Monetary Policy, Inflation - Advanced

UCLA - Econ 221 - Advanced Macro

François Geerolf

November 26, 2019

Monetary Creation

By Bernanke

Inflation Targeting Bnak of England

Inflation Targeting Bnak of England

Introduction: Fiscal or Monetary ?

Galbraith, in The Good Society:

Galbraith, in The Good Society:

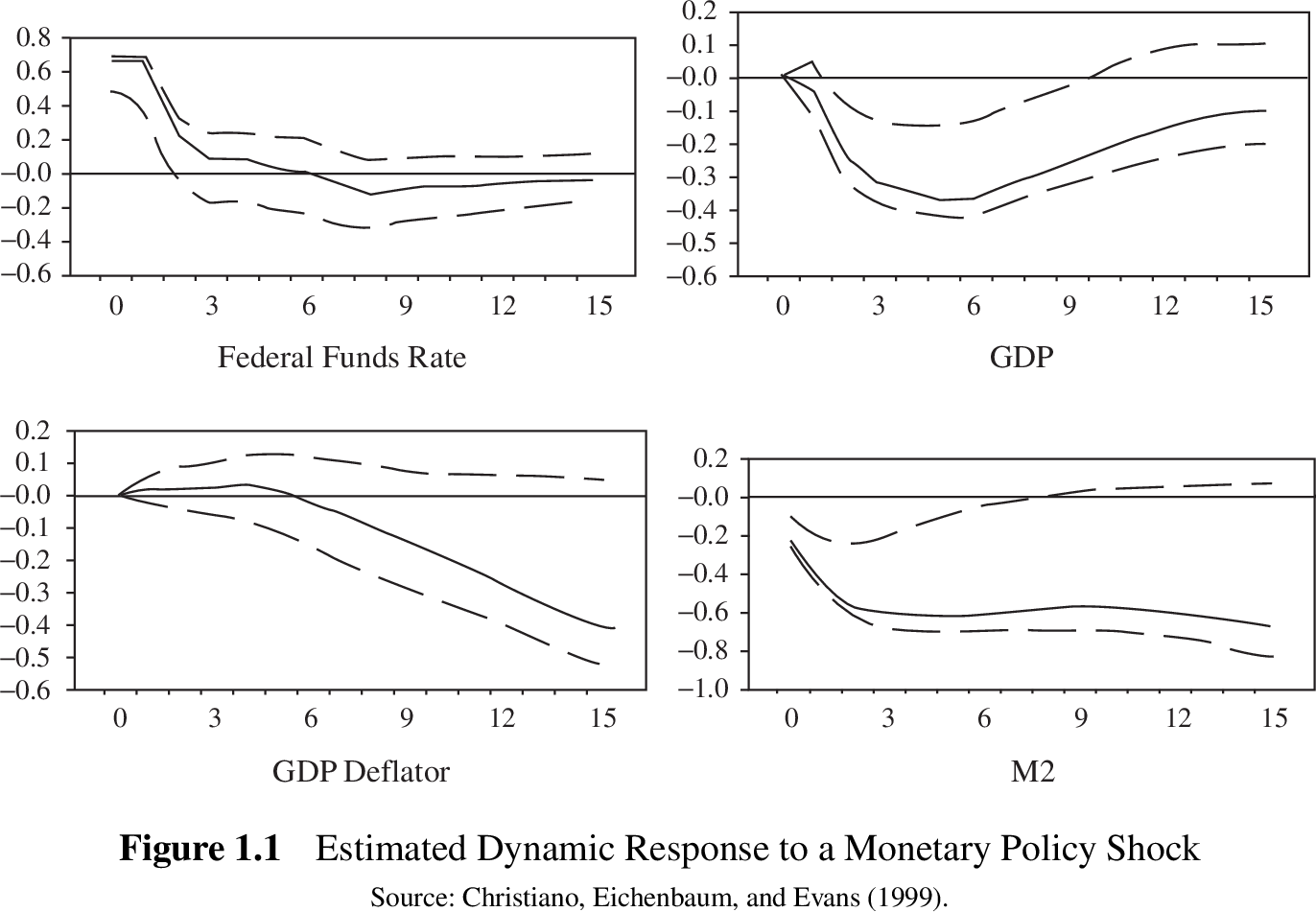

Gali (2007) - Effects of monetary policy

Ramey (2016) - Effects of monetary policy

Sticky Prices / Wages ?

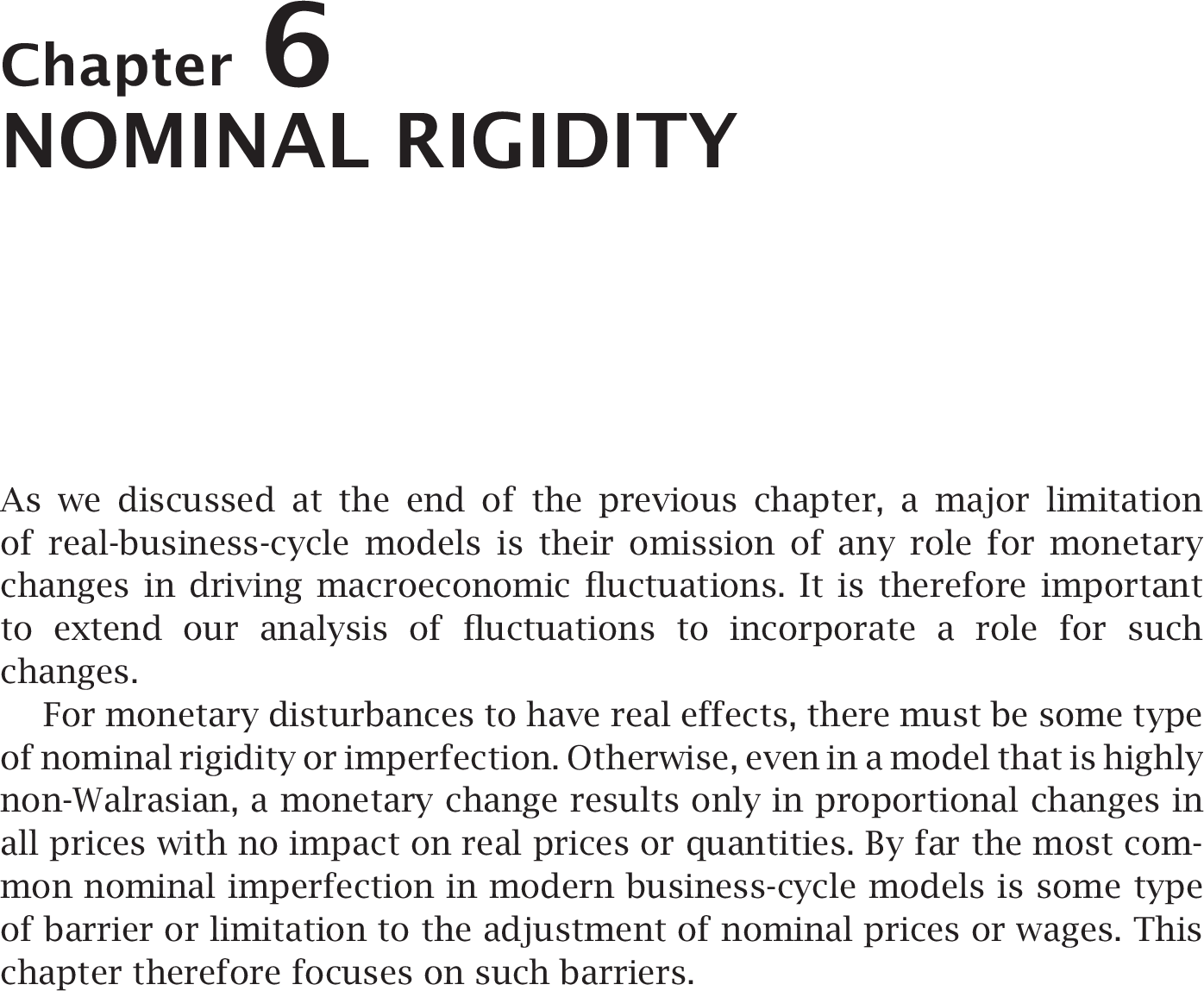

Introduction

New-Keynesian economics rests on a stiky-price / wage assumption.

Yet there is in fact very little direct evidence that prices / wages are that sticky.

There’s even less evidence that the effects of demand on output are related to sticky prices, as the IS-LM view of the world would suggest. See Summers’ (1991) previously cited paper.

So, what’s the evidence ?

Evidence for sticky prices?

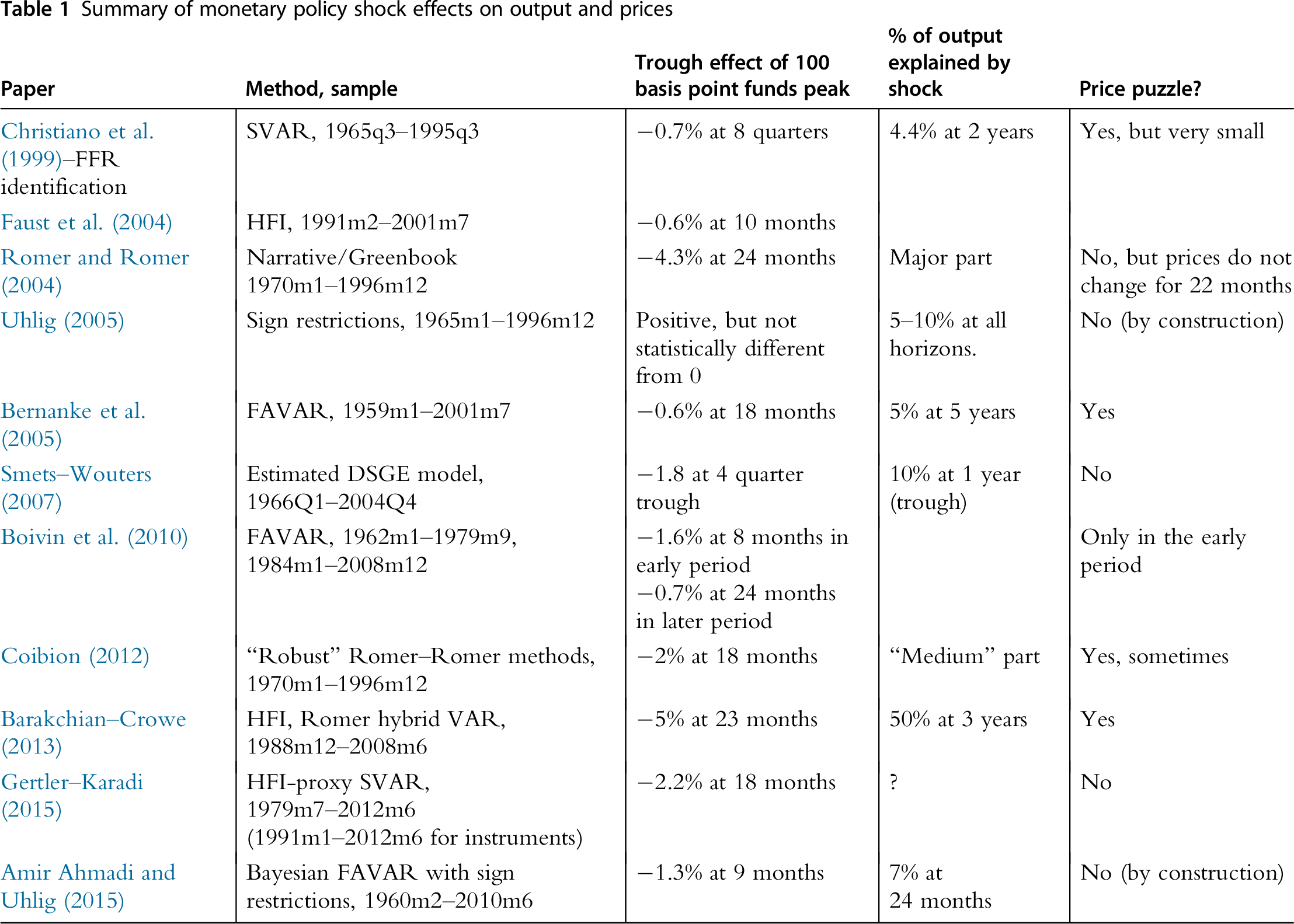

- Evidence for sticky prices? Usual argument, from Romer’s Advanced Macroeconomics textbook:

Evidence for sticky prices?

This argument is often made: monetary policy has real effects, hence prices must be sticky.

I think that this argument is incorrect. Here is another model with flexible prices, where monetary policy could have real effects:

Monetary policy redistributes disposable income between borrowers and lenders, especially through the mortgage market.

There is a paradox of thrift: more consumption, less saving leads to more investment:

Closed economy: increase in saving.

Open economy: increase in saving, and trade deficit, imbalance \(S-I\). (this is because there is a leakage of aggregate demand, so investment is also made elsewhere to increase capacity)

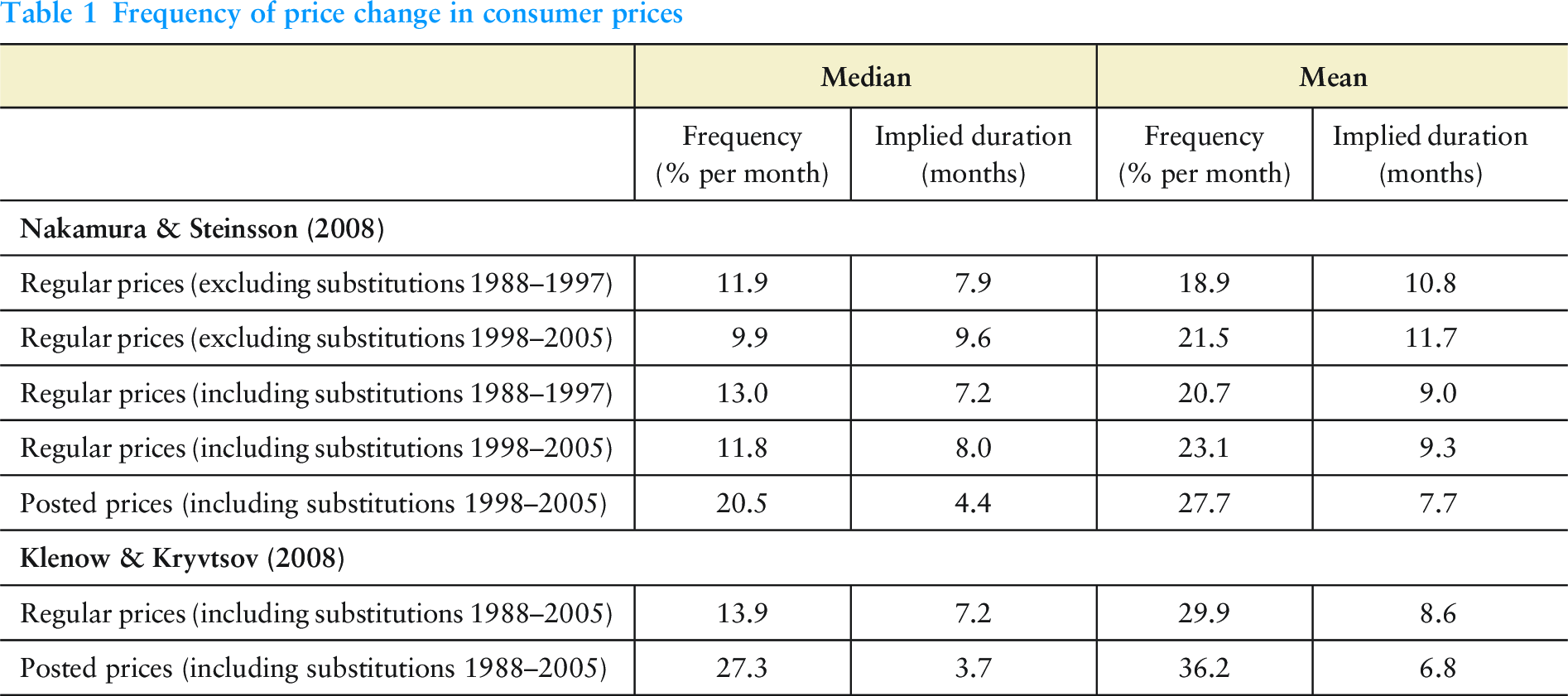

Frequency of price change

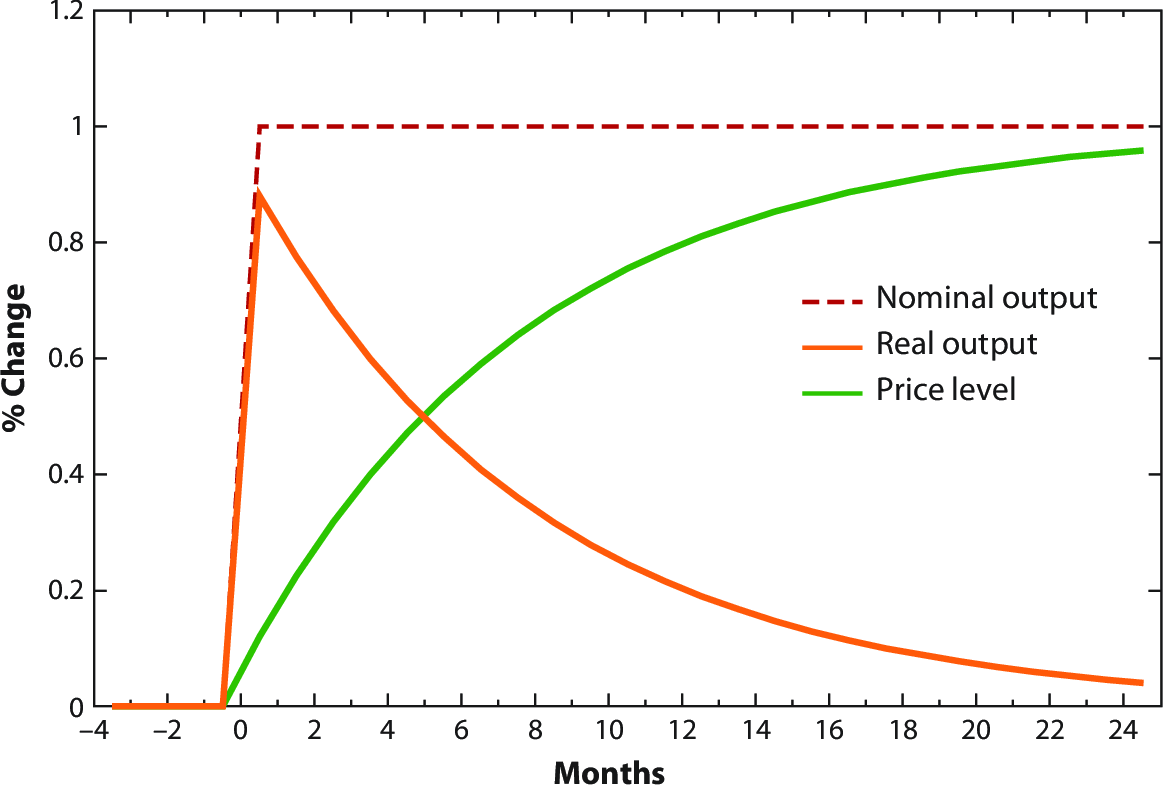

Response of real output and the price level to a one-time permanent shock to nominal aggregate demand in the Calvo model

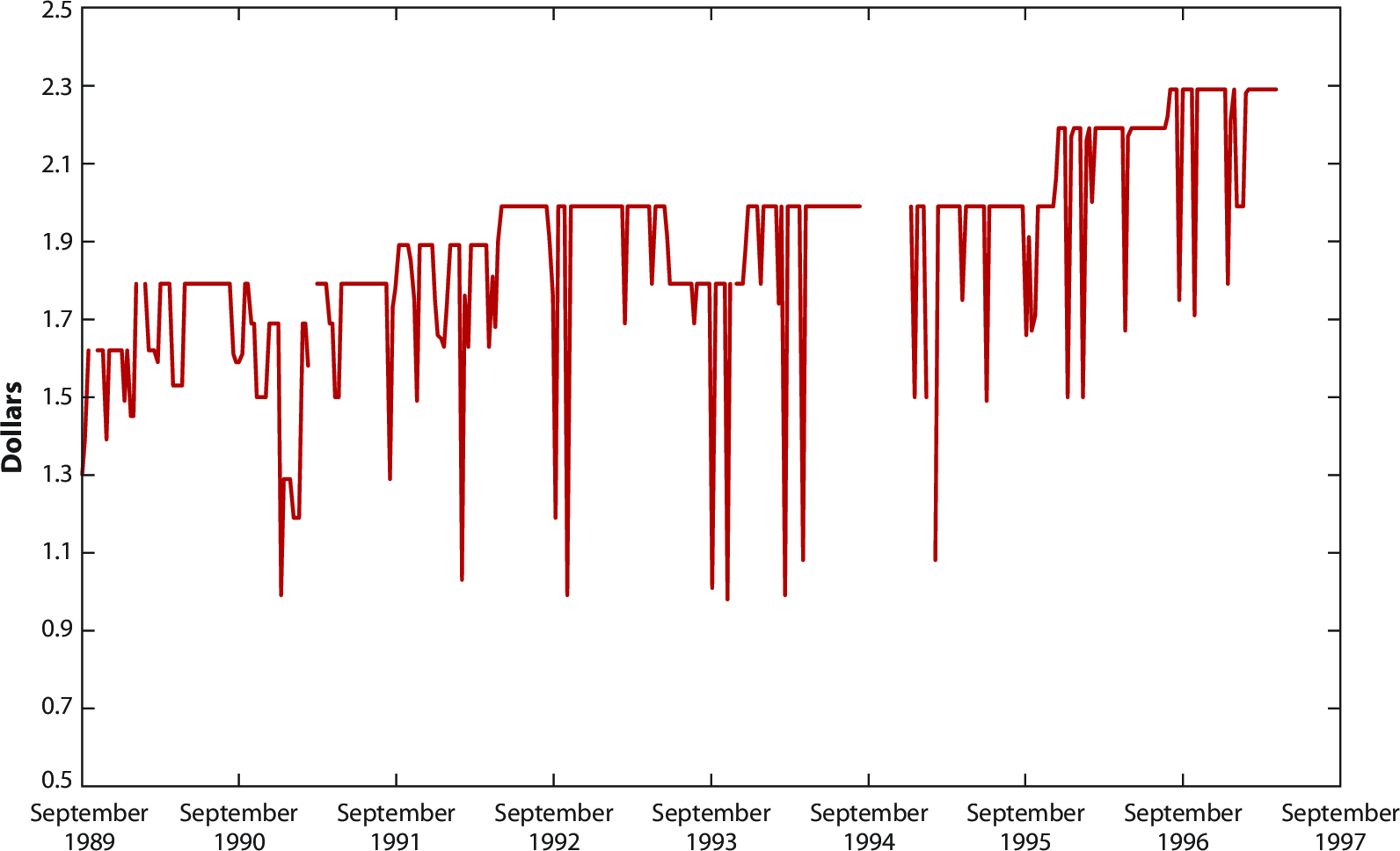

## Price series of Nabisco Premium Saltines (16 oz) at a Dominick’s Finer Foods store in Chicago

## Price series of Nabisco Premium Saltines (16 oz) at a Dominick’s Finer Foods store in Chicago

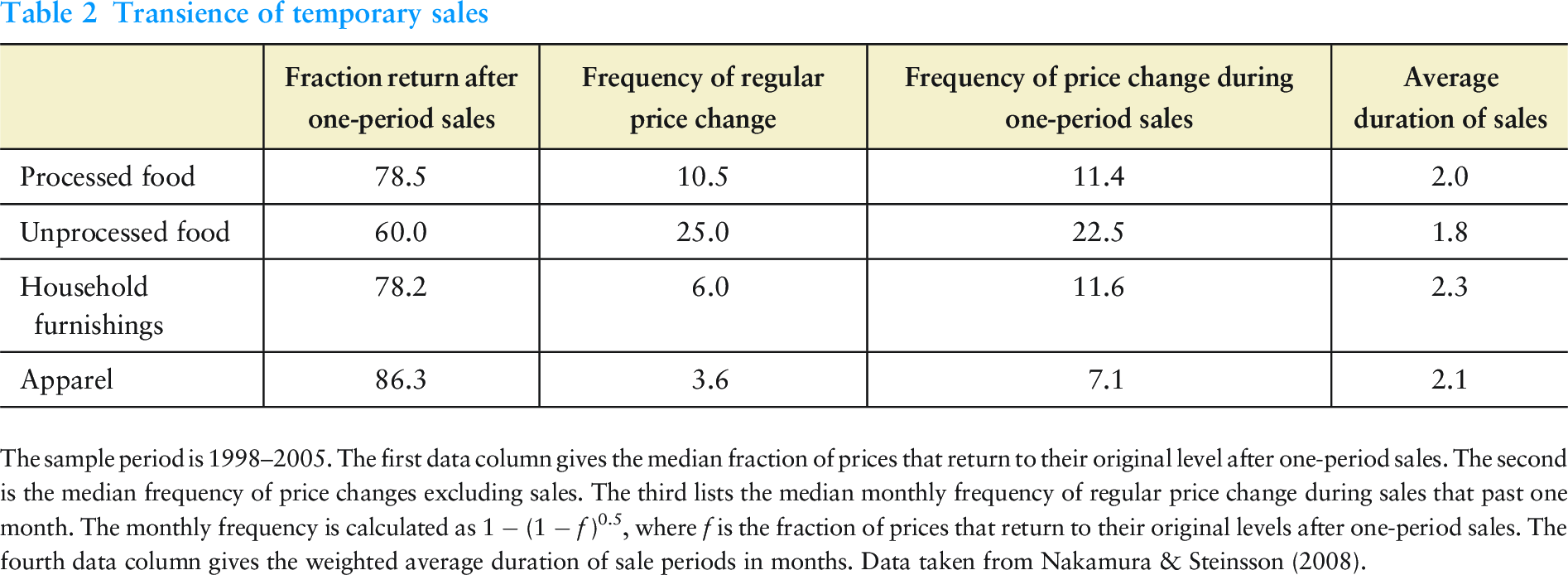

Transience of temporary sales

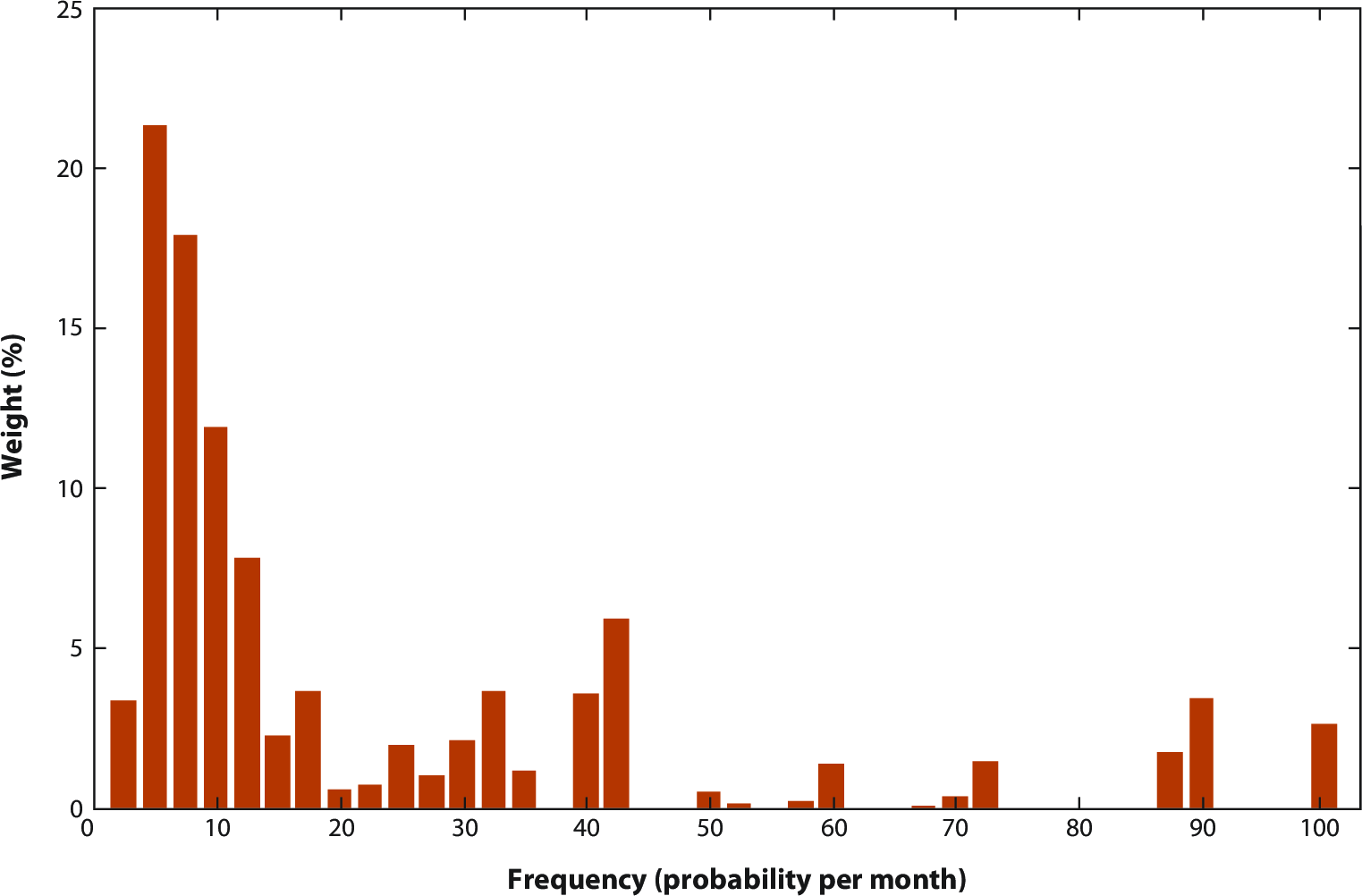

The expenditure weighted distribution of the frequency of regular price change

“Deflation” Policies

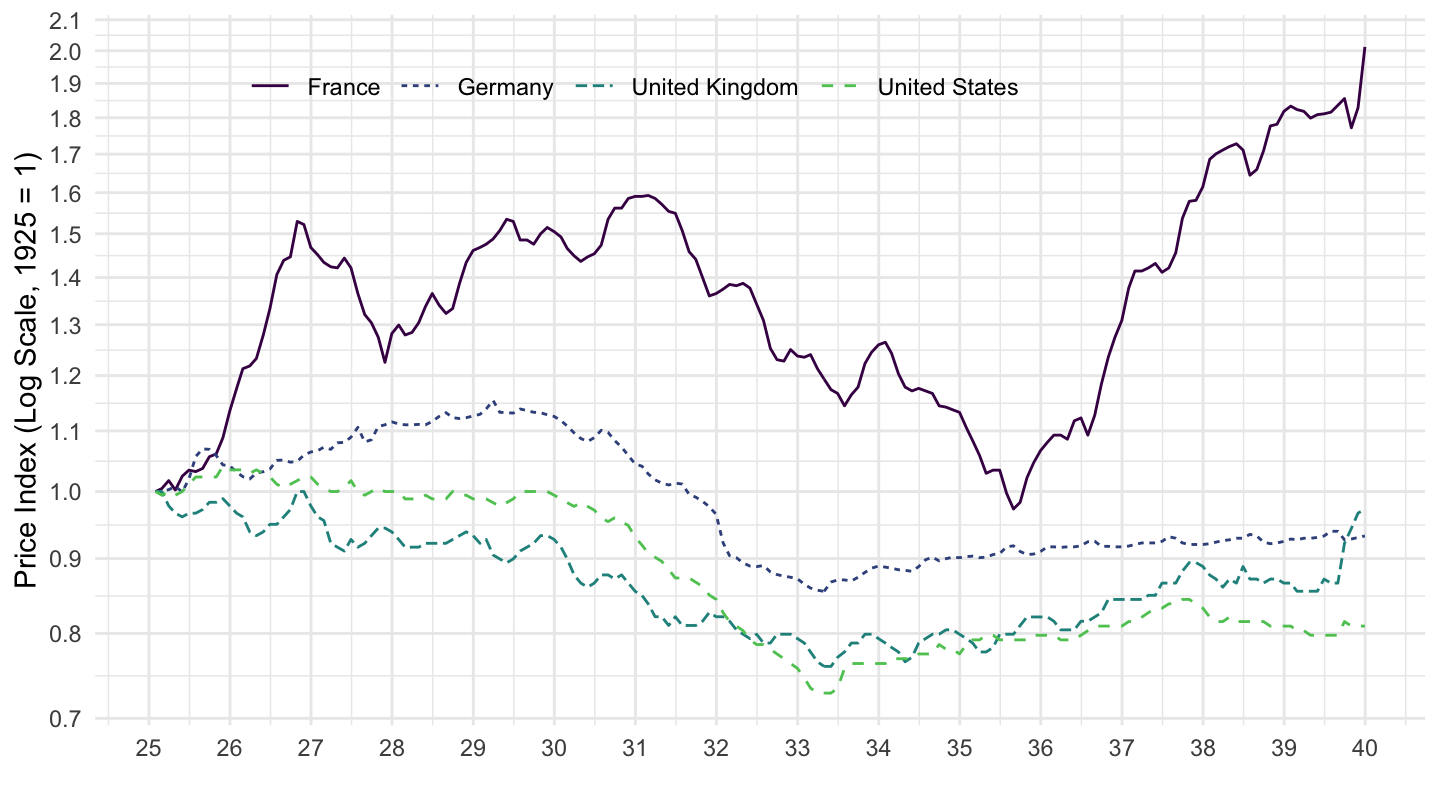

Deflation in the Great Depression

Heinrich Brüning’s Deflation Policies (1930-1932)

Devaluation of the Pound (September 21, 1931)

Devaluation of the Dollar (1933)

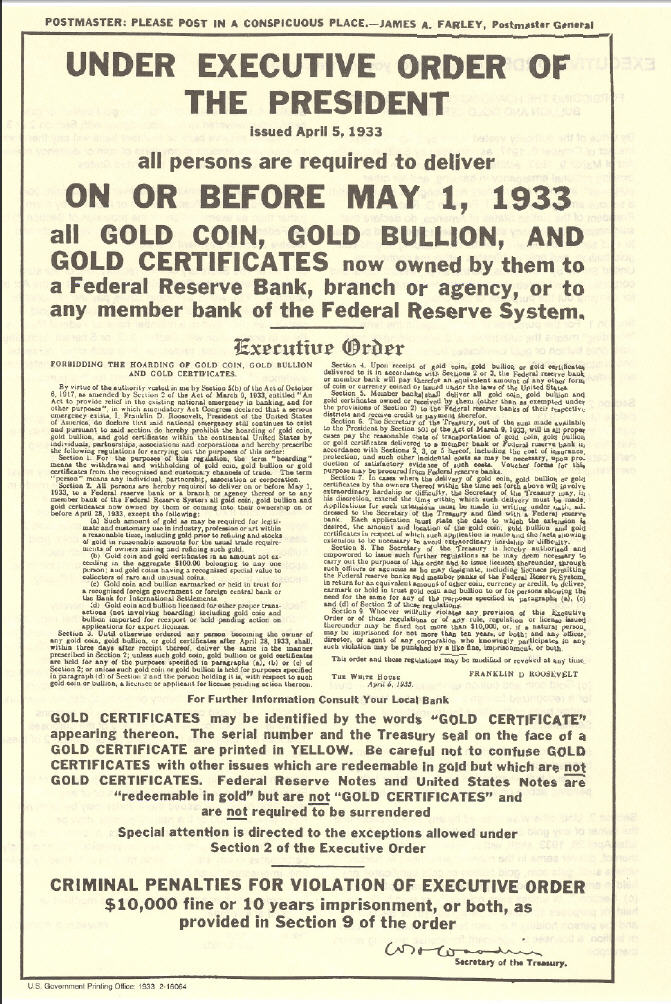

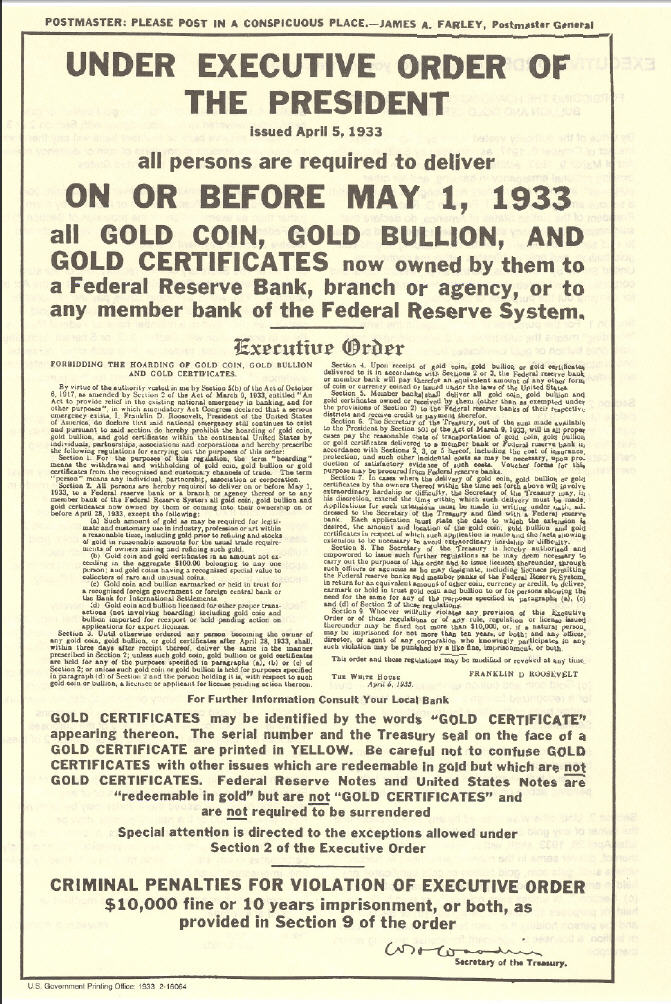

Executive Order 6102 (1933)

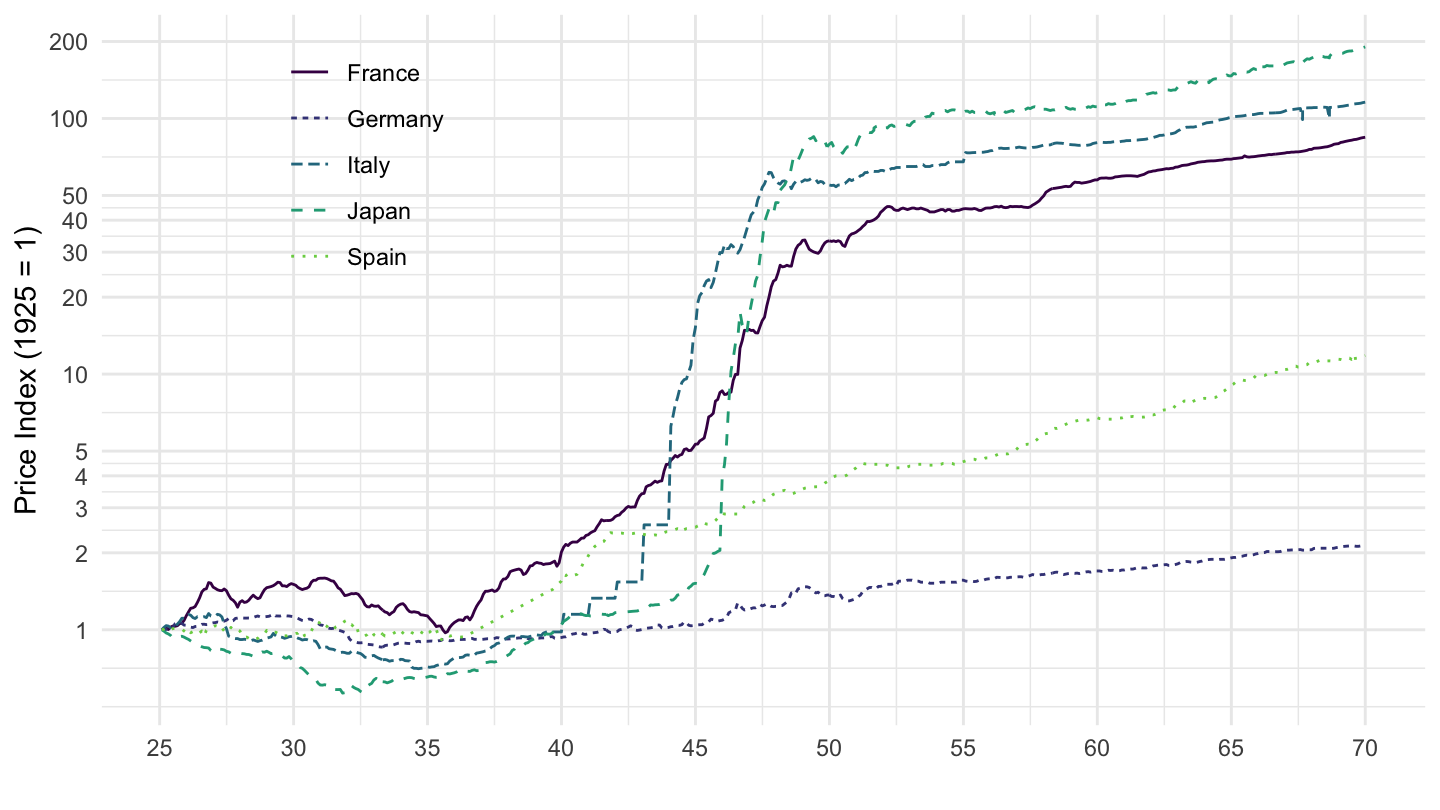

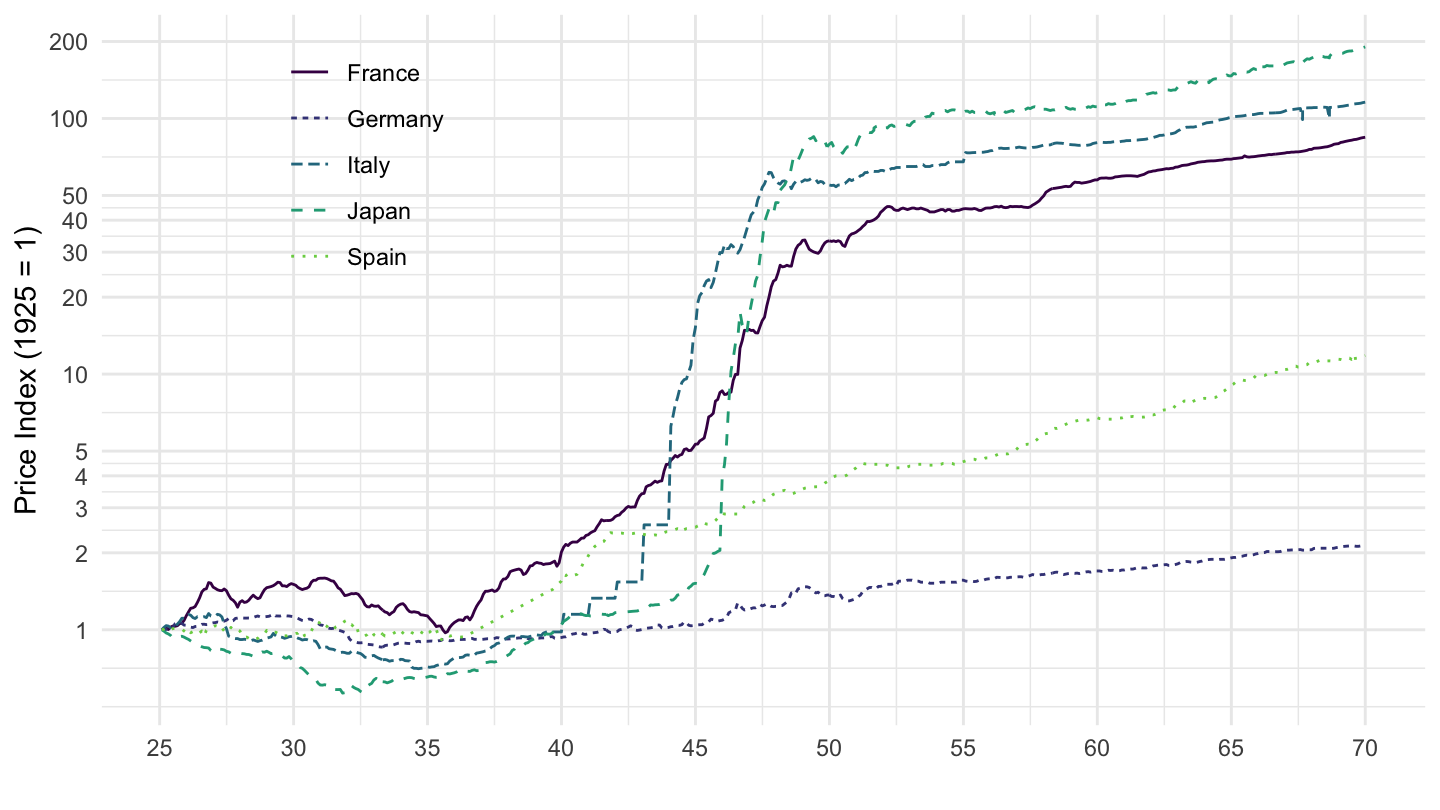

Inflation (1925-1970)

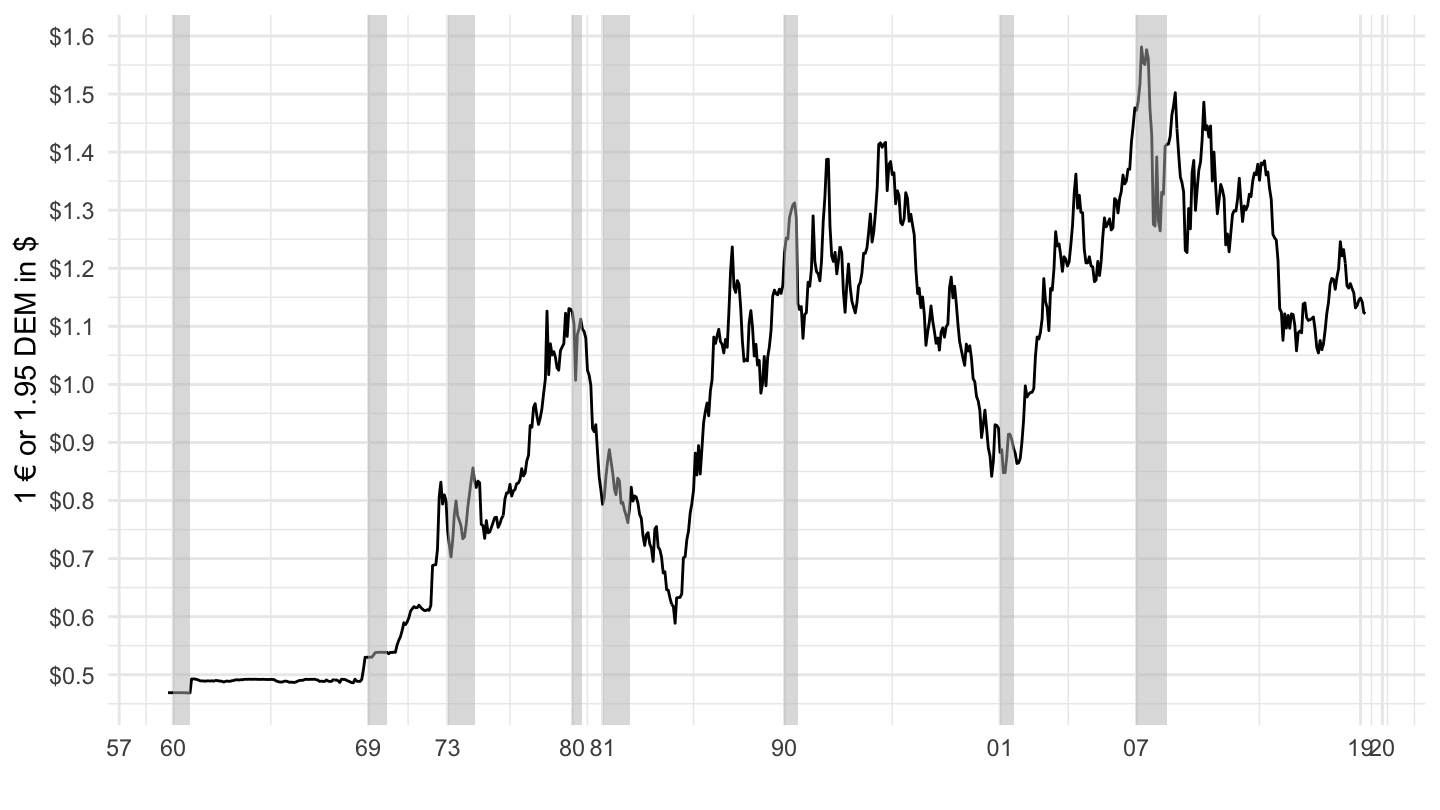

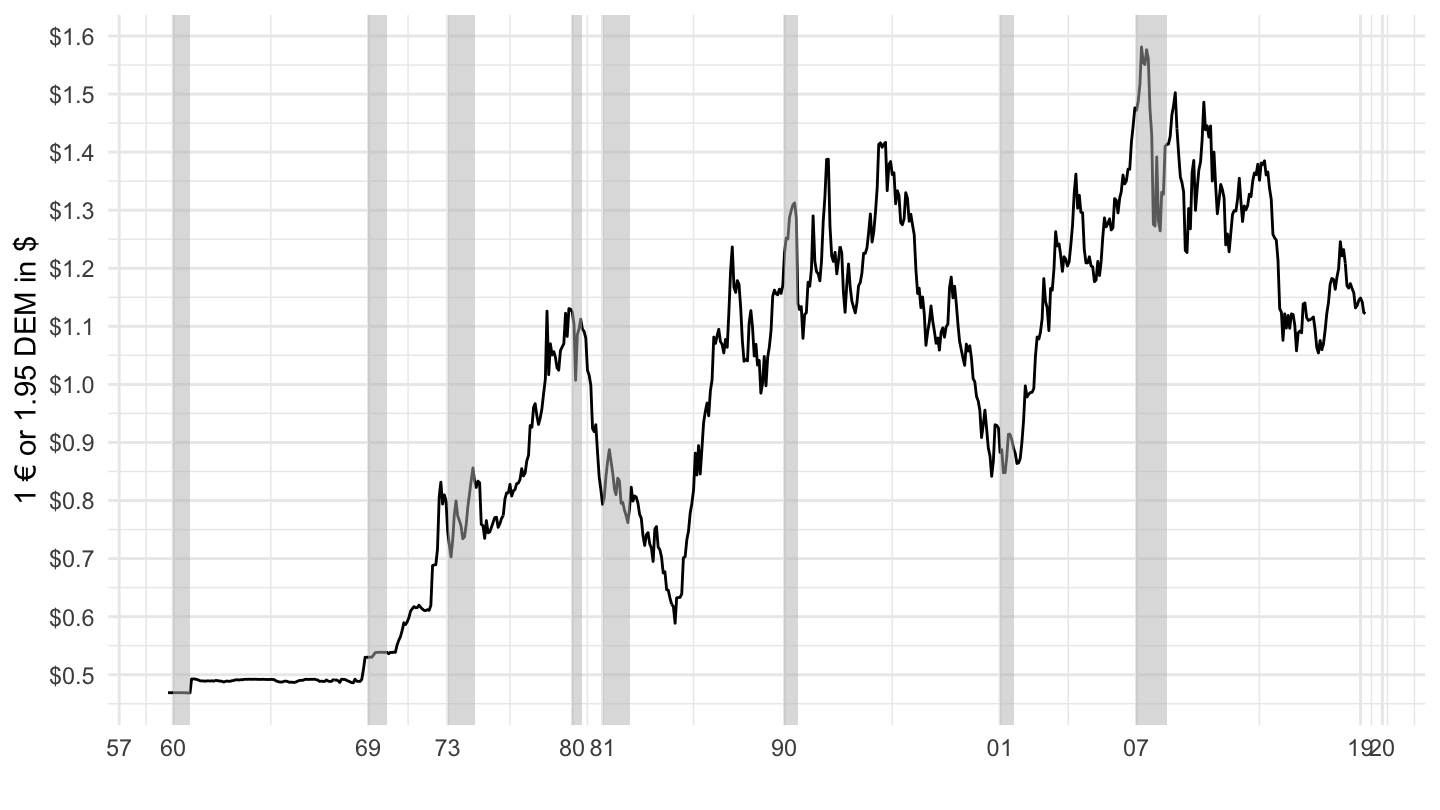

U.S.- Euro (DM) Nominal Exchange Rate

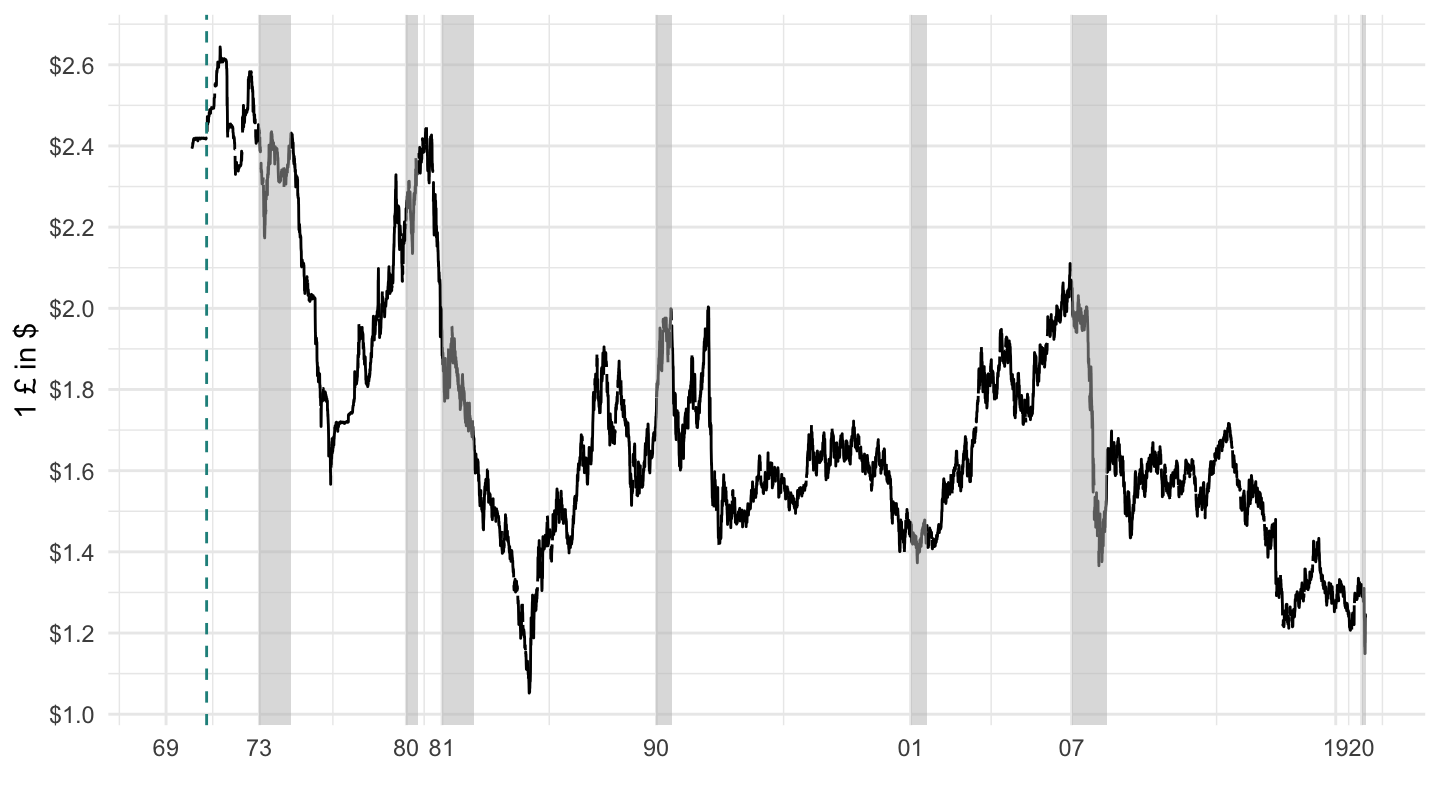

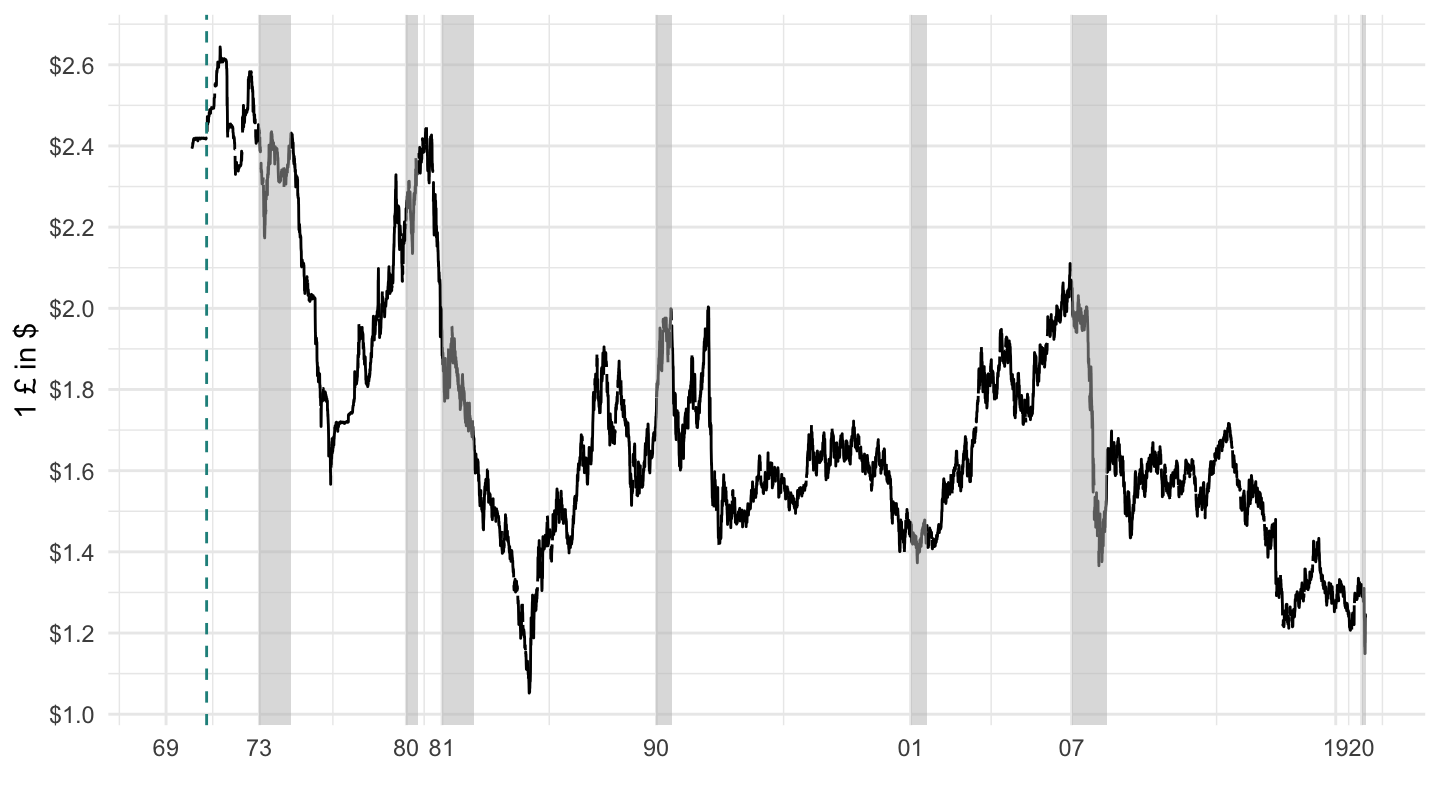

U.S. - U.K Nominal Exchange Rate

Monetary Policy and Secular Stagnation

Larry Summers

Larry Summers’ Speech

All kinds of questions for macroeconomics:

Can economies function well with negative interest rates ?

If bonds and money are very close substitutes, what are the distinction between fiscal and monetary policy, and between monetary and fiscal financing of deficits ?

Aftermath of the Scandinavian bank failures in the 1990s ?

Projections

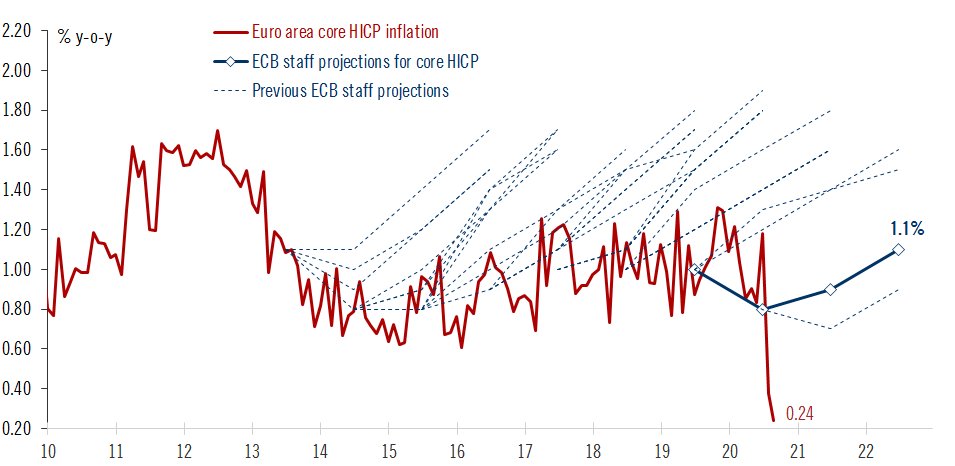

ECB - Projections vs. realizations

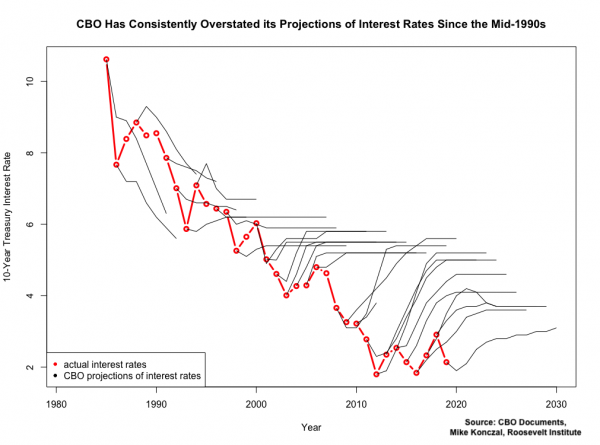

CBO Projections VS Realizations

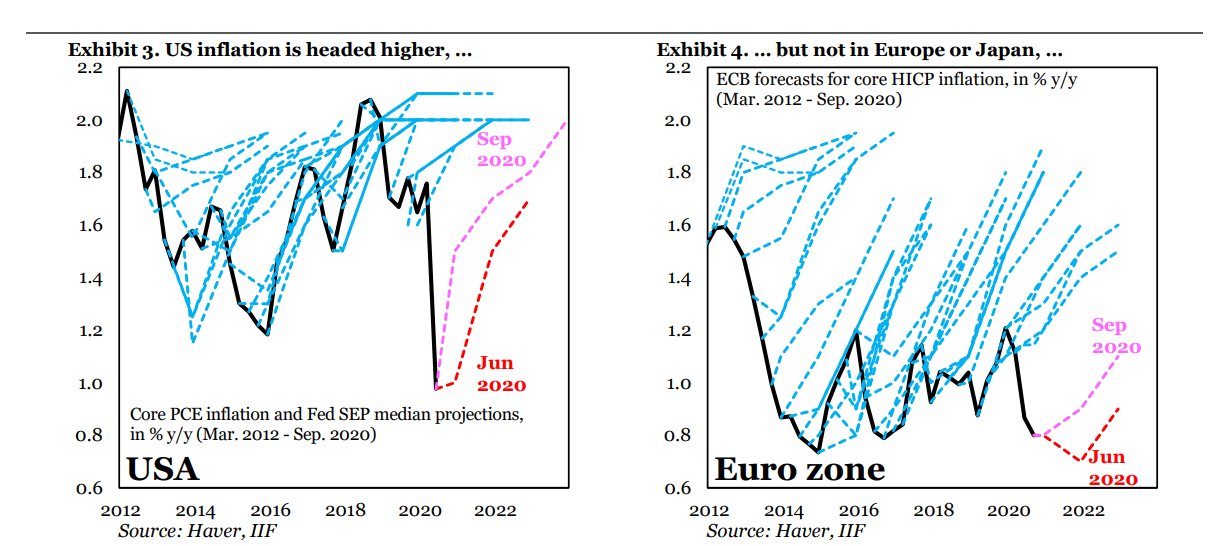

Fed and ECB - Projections vs. realizations

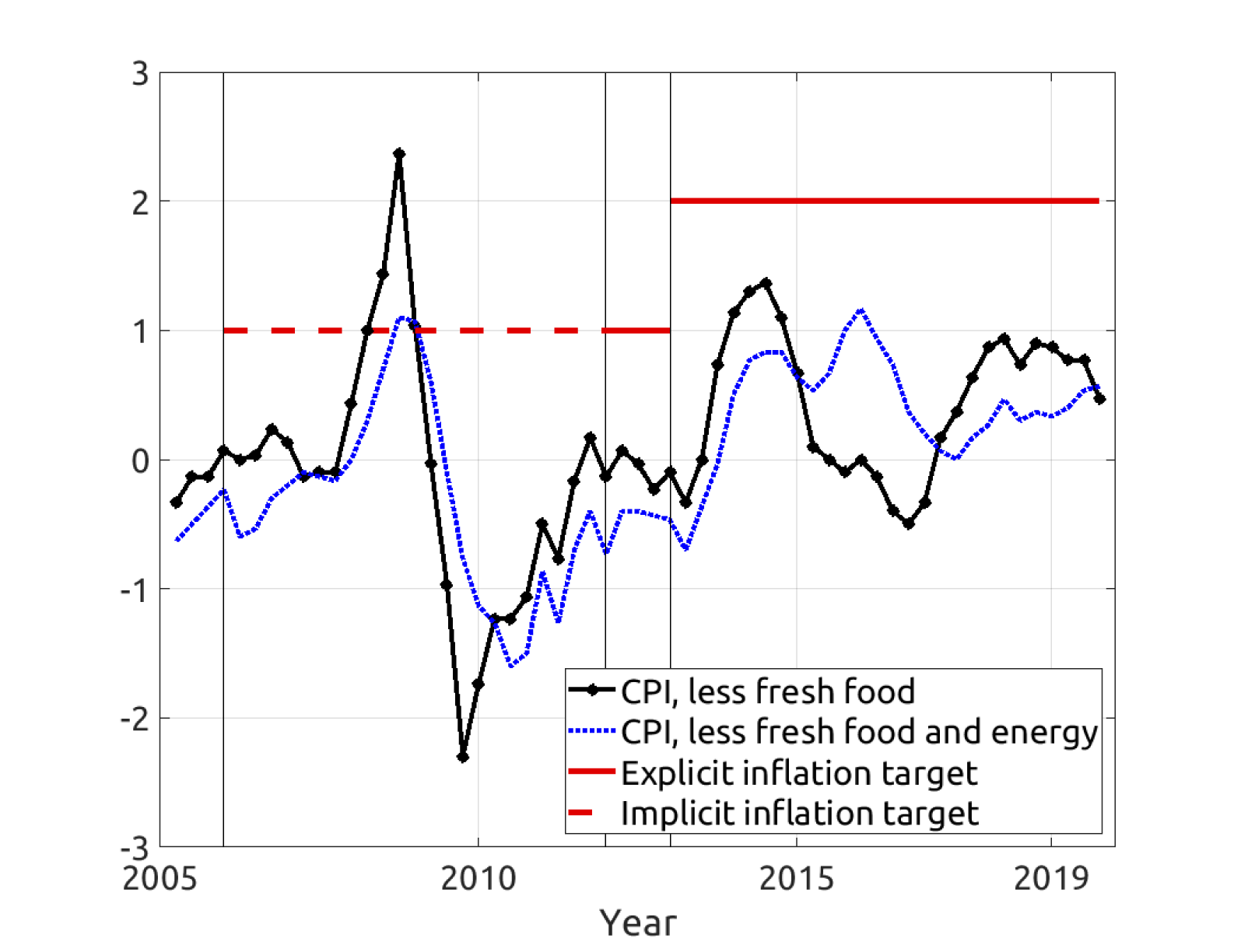

BoJ 1/2 - Source: Nakata (2020)

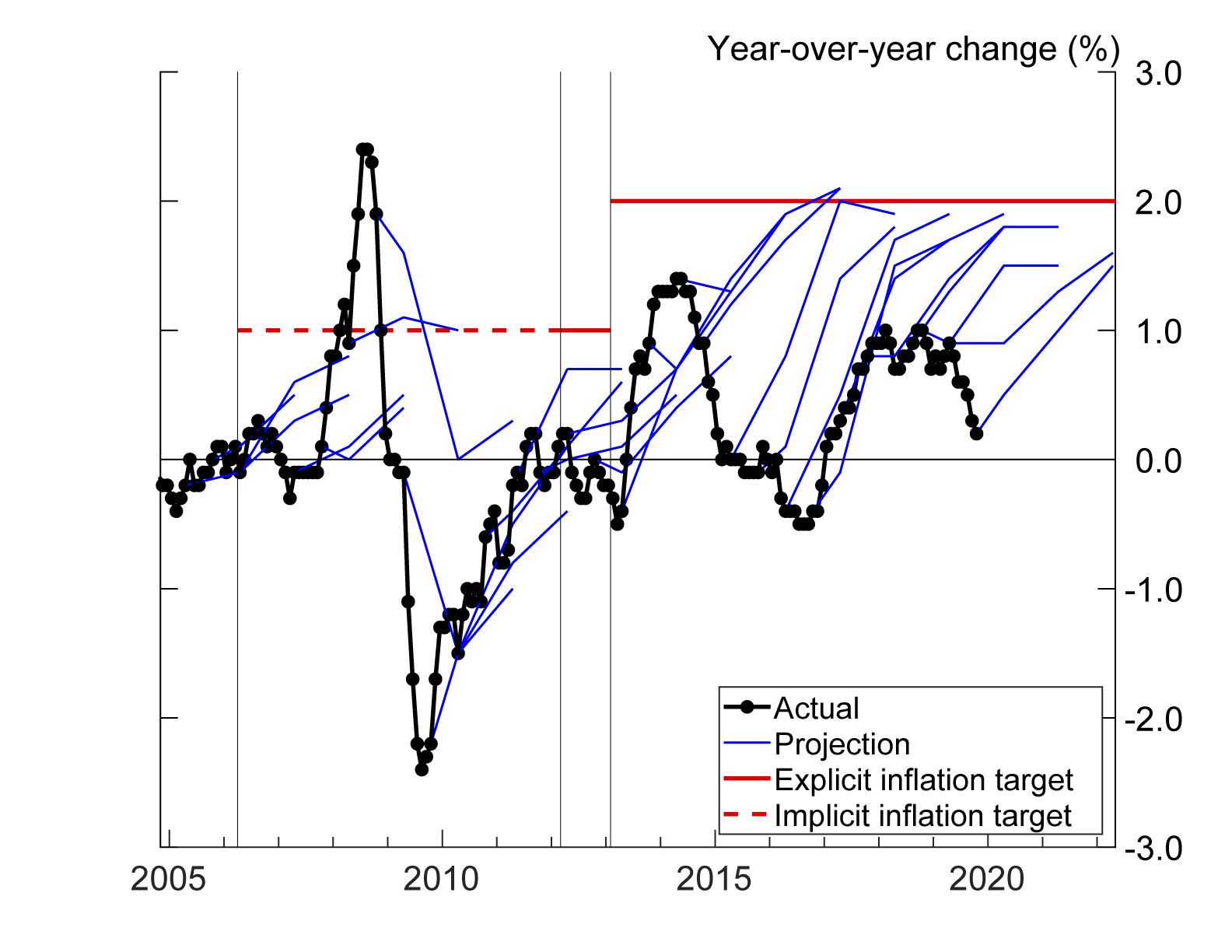

BoJ 2/2 - Source: Nakata (2020)

What is money ?

According to Friedman

Monetarism

Great Depression.

1970s Inflation.

Savings and Loans debacle.

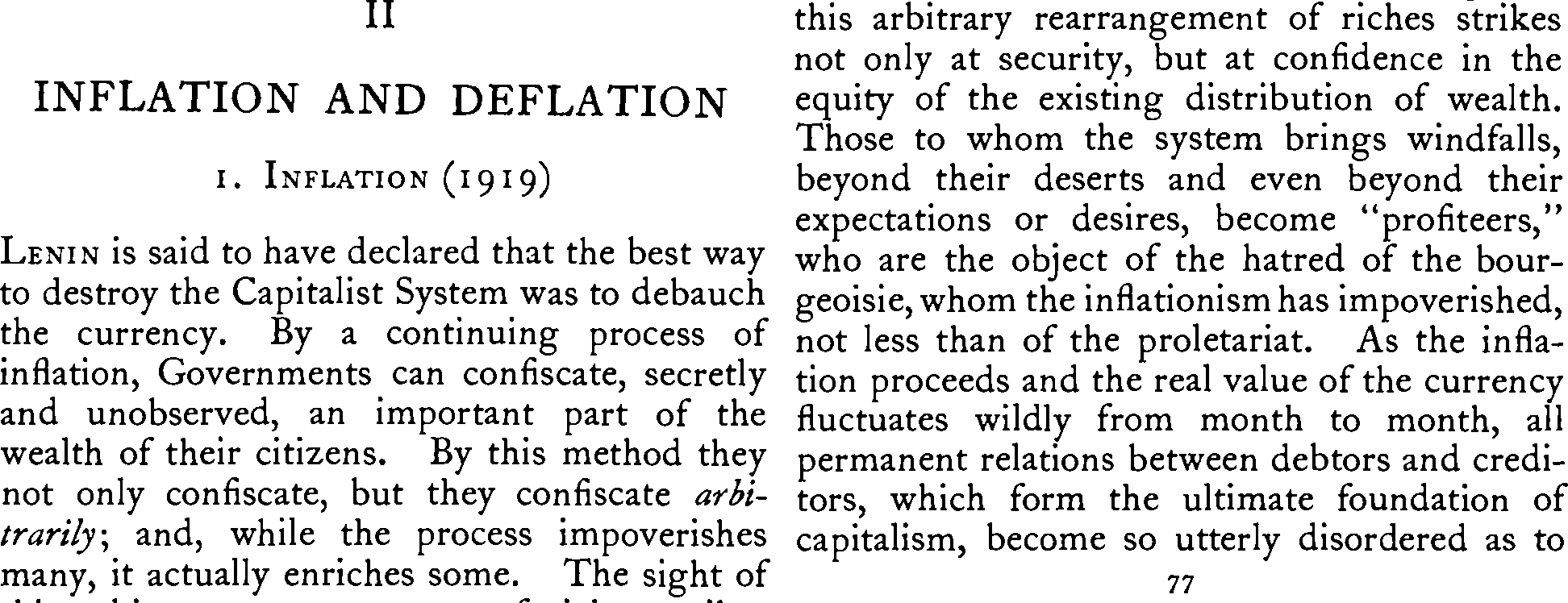

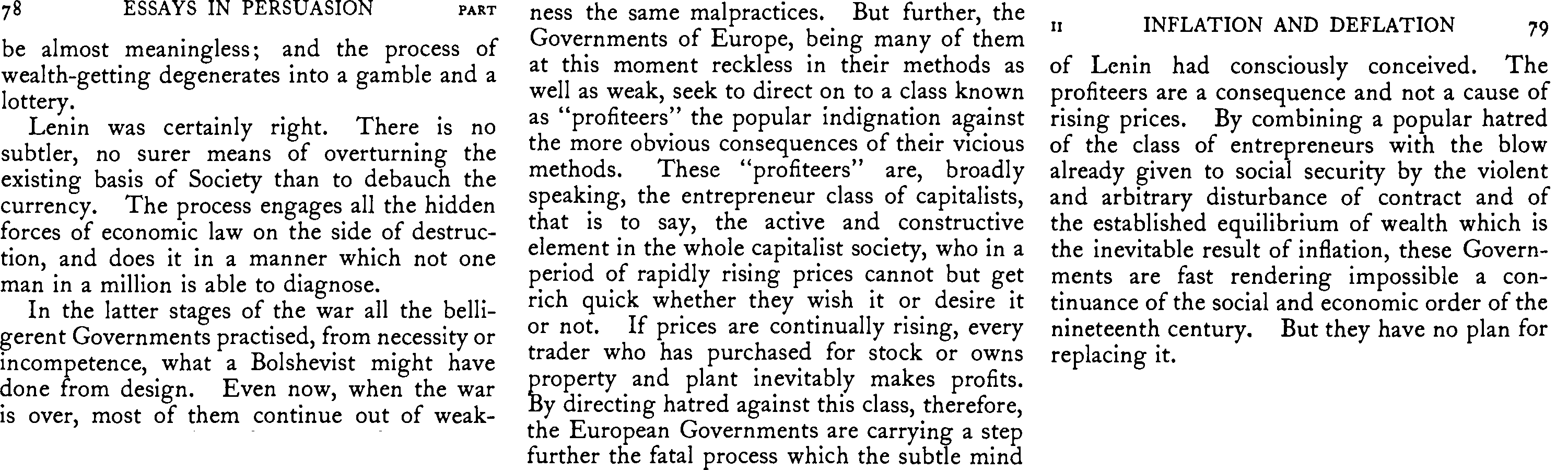

Keynes on inflation

Debasing the currency

Inflation and profiteering

Monetary Policy

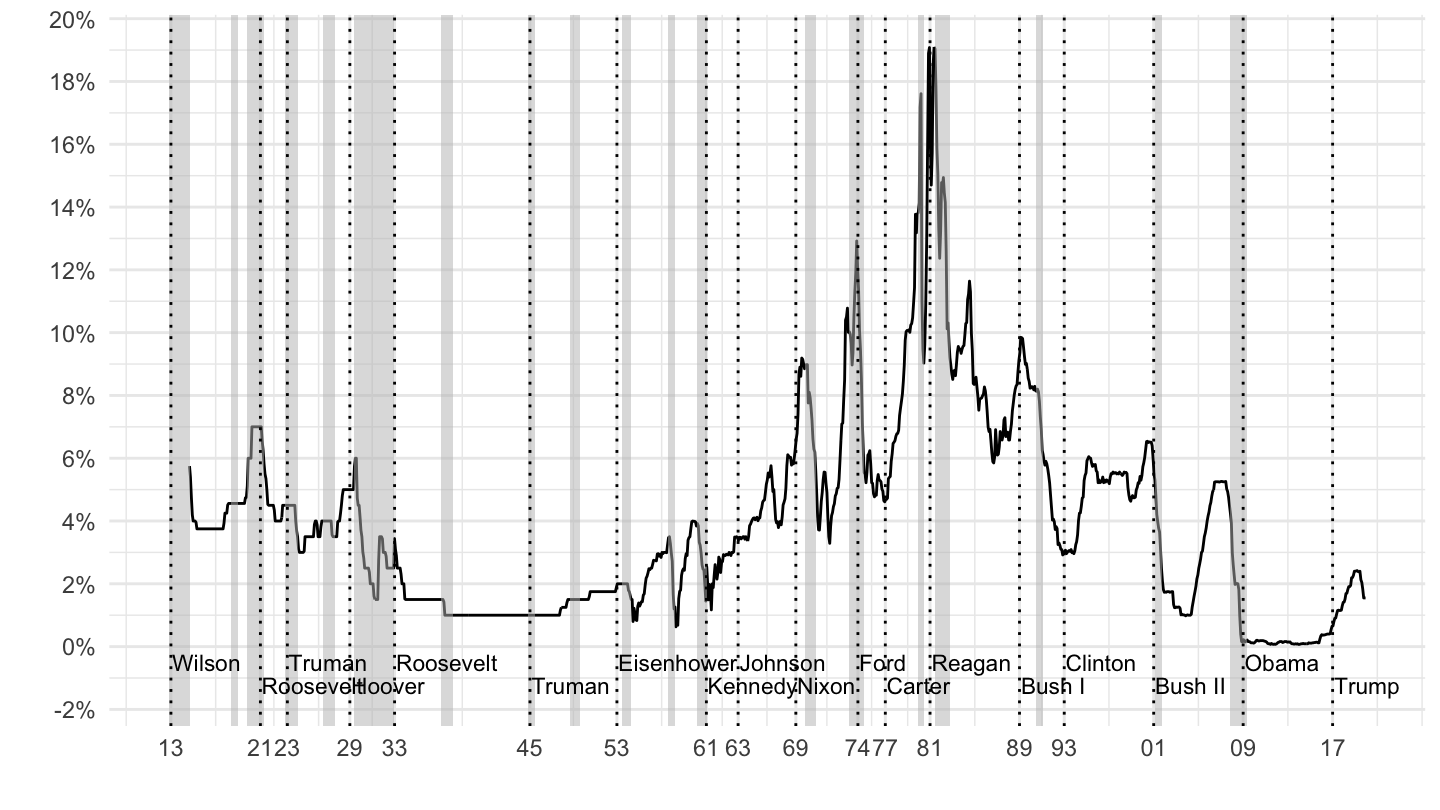

U.S. Fed Funds Rate / Discount Rate (1914-2019)

Nixon Address, August 15, 1971

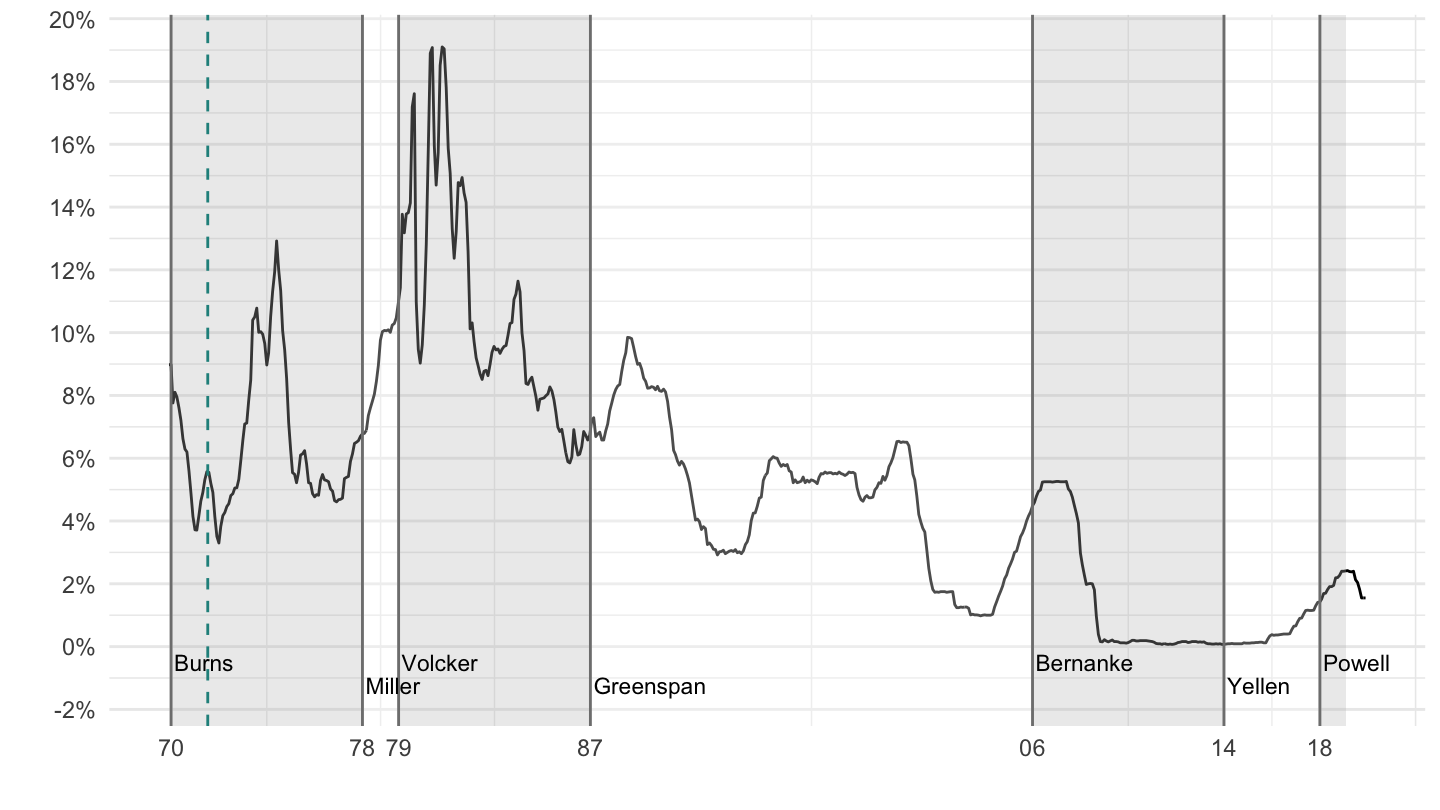

Fed Chairmen / Chairwomen

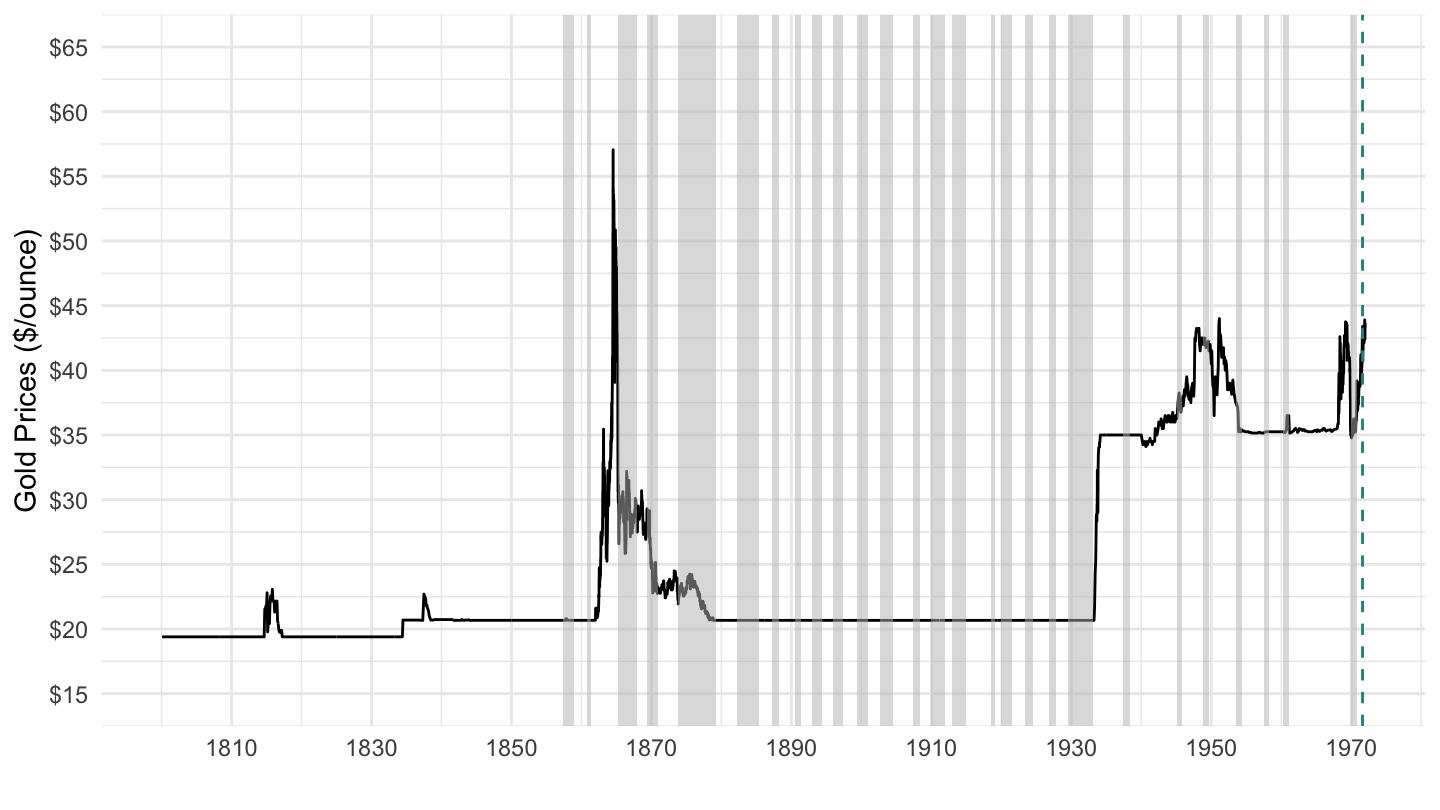

Gold Prices ($/Ounce) 1800-1972

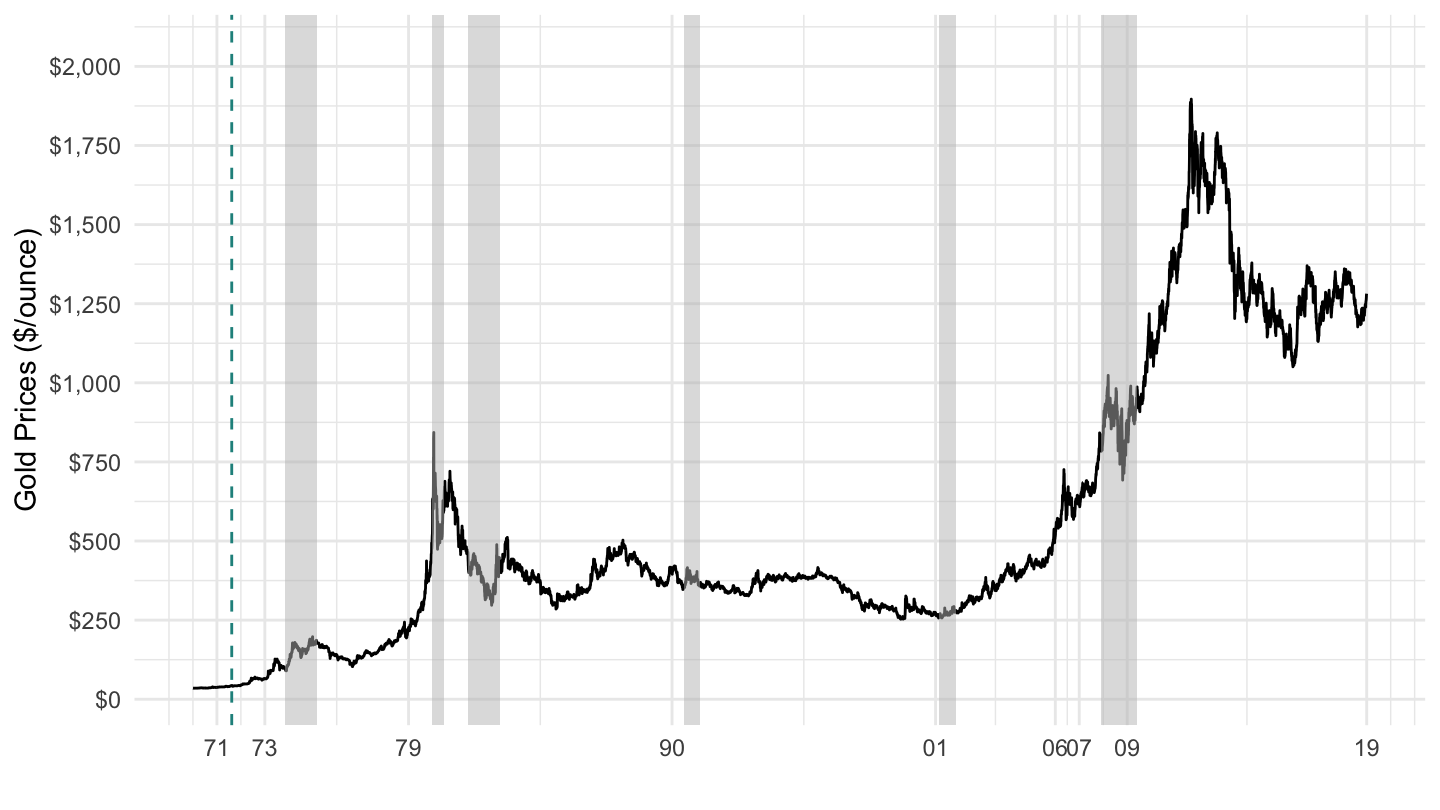

Gold Prices ($/Ounce) 1970-2019

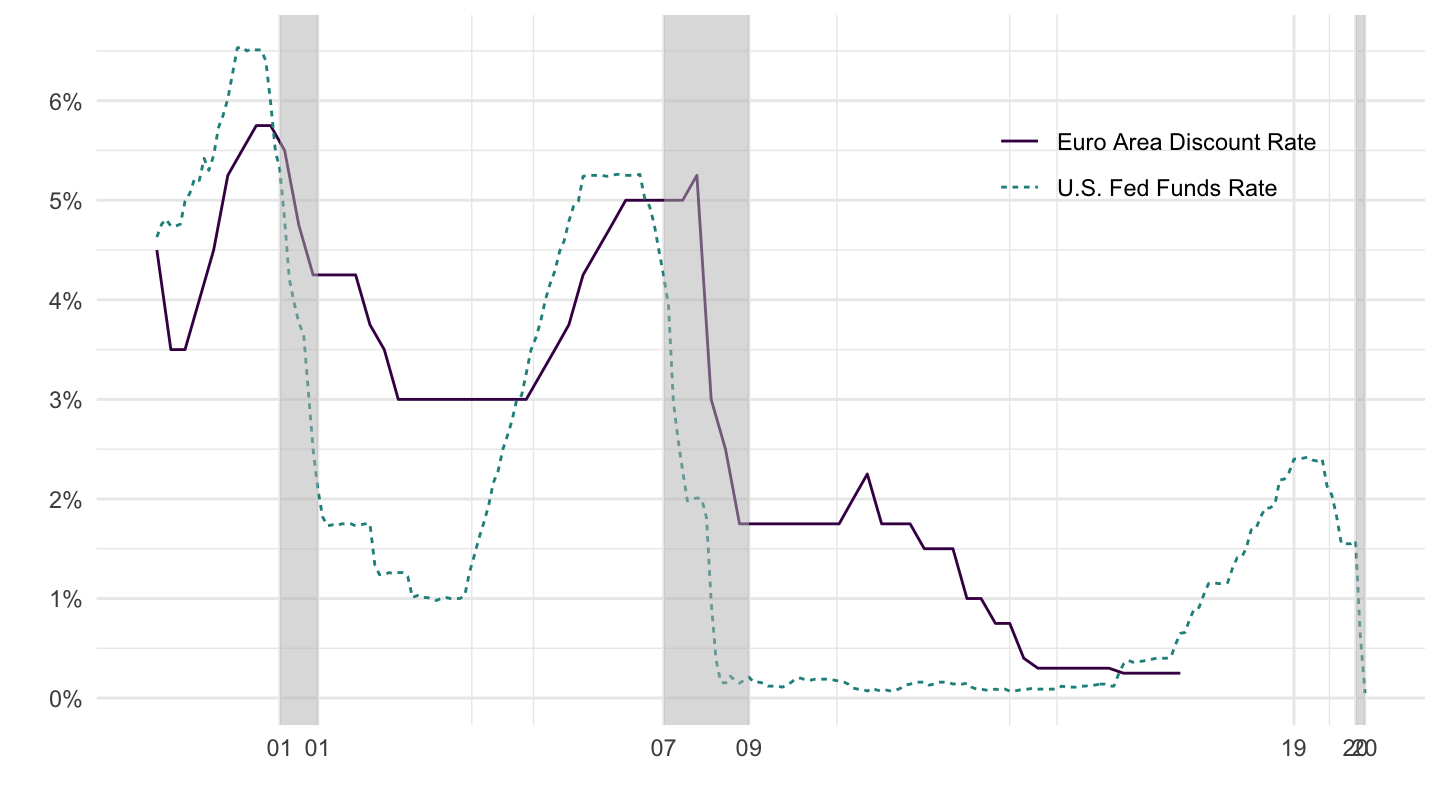

U.S. Versus Euro Area Discount Rates

Inflation

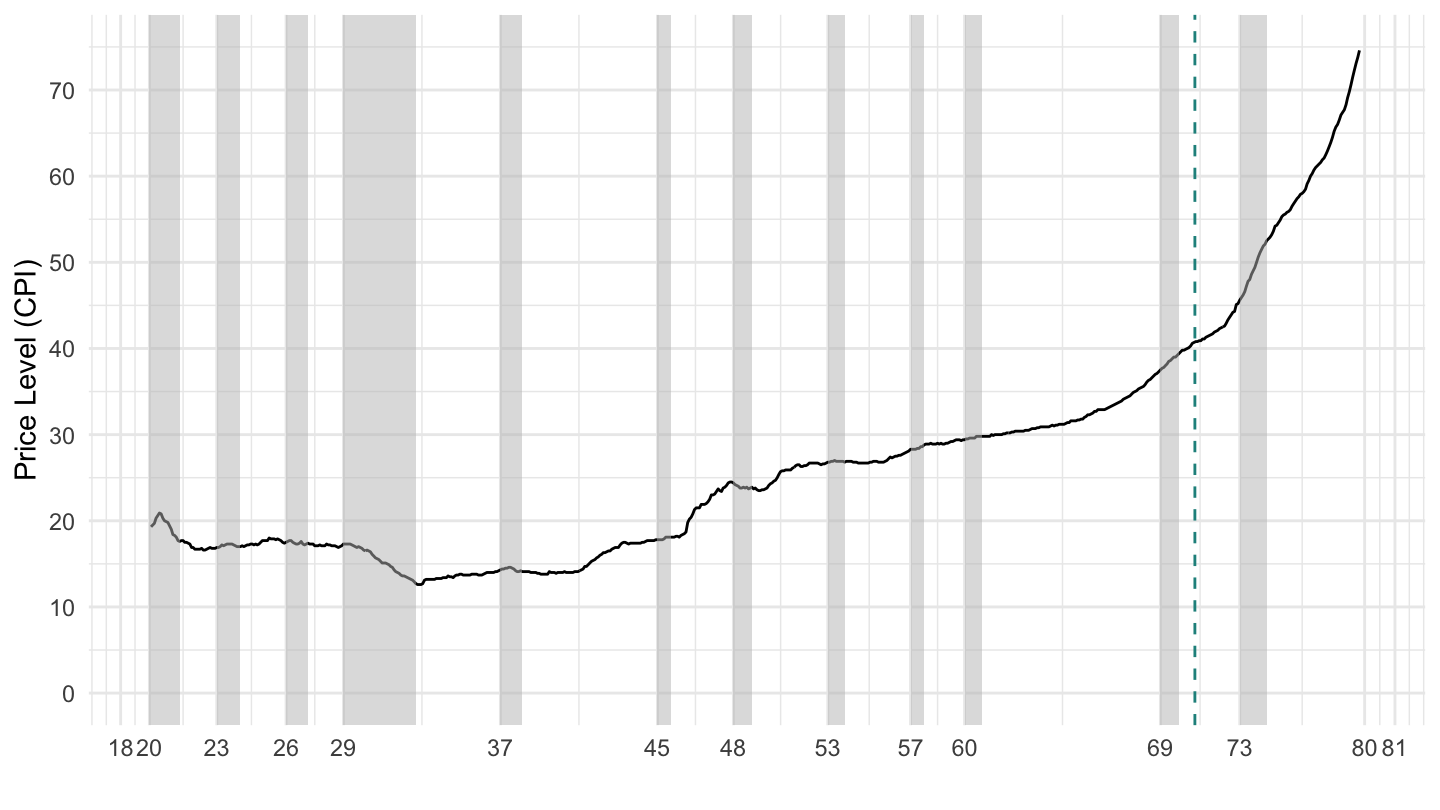

U.S. Price Level 1920-1980

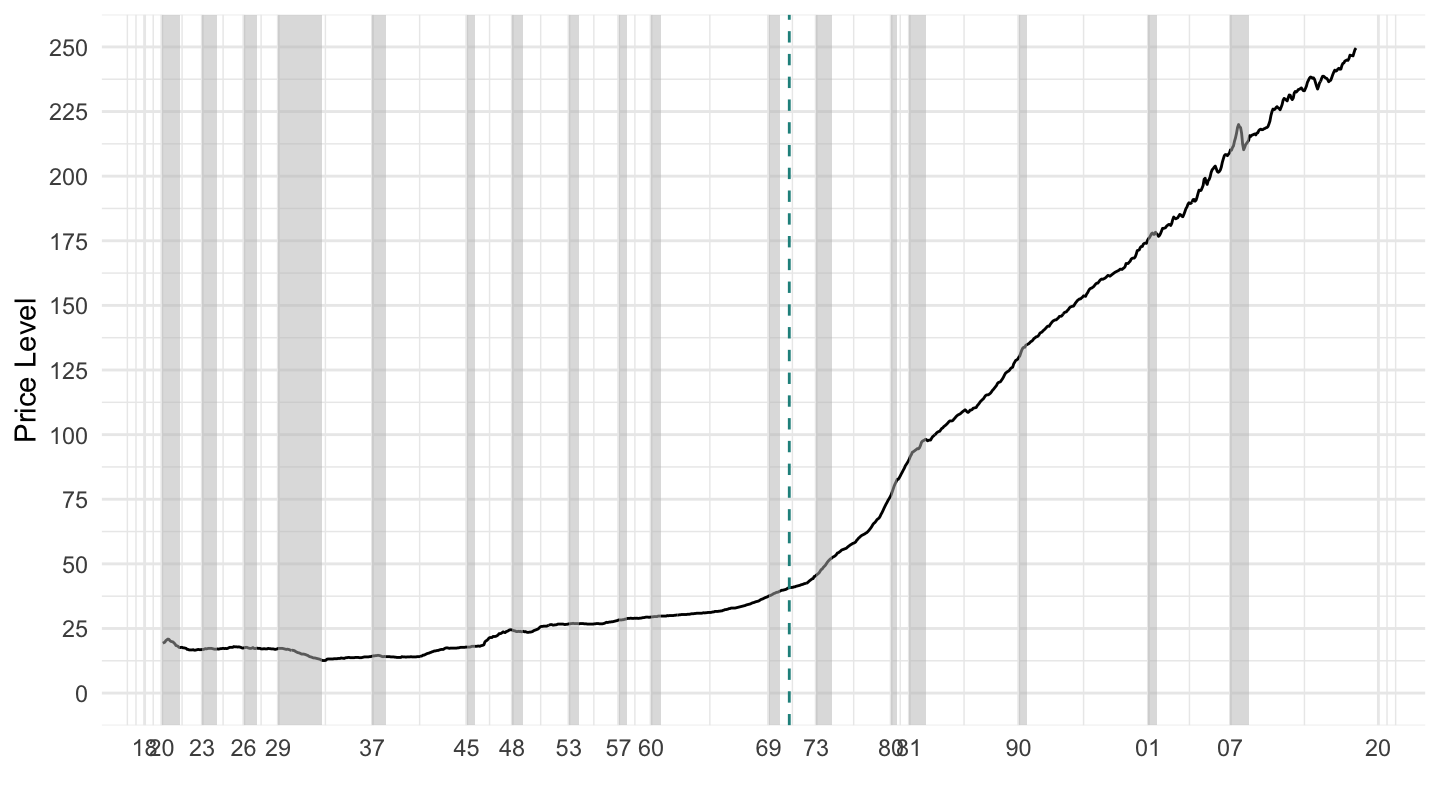

U.S. Price Level 1920-2019

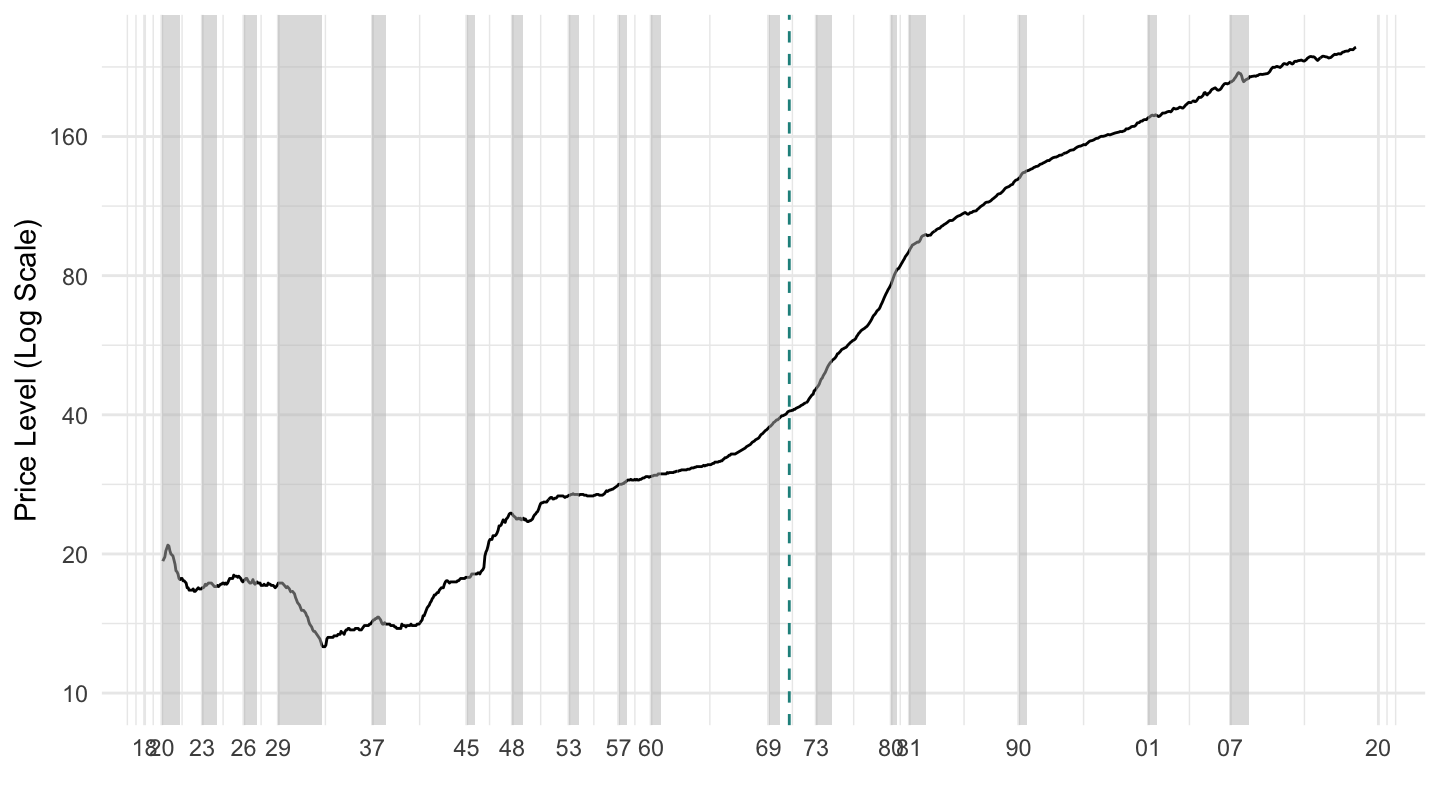

U.S. Price Level 1920-2019 (Log Scale)

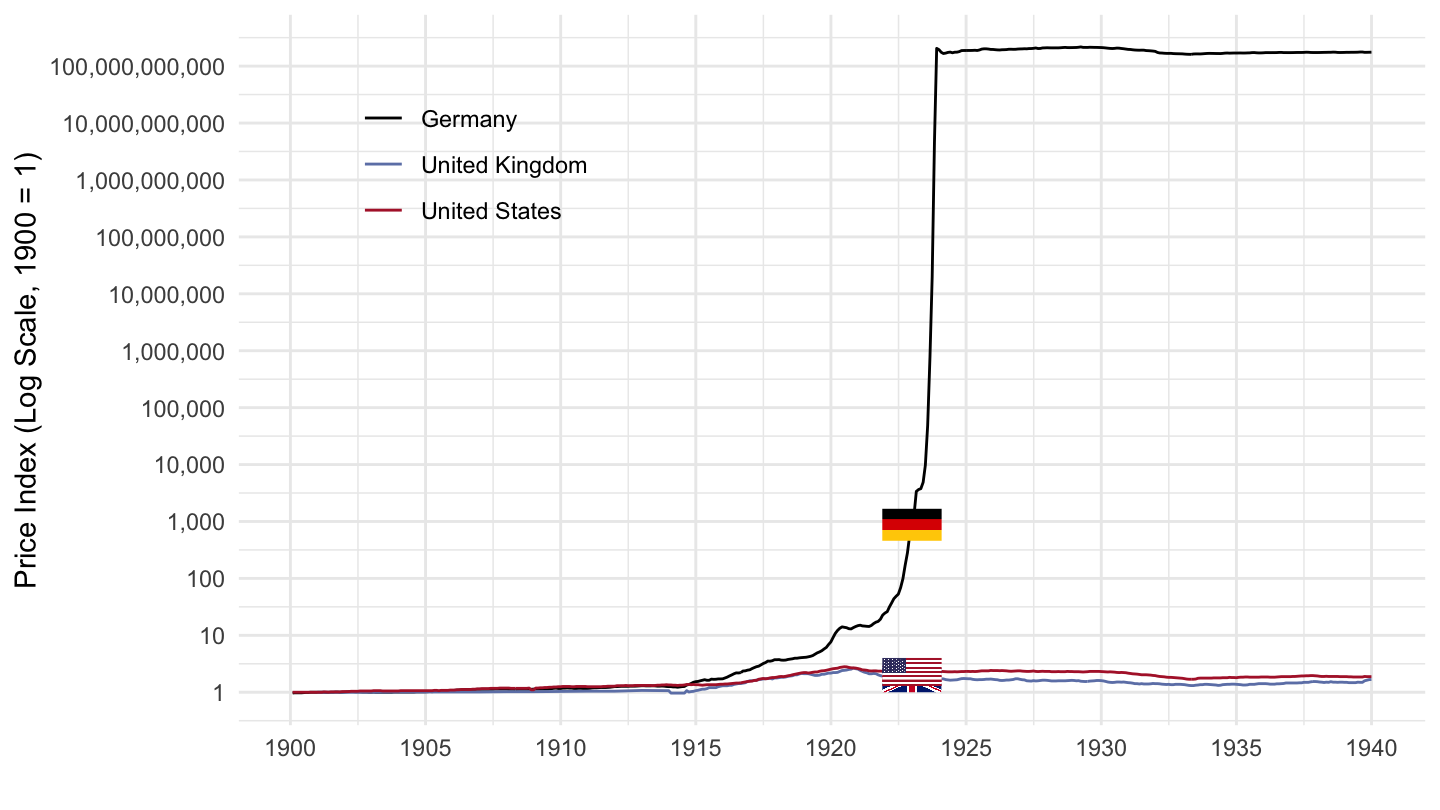

German Hyperinflation: Price Index

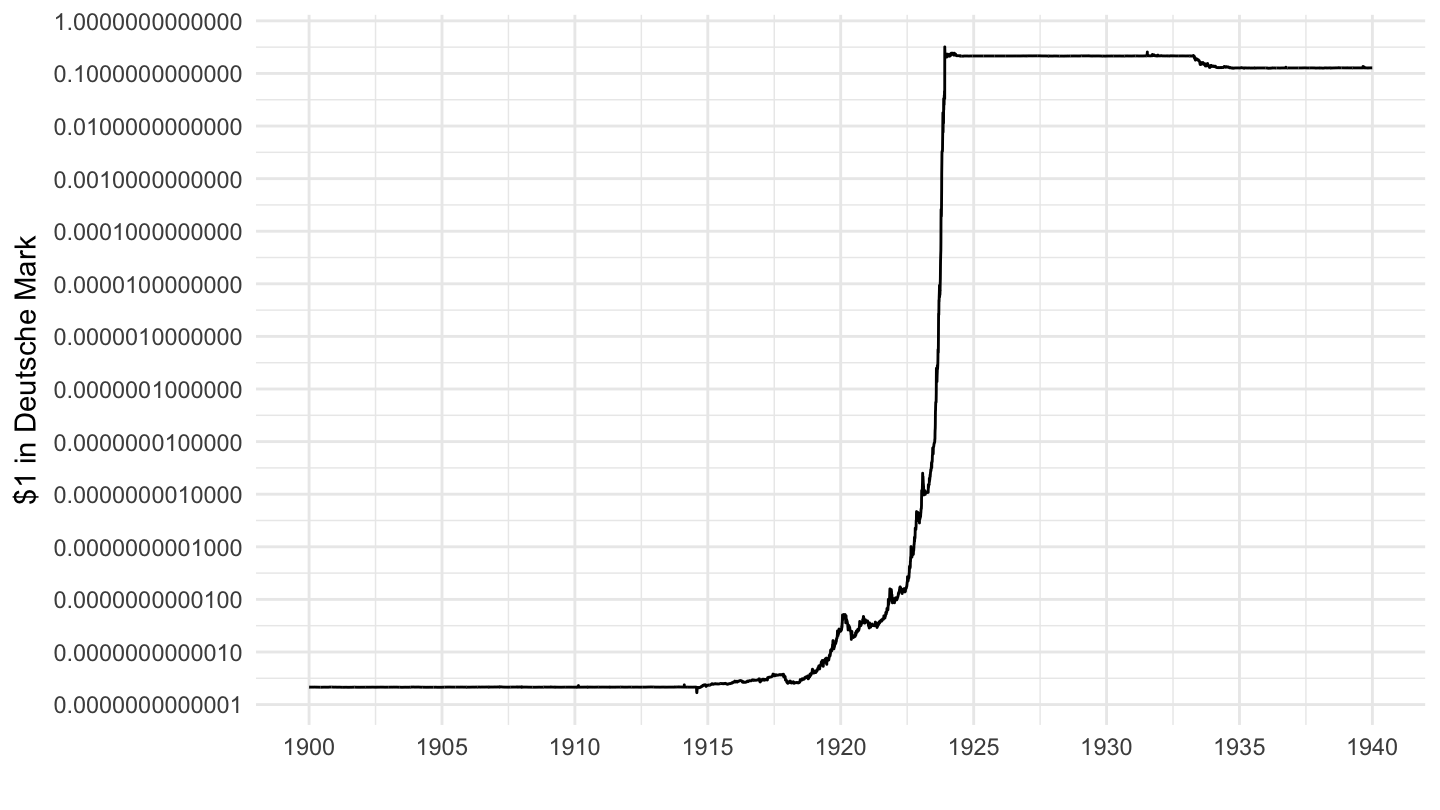

German Hyperinflation: Exchange Rates

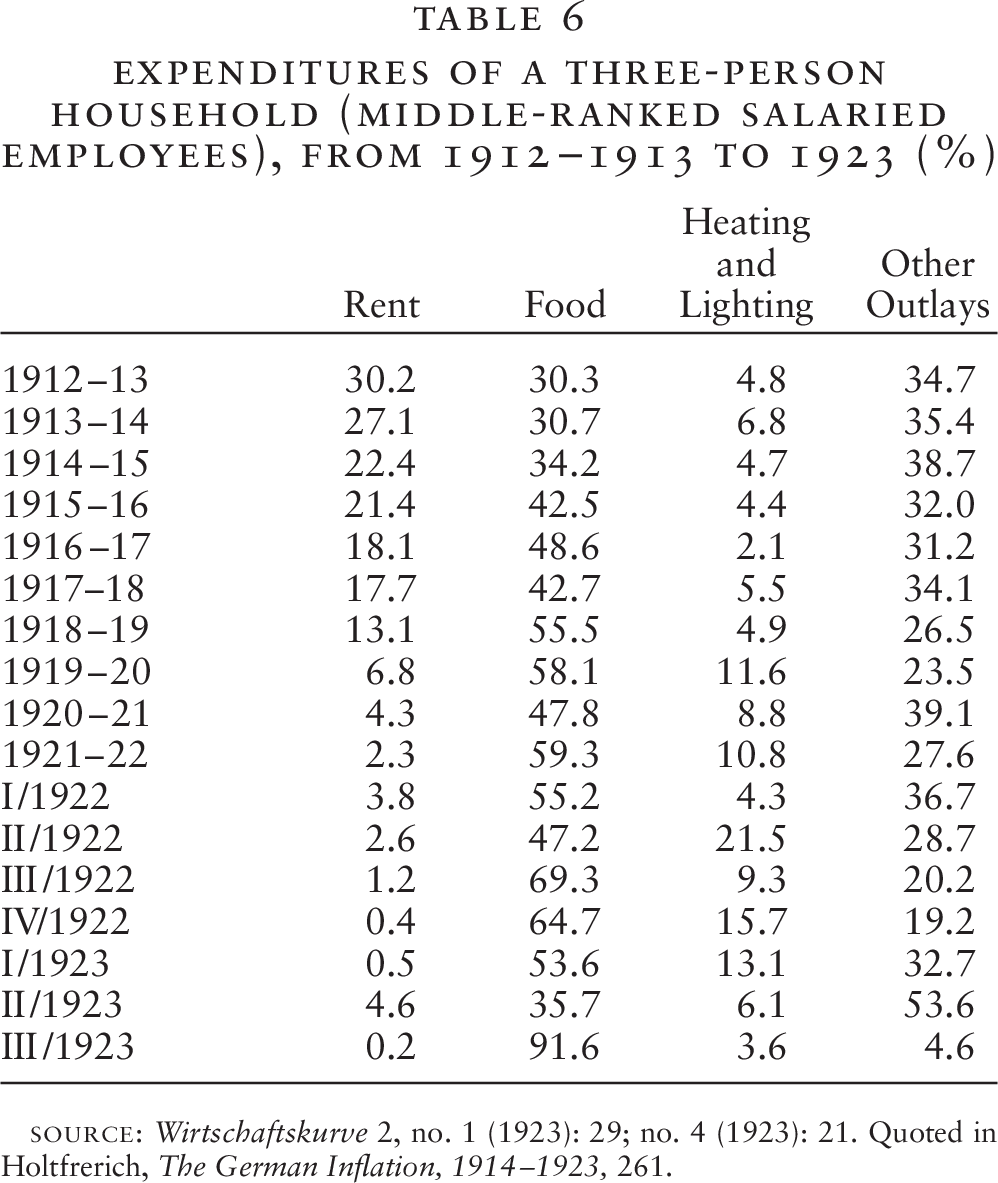

German Hyperinflation in the 1920s

German Hyperinflation in the 1920s

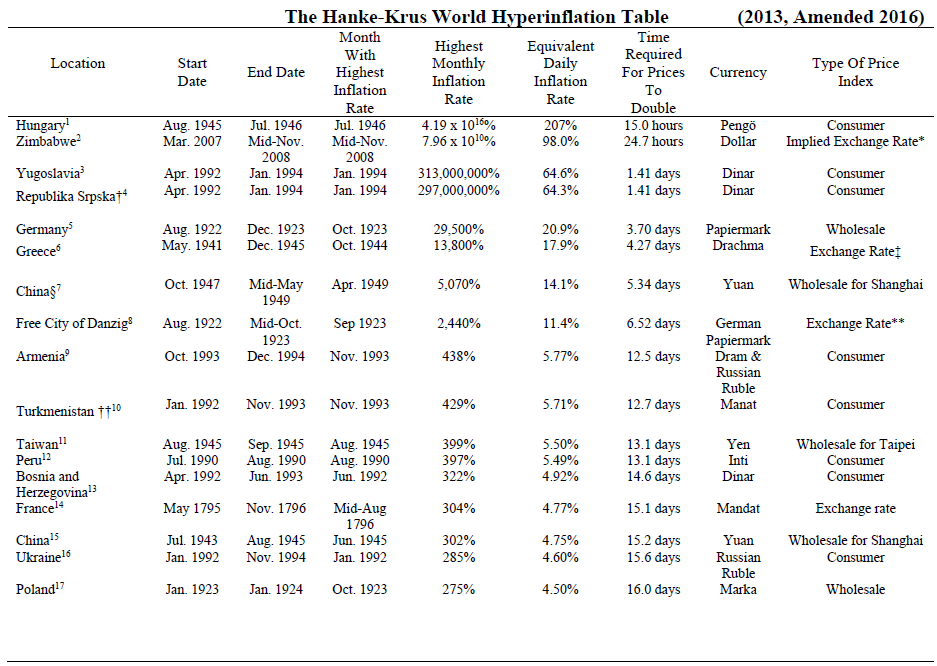

Other Hyperinflations

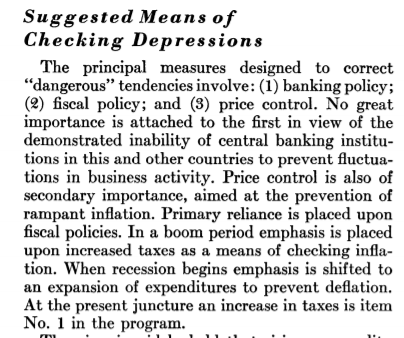

Deflation Policies

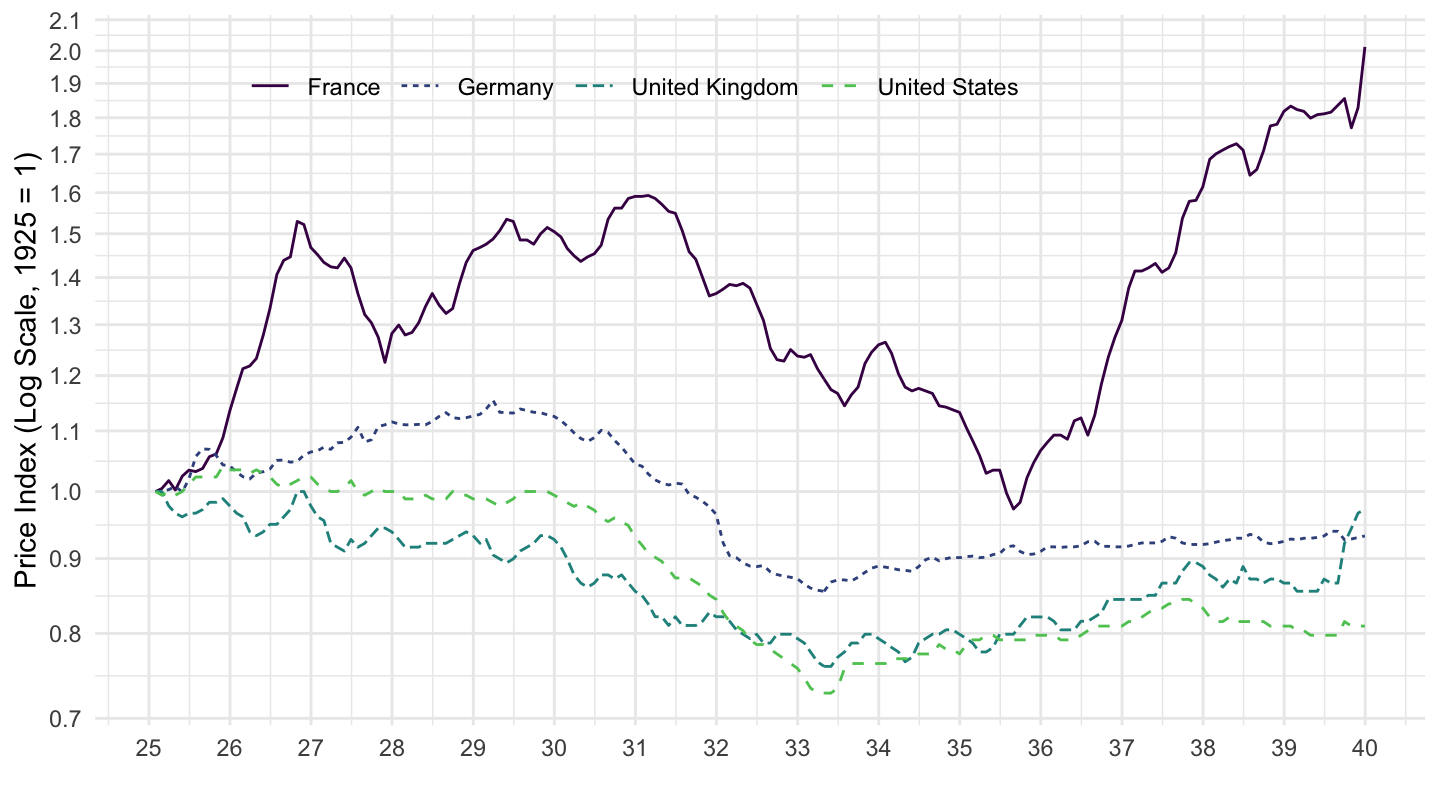

Deflation in the Great Depression

Heinrich Brüning’s Deflation Policies (1930-1932)

Devaluation of the Pound (September 21, 1931)

Devaluation of the Dollar (1933)

Executive Order 6102 (1933)

Inflation (1925-1970)

Exchange Rates

U.S. - U.K Nominal Exchange Rate

U.S.- Euro (DM) Nominal Exchange Rate

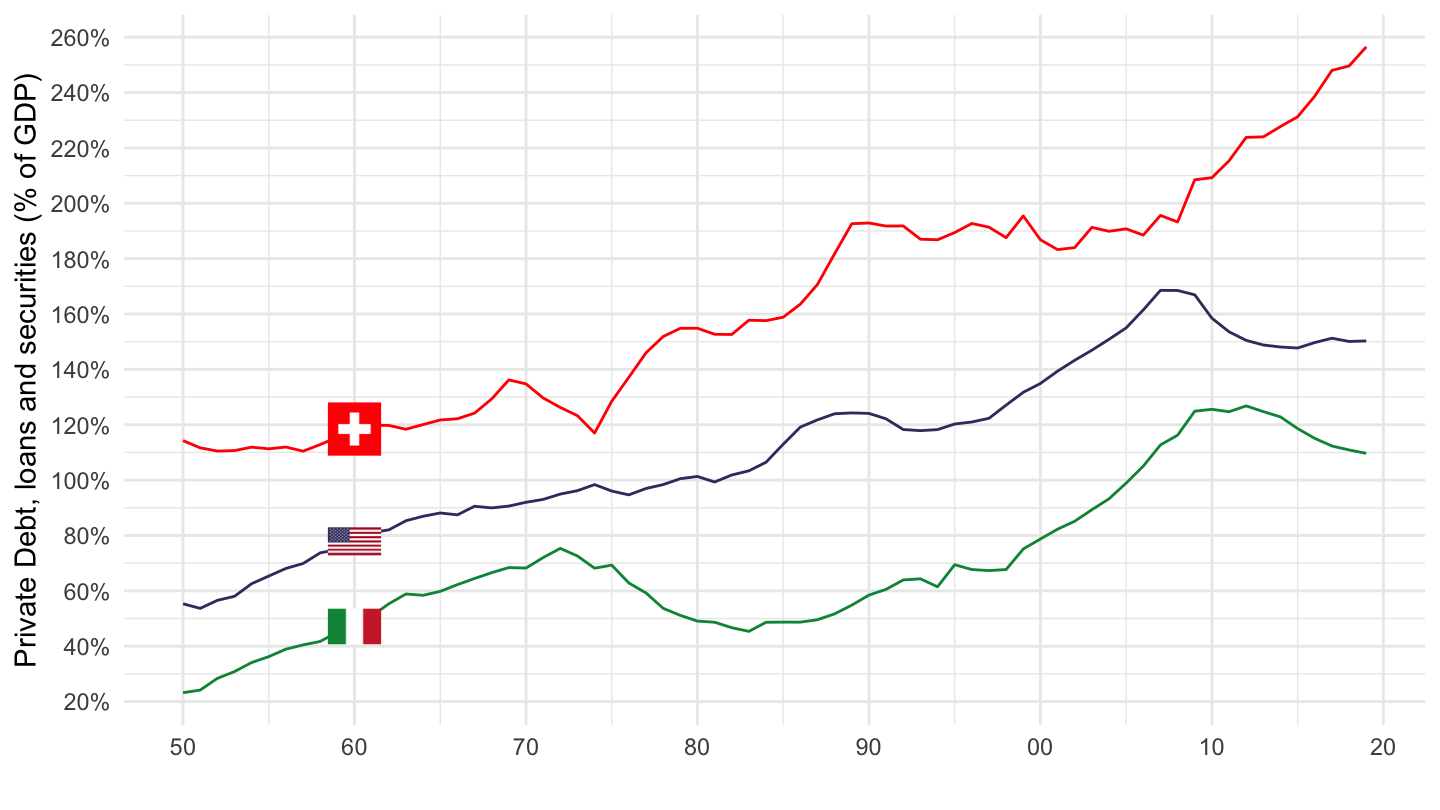

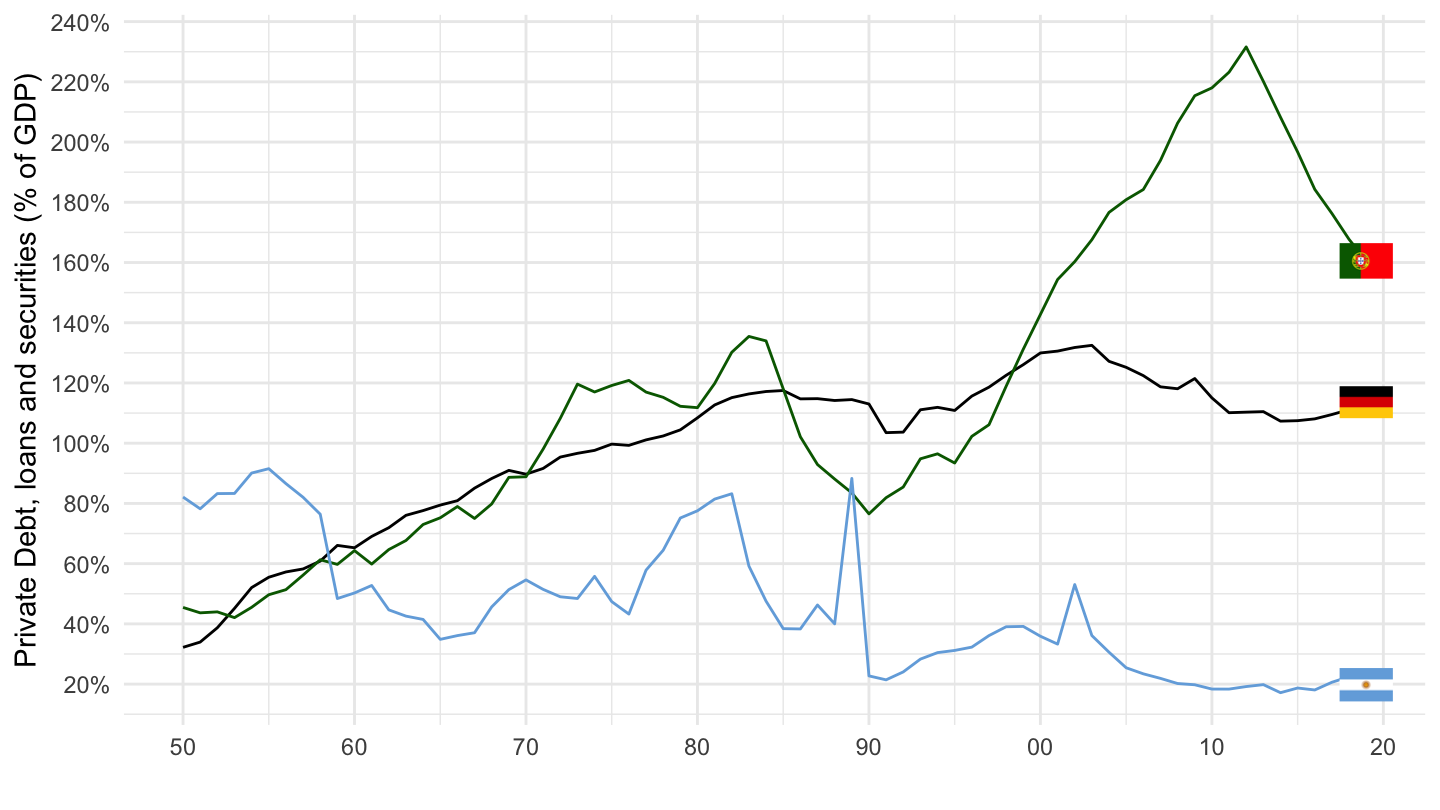

Private credit data

Italy, United States, Switzerland

Germany, Argentina, Portugal

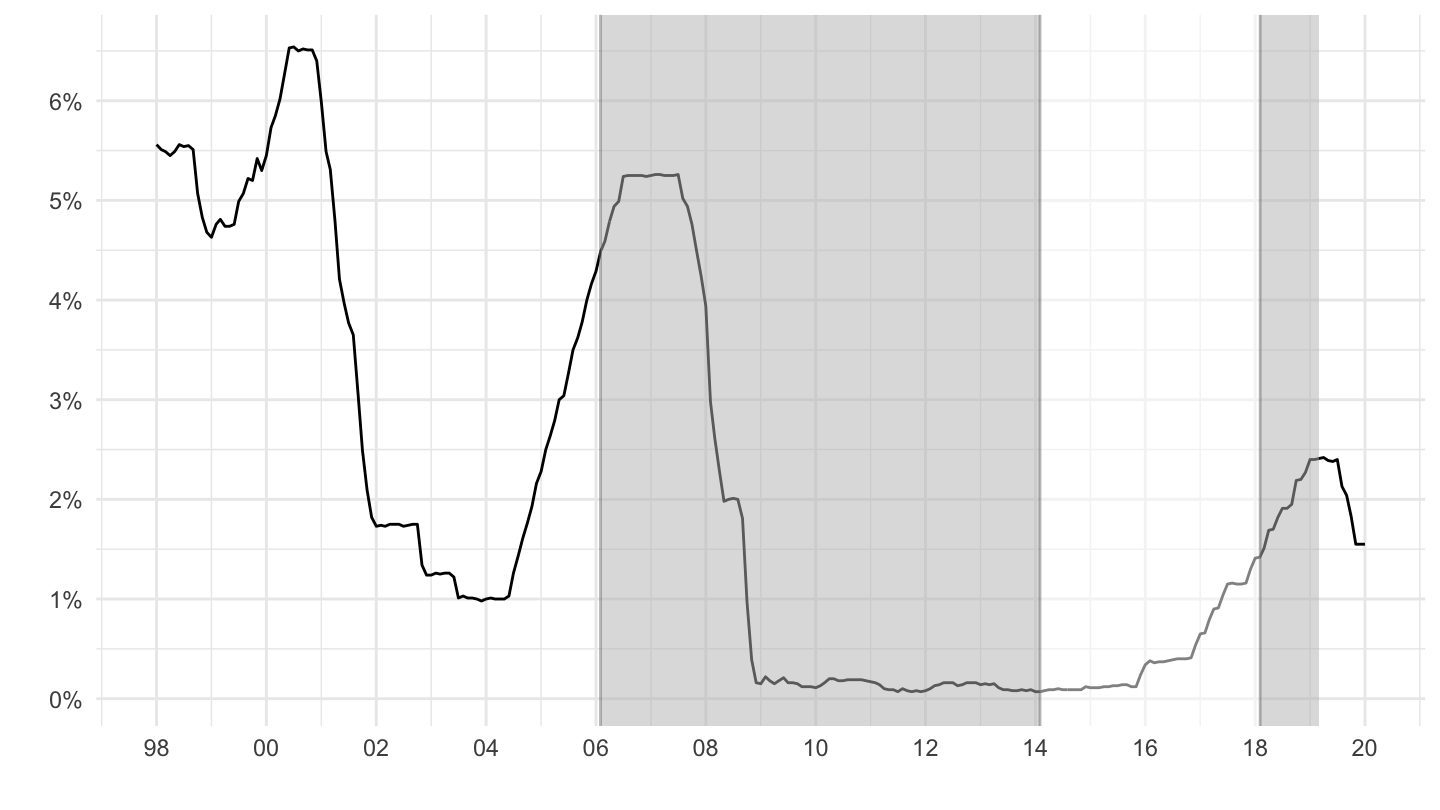

Housing and Monetary Policy: 2000-2015

Low Federal Funds Rates

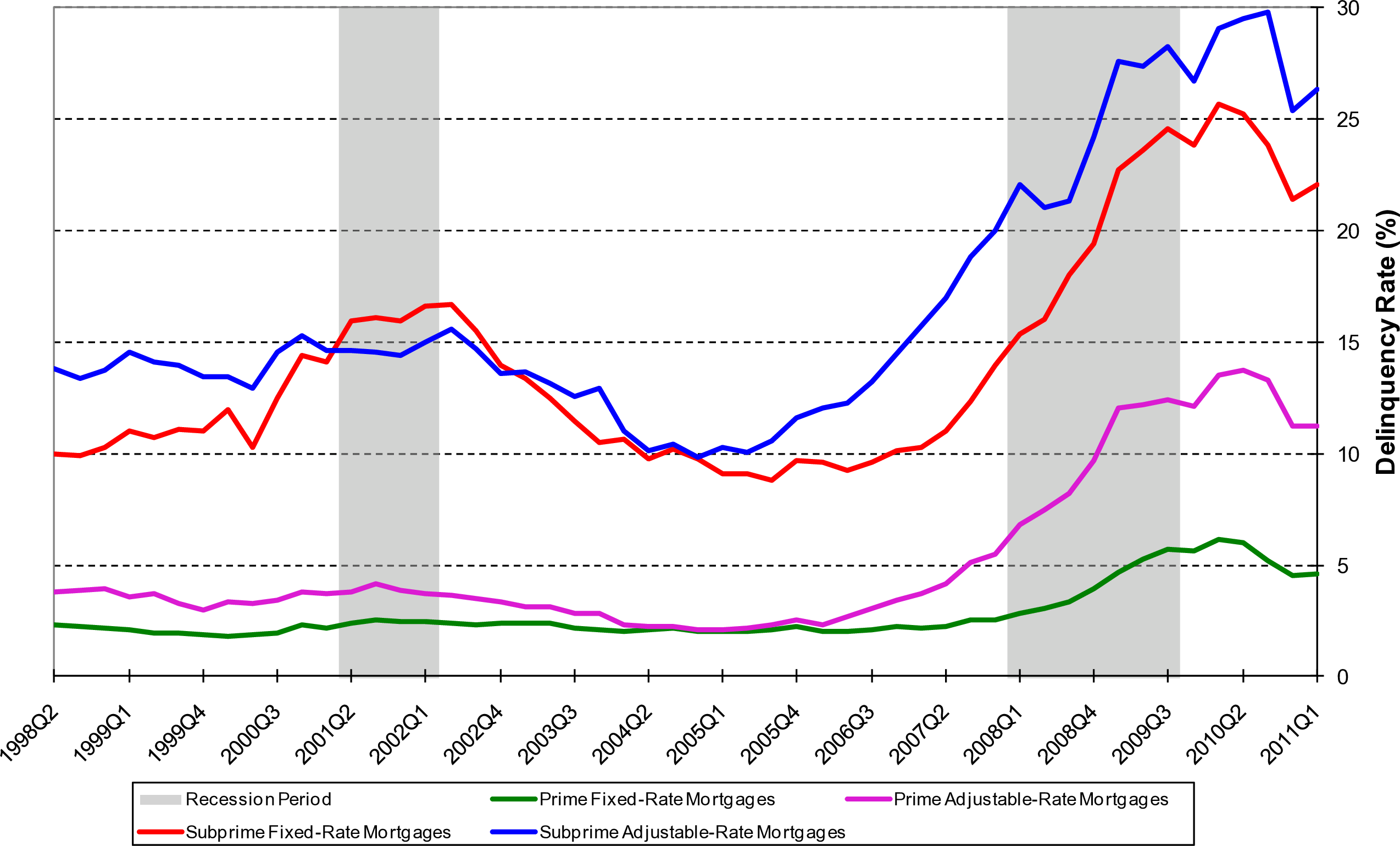

Delinquency Rates on Mortgages: Prime, Subprime, Adjustable, Fixed

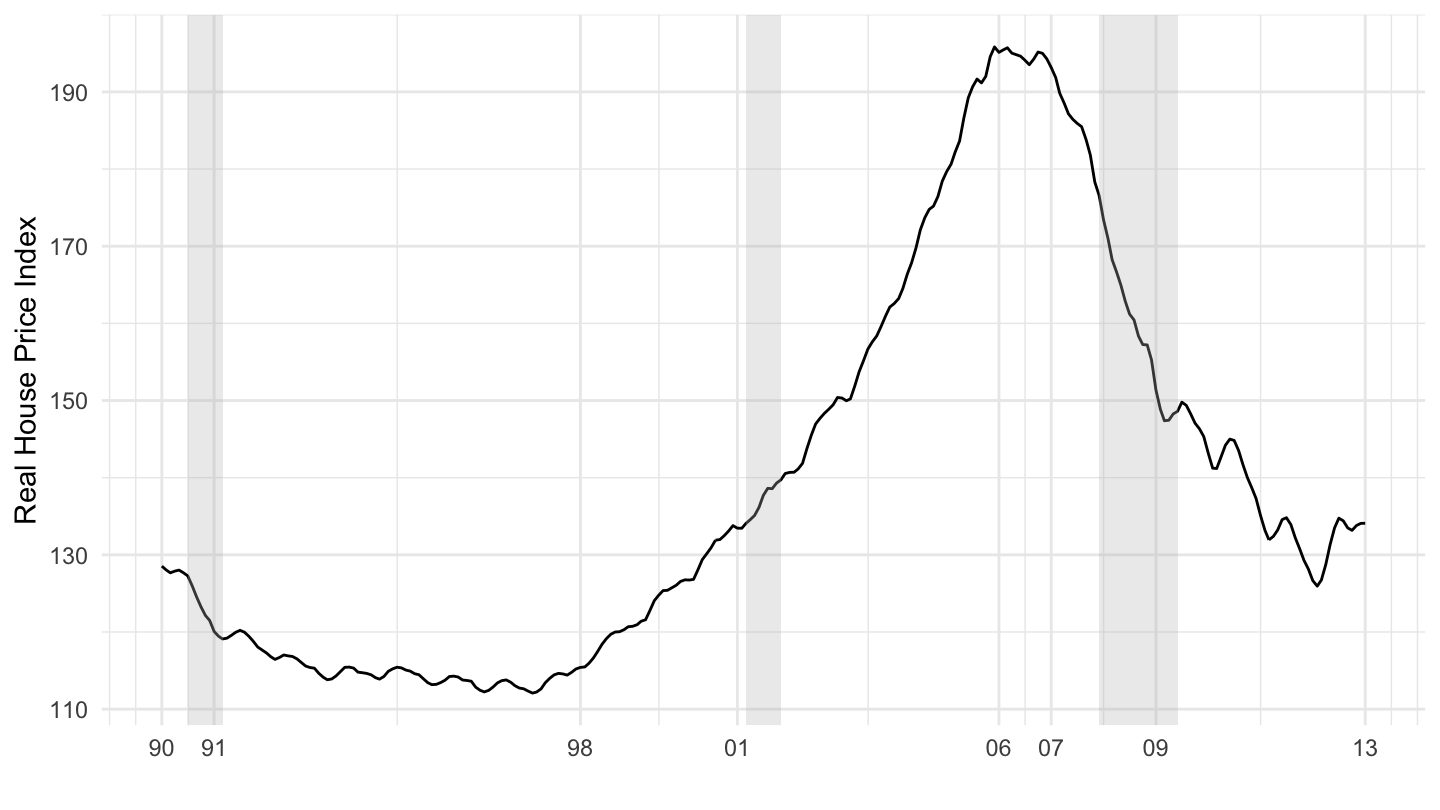

U.S. Real House Prices (1990-2013). Source: Shiller

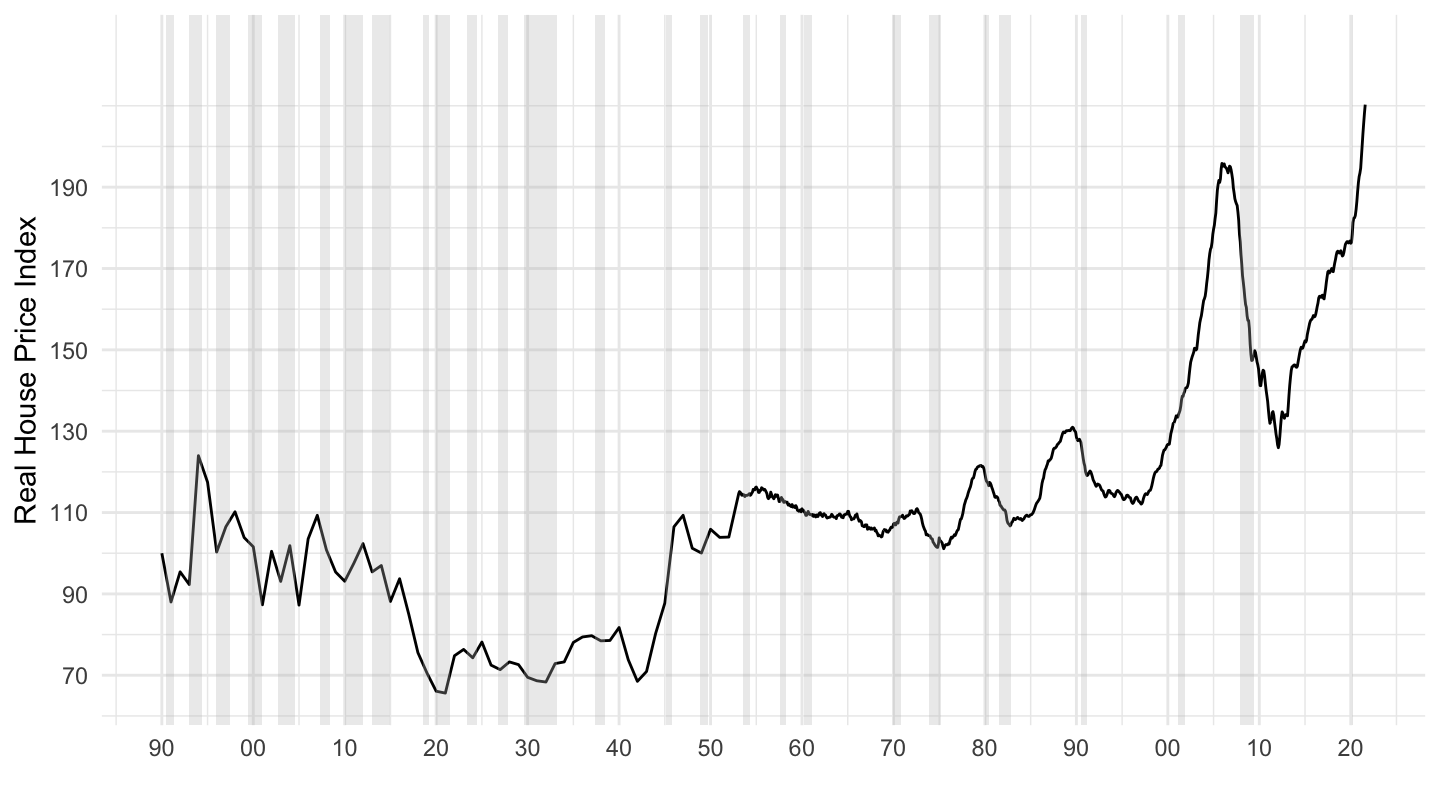

U.S. Real House Prices (1890-2019). Source: Shiller

Current Monetary Policy Issues

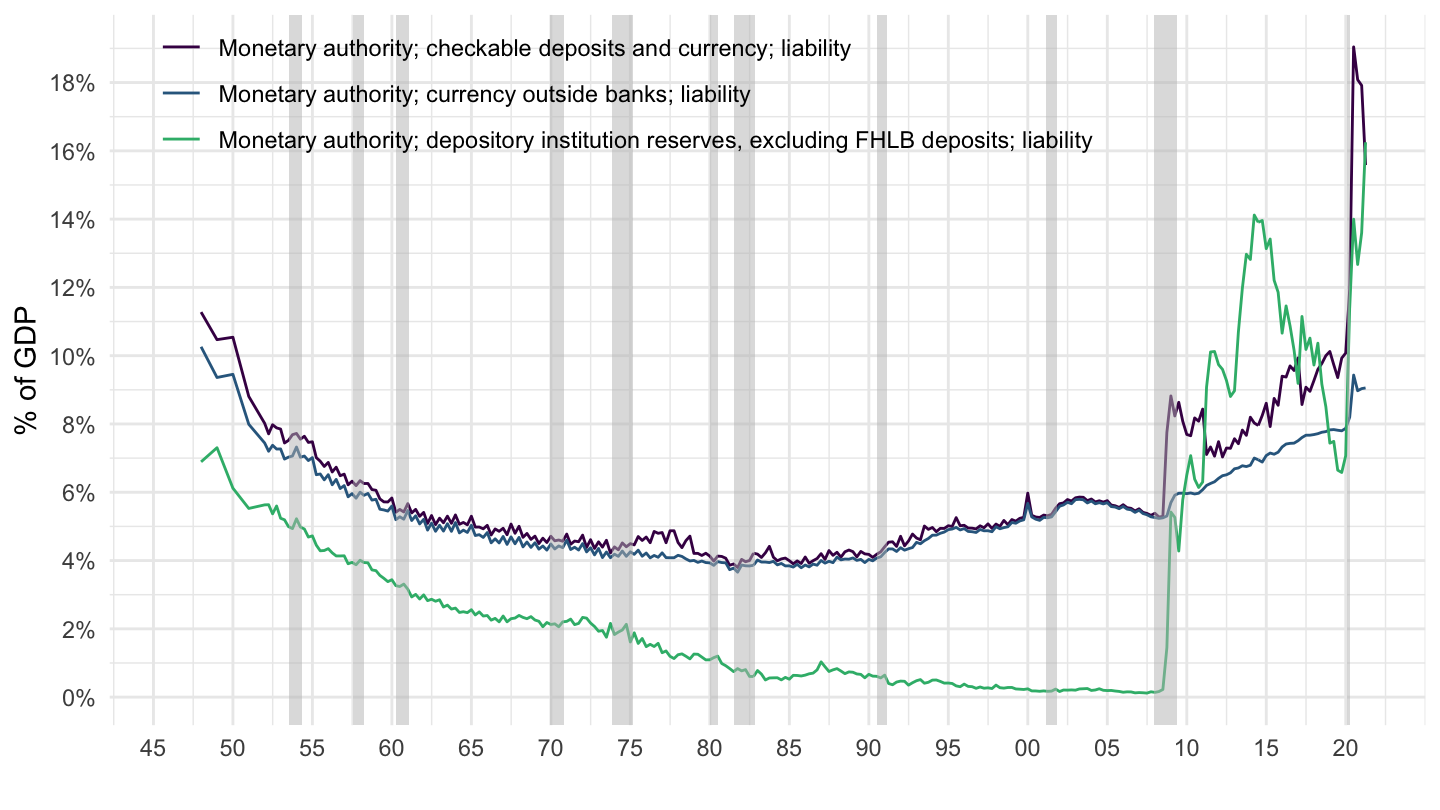

Fed Balance Sheet - Liabilities

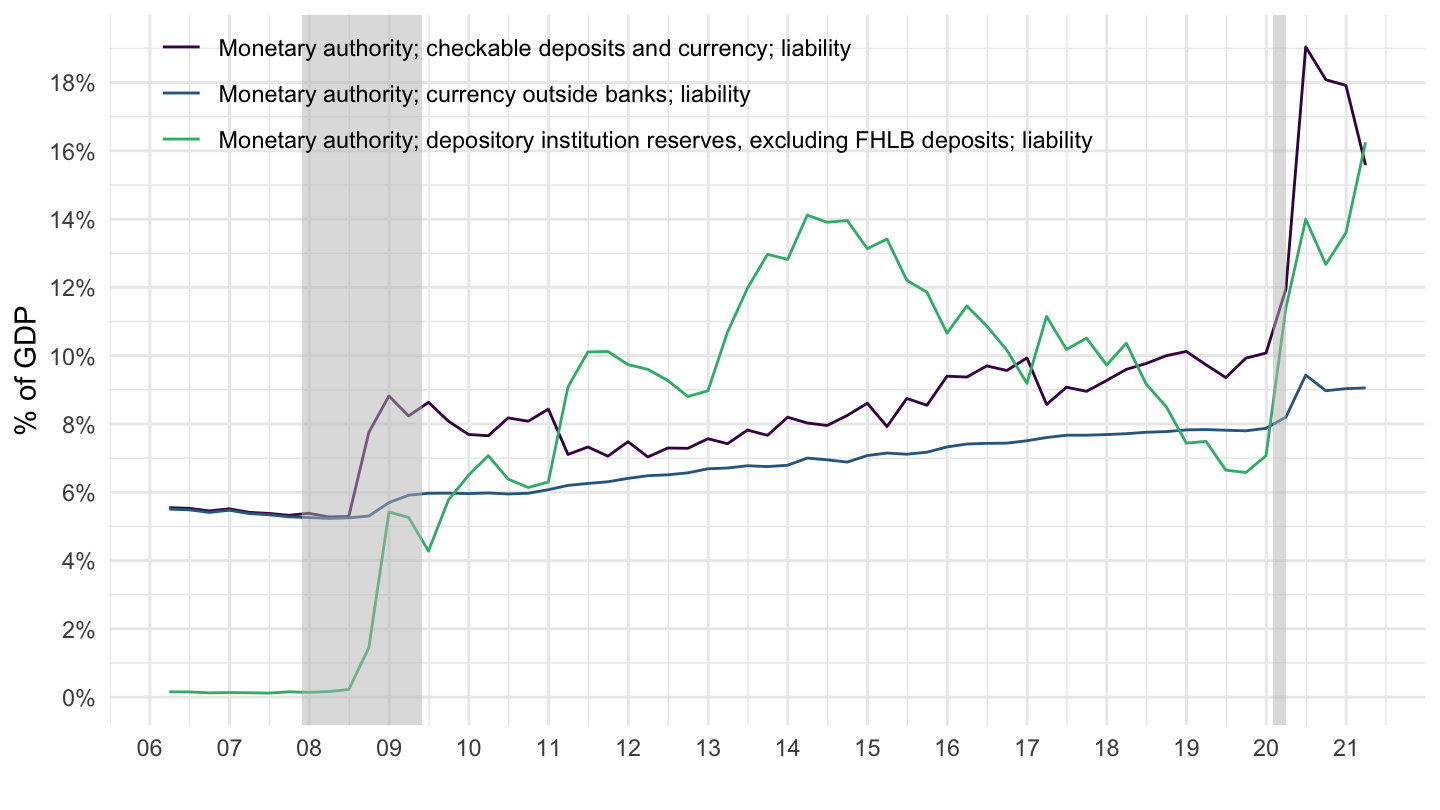

Fed Balance Sheet - Liabilities

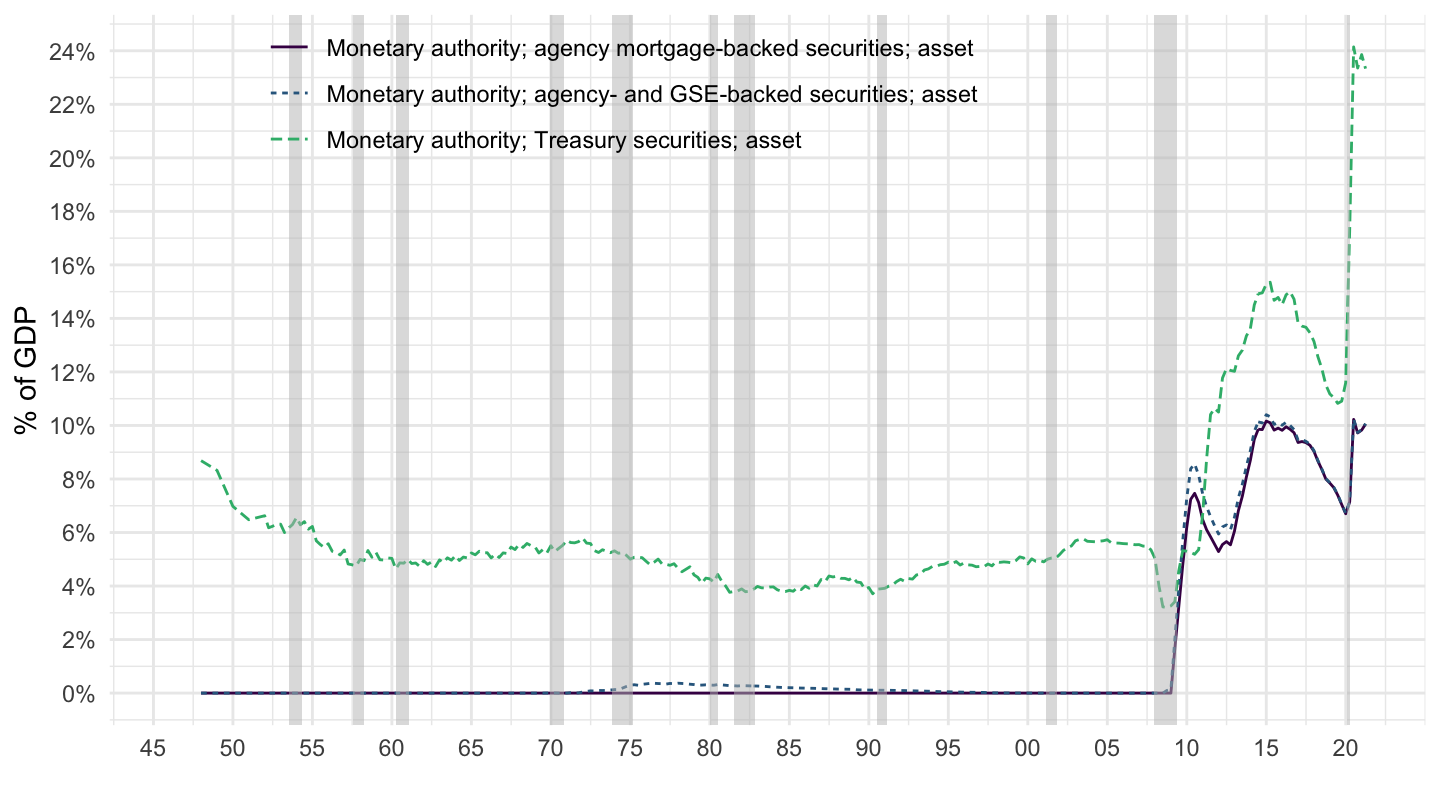

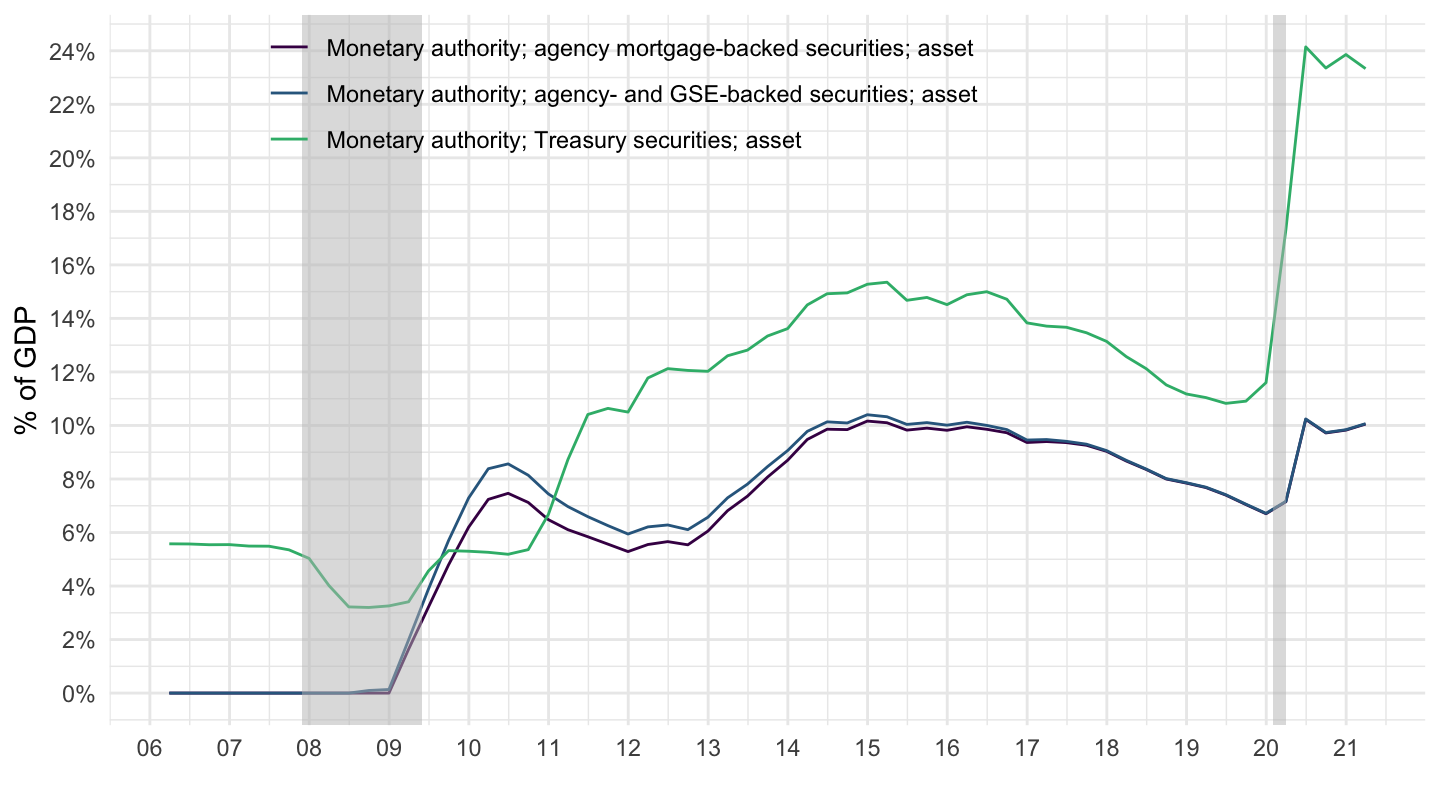

Fed Balance Sheet - Assets

Fed Balance Sheet - Assets

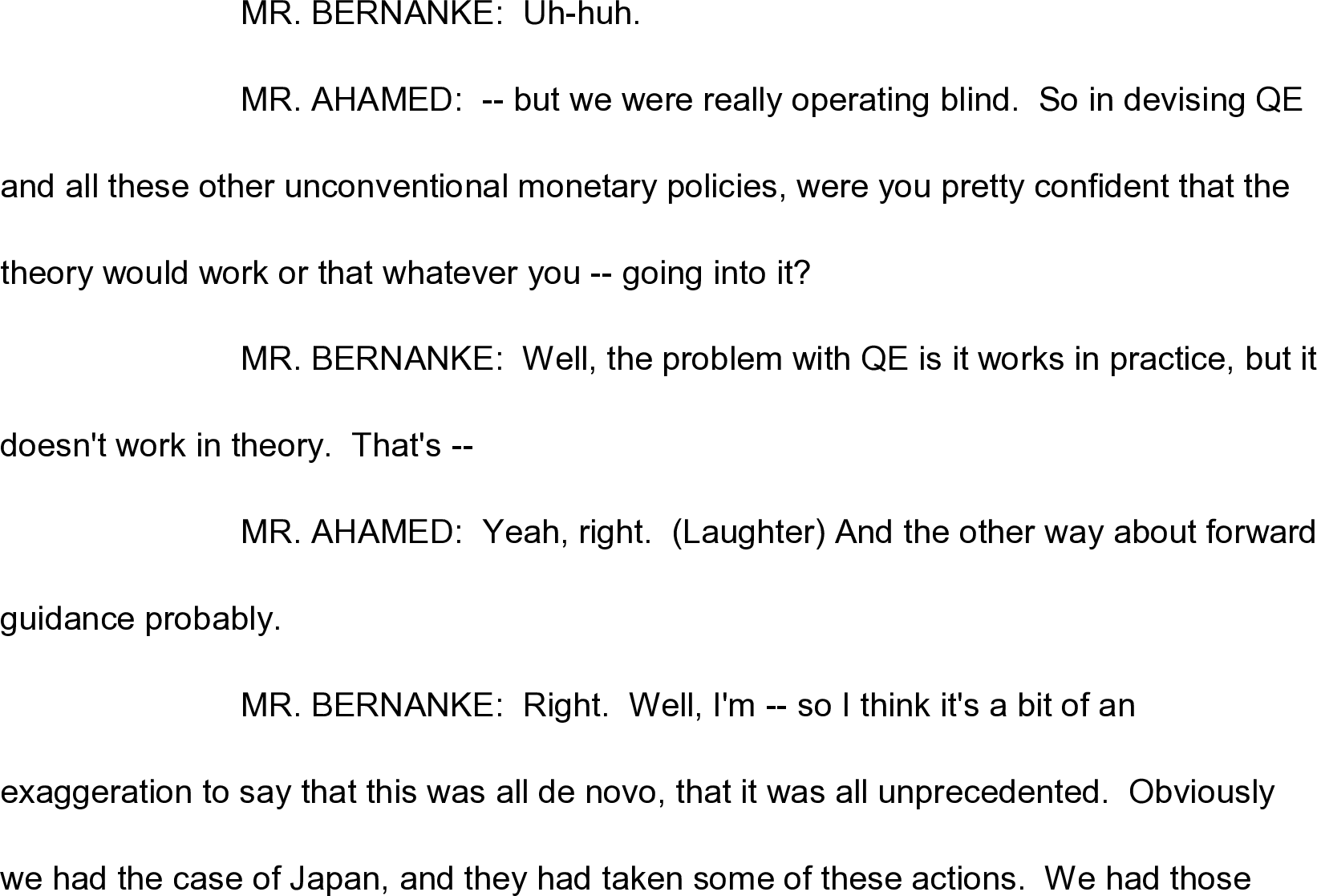

QE works in practice but doesn’t work in theory

QE works in practice but doesn’t work in theory

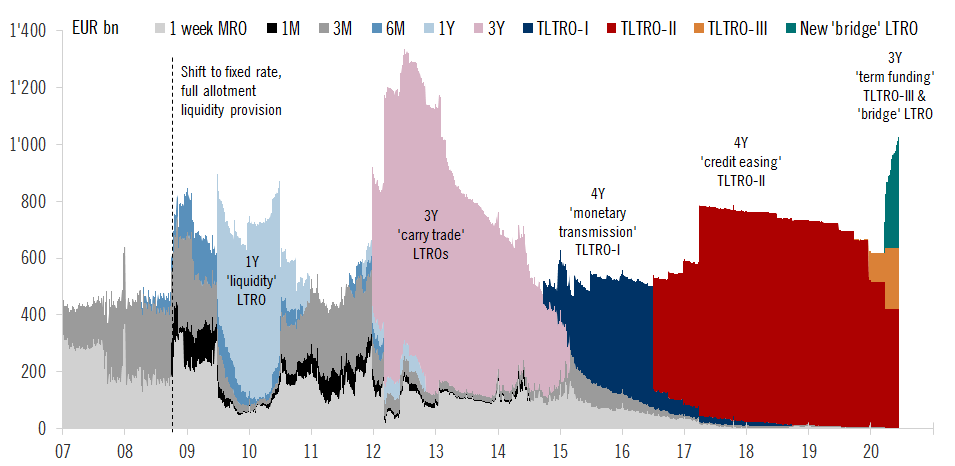

QE: Long Term Refinancing Operations

QE: Long Term Refinancing Operations

Bitcoin

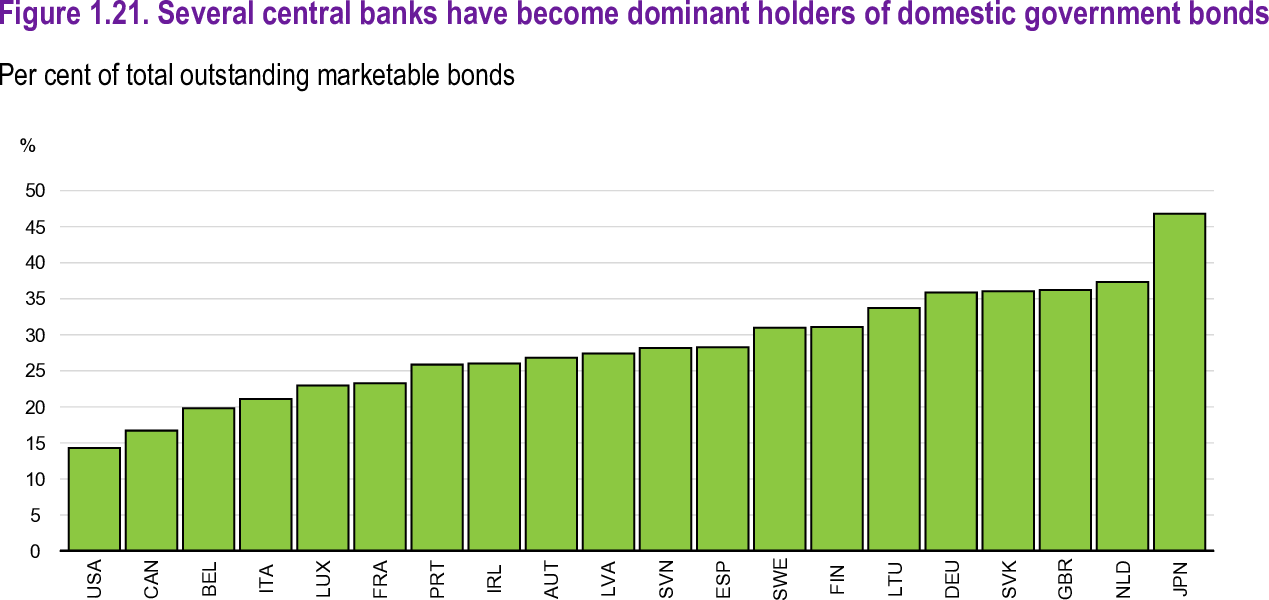

Dominant holders

Monetary Policy and Secular Stagnation

Larry Summers

Larry Summers’ Speech

All kinds of questions for macroeconomics:

Can economies function well with negative interest rates ?

If bonds and money are very close substitutes, what are the distinction between fiscal and monetary policy, and between monetary and fiscal financing of deficits ?

Aftermath of the Scandinavian bank failures in the 1990s ?

Galbraith, in The Good Society: