Code

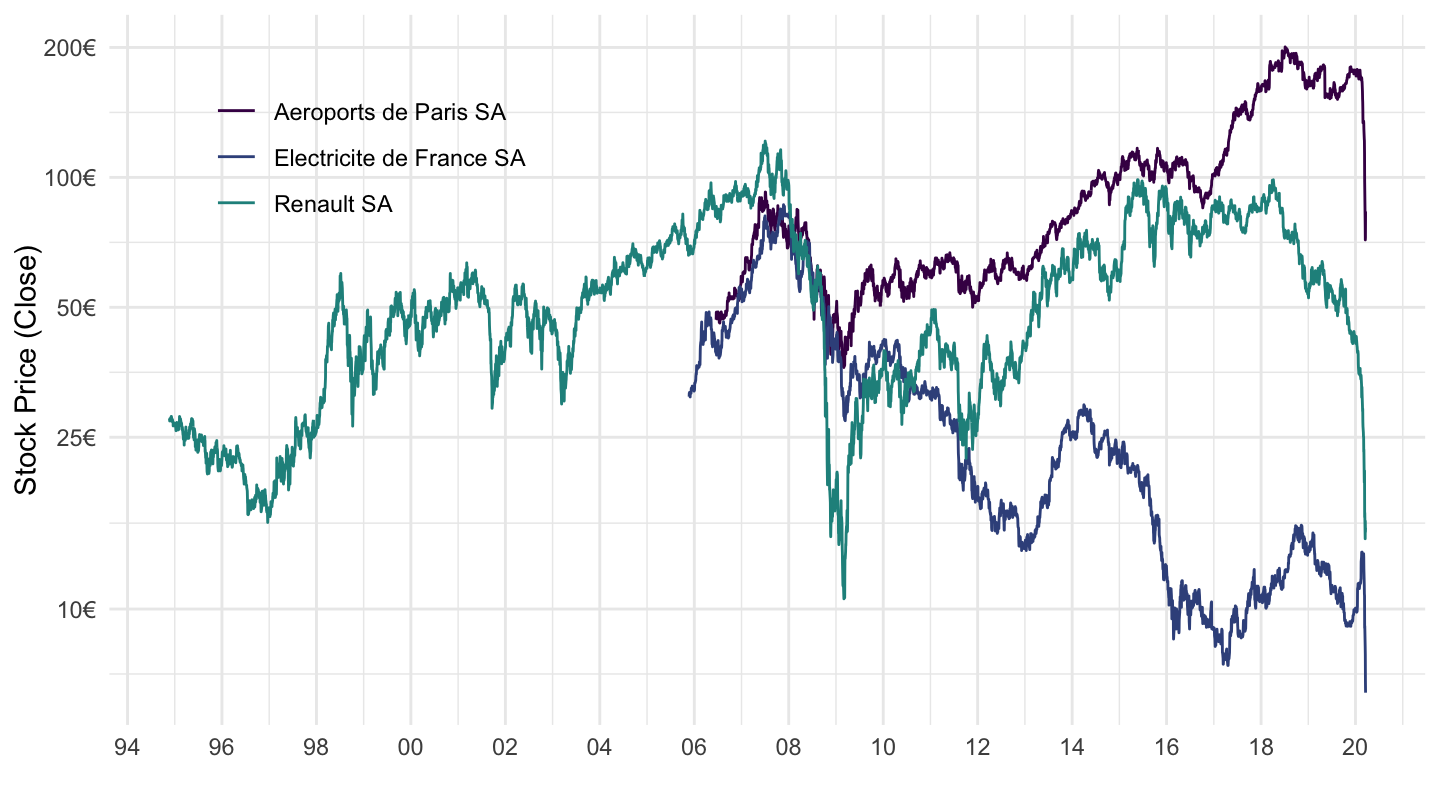

stocks %>%

filter(country == "france") %>%

select(name, symbol) %>%

{if (is_html_output()) datatable(., filter = 'top', rownames = F) else .}Data - Investing

stocks %>%

filter(country == "france") %>%

select(name, symbol) %>%

{if (is_html_output()) datatable(., filter = 'top', rownames = F) else .}stocks_FRA %>%

filter(symbol %in% c("ADP", "RENA", "EDF")) %>%

left_join(stocks_FRA_var, by = "symbol") %>%

ggplot + geom_line(aes(x = Date, y = Close, color = full_name)) +

theme_minimal() + xlab("") + ylab("Stock Price (Close)") +

scale_x_date(breaks = seq(1960, 2020, 2) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%y")) +

scale_y_log10(breaks = c(1, 2, 3, 5, 10, 25, 50, 100, 200, 500),

labels = dollar_format(prefix = "", suffix = "€", accuracy = 1)) +

scale_color_manual(values = viridis(5)[1:4]) +

theme(legend.position = c(0.2, 0.80),

legend.title = element_blank())

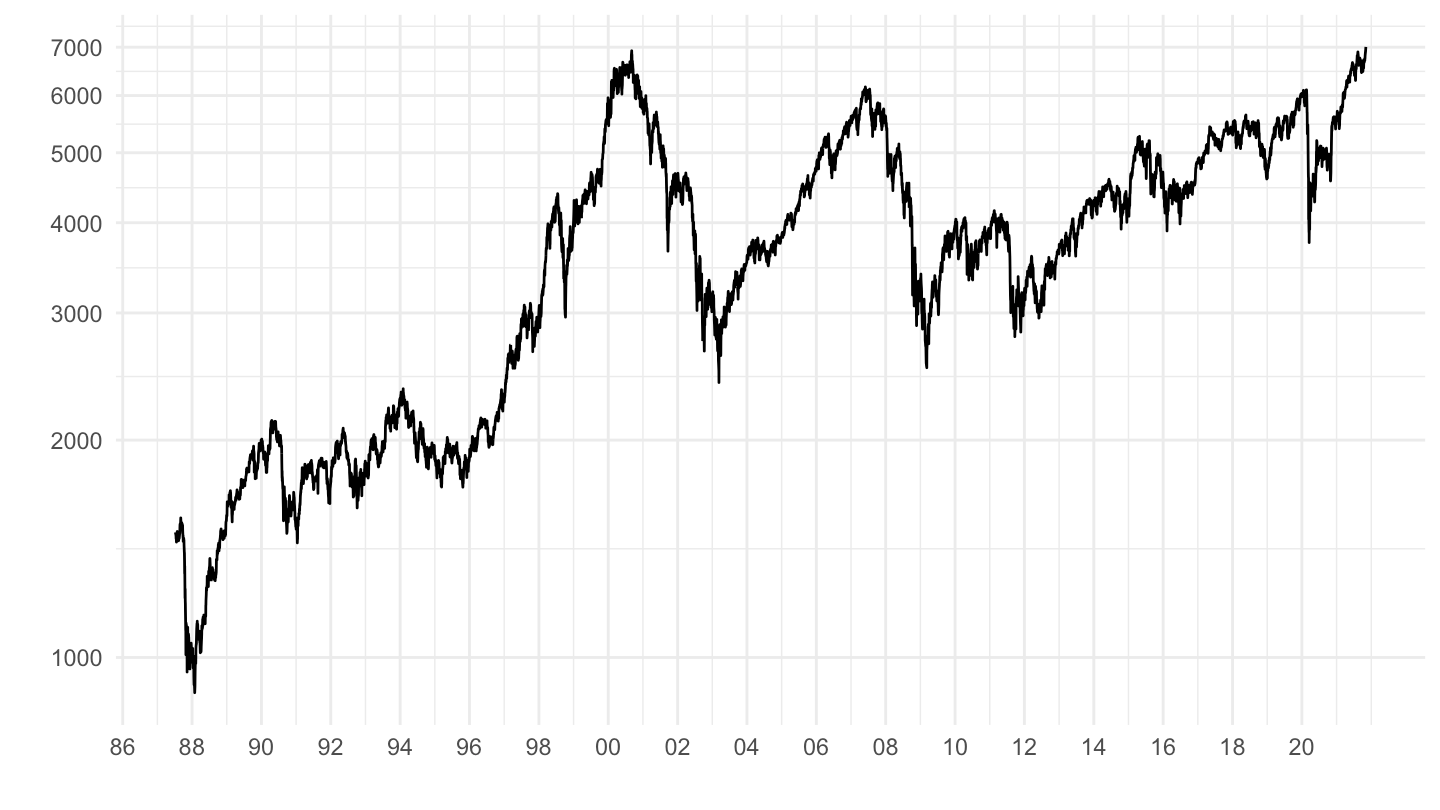

indices_FRA %>%

filter(symbol %in% c("FCHI")) %>%

select(Date, CAC40 = Close) %>%

ggplot + geom_line(aes(x = Date, y = CAC40)) +

theme_minimal() + xlab("") + ylab("") +

scale_x_date(breaks = seq(1960, 2020, 2) %>% paste0("-01-01") %>% as.Date,

labels = date_format("%y")) +

scale_y_log10(breaks = seq(0, 20000, 1000)) +

scale_color_manual(values = viridis(5)[1:4]) +

theme(legend.position = c(0.2, 0.85),

legend.title = element_blank())

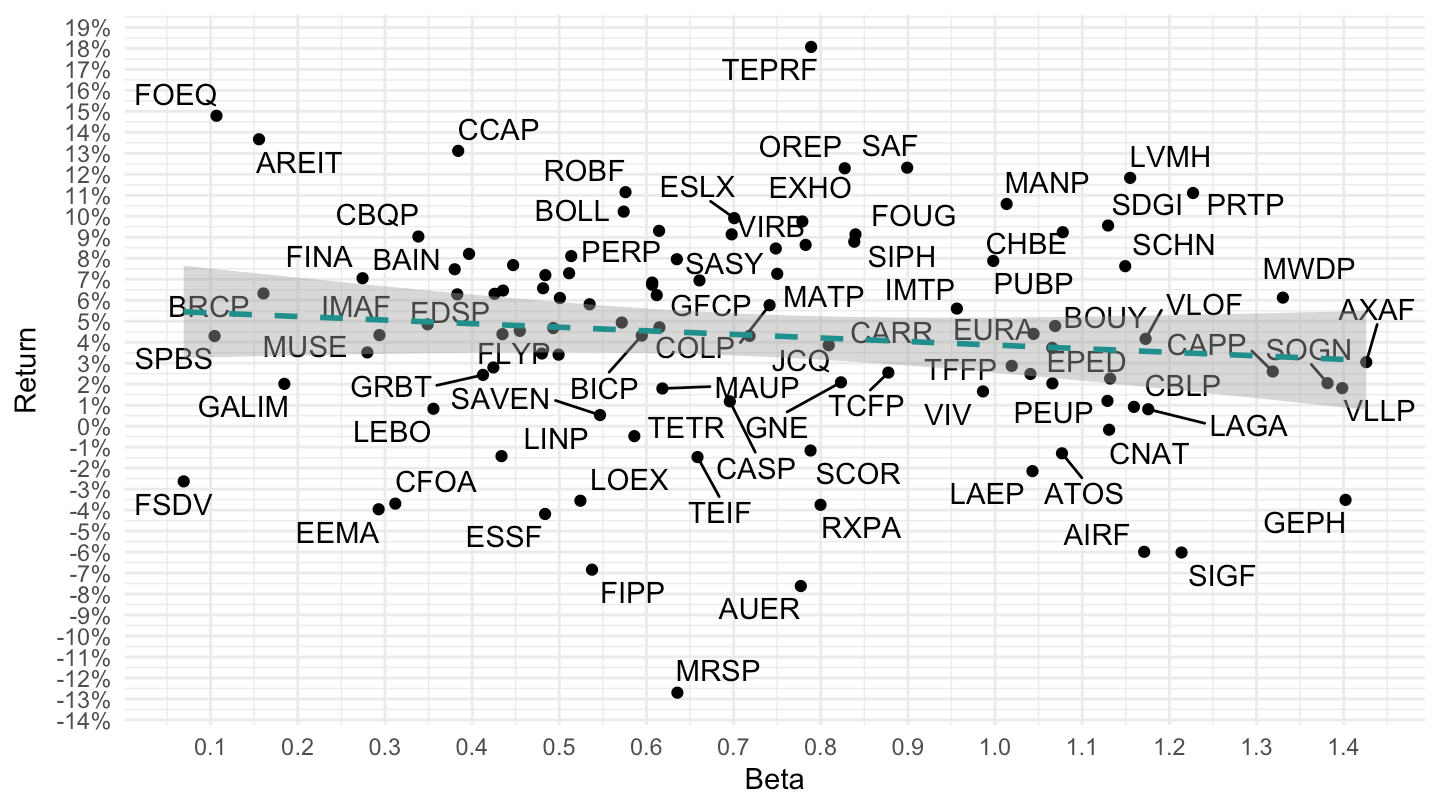

data <- stocks_FRA %>%

select(symbol, Date, Close) %>%

left_join(indices_FRA %>%

filter(symbol %in% c("FCHI")) %>%

select(Date, CAC40 = Close),

by = "Date") %>%

group_by(symbol) %>%

complete(Date = seq.Date(min(Date), max(Date), by = "day")) %>%

fill(Close, CAC40) %>%

filter(!is.na(CAC40),

day(Date) == 1) %>%

mutate_at(vars(Close, CAC40), funs(log(.) - lag(log(.), 1))) %>%

group_by(symbol) %>%

na.omit %>%

summarise(covariance = cov(Close, CAC40) / cov(CAC40, CAC40),

mean = exp(12*mean(Close))-1,

first = first(Date),

last = last(Date))data %>%

filter(first == as.Date("1987-09-01")) %>%

ggplot(.) + theme_minimal() +

geom_point(aes(x = covariance, y = mean)) +

geom_text_repel(aes(x = covariance, y = mean, label = symbol)) +

xlab("Beta") + ylab("Return") +

scale_x_continuous(breaks = seq(0, 4, 0.1)) +

scale_y_continuous(breaks = 0.01*seq(-20, 20, 1),

labels = scales::percent_format(accuracy = 1)) +

stat_smooth(aes(x = covariance, y = mean), linetype = 2, method = "lm", color = viridis(3)[2])

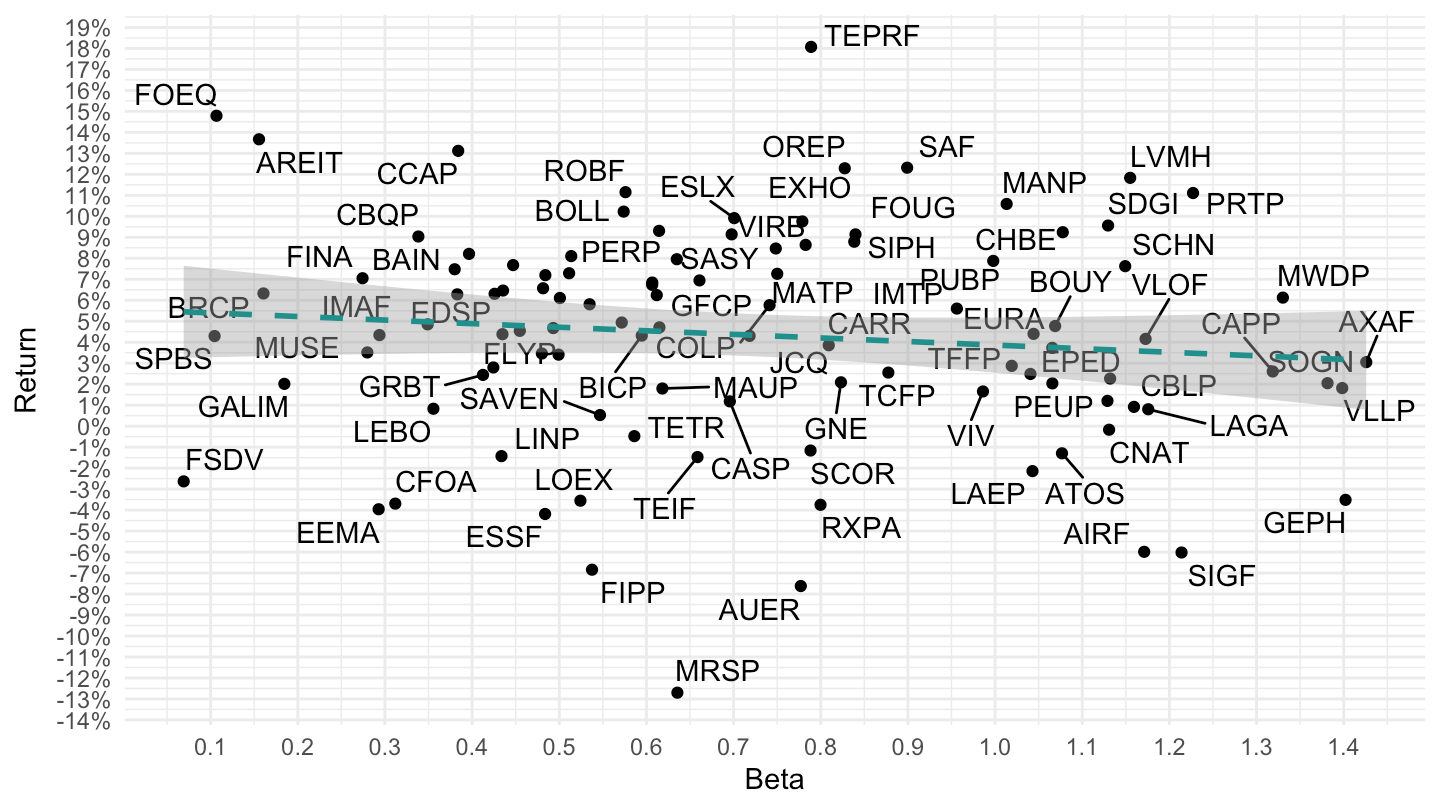

data %>%

filter(first == as.Date("1987-09-01")) %>%

ggplot(.) + theme_minimal() +

geom_point(aes(x = covariance, y = mean)) +

geom_text_repel(aes(x = covariance, y = mean, label = symbol)) +

xlab("Beta") + ylab("Return") +

scale_x_continuous(breaks = seq(0, 4, 0.1)) +

scale_y_continuous(breaks = 0.01*seq(-20, 20, 1),

labels = scales::percent_format(accuracy = 1)) +

stat_smooth(aes(x = covariance, y = mean), linetype = 2, method = "lm", color = viridis(3)[2])

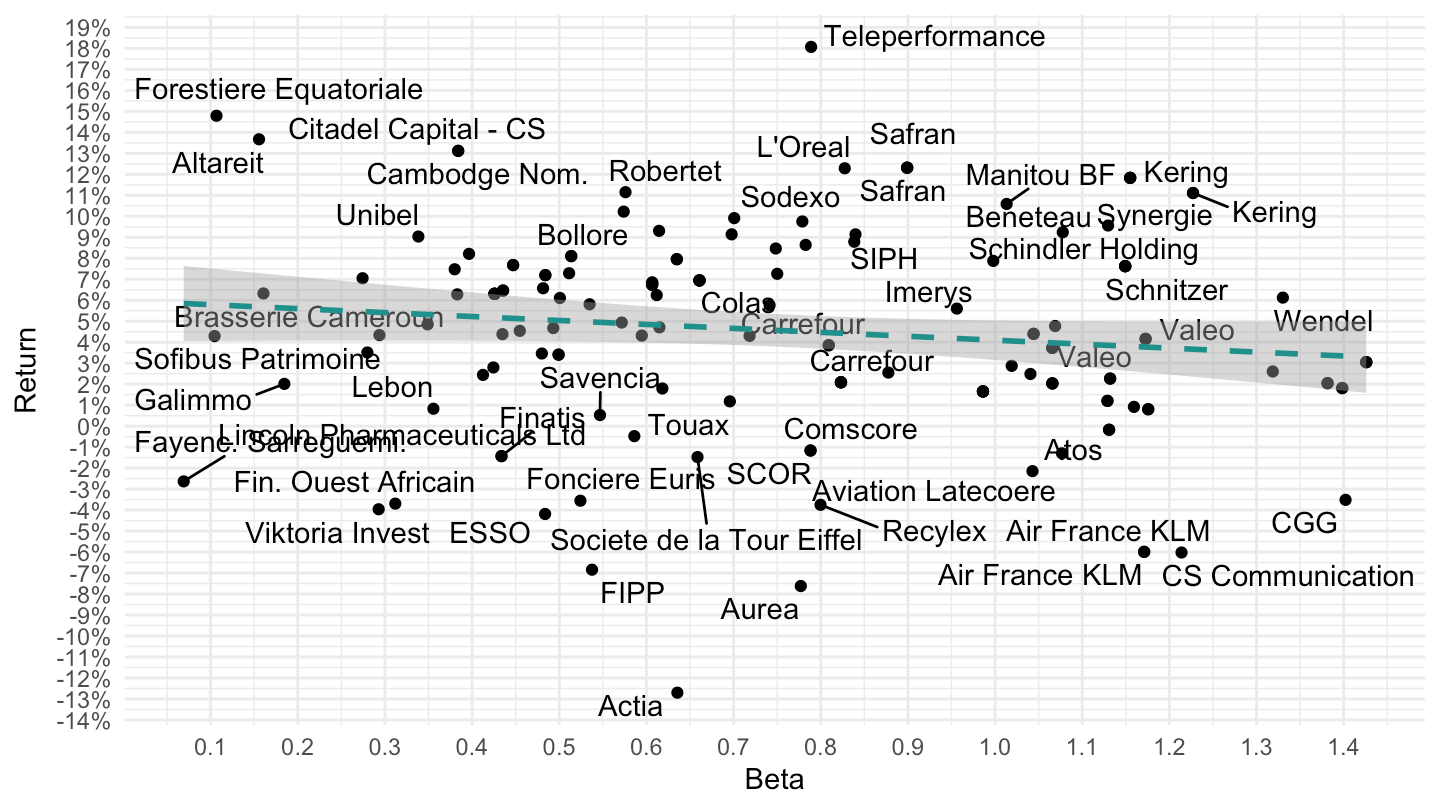

data %>%

left_join(stocks %>%

select(symbol, name), by = "symbol") %>%

filter(first == as.Date("1987-09-01")) %>%

ggplot(.) + theme_minimal() +

geom_point(aes(x = covariance, y = mean)) +

geom_text_repel(aes(x = covariance, y = mean, label = name)) +

xlab("Beta") + ylab("Return") +

scale_x_continuous(breaks = seq(0, 4, 0.1)) +

scale_y_continuous(breaks = 0.01*seq(-20, 20, 1),

labels = scales::percent_format(accuracy = 1)) +

stat_smooth(aes(x = covariance, y = mean), linetype = 2, method = "lm", color = viridis(3)[2])

data %>%

filter(first == as.Date("1987-09-01")) %>%

lm(mean ~ covariance, data = .) %>%

summary#

# Call:

# lm(formula = mean ~ covariance, data = .)

#

# Residuals:

# Min 1Q Median 3Q Max

# -0.171844 -0.024386 -0.000212 0.033190 0.138504

#

# Coefficients:

# Estimate Std. Error t value Pr(>|t|)

# (Intercept) 0.05566 0.01202 4.631 1.06e-05 ***

# covariance -0.01704 0.01518 -1.123 0.264

# ---

# Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#

# Residual standard error: 0.05197 on 103 degrees of freedom

# Multiple R-squared: 0.01209, Adjusted R-squared: 0.002501

# F-statistic: 1.261 on 1 and 103 DF, p-value: 0.2641data %>%

lm(mean ~ covariance, data = .) %>%

summary#

# Call:

# lm(formula = mean ~ covariance, data = .)

#

# Residuals:

# Min 1Q Median 3Q Max

# -0.79503 -0.08422 0.04277 0.11051 1.33026

#

# Coefficients:

# Estimate Std. Error t value Pr(>|t|)

# (Intercept) -0.042048 0.008444 -4.980 7.91e-07 ***

# covariance -0.001514 0.006289 -0.241 0.81

# ---

# Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#

# Residual standard error: 0.2042 on 746 degrees of freedom

# (1 observation effacée parce que manquante)

# Multiple R-squared: 7.765e-05, Adjusted R-squared: -0.001263

# F-statistic: 0.05793 on 1 and 746 DF, p-value: 0.8099