October 7, 2020

Consumption

Average

-a14f.jpg)

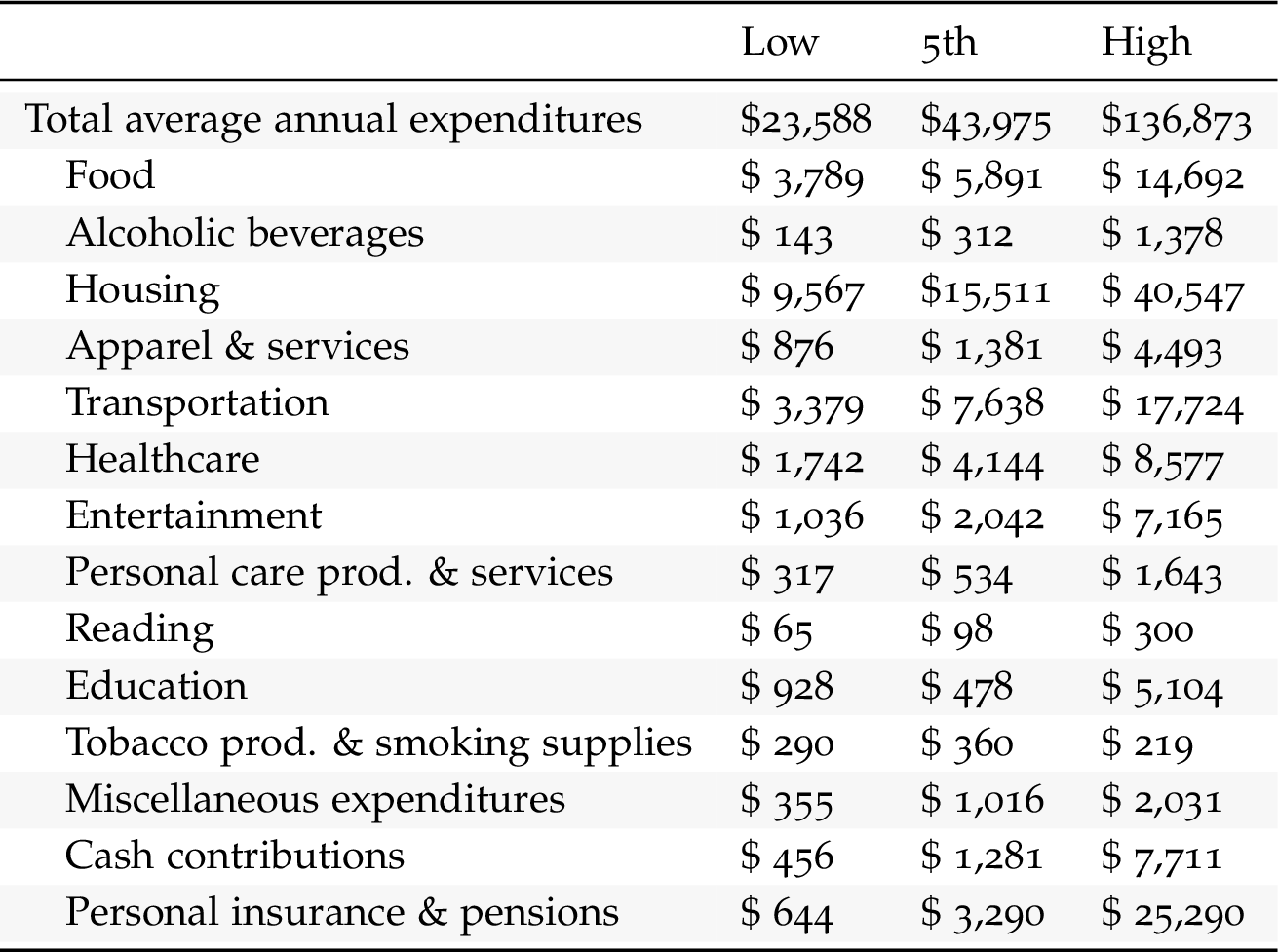

$ Expenditure for 1st, 5th, 10th Decile (in $)

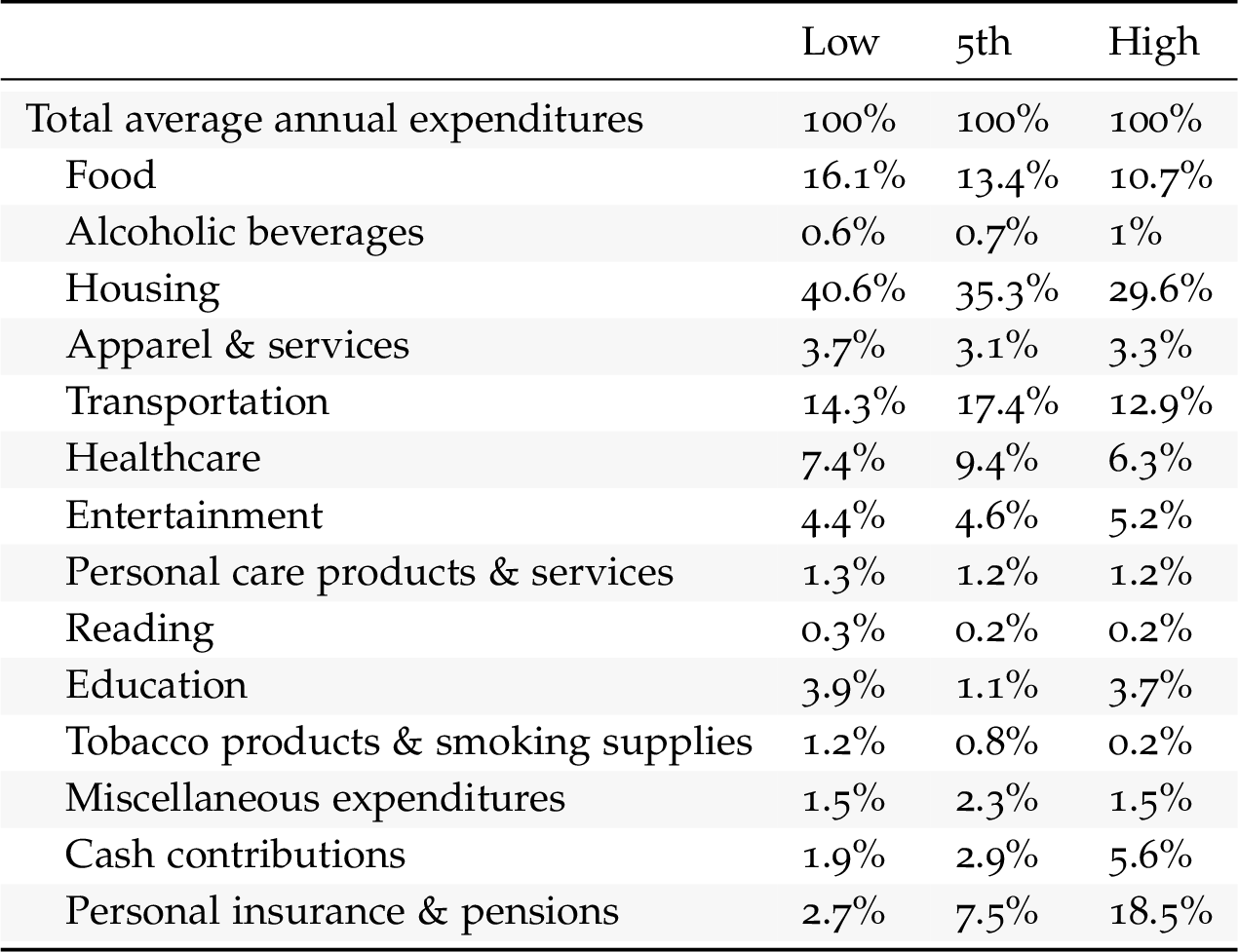

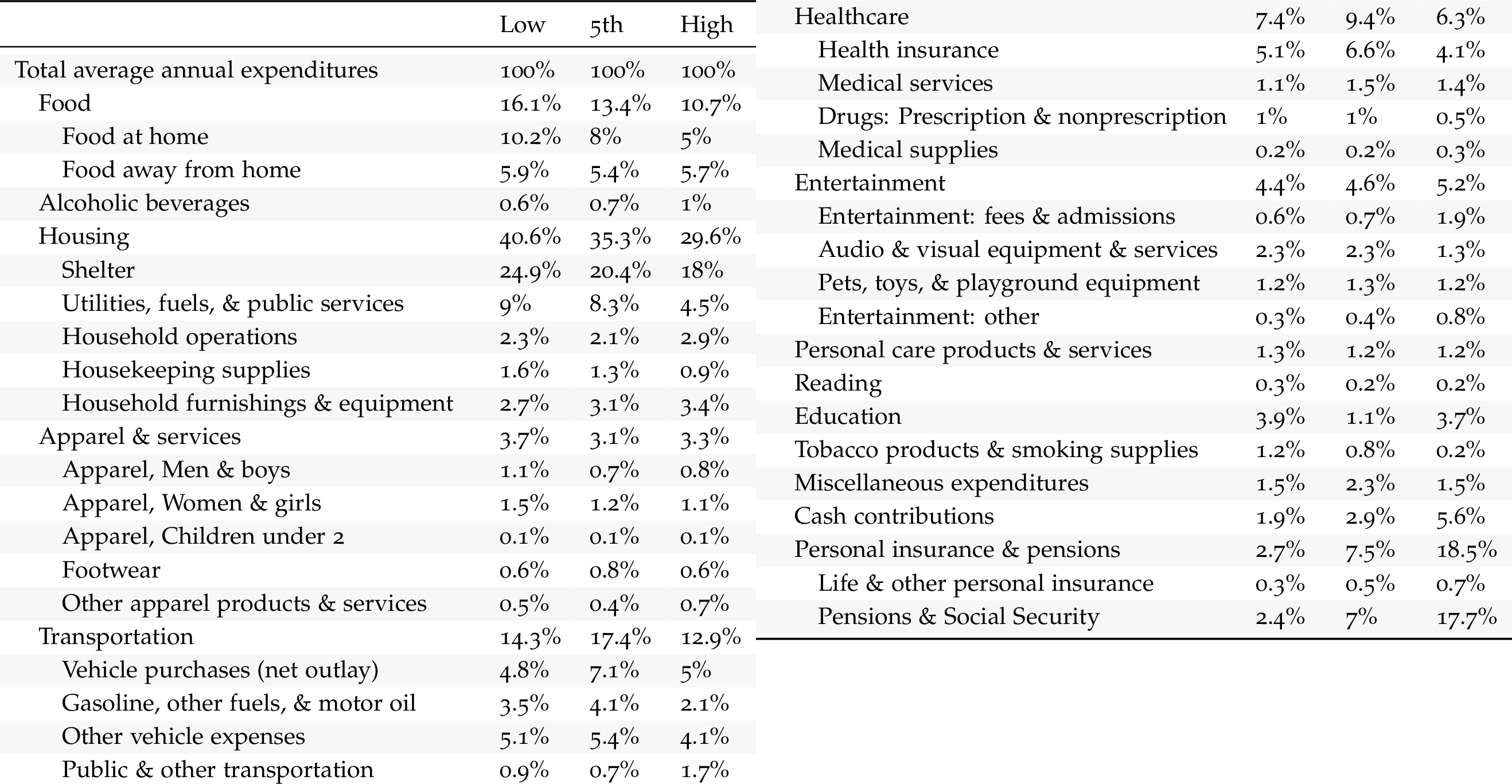

% Expenditure for 1st, 5th, 10th Decile (in %)

$ Detailed Expenditure by Decile (in $)

% Detailed Expenditure by Decile (in %)

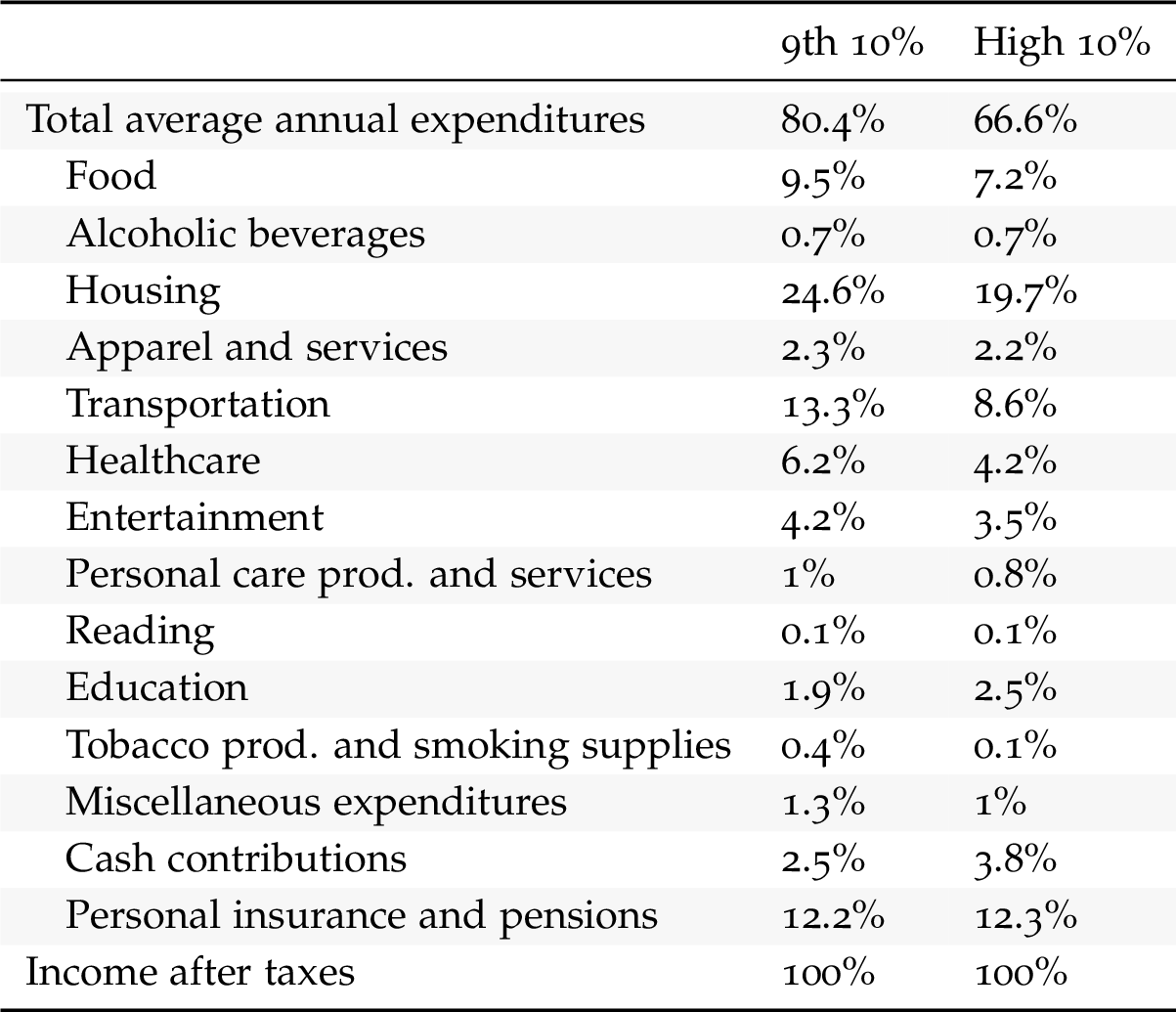

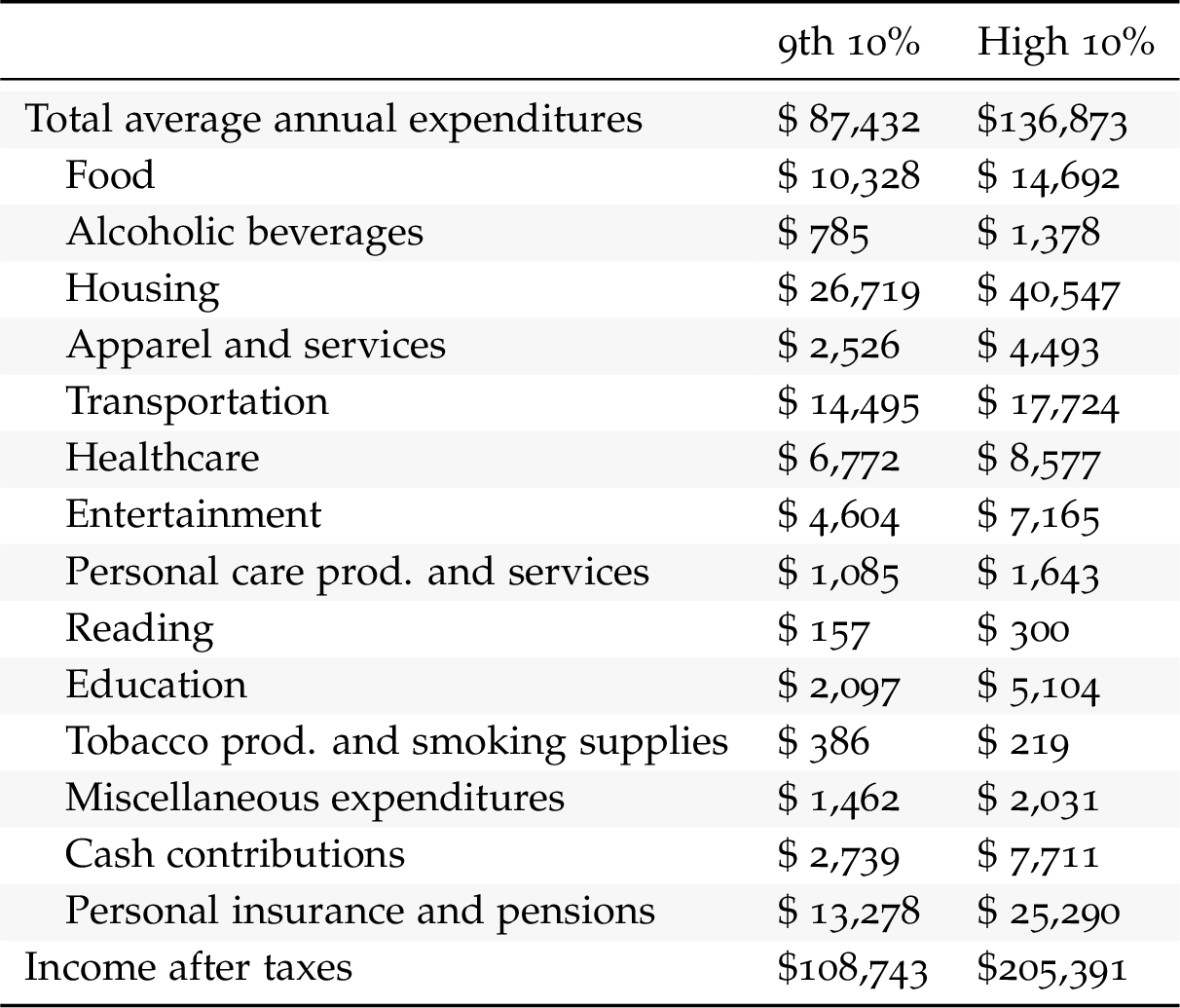

$ Expenditure for 9th, 10th Decile

% Expenditure for 9th, 10th Decile

All Deciles

Saving

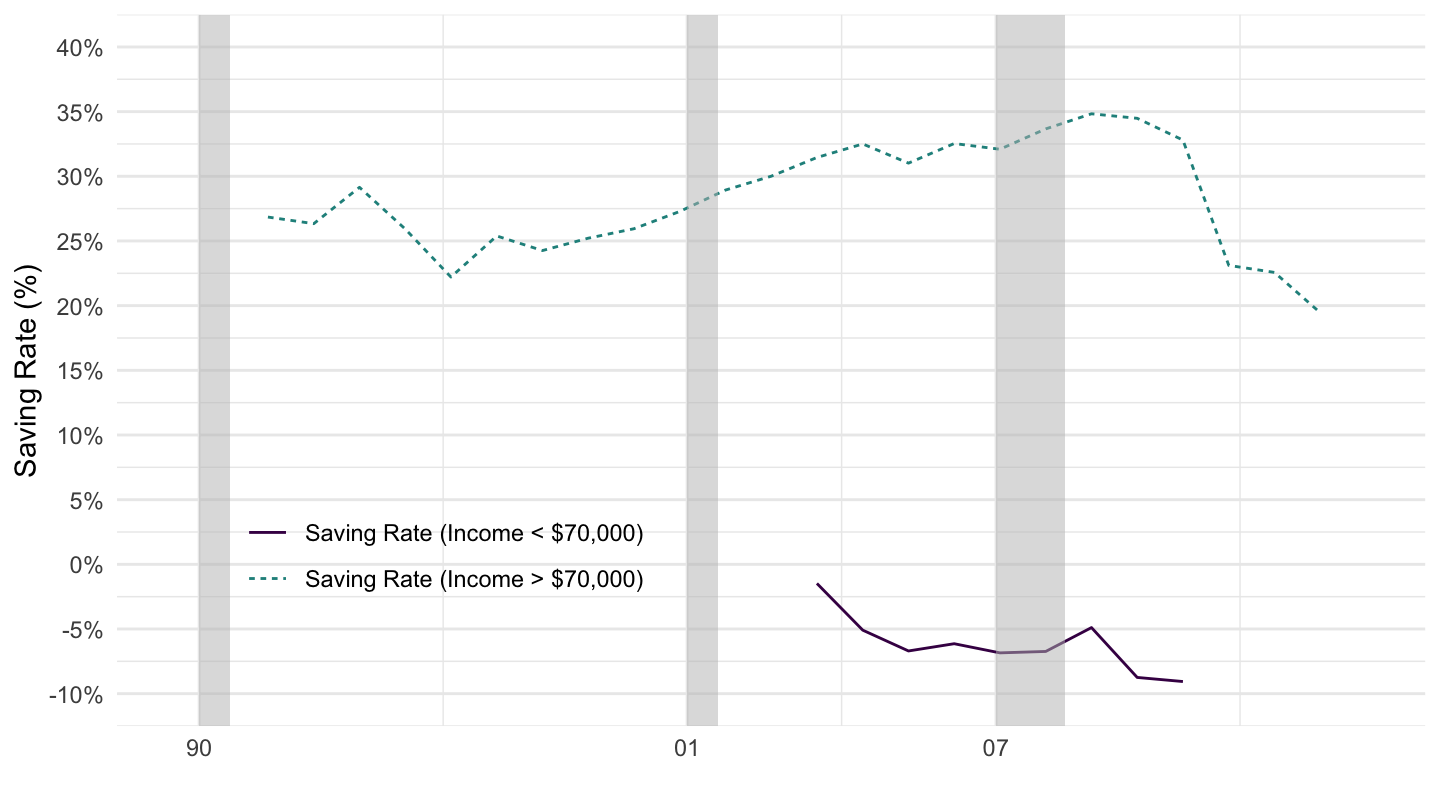

Saez, Zucman (2016) - Saving Rate by Income

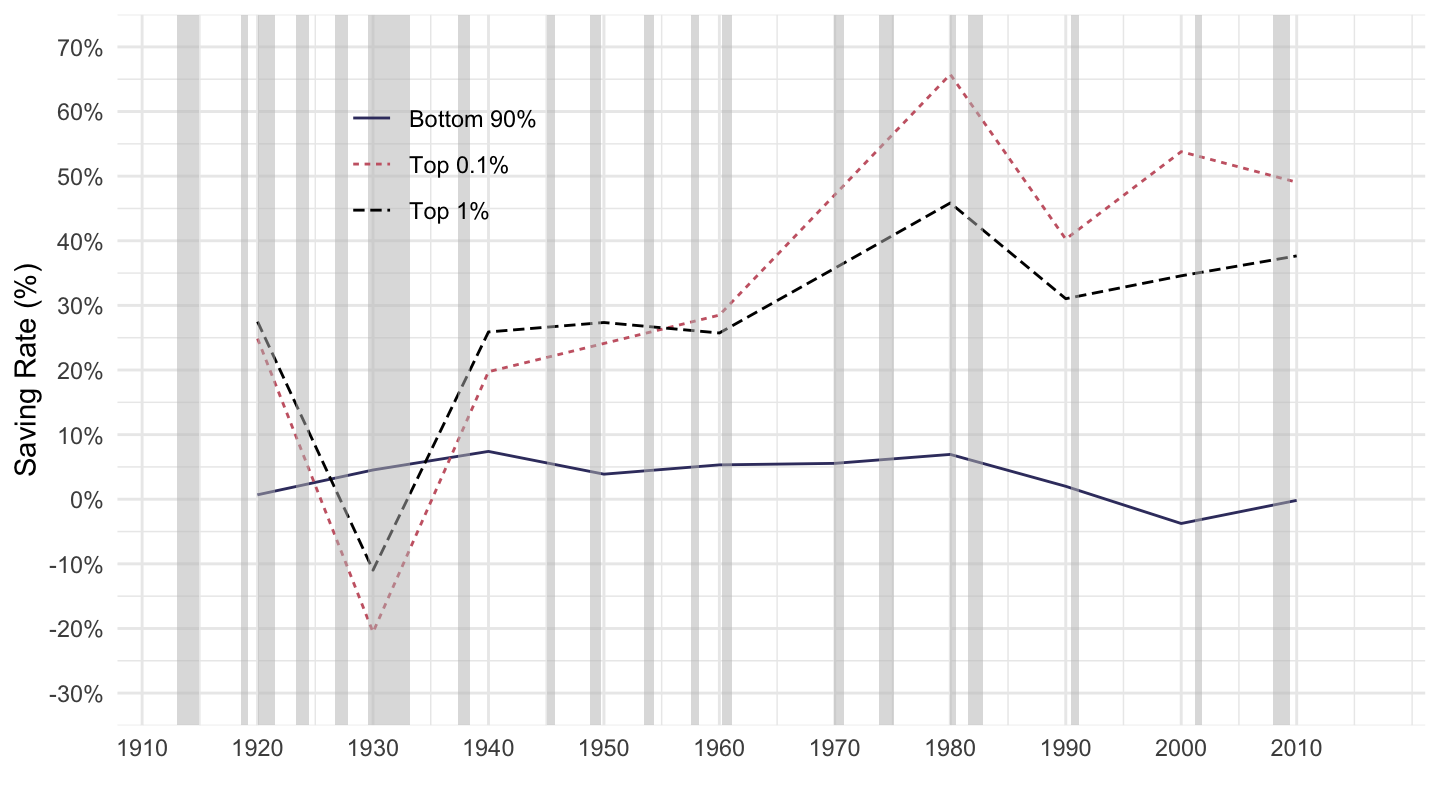

Saving Rate by Wealth

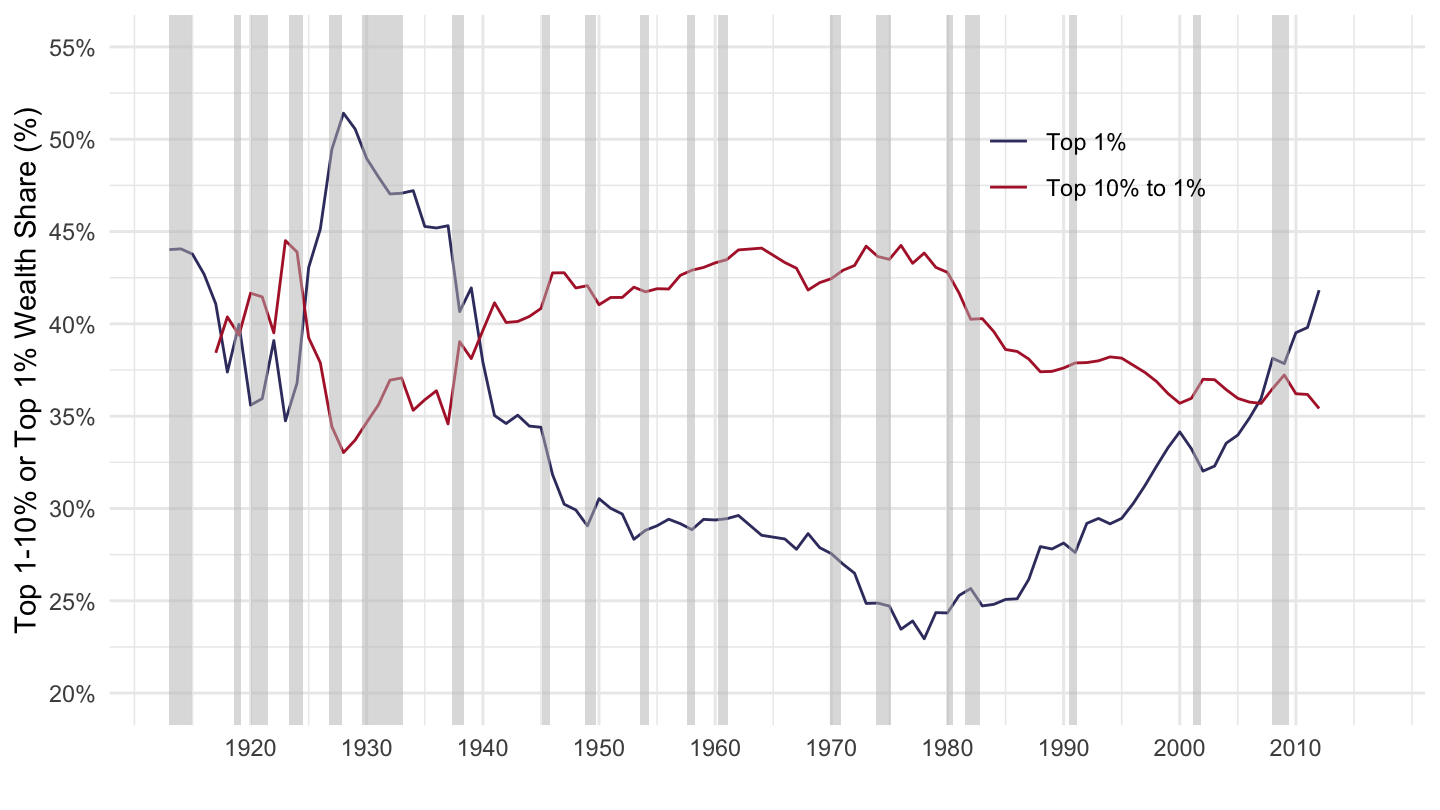

Top 1-10% and Top 1% wealth share

The global wealth pyramid, 2019

Global debt (public + private) = $188Tn. IMF

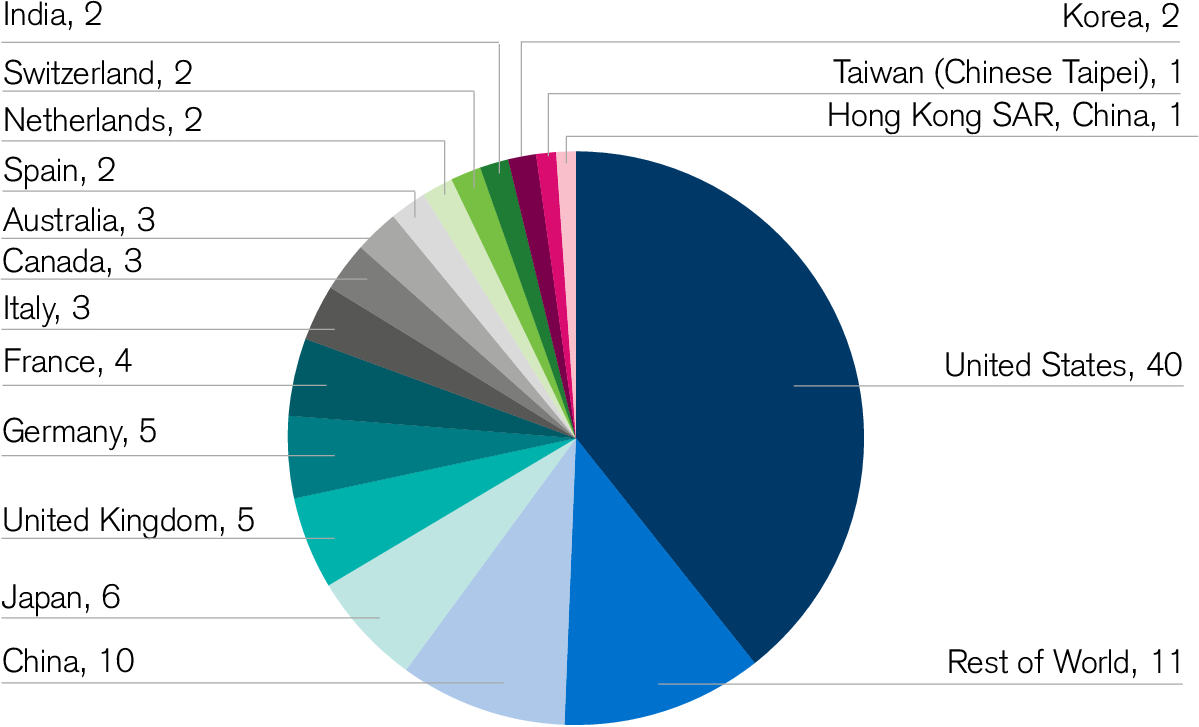

Number of dollar millionaires (% of world total)

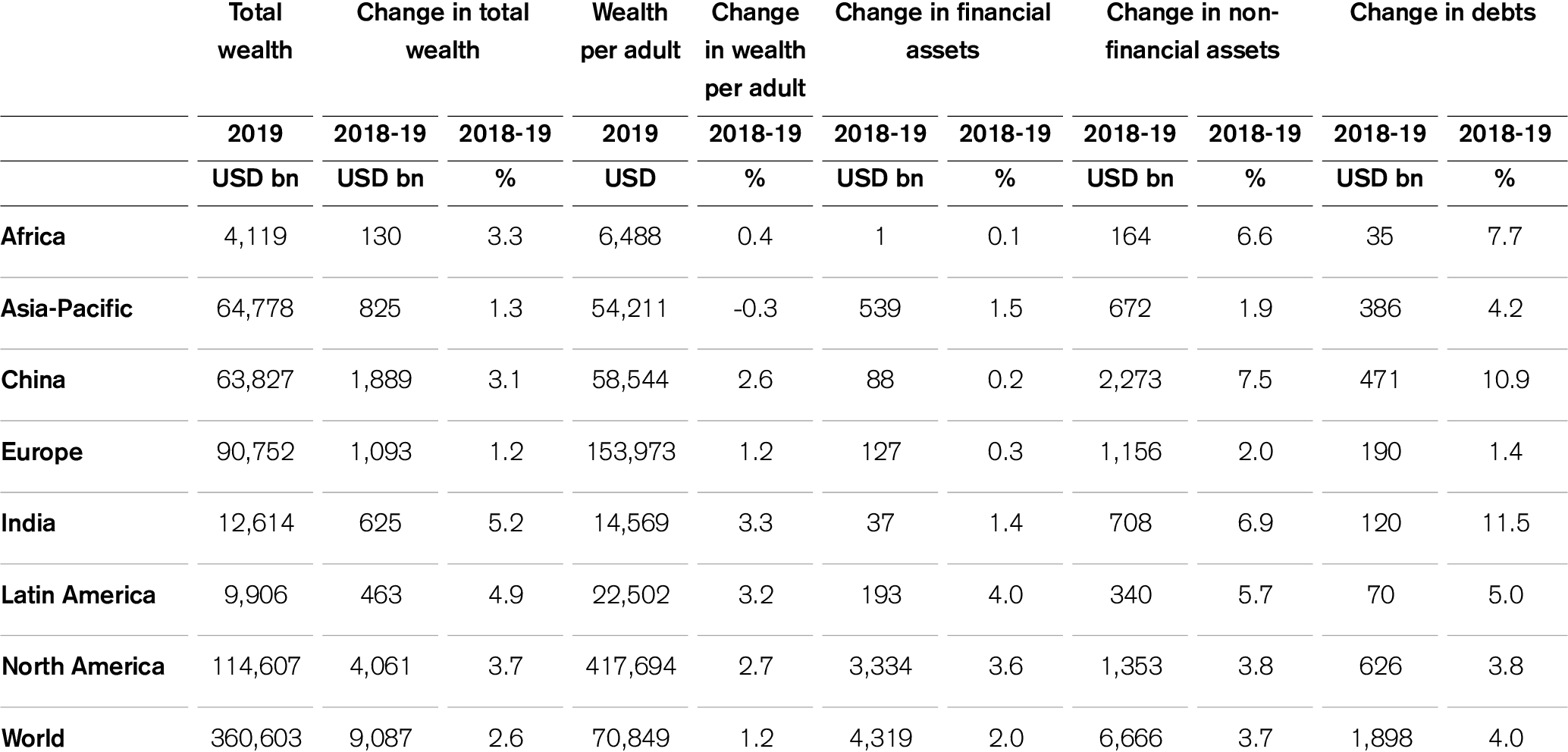

Change in household wealth by region

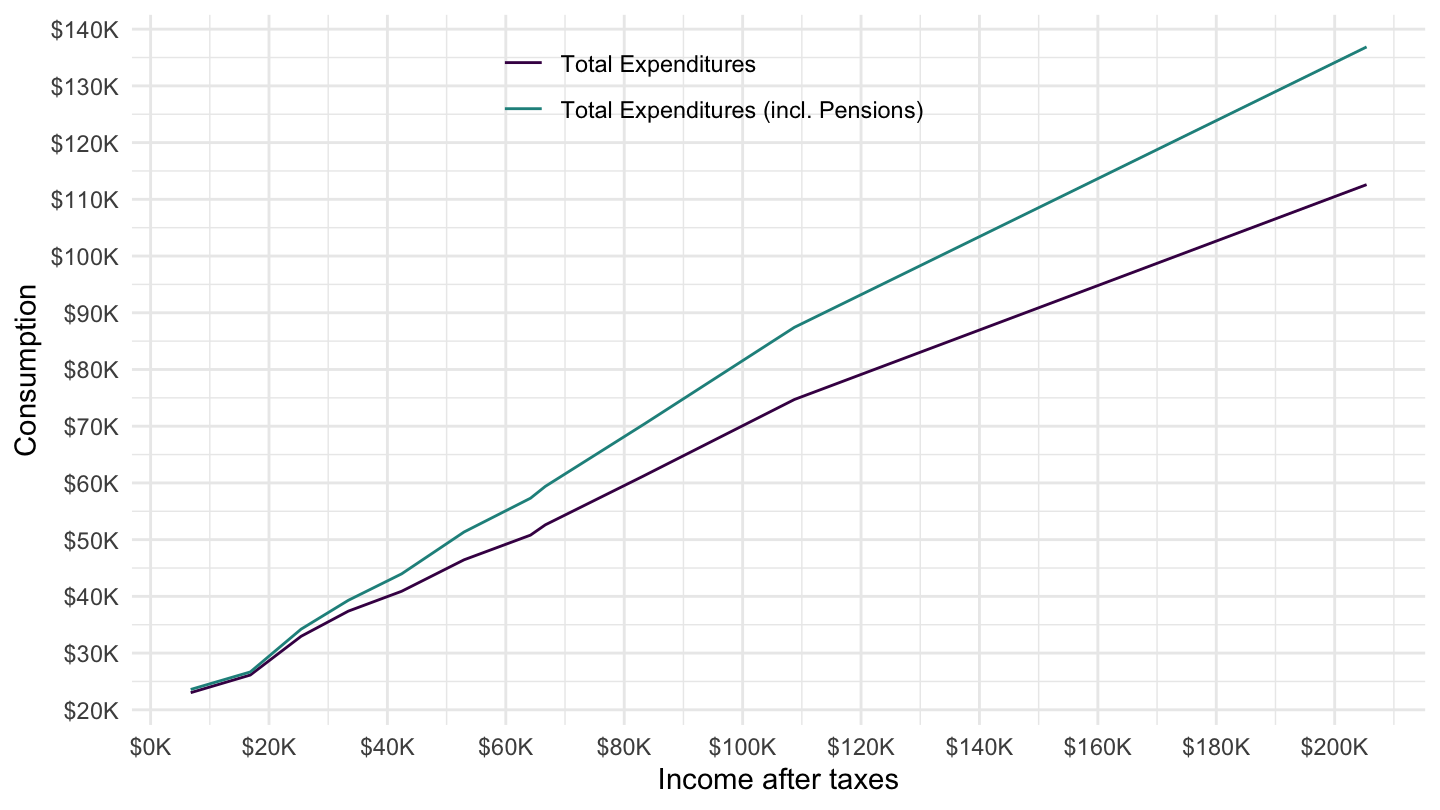

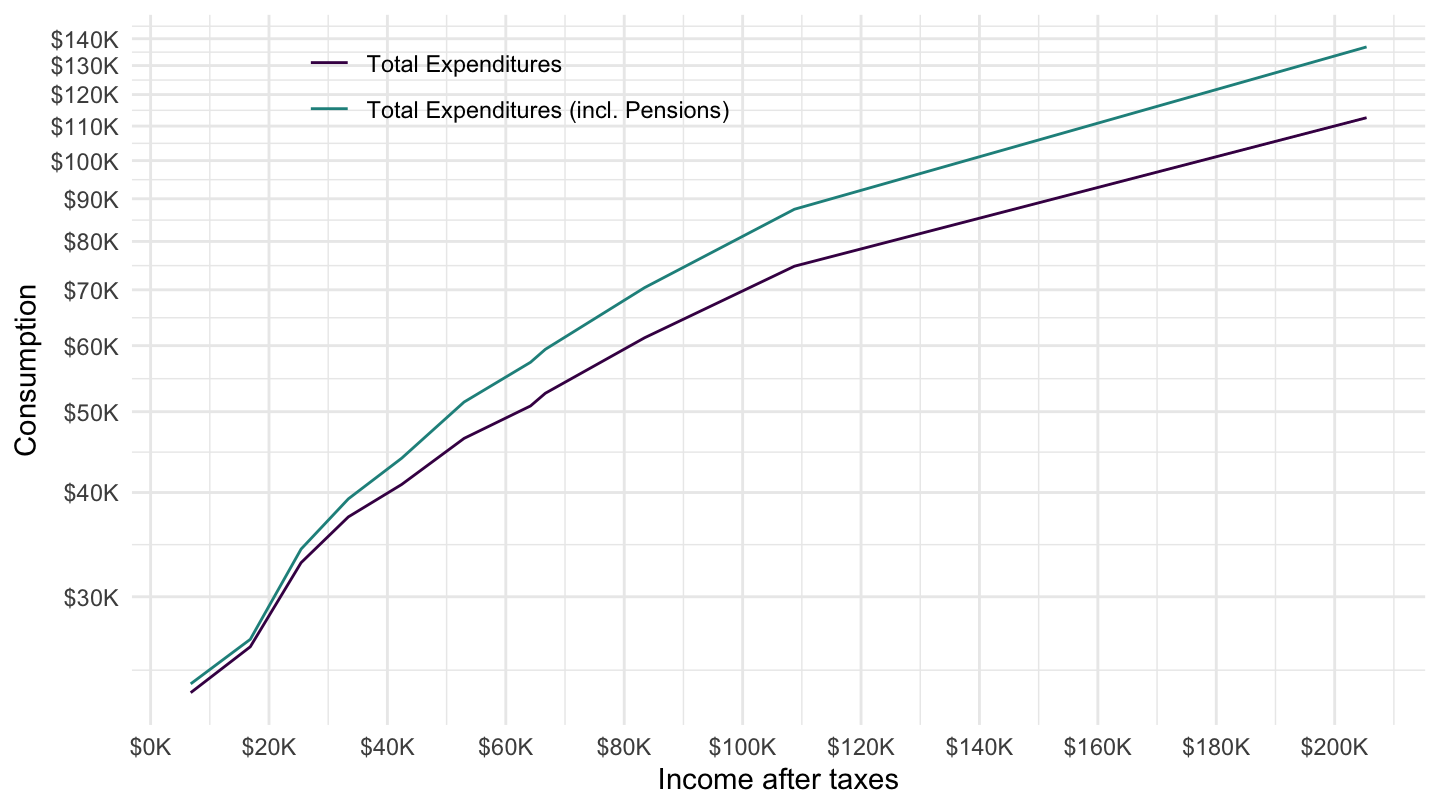

Consumption and Saving from the CEX

Consumption

Consumption (Log)

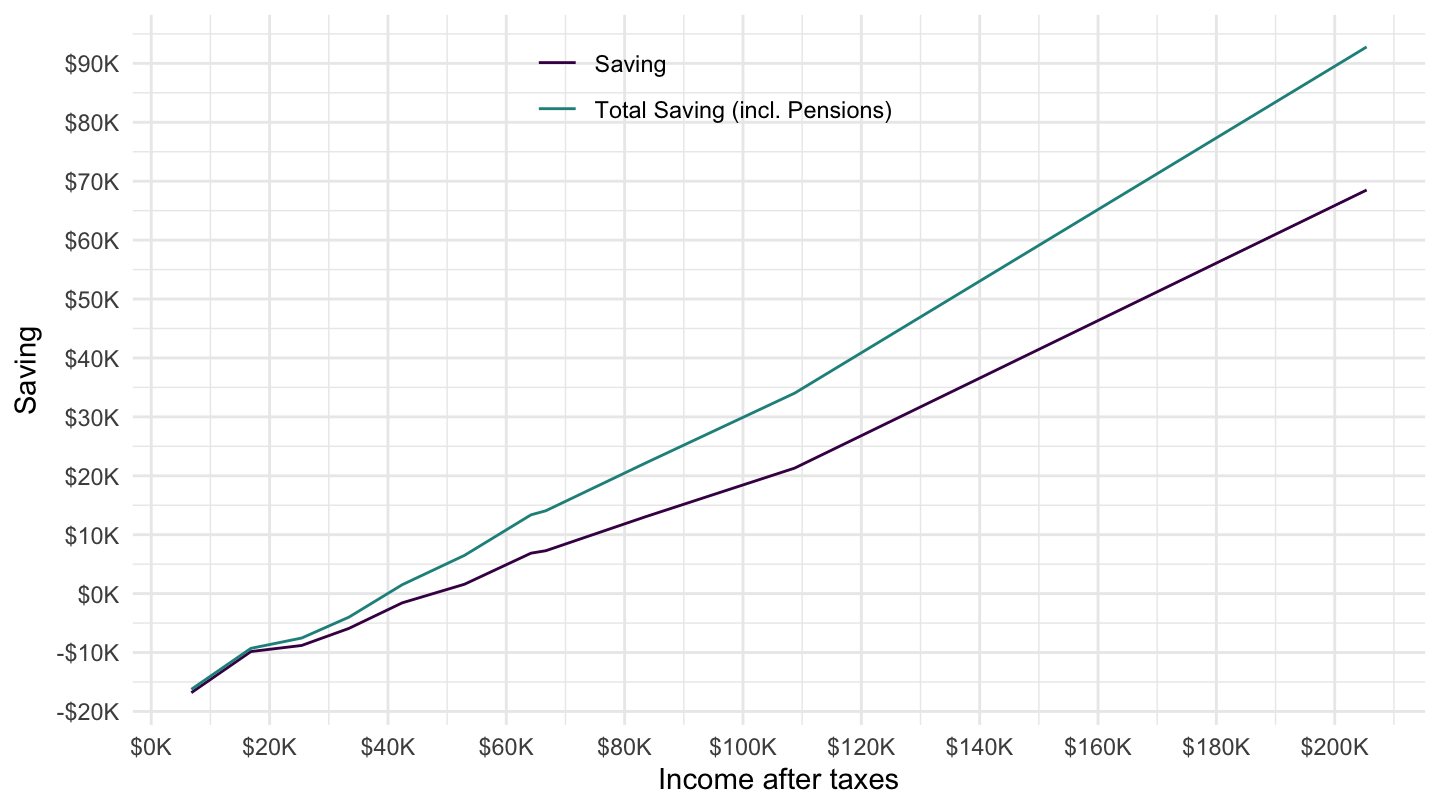

Saving

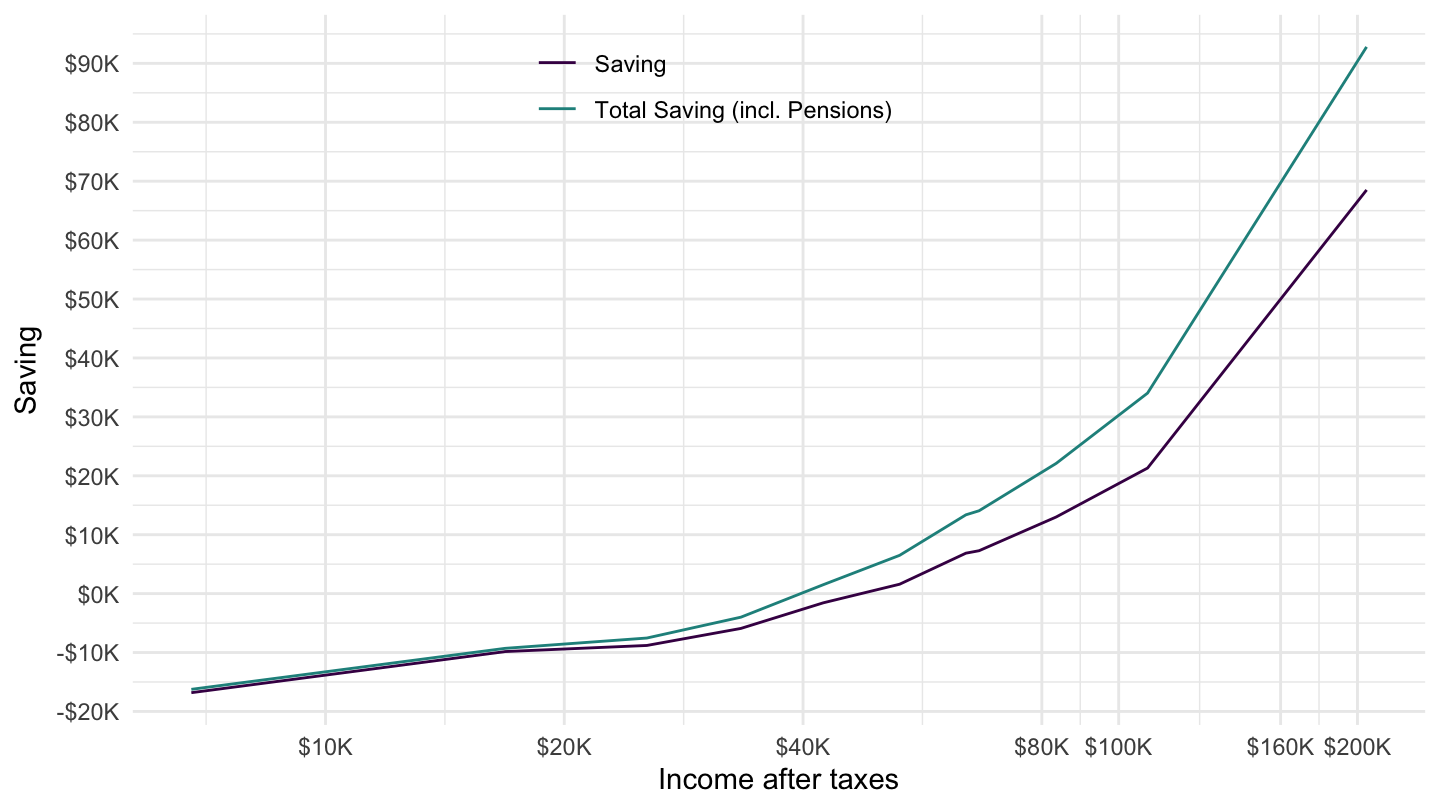

Saving (Log)

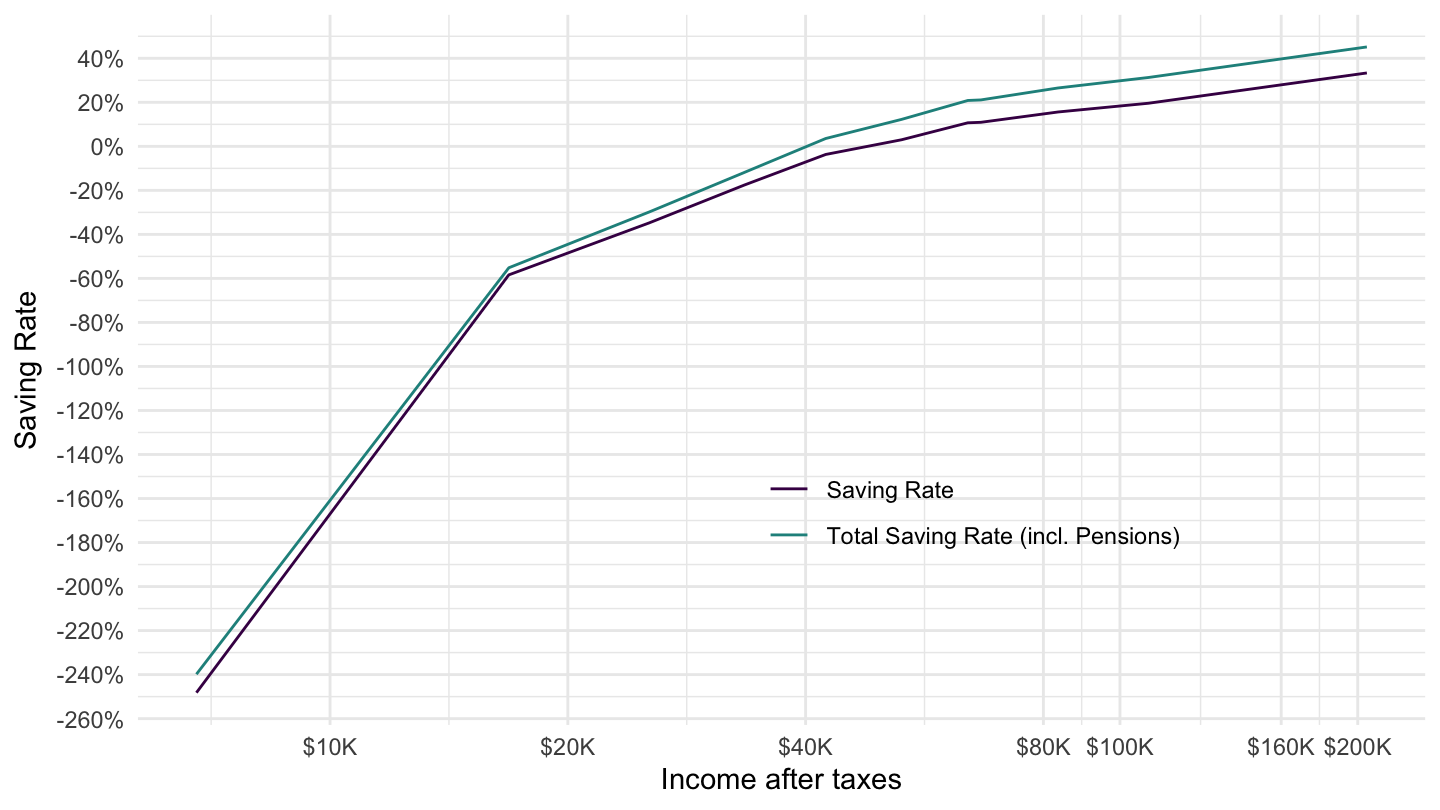

Saving Rate

Saving Rate (Log)

Saving of the Very Rich

Adam Smith (1759) - Theory of Moral Sentiments

Lee Iacocca

- Lee Iacocca, former CEO from Chrysler:

Once you reach a certain level in a material way, what more can you do? You can’t eat more than three meals a day; you’ll kill yourself. You can’t wear two suits one over the other. You might now have three cars in your garage-but six! Oh, you can indulge yourself, but only to a point.

Keynes

Who wants to be a millionaire ?

Utility for wealth

Scrooge Mc Duck

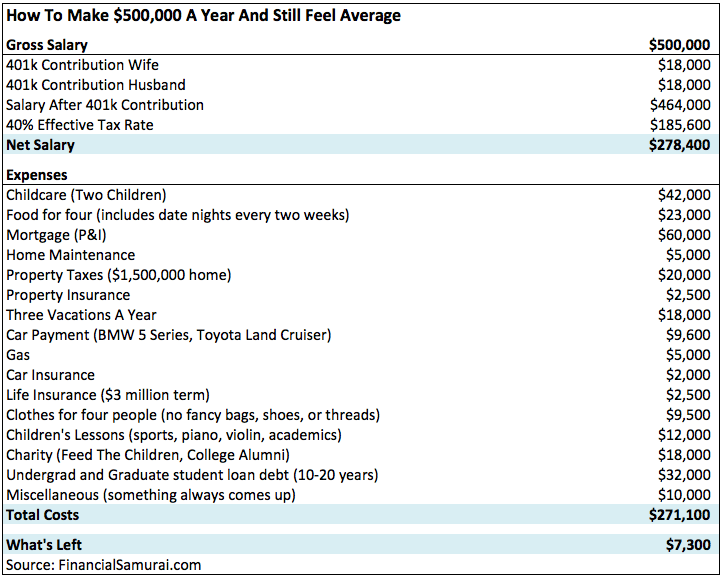

How to Make $500K a year and still feel average

How to spend it

Rich people’s problems: how to spend it ?

Rich people’s problems: how to spend it ?

24K Gold Plated iPhone X

“Ricardian” Equivalence

Complicated story

Story is very complicated. First, because Ricardo himself did not believe in what is now called “Ricardian” equivalence.

Moreover, this view is often misrepresented.

For example, it is a view that is critical of Keynesian economics, but it is not against public debt. It argues that Keynesian stimulus is not efficient.

But this view is also critical of the crowding-out hypothesis, that is often used to criticize public debt and Keynesian economics. (public debt raises interest rates) Therefore, this view also asserts that Tthe debt hawks were wrong.

3 views

In order to not get lost in Ricardian Equivalence, think that there are 3 views out there:

One view is the Keynesian view: public debt raises consumption, and thus output.

Another is the neoclassical view: public debt raises interest rates, and crowds out capital accumulation. To that extent, public debt is “debt we leave to our children”: there will be a lower capital stock in the future.

Finally, the Ricardian equivalence view states that both are wrong.

Ricardo (1820) 1/4

Ricardo (1820) 2/4

Ricardo (1820) 3/4

Ricardo (1820) 4/4

Barro (1974)

Barro (1974)

O’Driscoll (1977)

O’Driscoll (1977)

O’Driscoll (1977)

Bibliography

Barro, Robert J. 1974. “Are Government Bonds Net Wealth?” Journal of Political Economy 82 (6): 1095–1117. http://www.jstor.org/stable/1830663.

O’Driscoll, Gerald P. 1977. “The Ricardian Nonequivalence Theorem.” Journal of Political Economy 85 (1): 207–10. https://doi.org/10.1086/260552.

Ricardo, David. 1820. Essays on the Funding System.

Smith, Adam. 1759. The Theory of Moral Sentiments. Penguin.