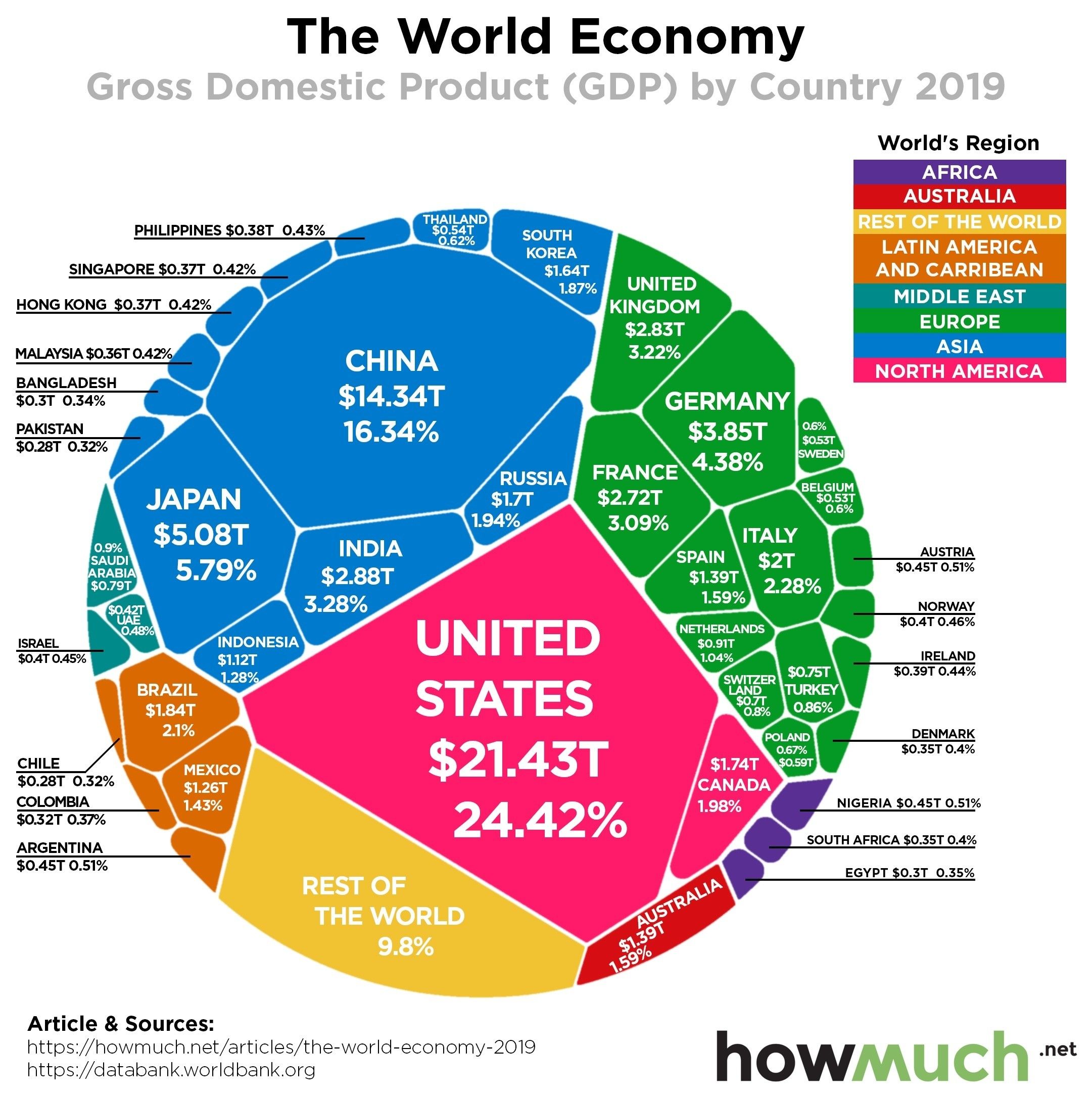

World GDP = $ 80 Tn

GDP

GDP Per Capita

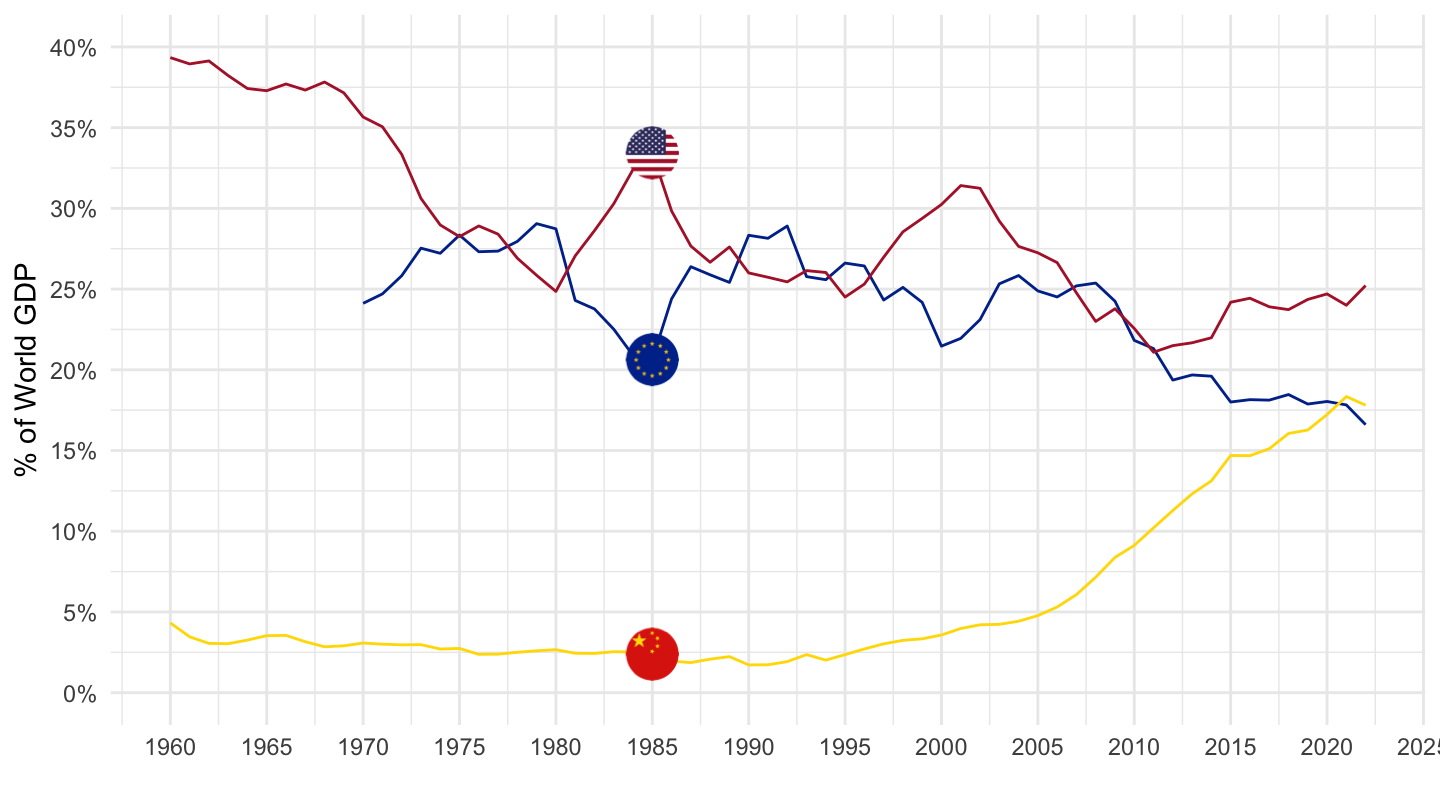

U.S., Europe, China

Japan, India, United Kingdom

Germany, France, Italy

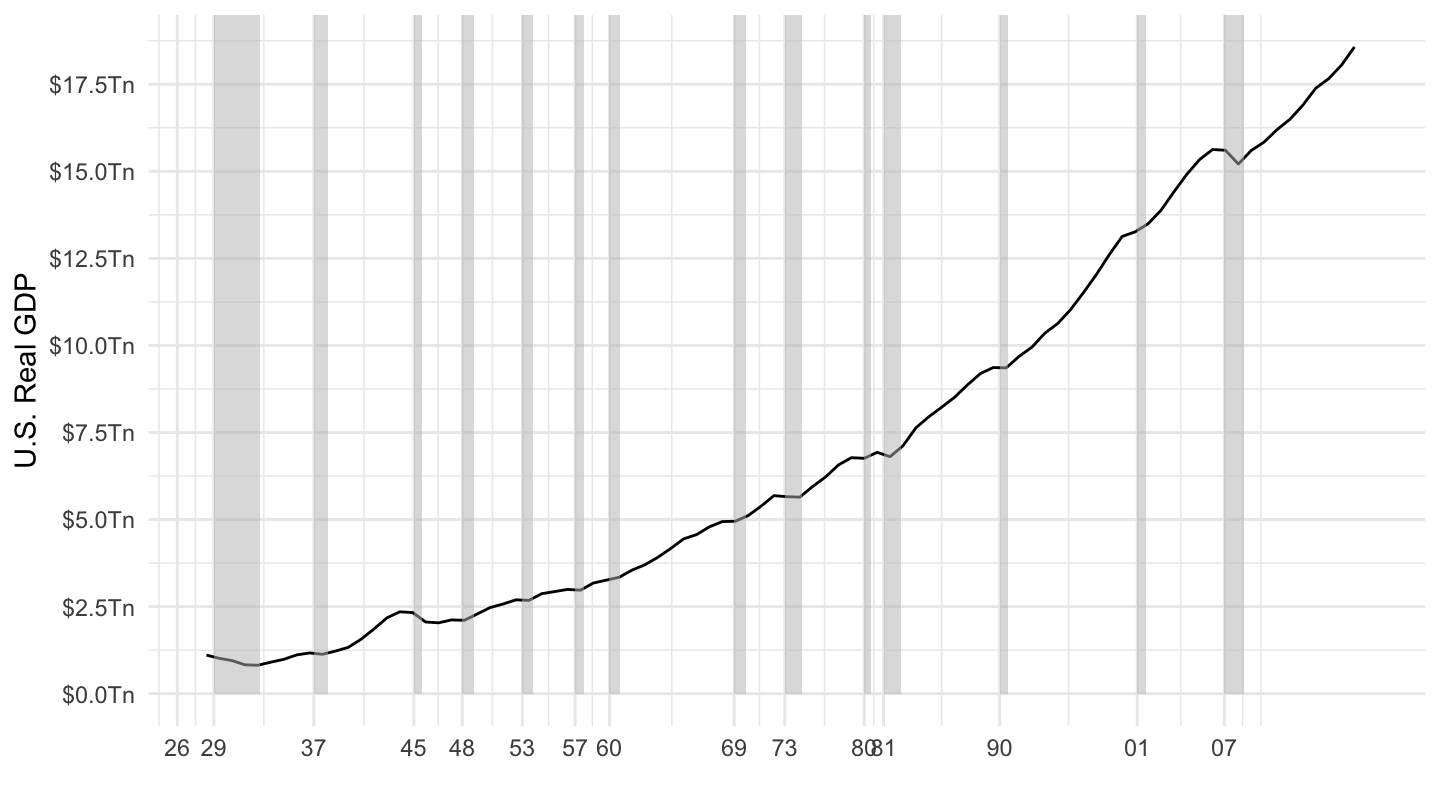

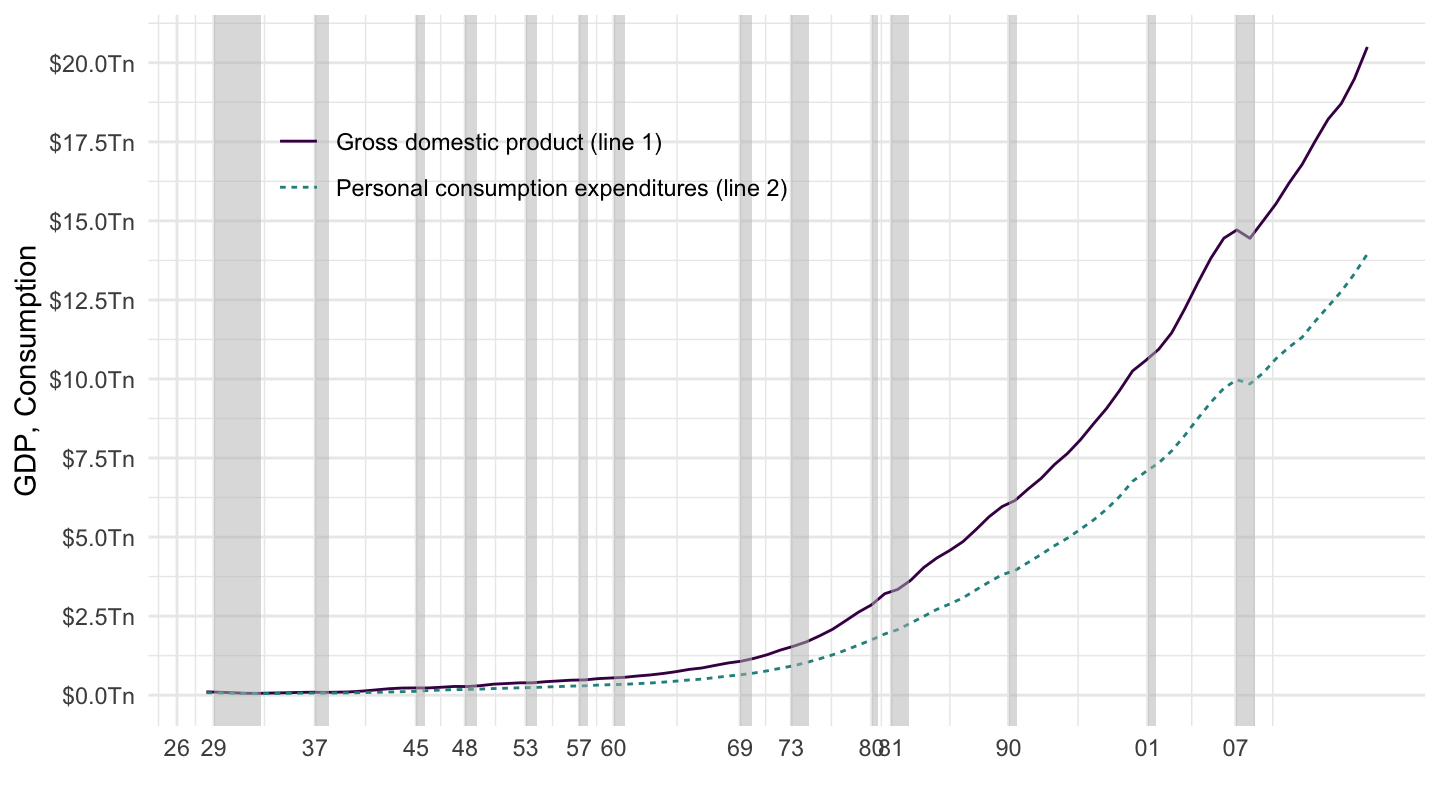

U.S. Real GDP (1929-2019)

- Let’s look at U.S. “Real” GDP (somehow, we’ve taken out inflation). $1Tn = $1,000Bn = $1,000,000 = $1,000,000,000,000.

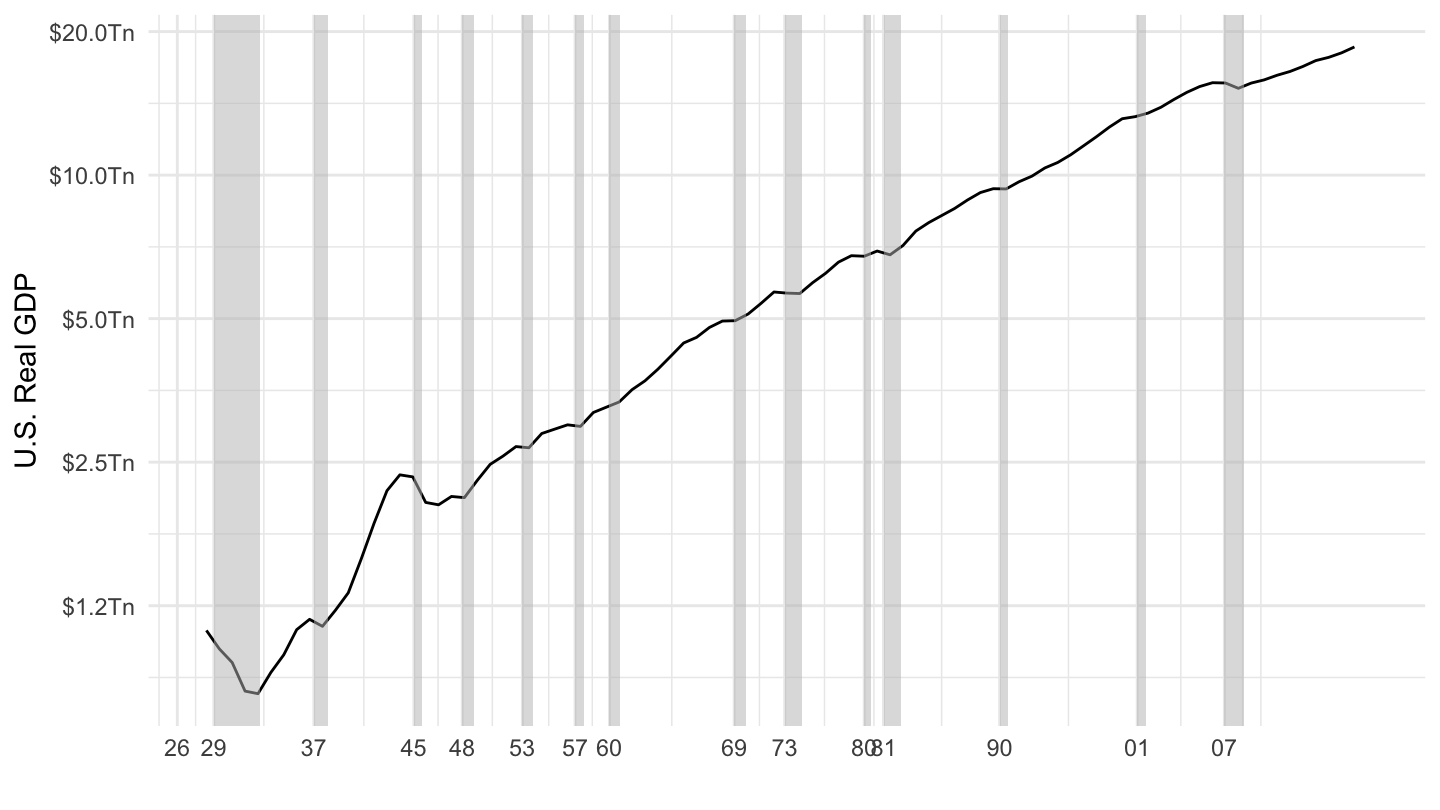

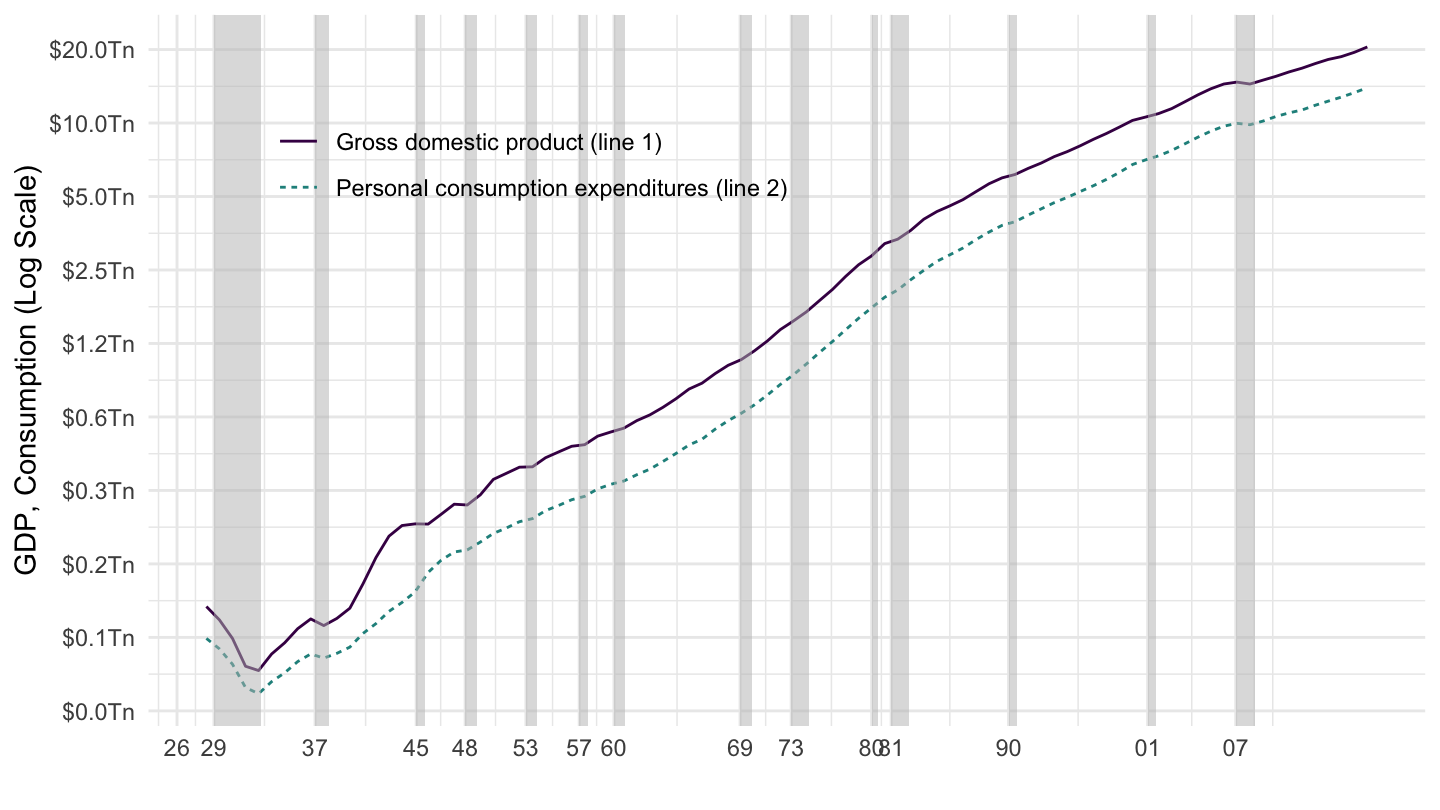

U.S. Real GDP - Log Scale (1929-2019)

- Let’s look at U.S. “Real” GDP on a log Scale. (in 2012 dollars)

U.S. Real GDP (1929-2019)

- What do you notice?

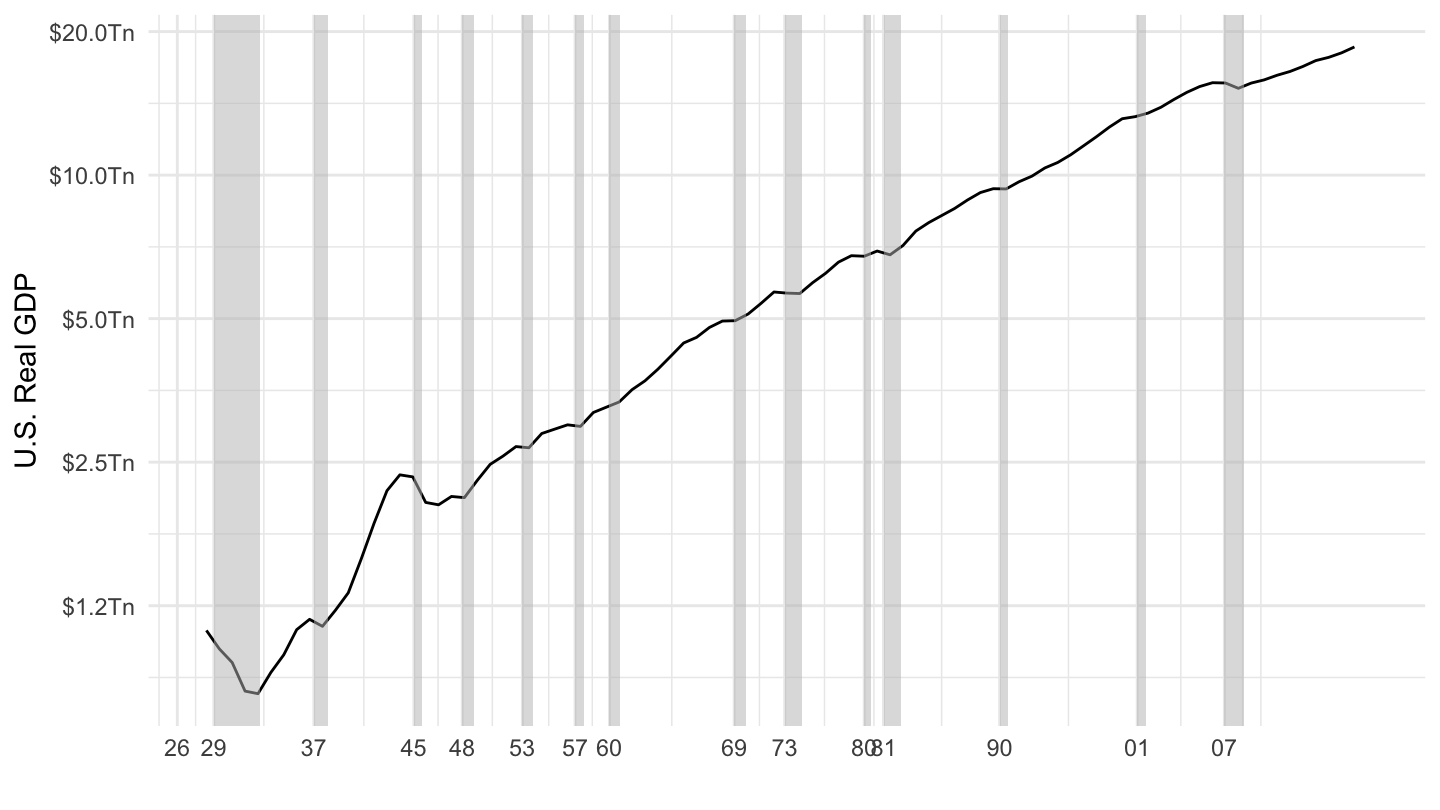

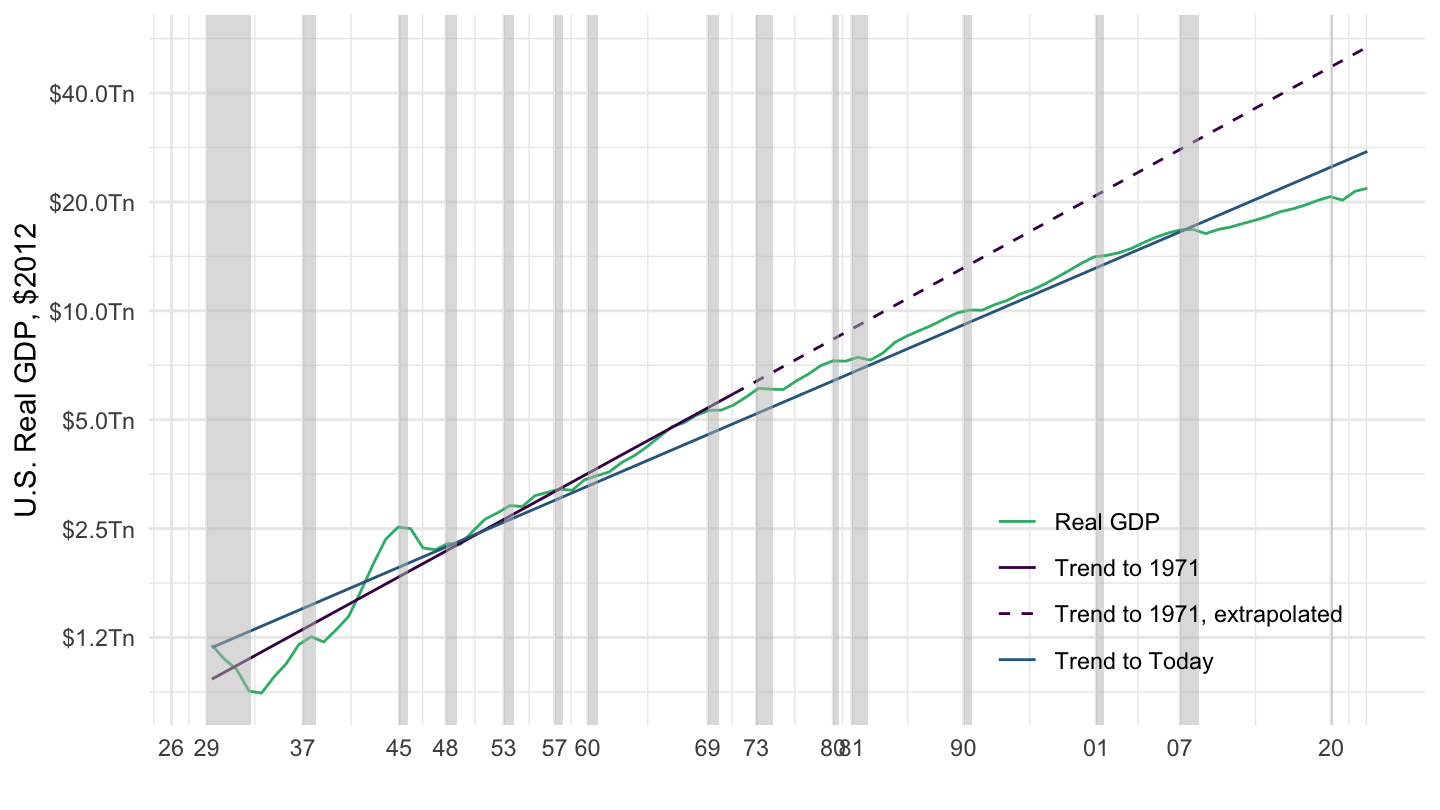

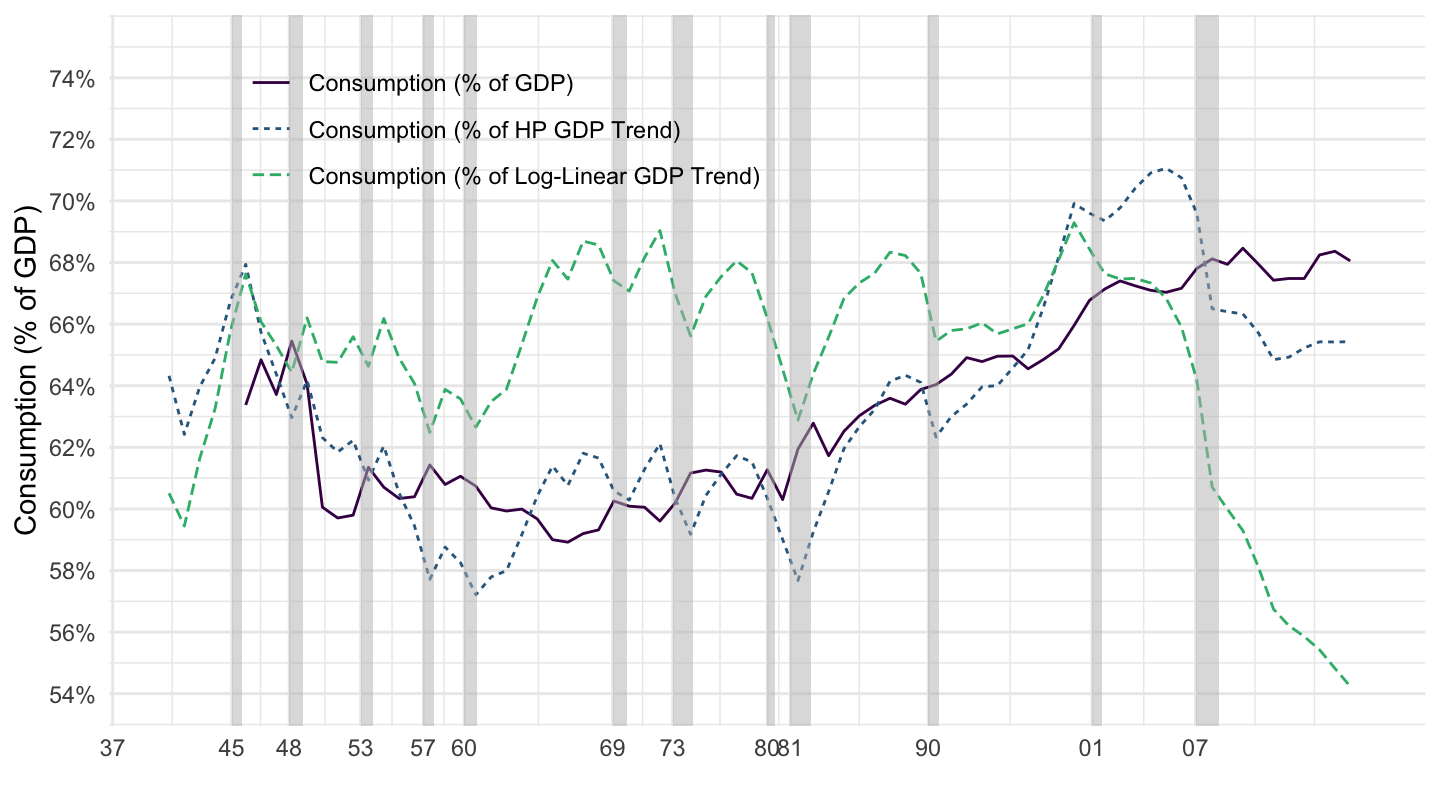

What is the cycle, what is the trend? (Figure 1.1)

What is the cycle, what is the trend?

Blue line fits a trend line until 2019.

Purple line fits a trend line until 1971.

Implication: growth has substantially slowed since 1971.

During the TA section this week, you’ll replicate Figure 1.1 using NIPA data (available online) and Google Sheets.

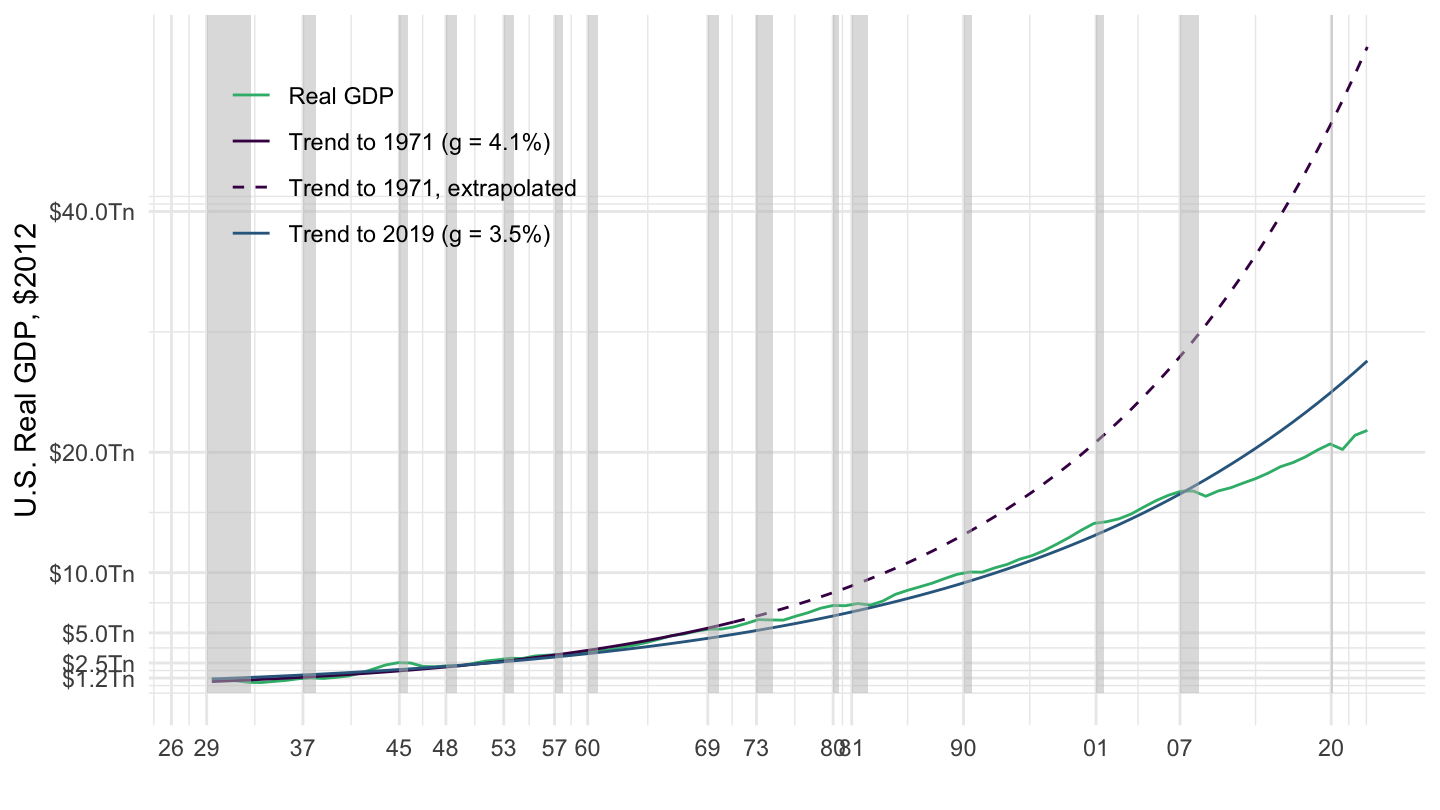

What is the cycle, what is the trend? (Figure 1.2)

Importance of Cycle VS Trend

This may seem like a technical detail, but it’s really not.

The trend is often seen as a measure of “potential output”: that is, how much output could potentially be produced given a state of technology, if resources were fully used (unemployment was minimal)

What you assume about the trend matters a great deal.

We’ll see that it impacts how much monetary policy, and fiscal policy, authorities need to do.

It also interacts with how much of fluctuations in GDP is due to supply VS demand.

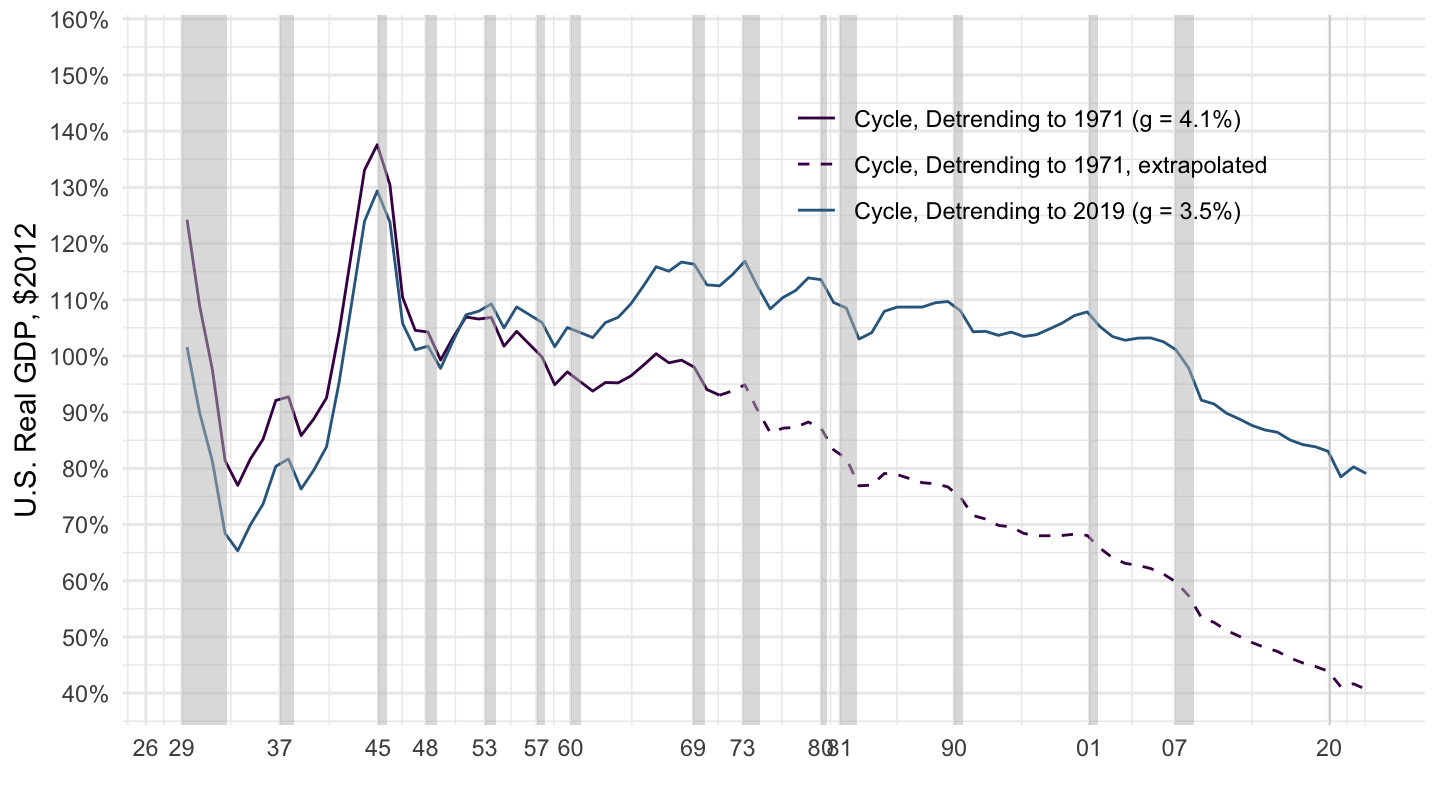

What is the cycle, what is the trend? (Figure 1.3)

- GDP as a fraction of Trend GDP, in %. (GDP / Trend GDP)

Product Approach

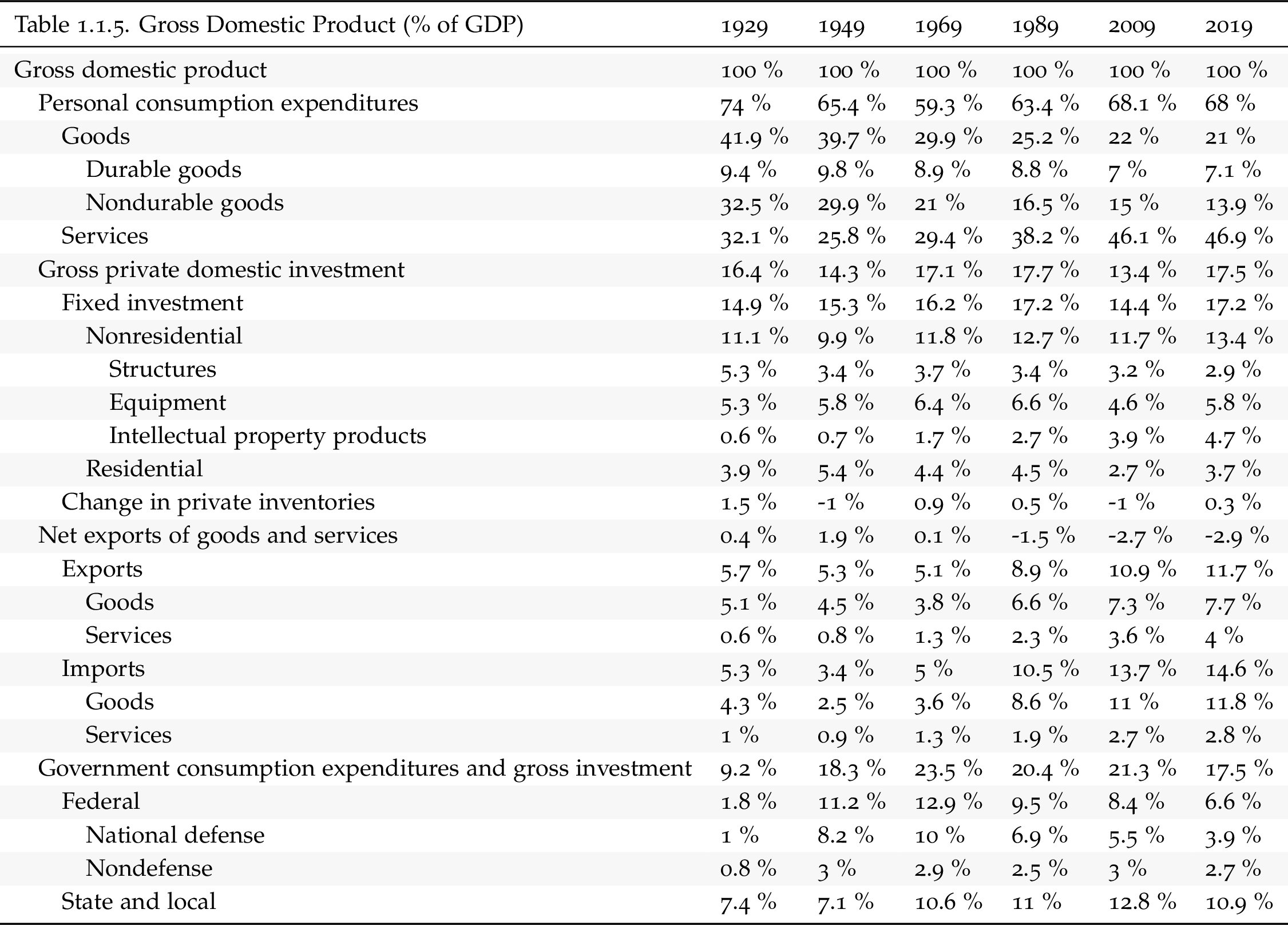

Components

According to the product approach to GDP, GDP is the sum of four components:

Consumption spending by households (C).

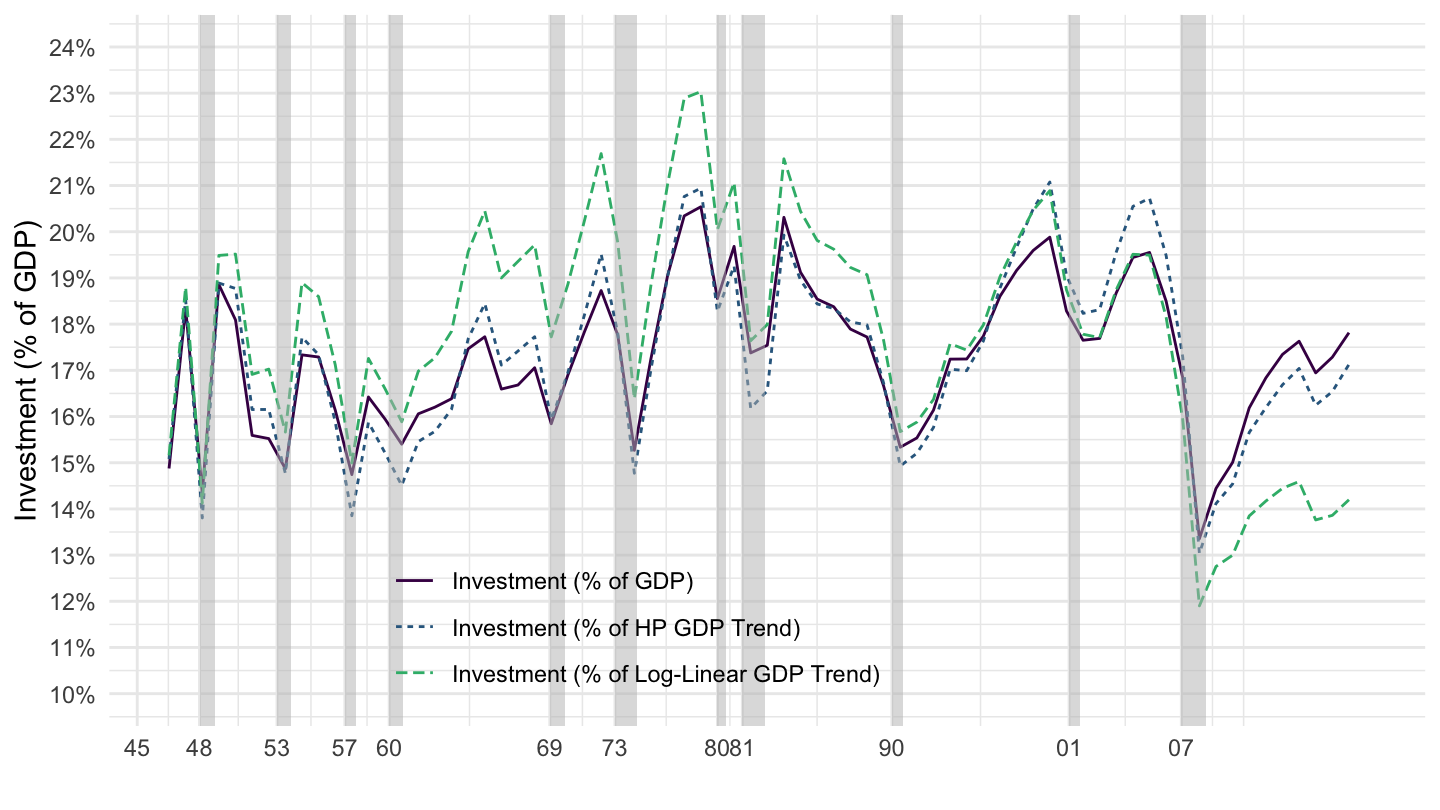

Investment spending by households and corporations (I).

Government purchases (G).

Net exports (NX).

Components

GDP is equal to the total aggregate demand for goods: \[ Y = C + I + G + X -M.\]

We often define net exports as:1 \[NX \equiv X-M,\]

so that GDP is simply: \[ Y = C + I + G + NX.\]

Main GDP Components (NIPA)

Don’t confuse: GDP By Industry

US GDP and Consumption from NIPA (BEA)

US GDP and Consumption from NIPA - Log

Consumption

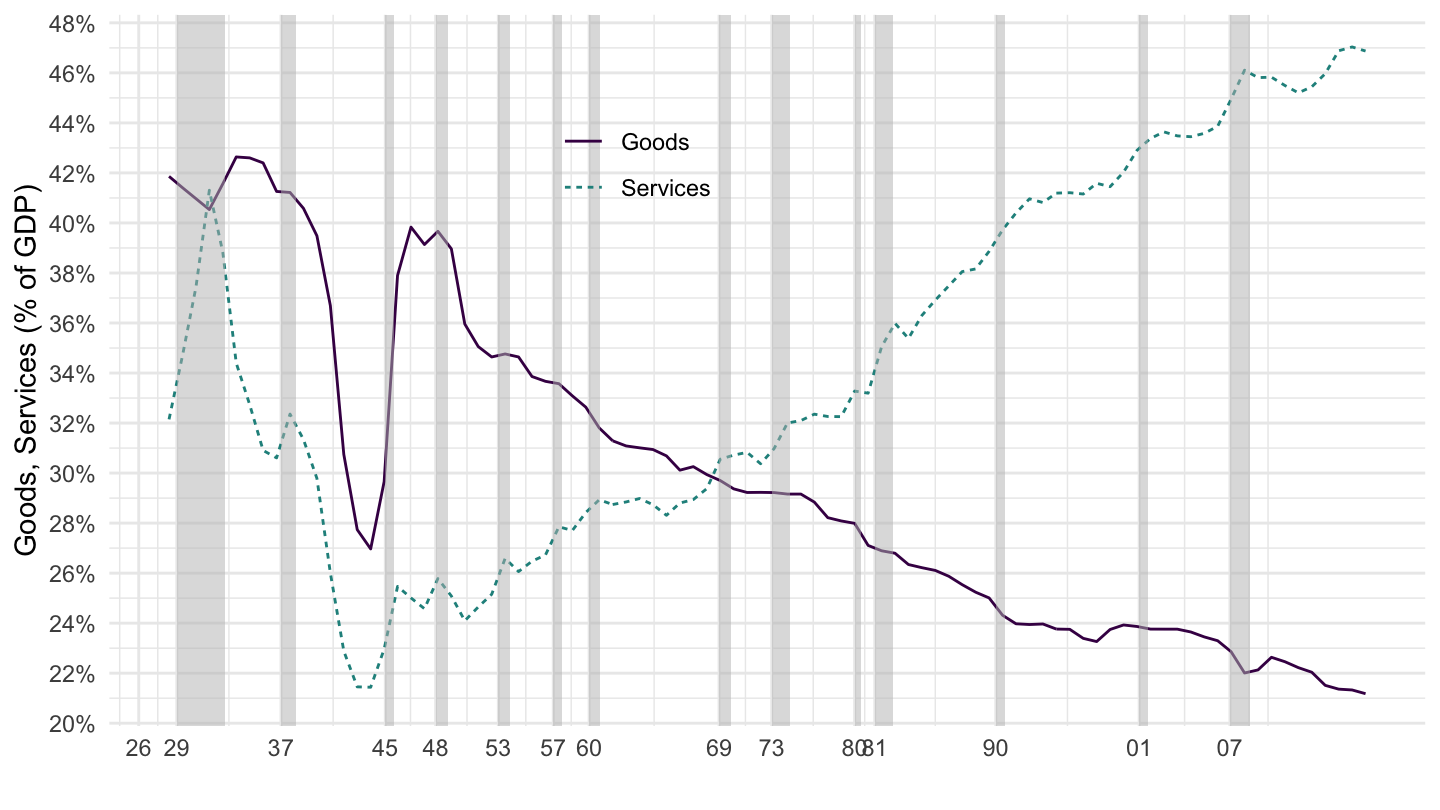

Goods and Services Consumption

Goods and Services Consumption

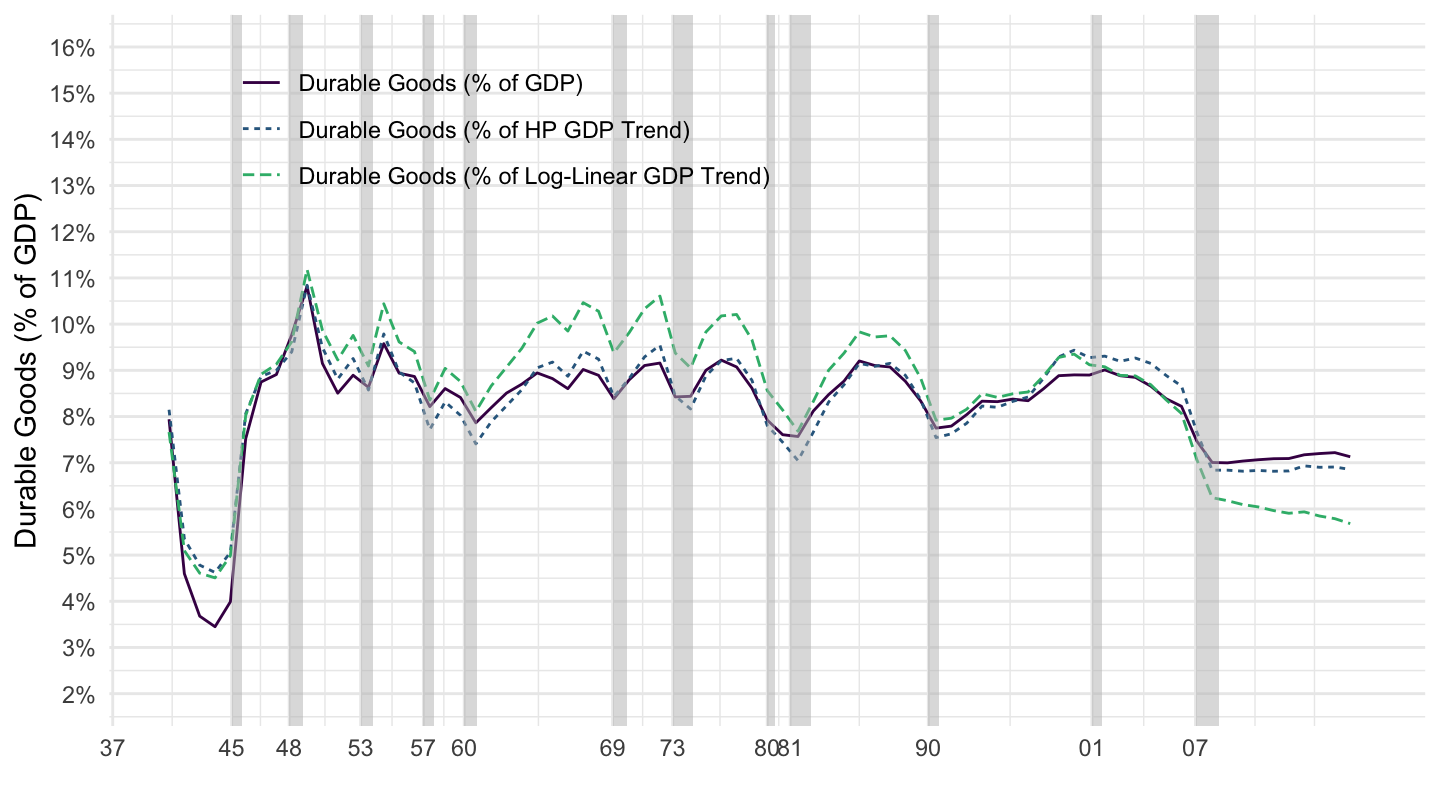

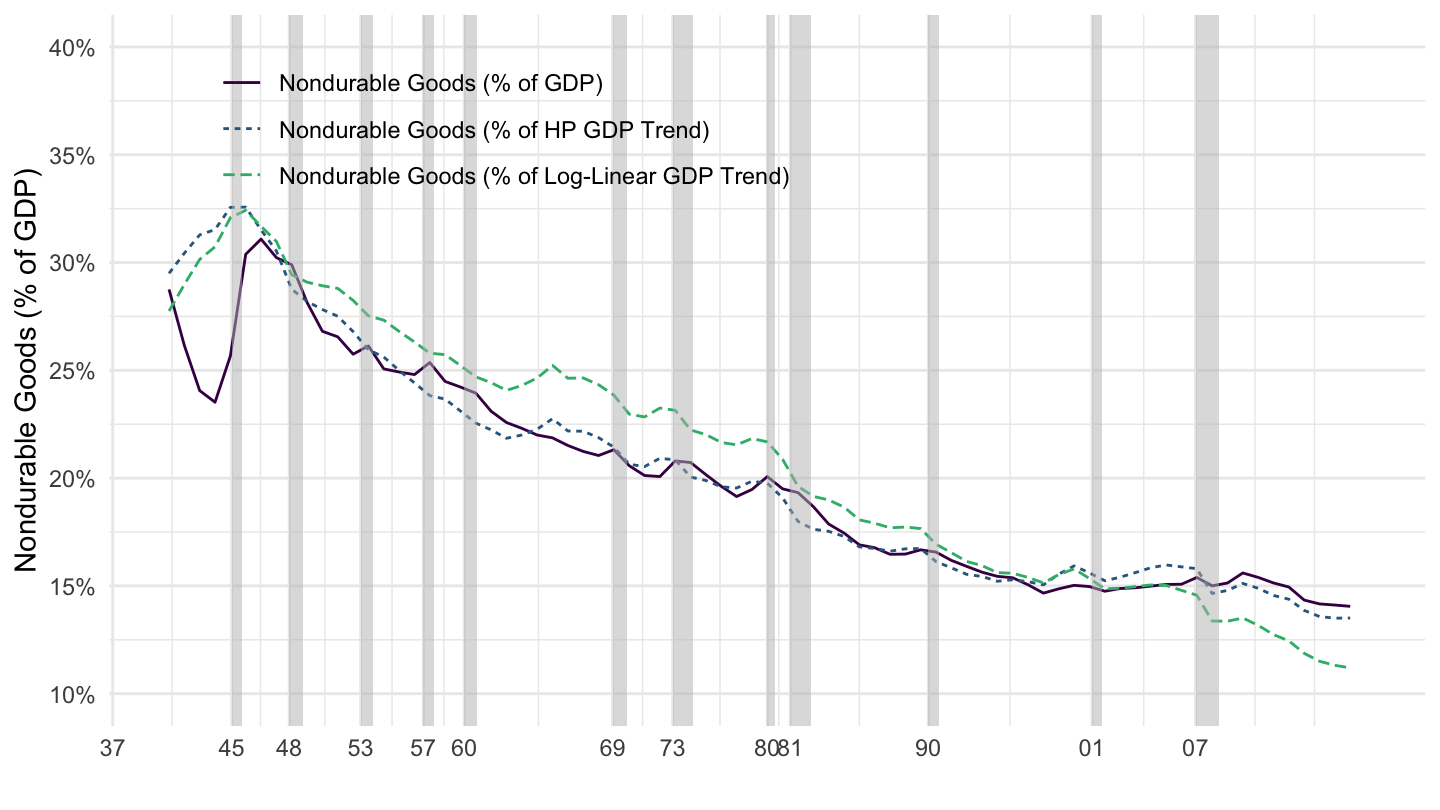

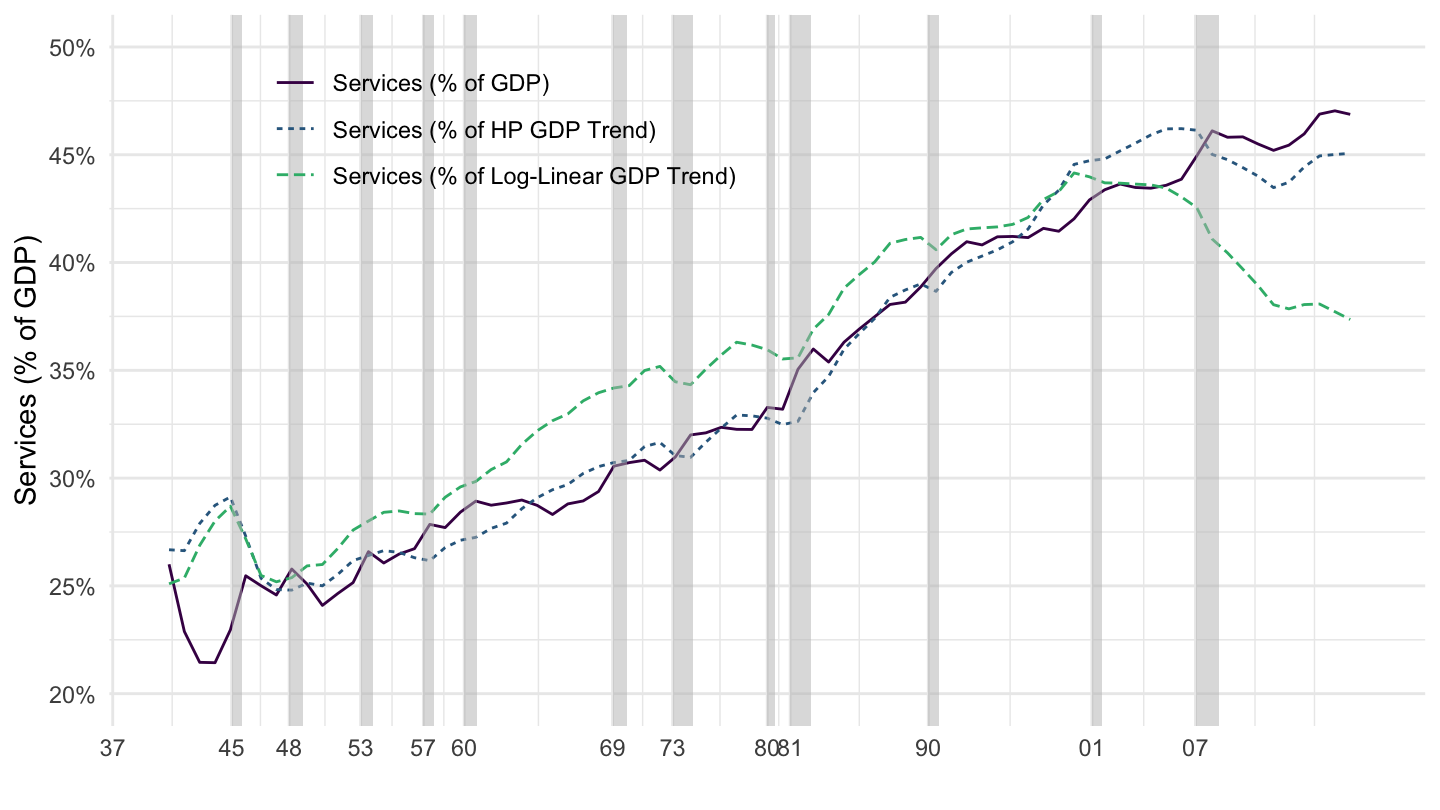

In turn, Personal Consumption Expenditures are composed of goods and services:

Durable goods (by definition, more than 3 years of durability): for example, cars.

Non-durable Goods (less than 3 years of durability).

Services.

Durable Goods

Nondurable Goods

Services

Product Approach: Investment

Investment

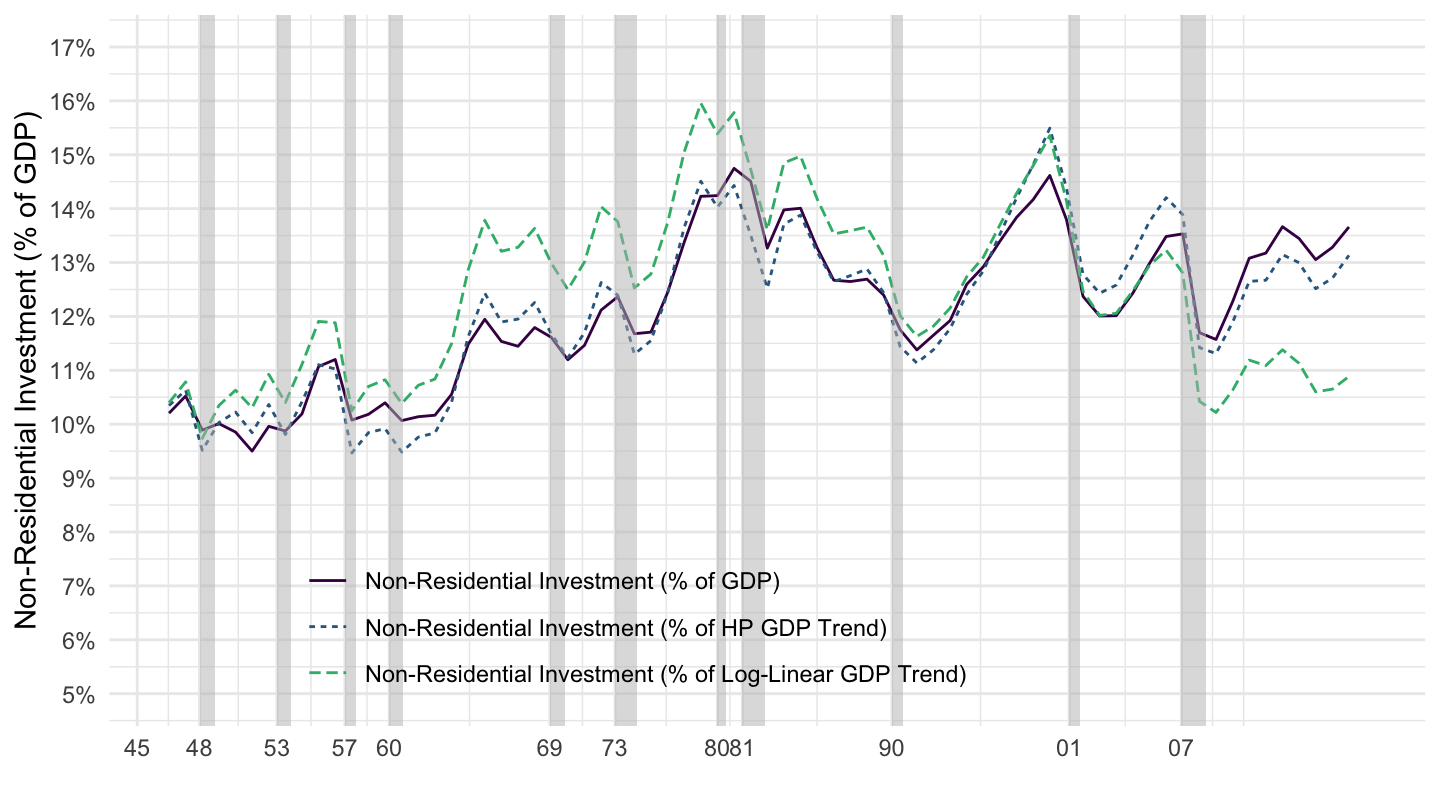

Non-Residential Investment

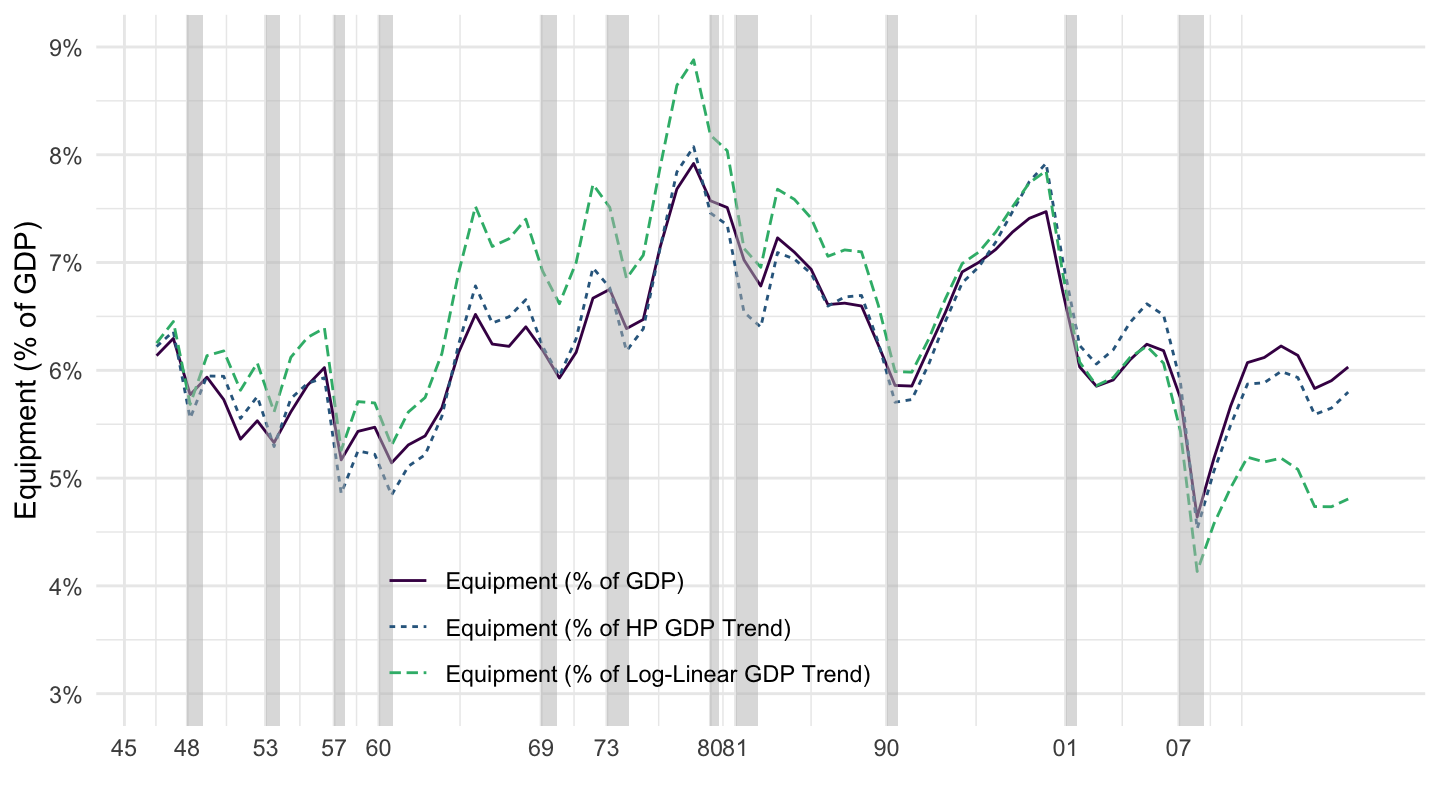

Equipment

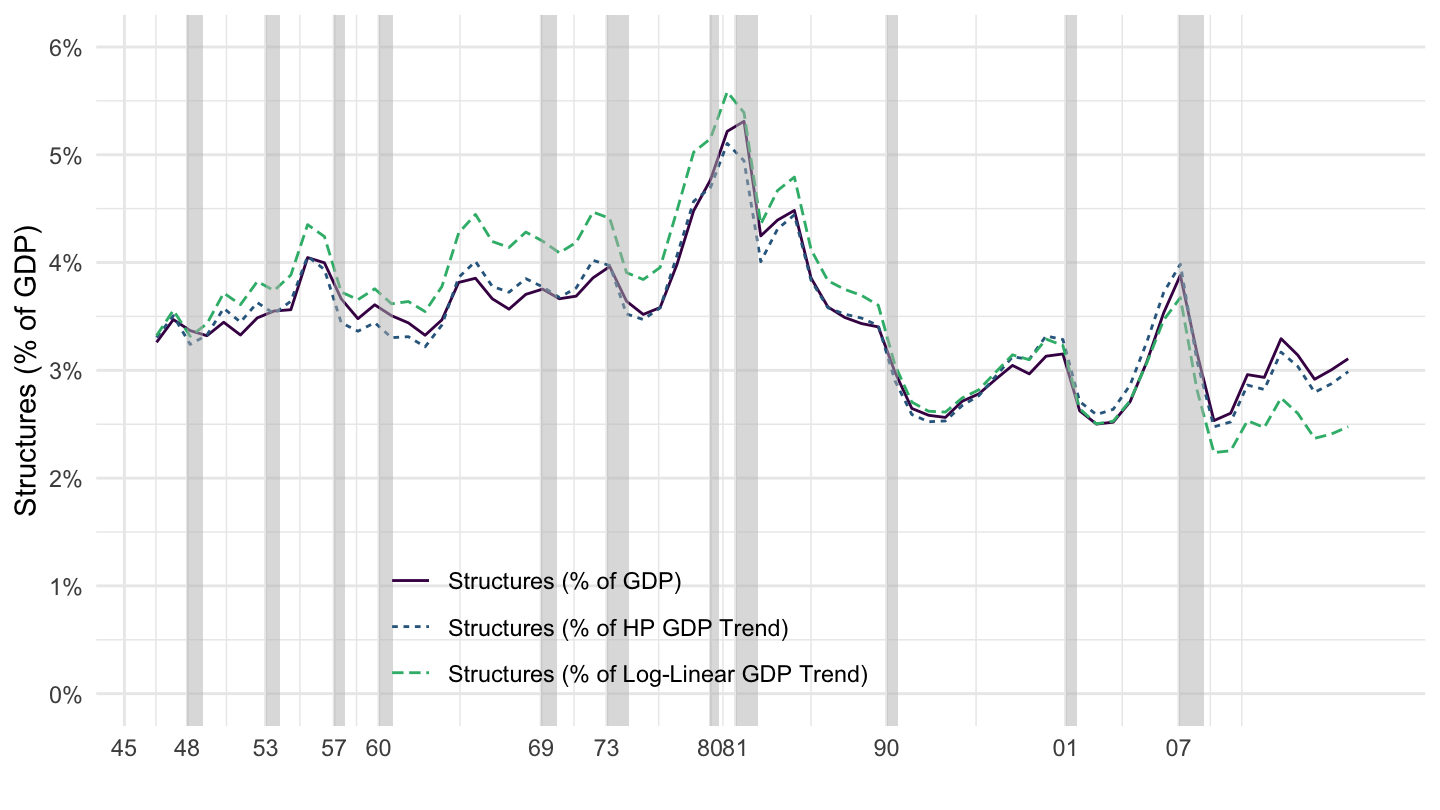

Structures

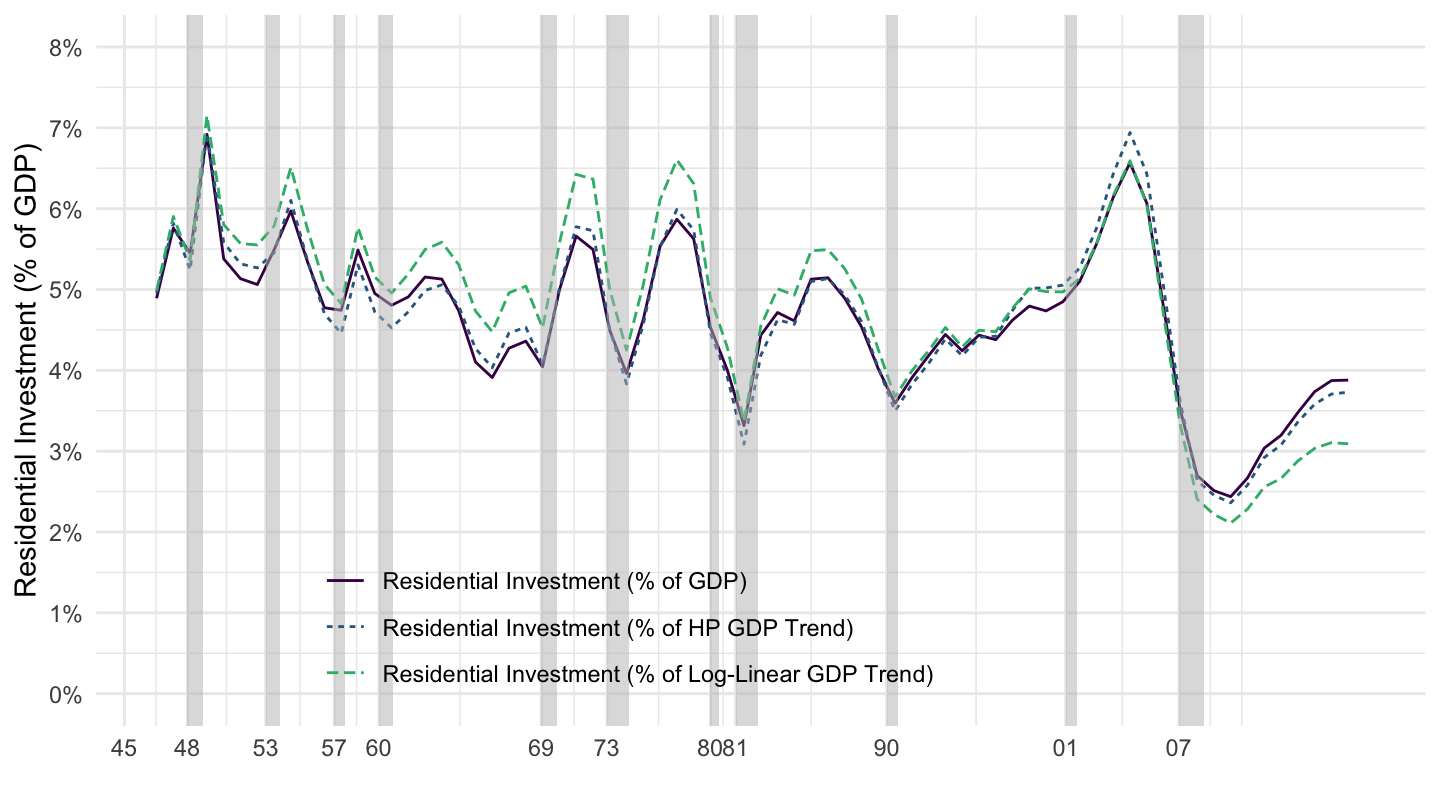

Residential Investment

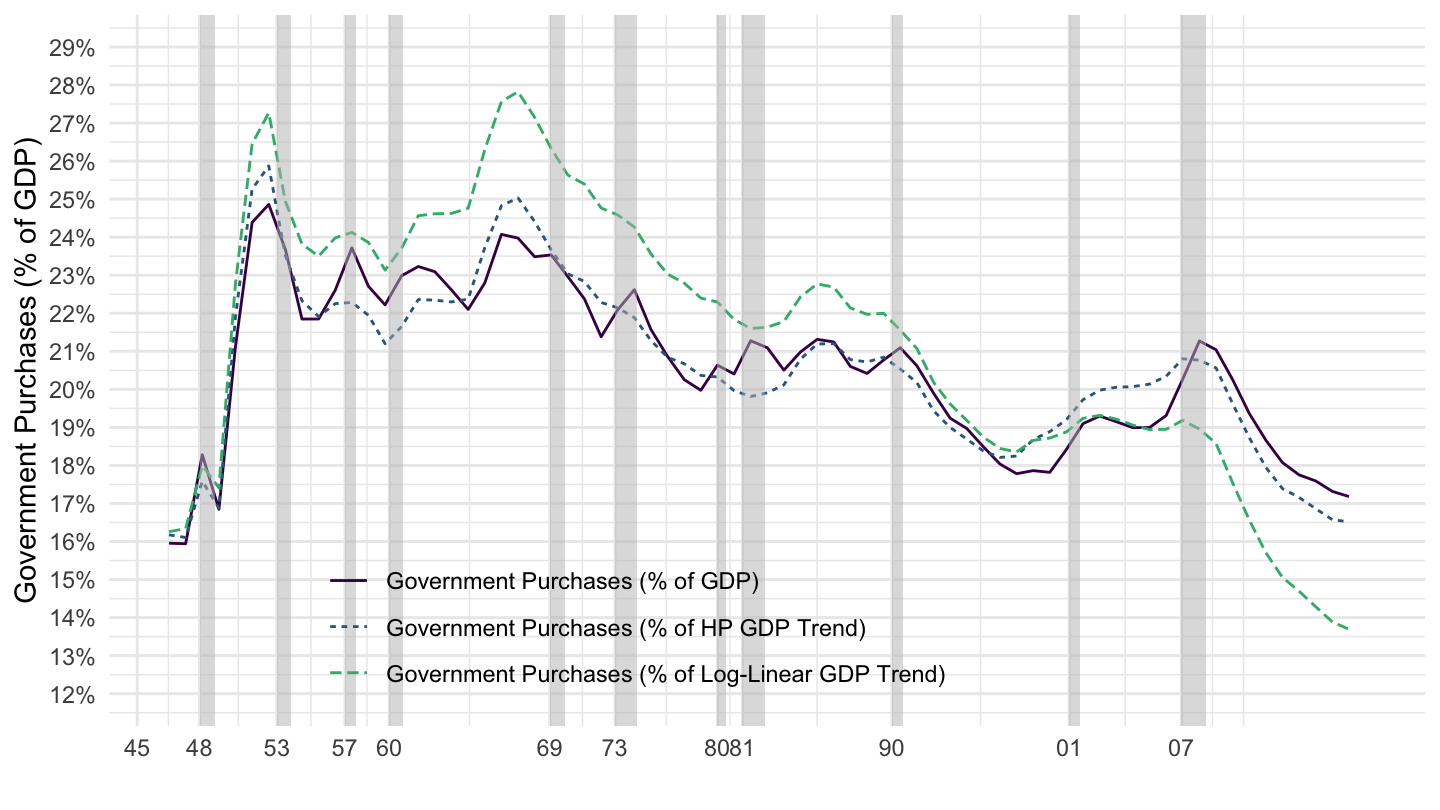

Product Approach: Government Purchases

Government Purchases

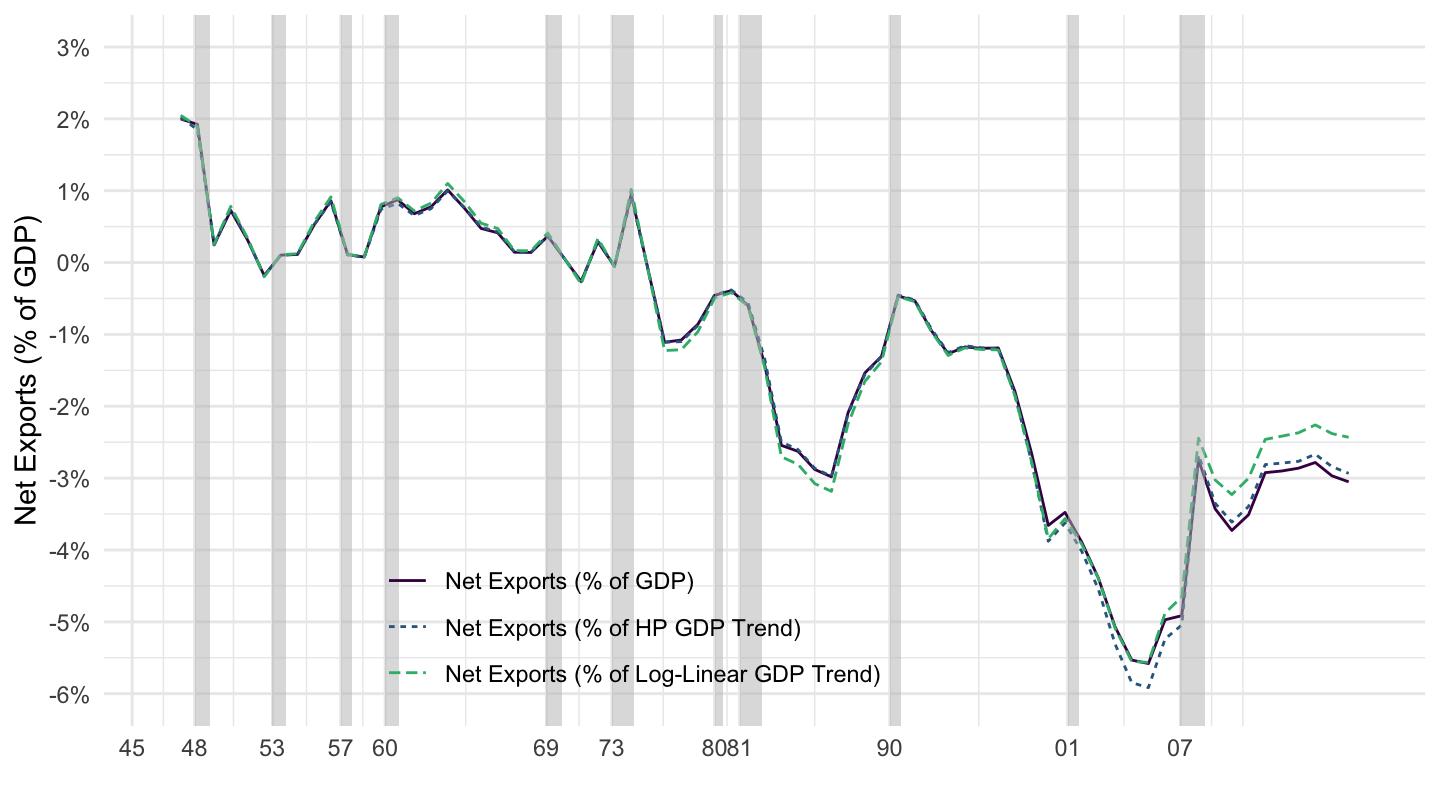

Product Approach: Net Exports

Net Exports

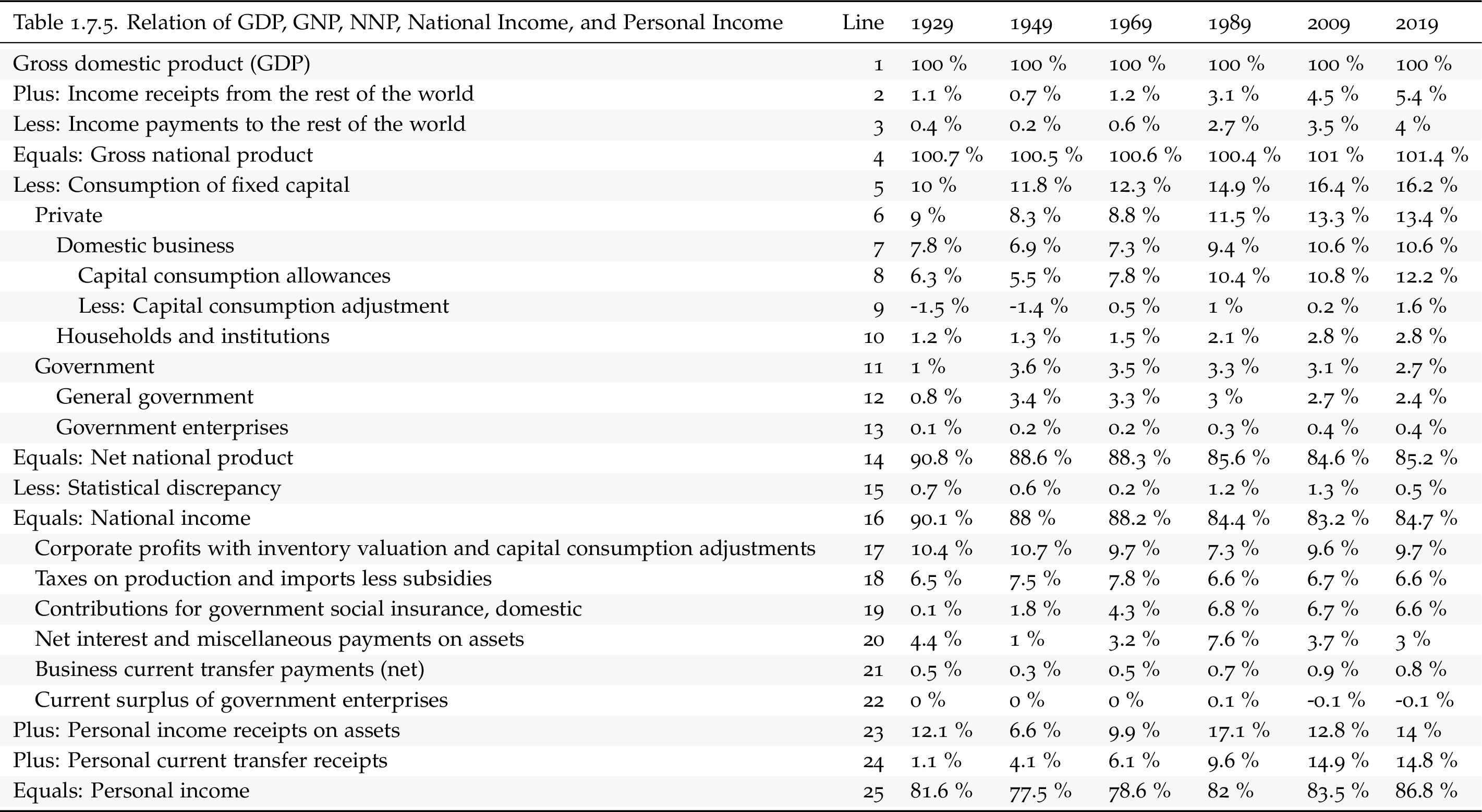

Income Approach to GDP

GDP, GNP, NNP, NI, PI

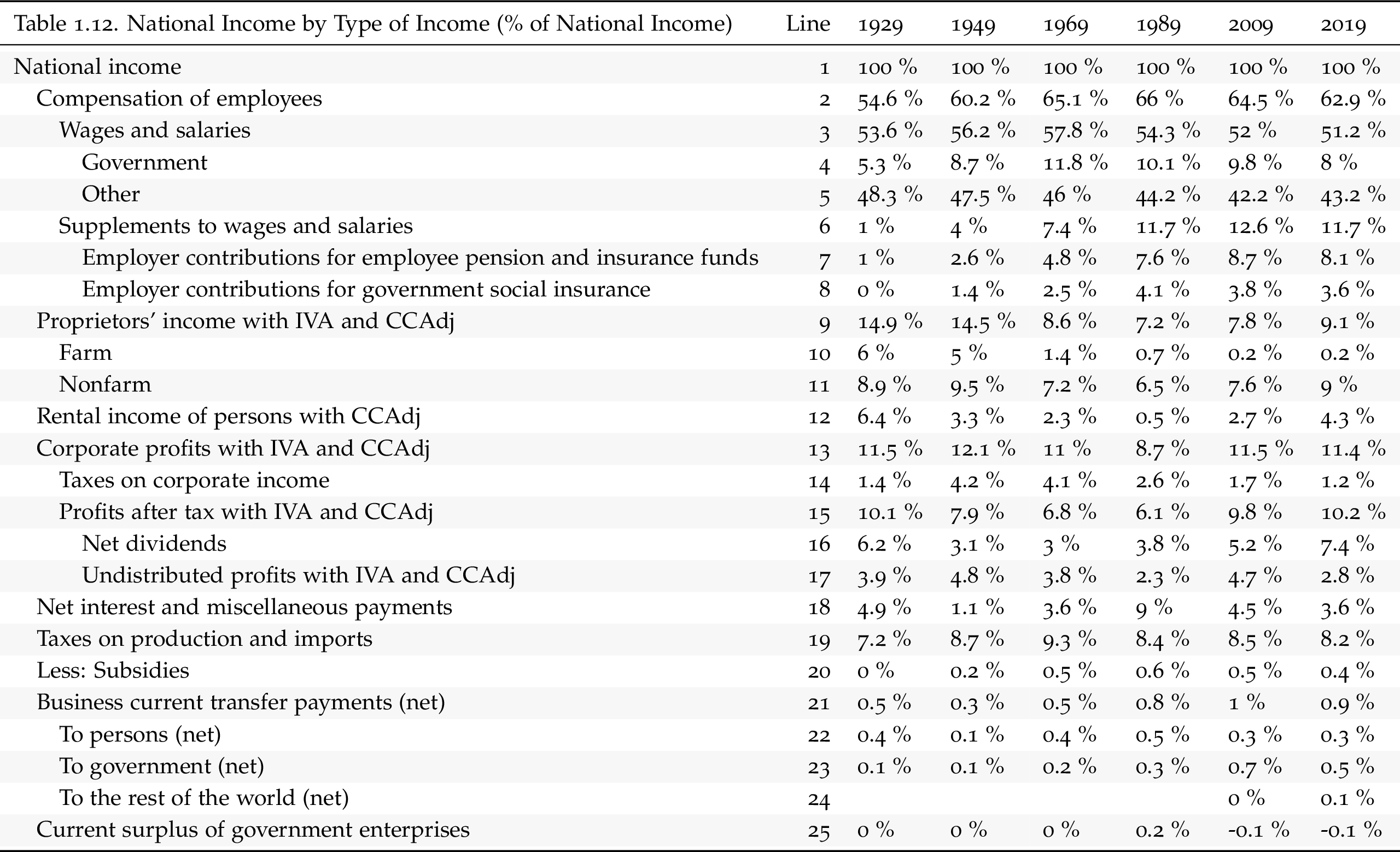

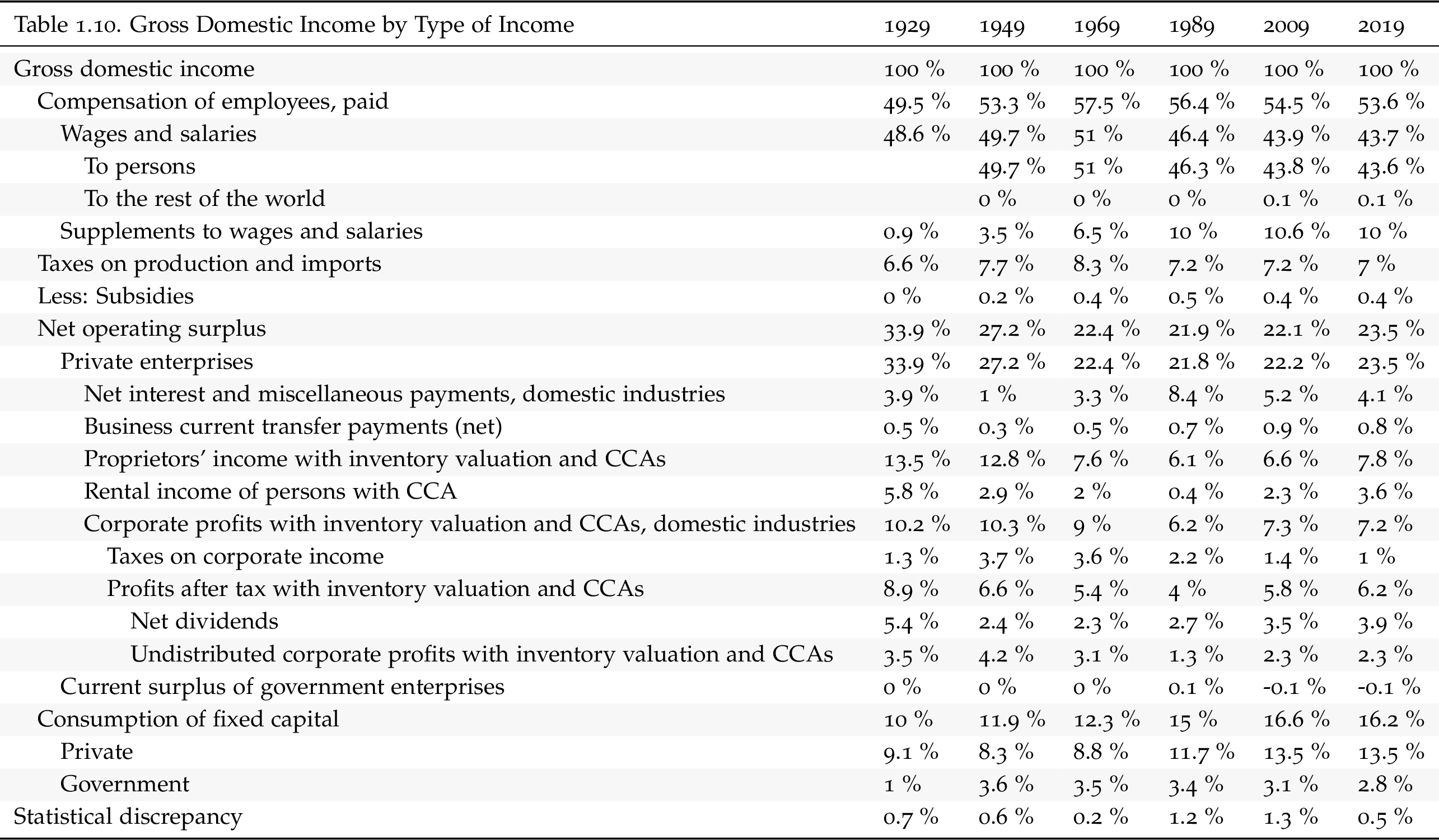

National Income by Type

National Income by Type

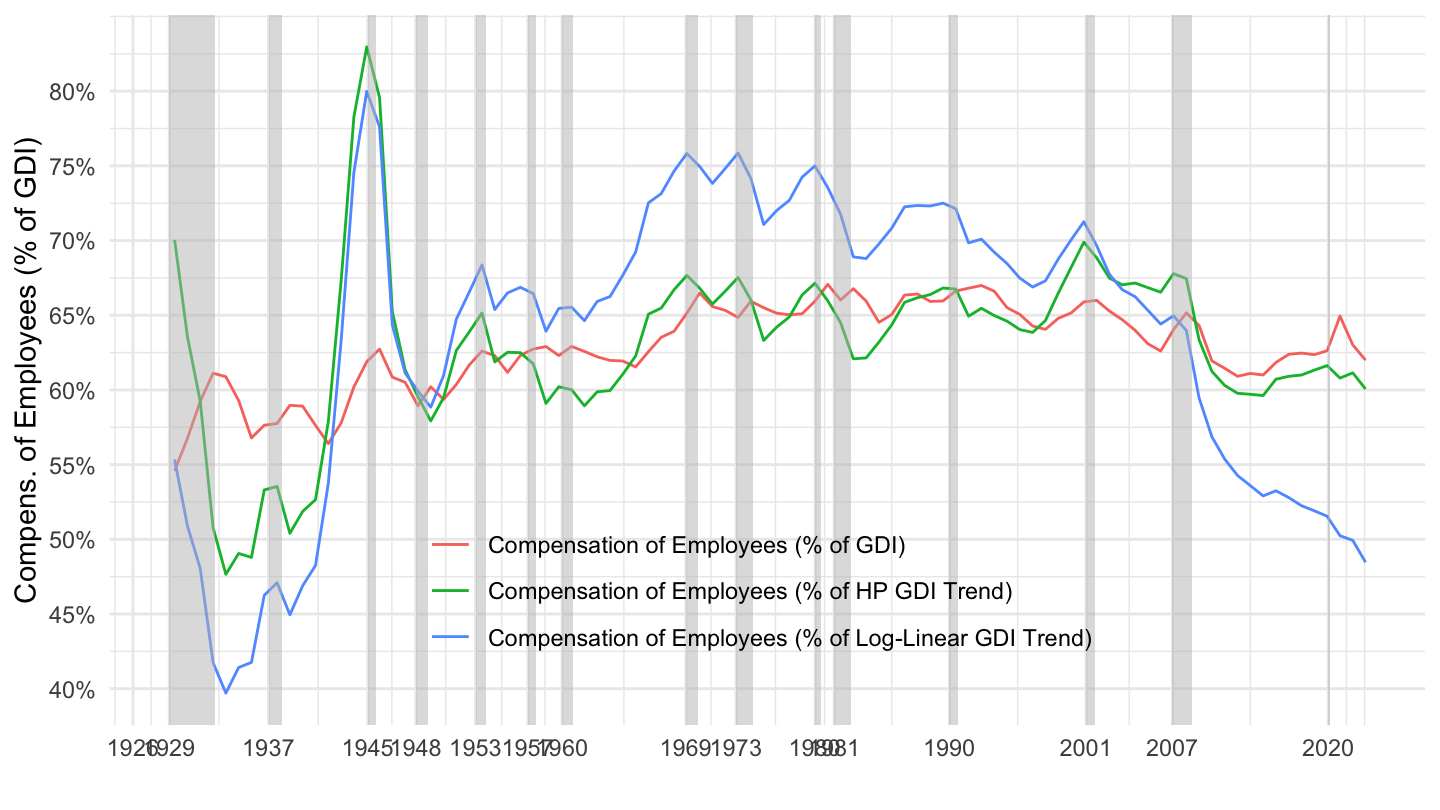

Compensation of Employees

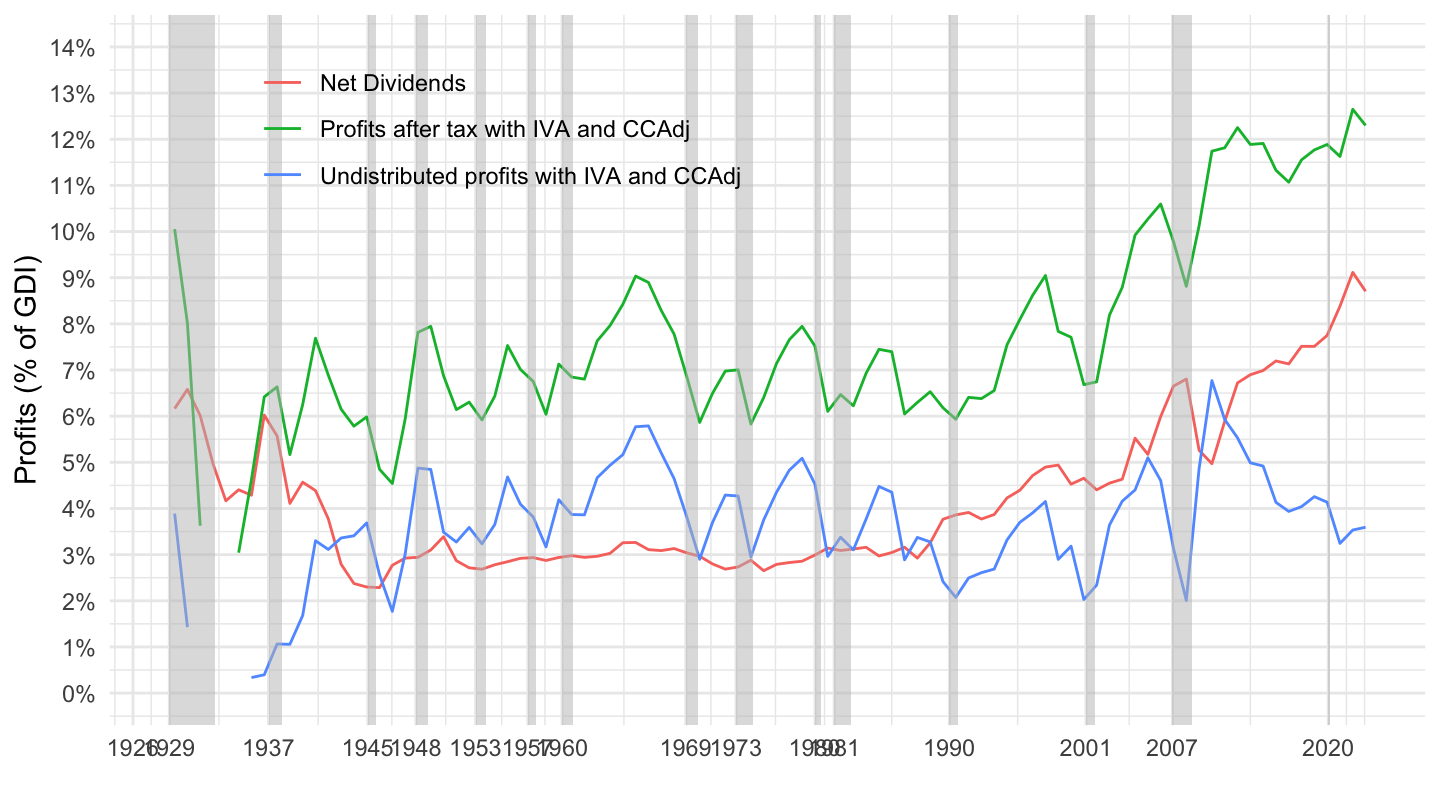

Profits, Net Dividends, Undistributed Profits

Conclusion

More advanced treatment of macroeconomics

Only for those of you who want to dig further into each one of the topics: absolutely not exam material !

I also teach a 2nd-year Ph.D. class on the exact same topic, entitled “Evidence-Based Macroeconomics and Finance” whose syllabus you can find here.

This is the last class in Macroeconomics students taken on before they write a Ph.D. Dissertation

You can access these classes by the following process. For example: the econ102 class on the Phillips curve will be available here: https://fgeerolf.com/econ102/handouts/phillips.html

Then the corresponding econ221 class is available here: https://fgeerolf.com/econ221/handouts/phillips.html.

Bibliography

Mankiw, N. Gregory. 2019. “Six Guidelines for Teaching Intermediate Macroeconomics.” The Journal of Economic Education 50 (3): 258–60. https://doi.org/10.1080/00220485.2019.1618768.