December 2, 2020

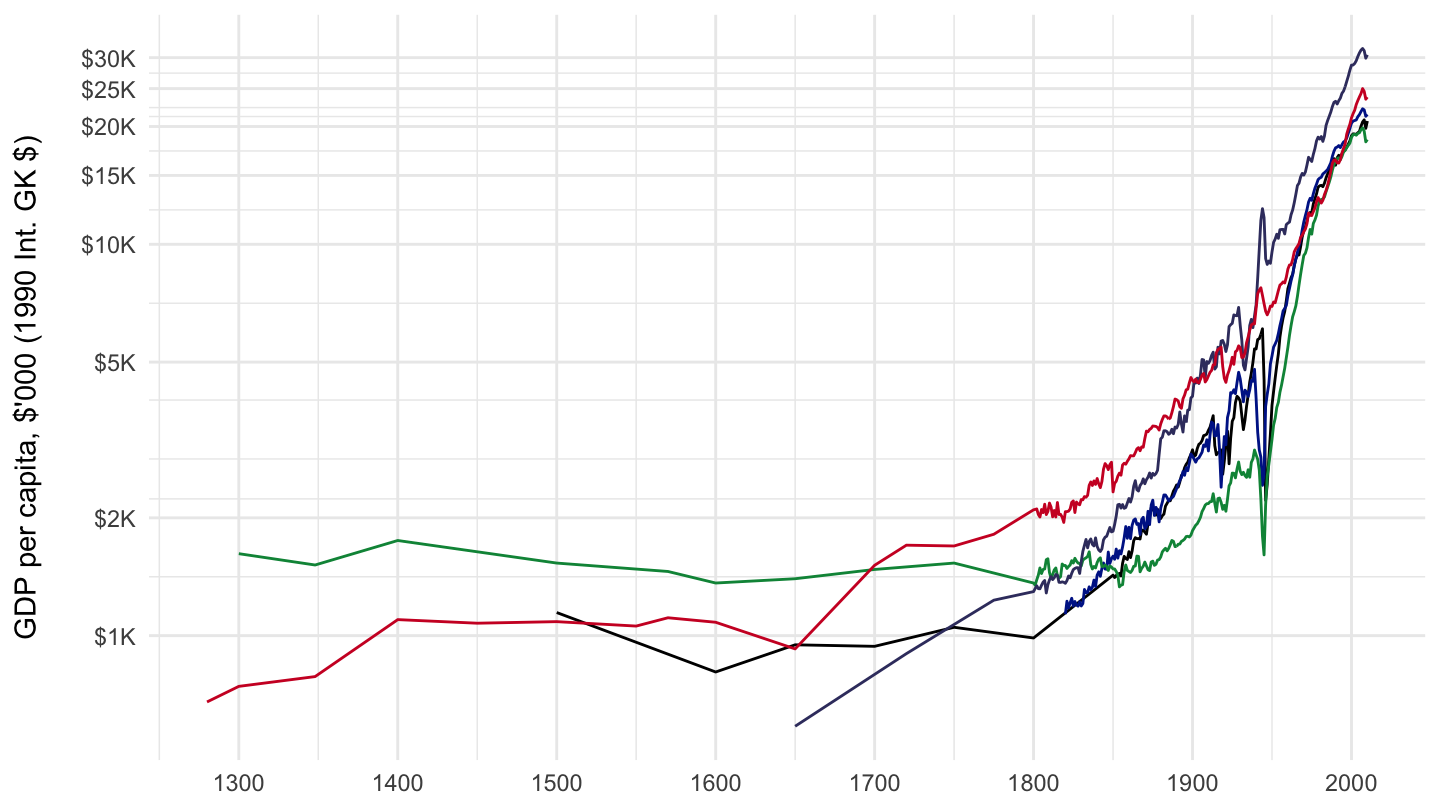

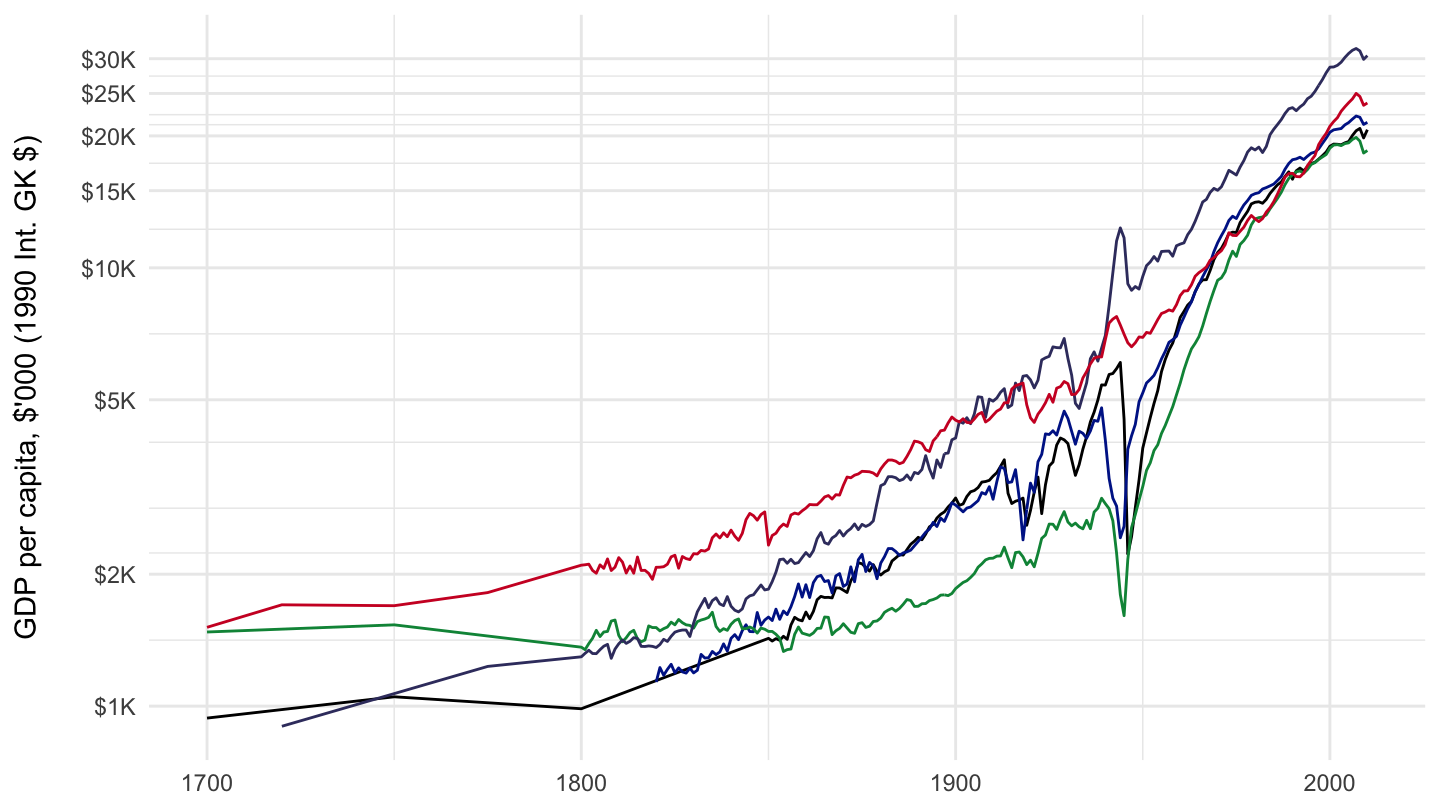

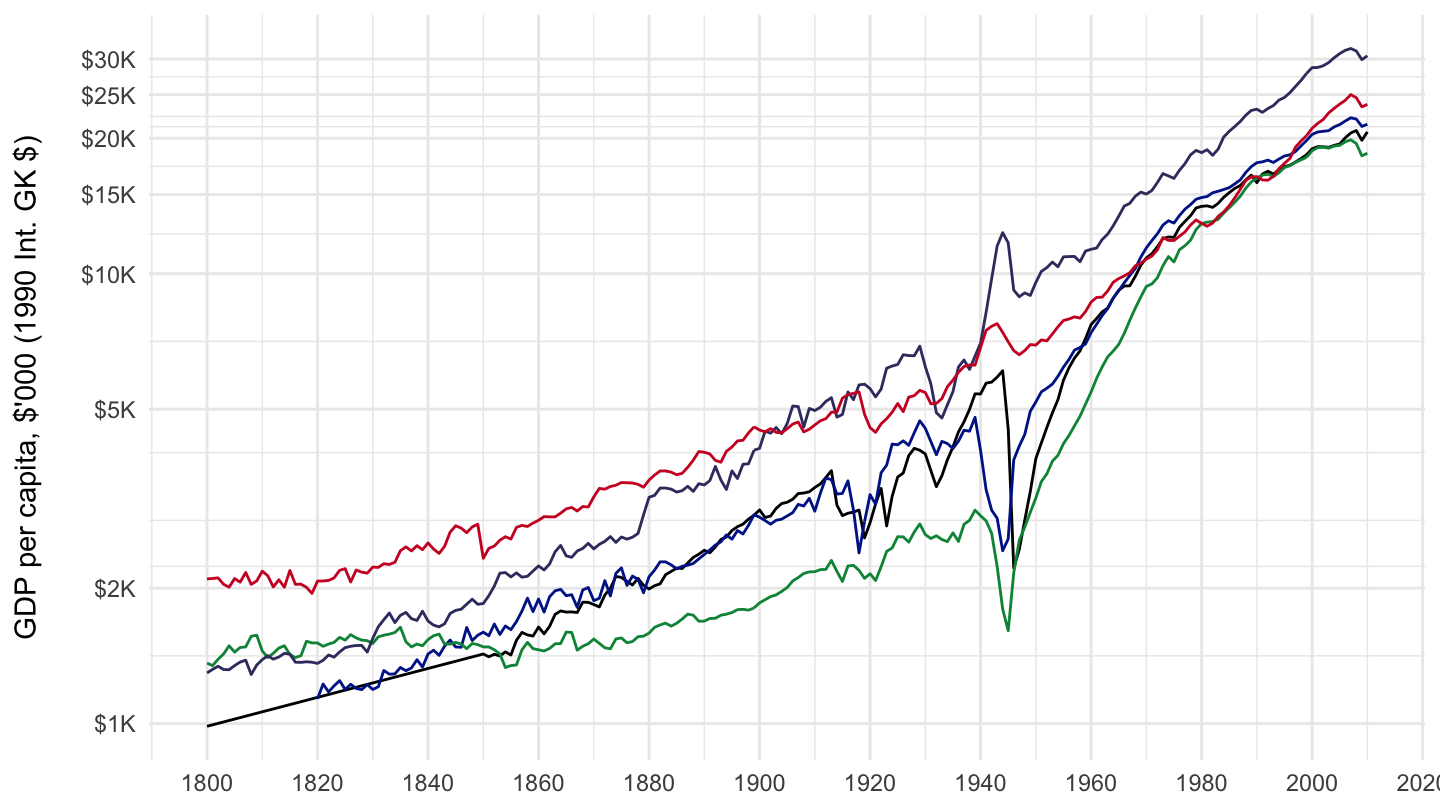

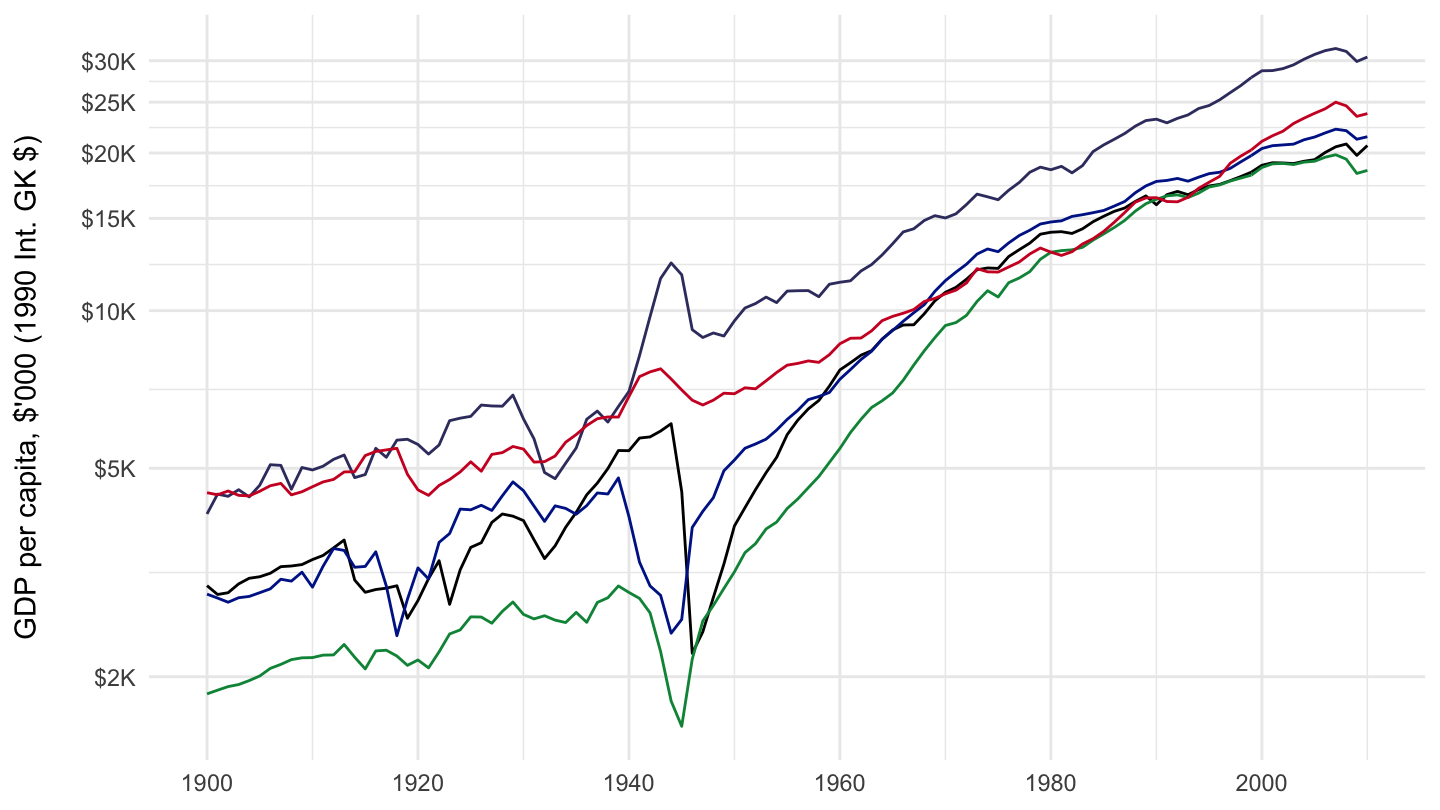

Maddison Data

1200-2010

1700-2010

1800-2010

1900-2010

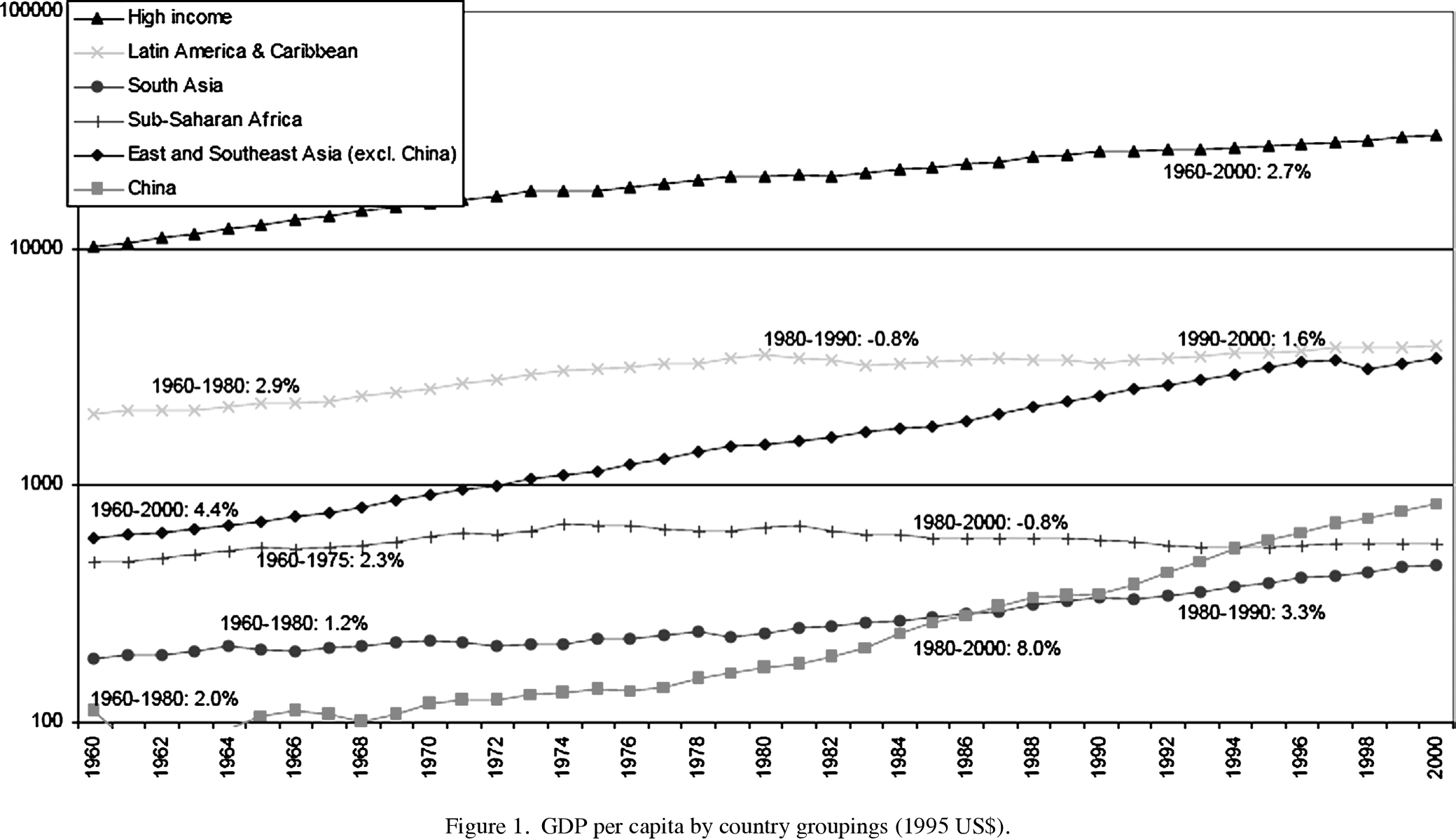

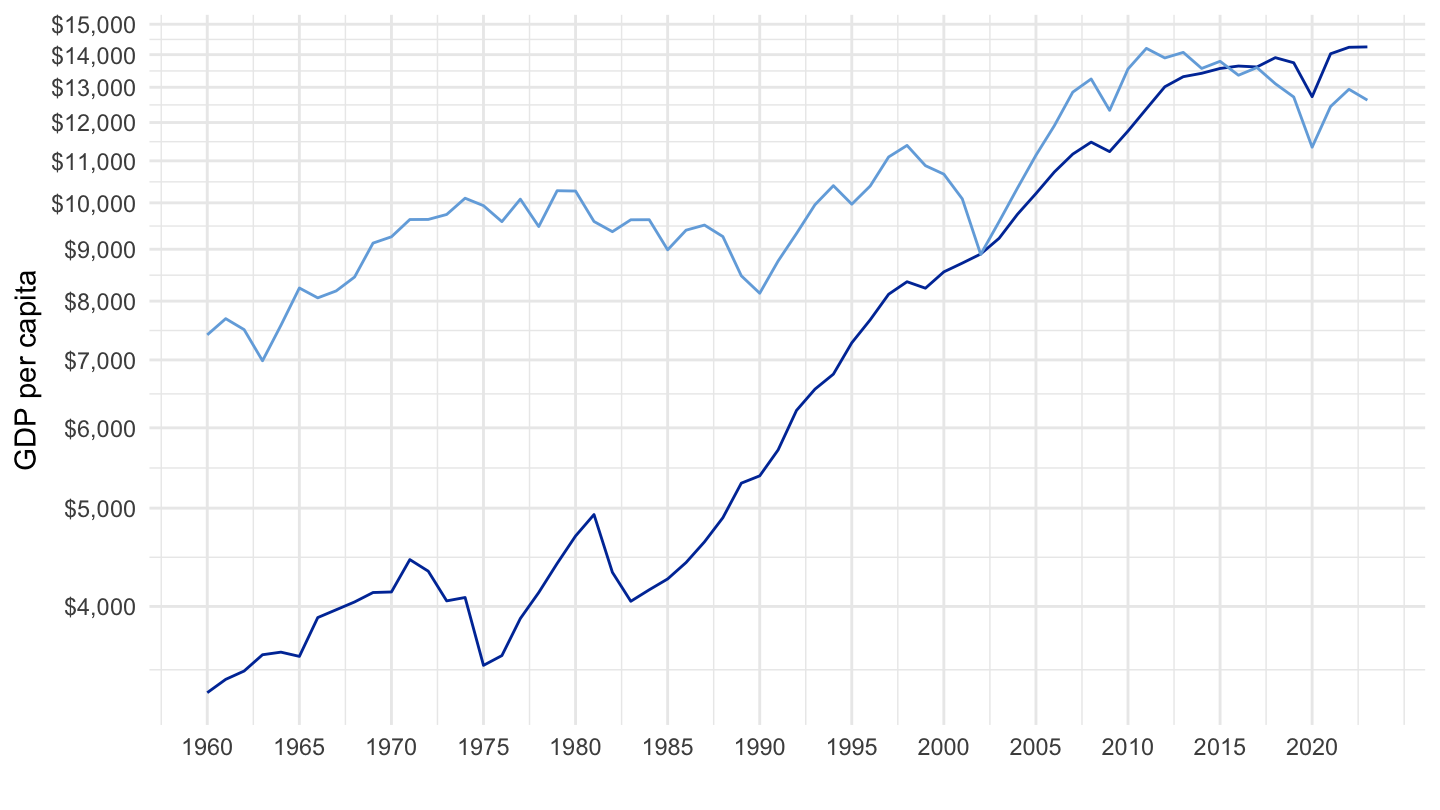

Rodrik (2005) - GDP Per Capita

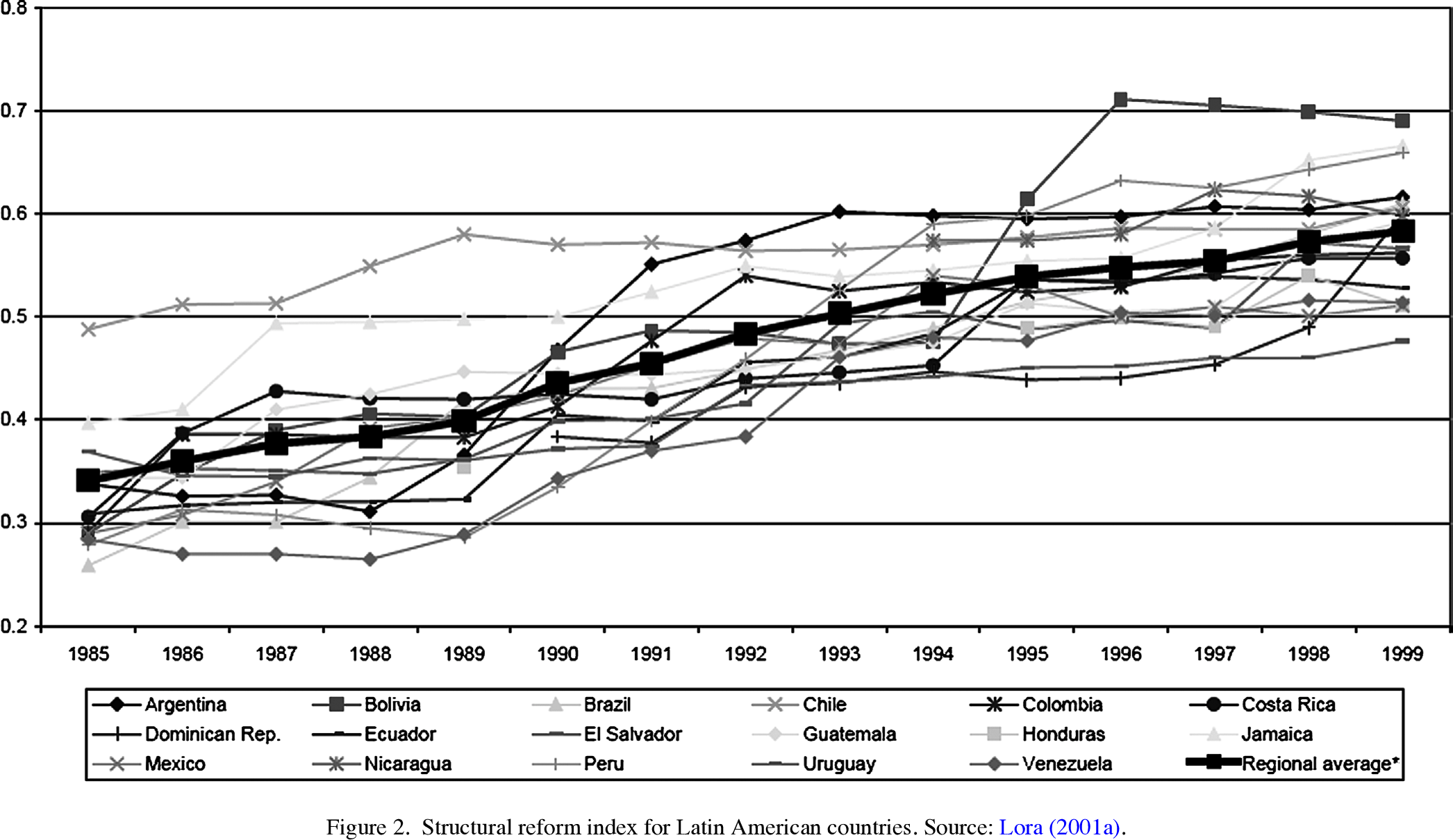

Structural reform index

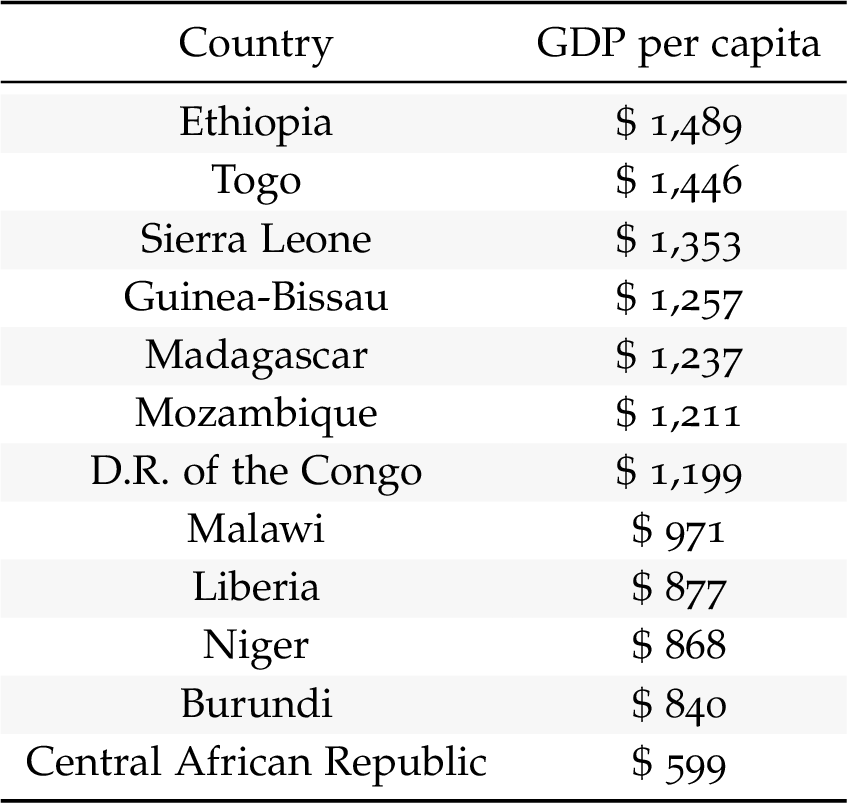

Countries with GDP per capita lower than $1.5K

Countries with GDP per capita higher than $40K

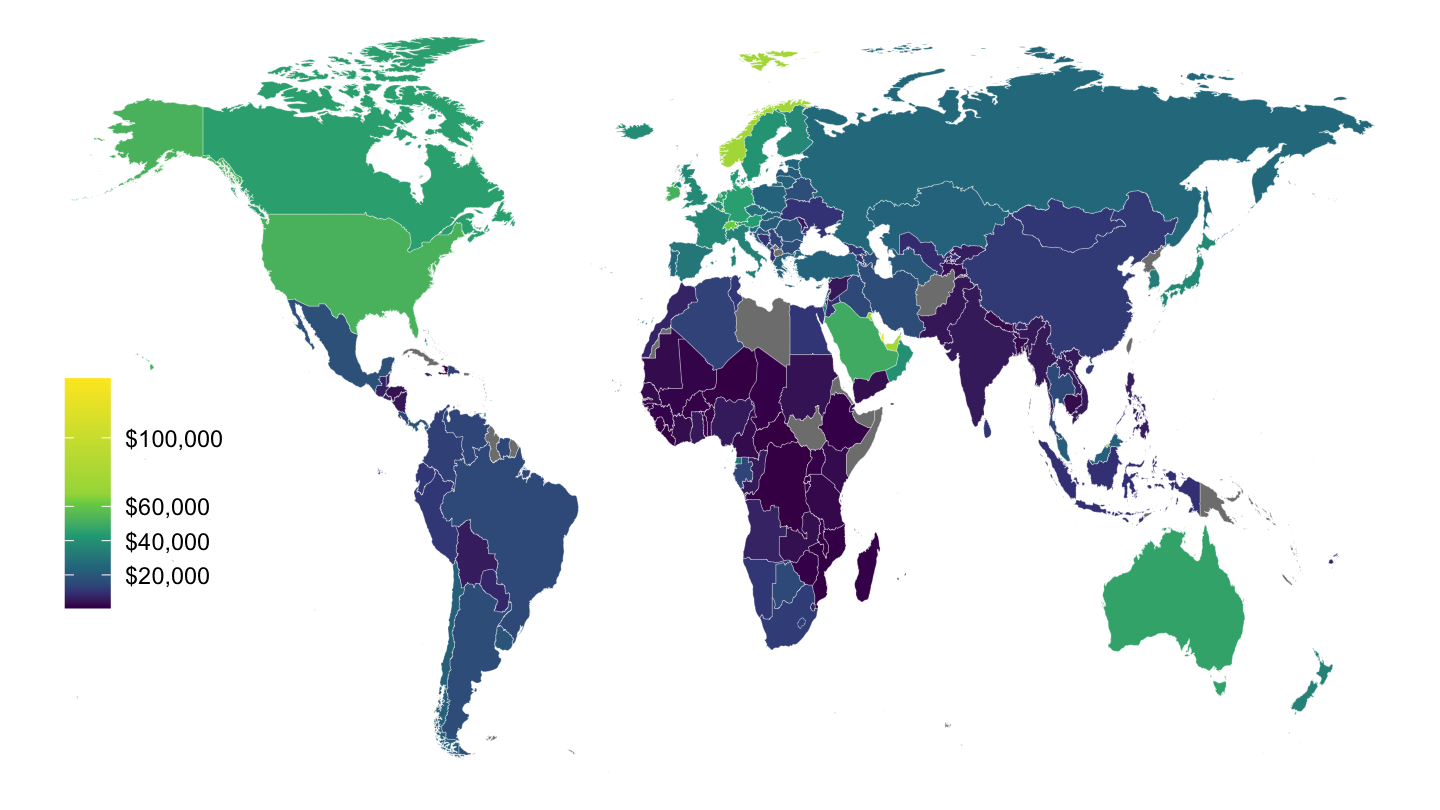

2014 GDP per capita (Penn World Tables)

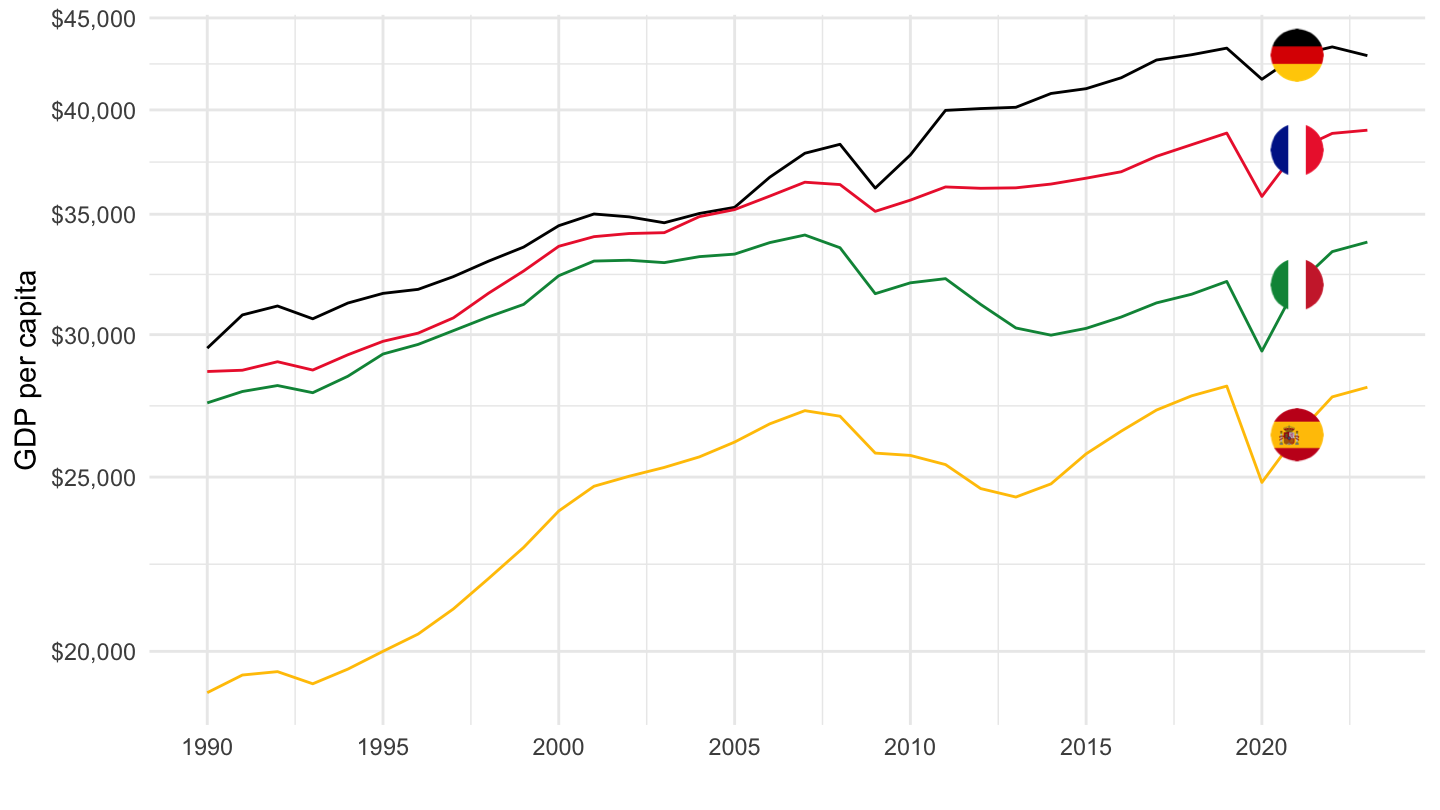

GDP Per Capita

Spain, Italy, France, Germany

Argentina, Chile, Venezuela

# Increase in productivity

# Increase in productivity

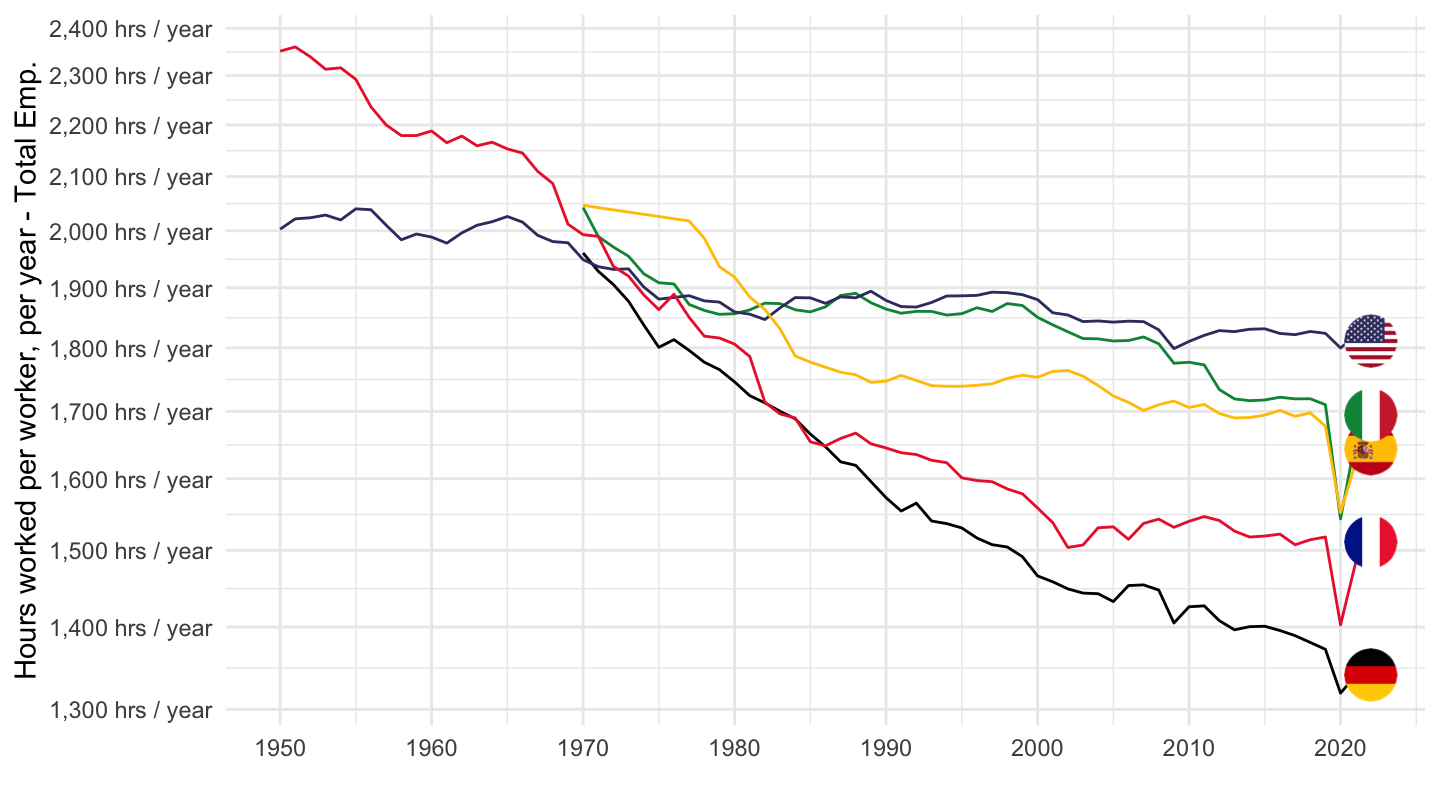

Hours

“The data are intended for comparisons of trends over time; they are unsuitable for comparisons of the level of average annual hours of work for a given year, because of differences in their sources and method of calculation.”

Issues with Competitiveness ?

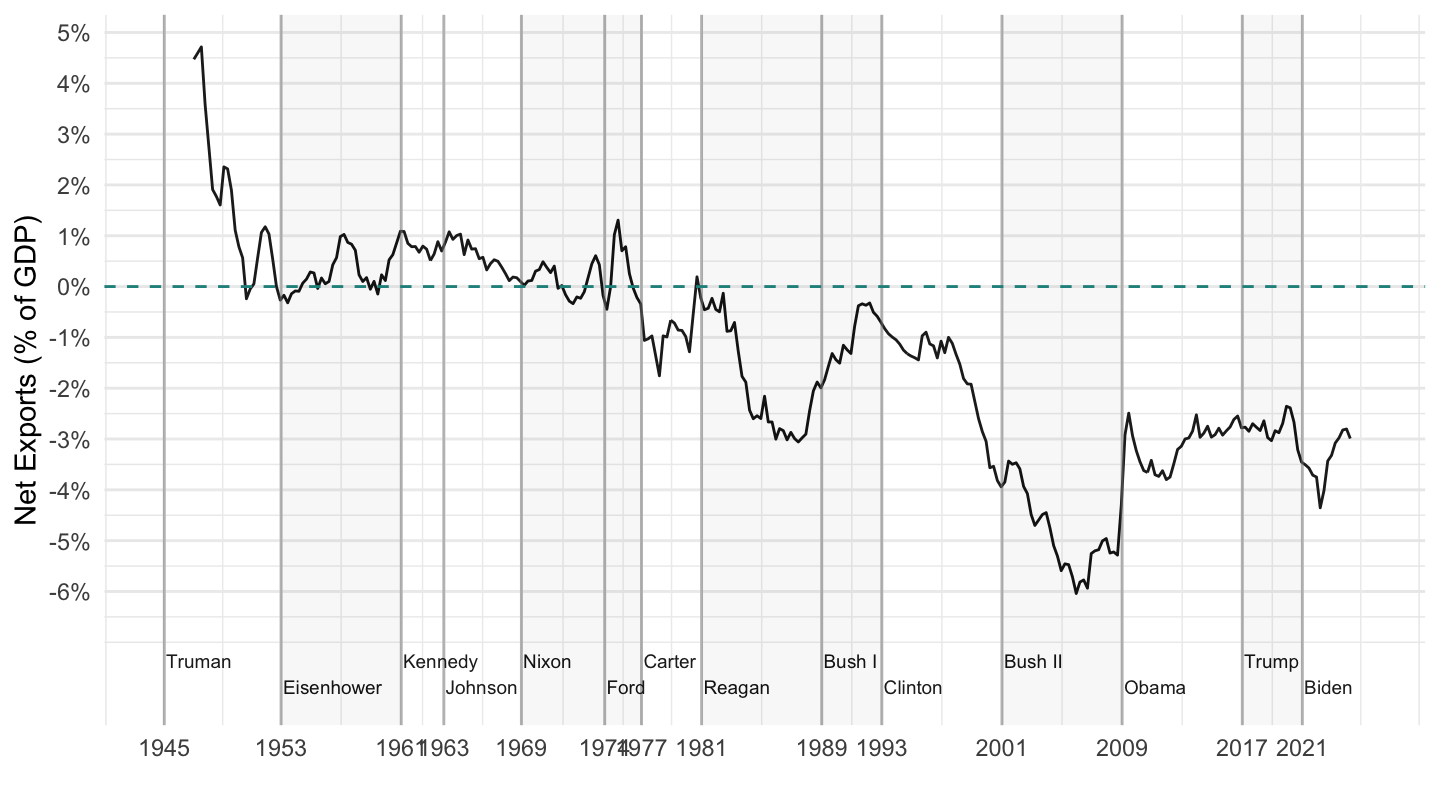

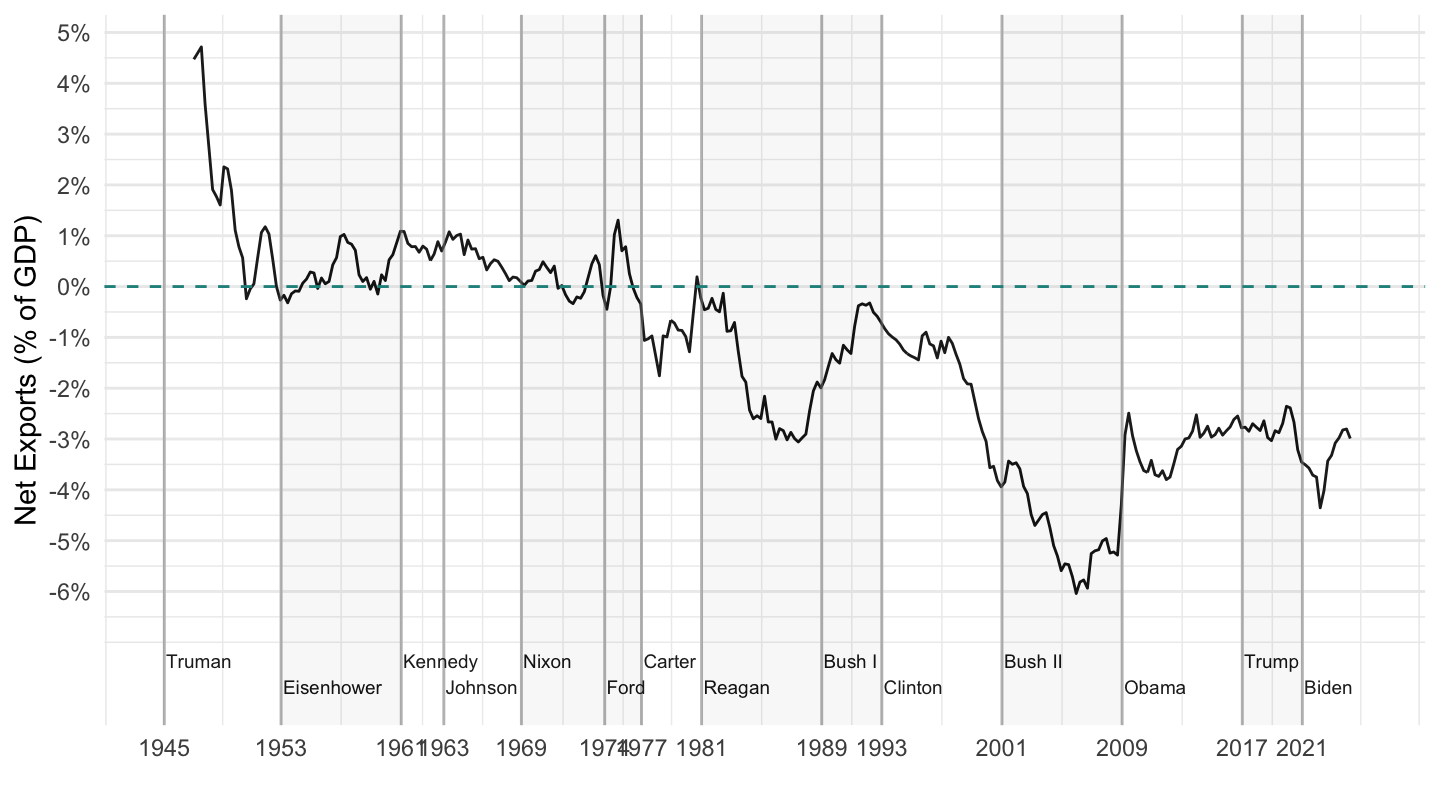

Net Exports

Warning

Trade deficits since the end of the convertibility.

Warning - I am more worried about trade deficits and manufacturing decline than most economists.

The Economist magazine says that Germany’s surpluses are a threat to free trade).

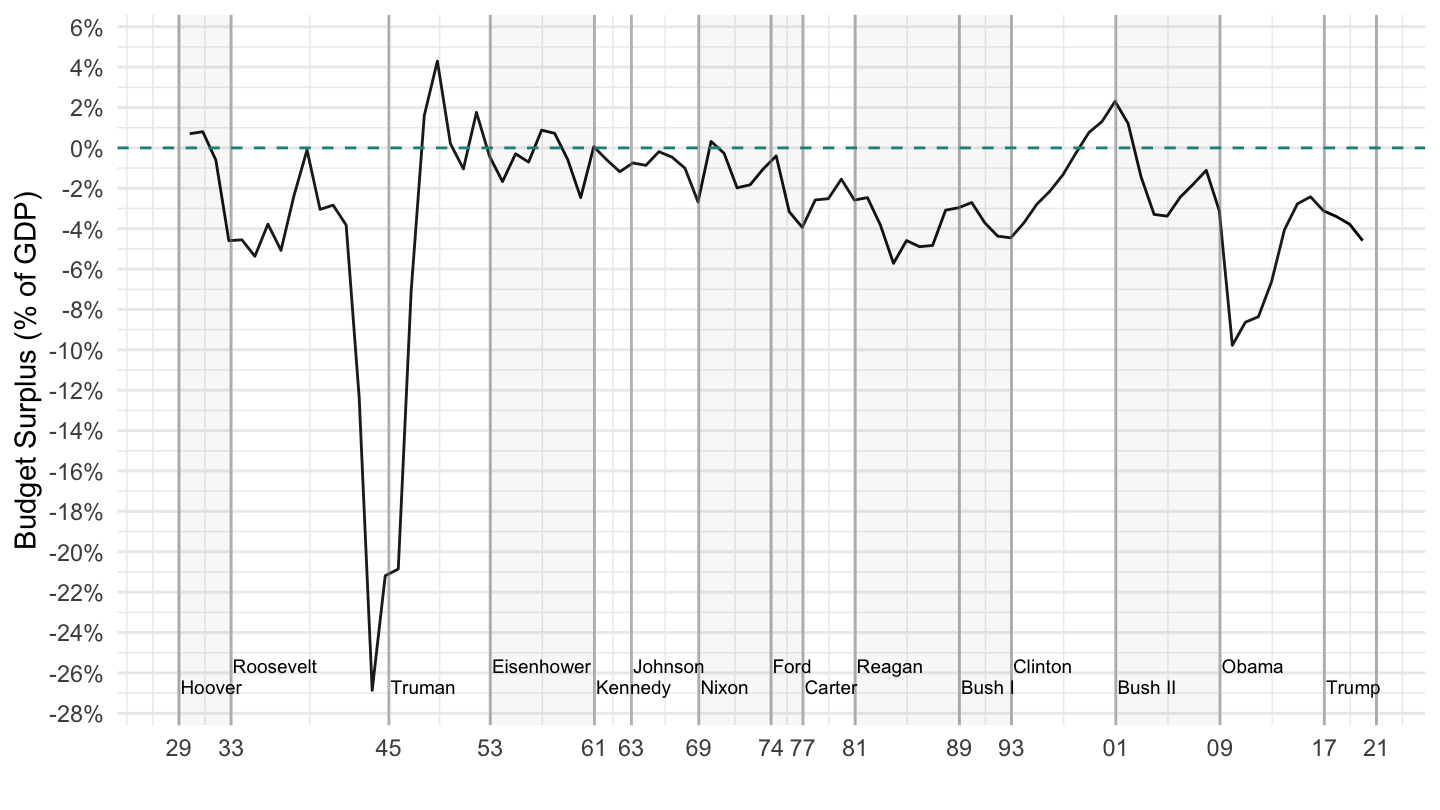

Budget Surpluses

Most of the time budget surpluses are negative. (except briefly under Bill Clinton)

Often, large trade deficits are blamed on too large budget deficits. If the U.S. is unhappy about its trade deficits, then it should simply save more, that is do less government deficits.

s

s

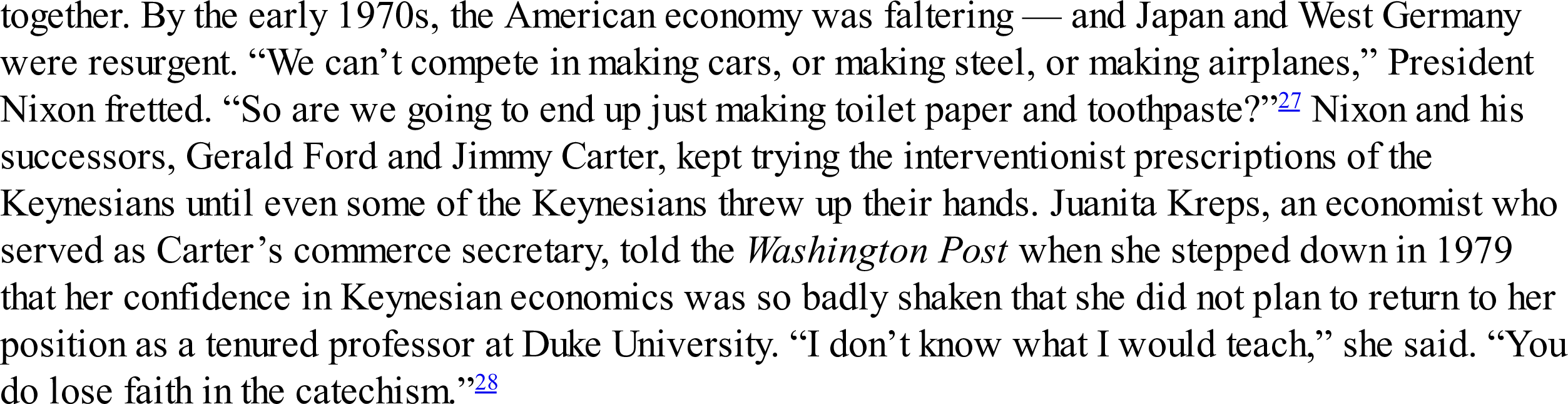

Nixon’s worries about competitiveness

Source: Binyamin Appelbaum - The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society

Activist “hands-on” approach is no longer working

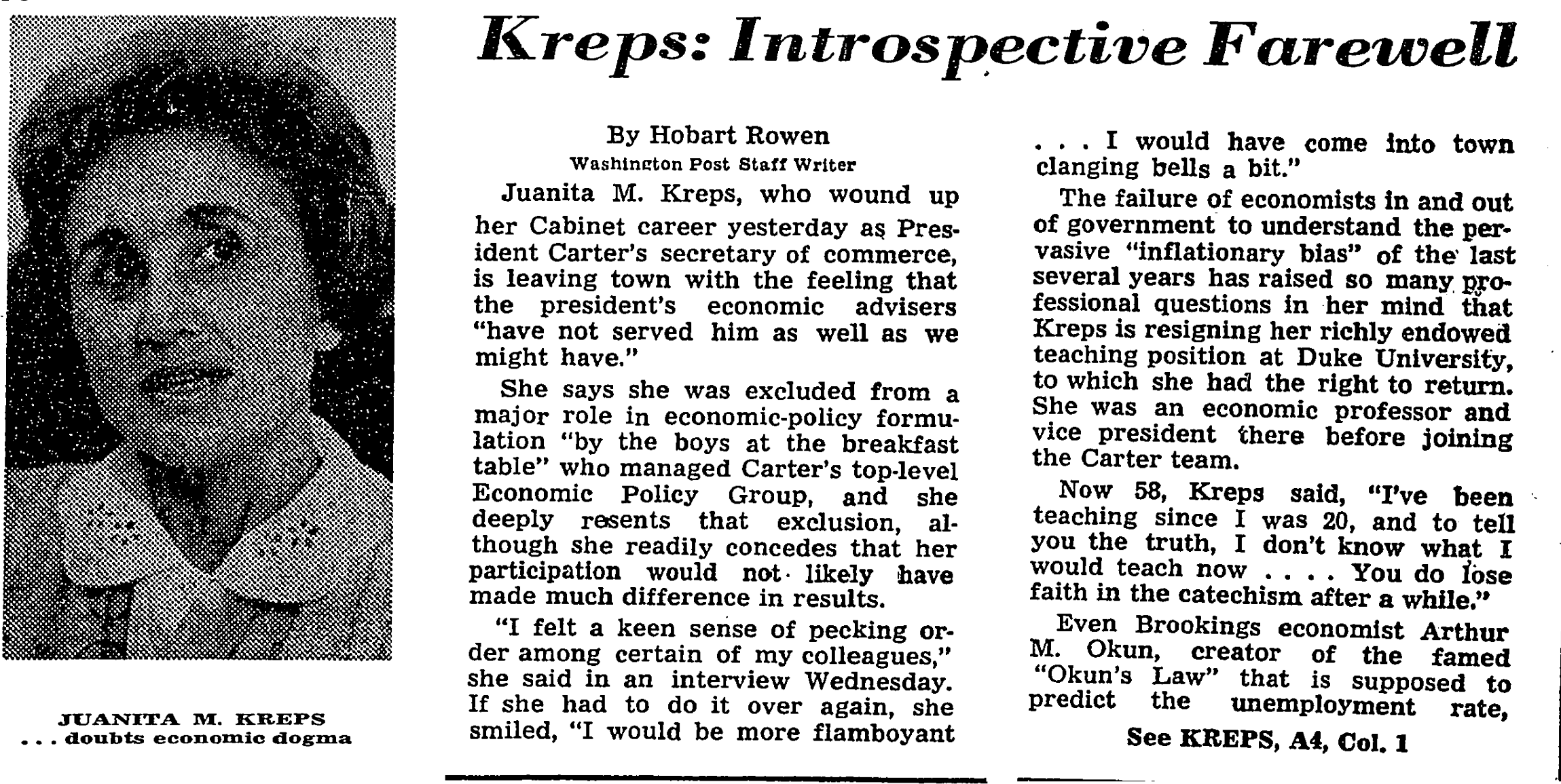

Juanita Kreps & Carter’s problems with Keynesianism

“You Lose Faith” in Economic Dogma

Juanita Kreps Short Video (with Kuznetsov and Blumenthal)

Secretary of Commerce

Academic Career

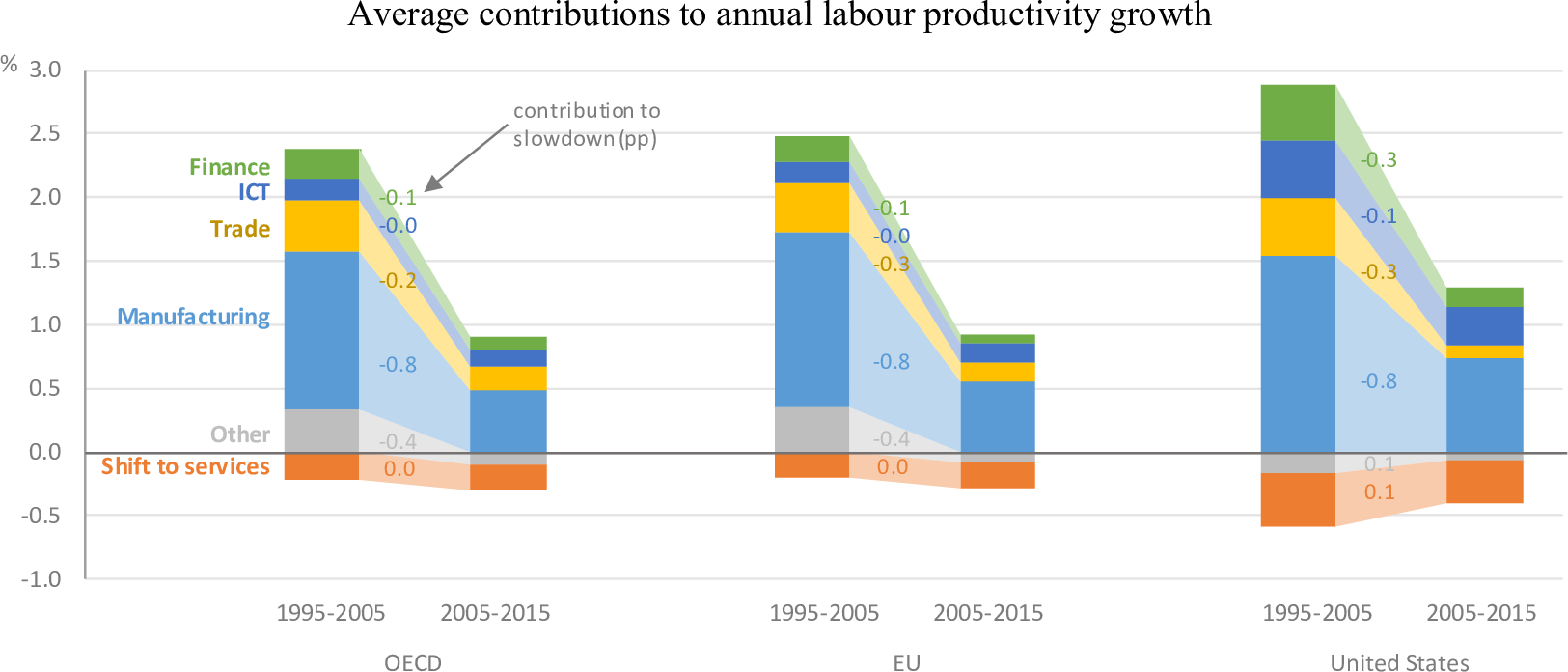

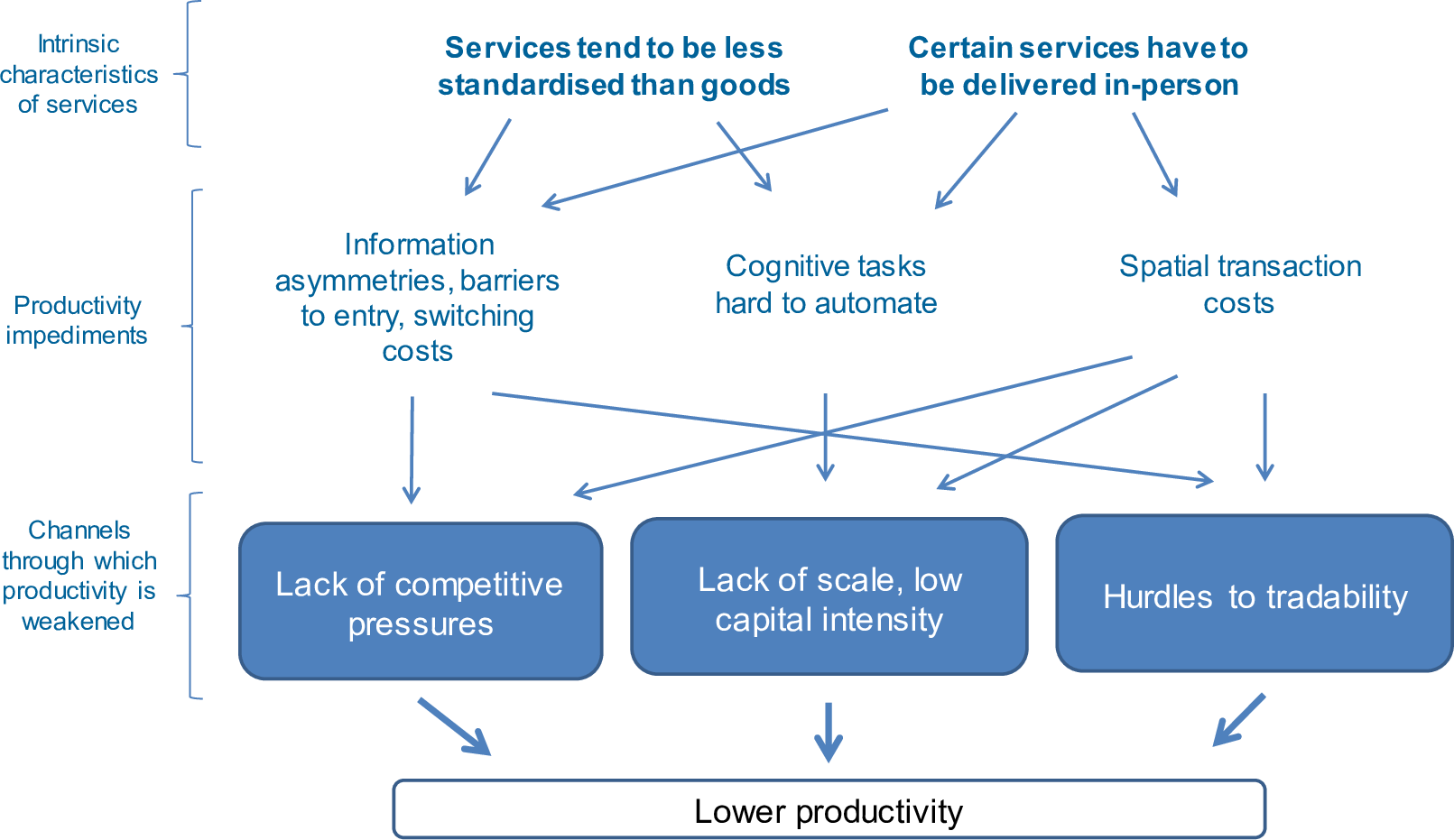

Baumol (1967); Baumol (1968)

Idea

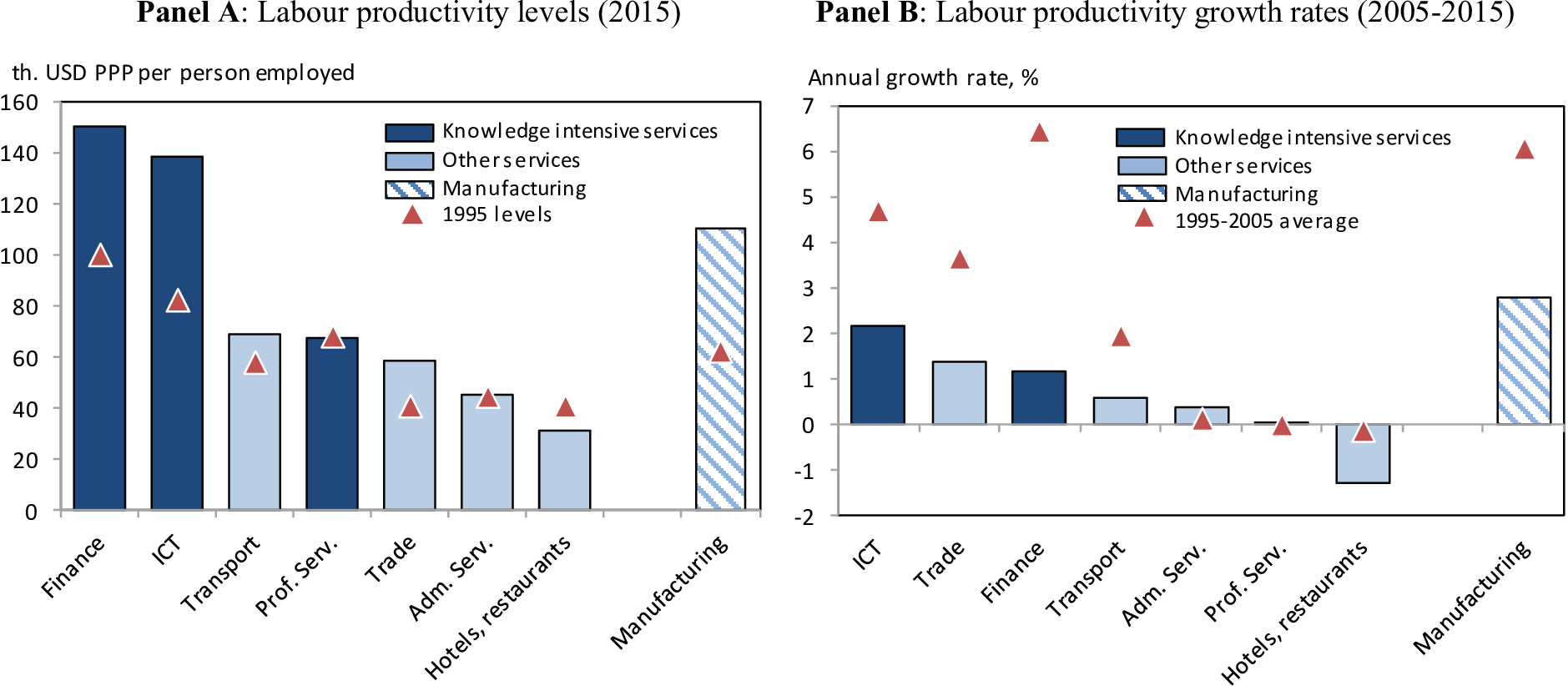

Services industry sees less rapid productivity gains.

Therefore, services are an increasingly larger share of the economy.

This is an important fact, because some deindustrialization is needed.

Productivity gains low in Services

Manufacturing Productivity

Productivity gains low in Services

Productivity gains low in Services

Balassa-Samuelson Effect

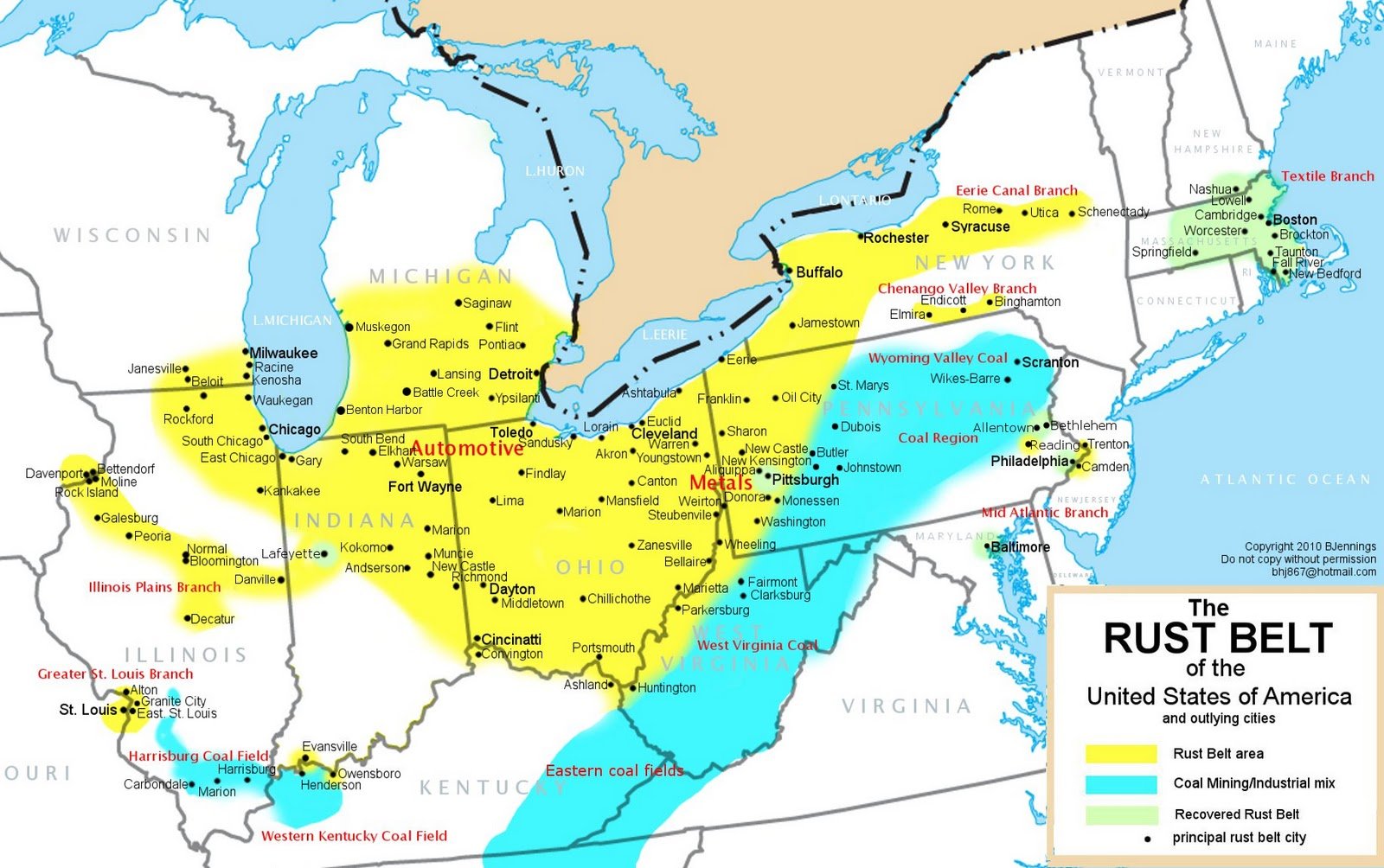

1980s: Reagan, The Rust Belt, etc.

1990s: Rising Japan - Books

The Rust Belt

Plaza Accords

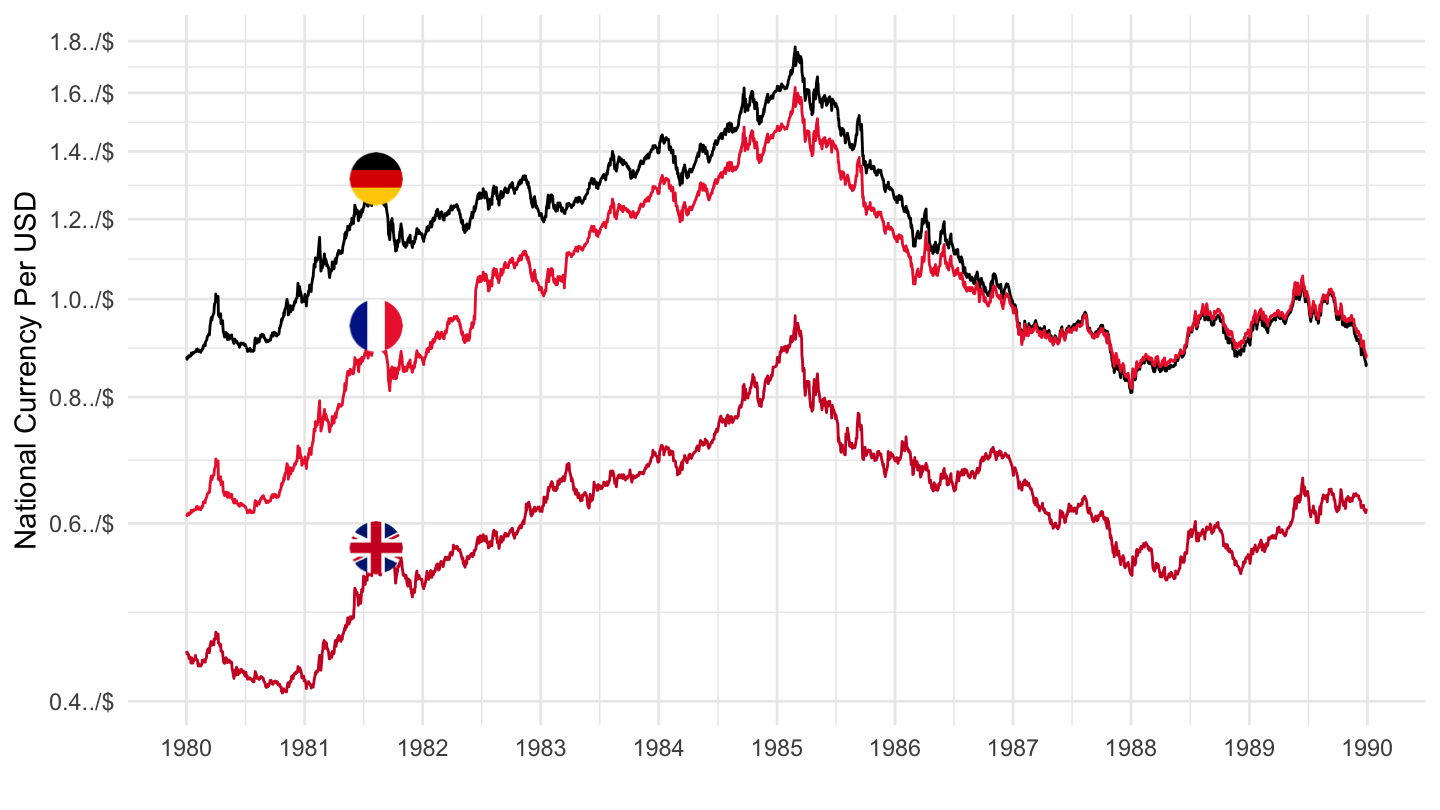

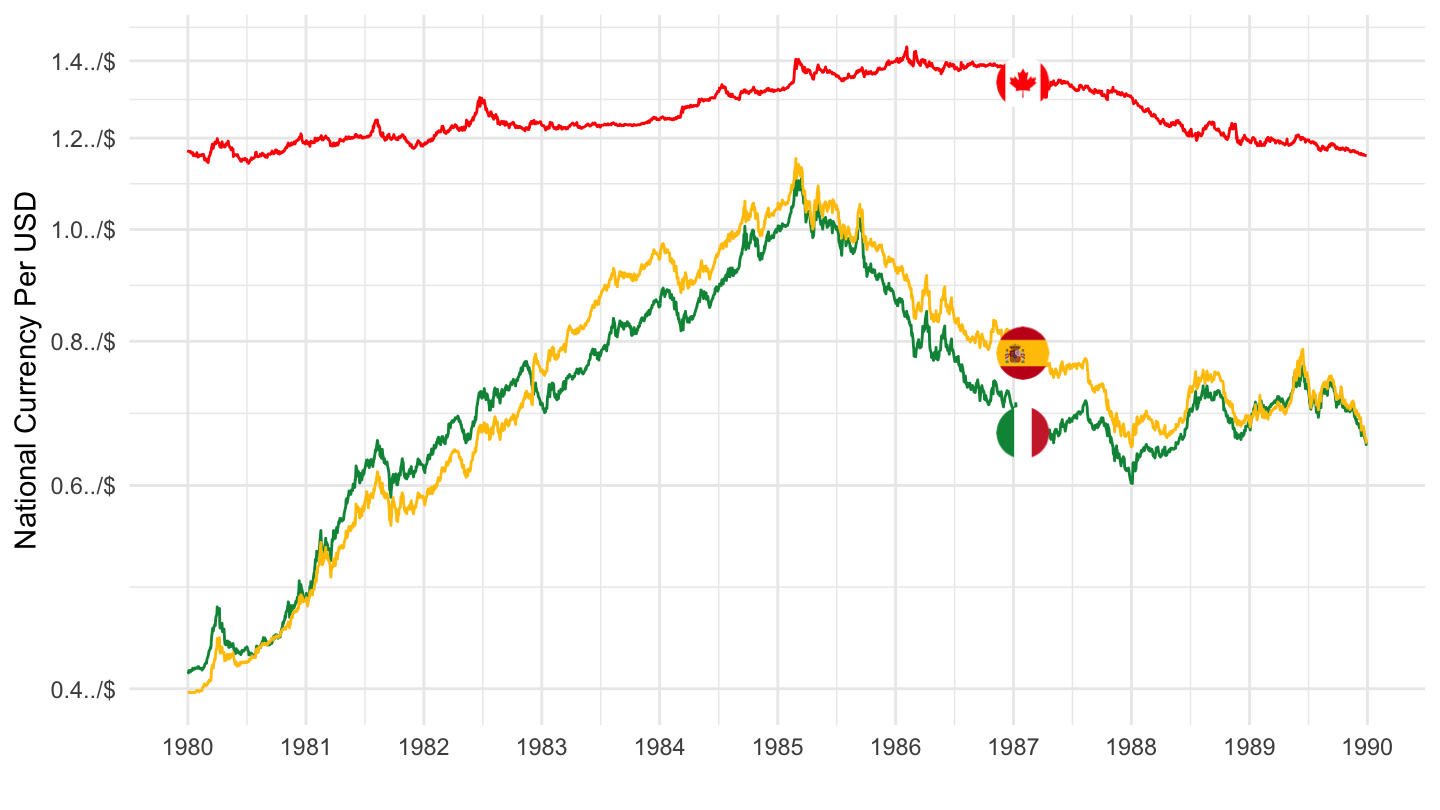

Xrates against US. Dollar (1980-1990)

Xrates against US. Dollar (1980-1990)

Xrates around Plaza Accords (1980-1990)

Porter (1990) - The Competitive Advantage of Nations

Title

Why do some nations succees and other fail?

Germany

Horizontal Competitiveness

Krugman (1994) - Does competitiveness exist?

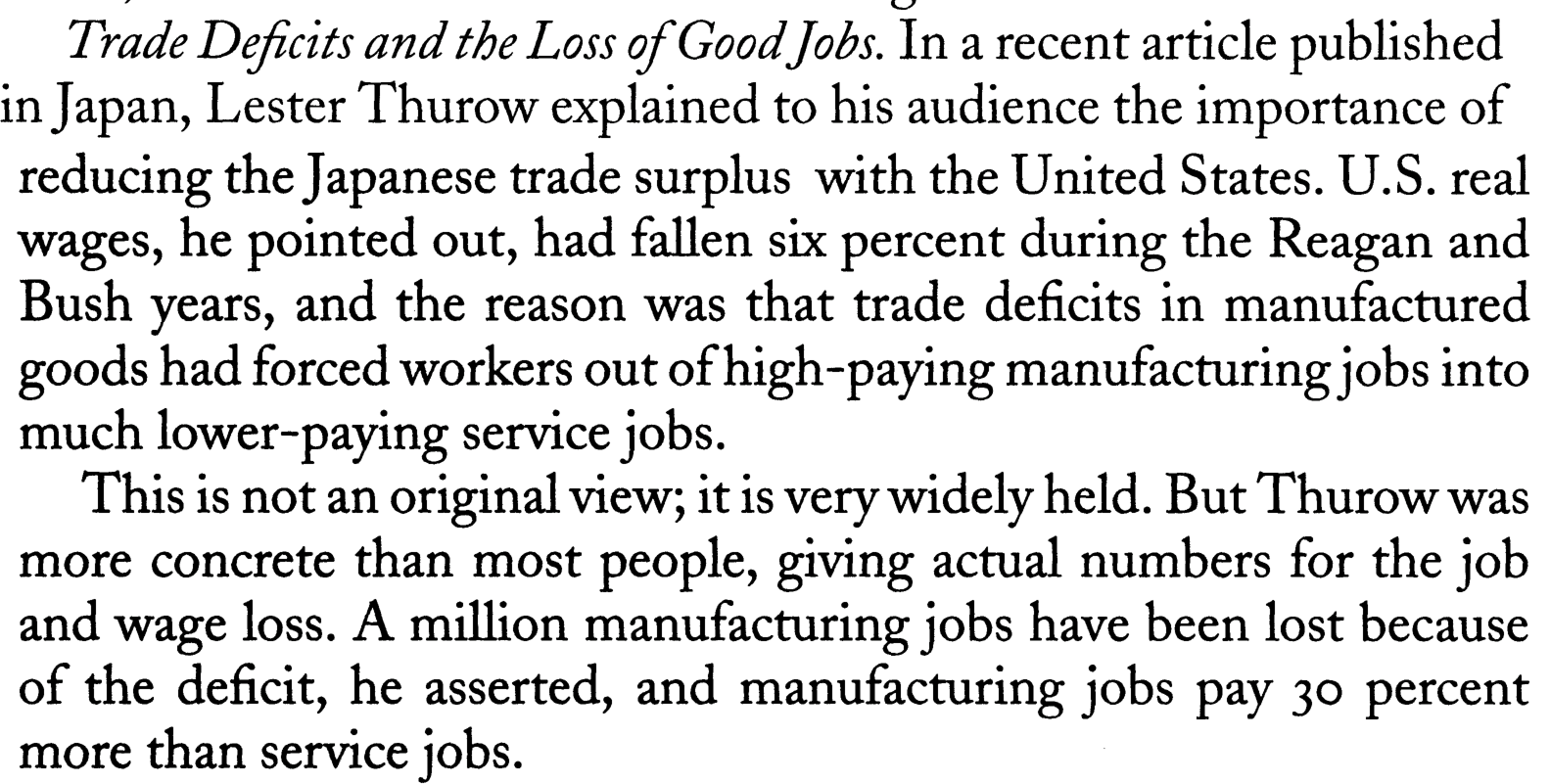

Lester Thurow

Bill Clinton’s speech

- Bill Clinton talks about Lester Thurow’s book. html

In his most recent book, “Head to Head,” the economist Lester Thurow (sp) argues that there are seven major areas of technology which will produce the lion’s share of the high-wage, high-growth jobs of the 21st century, at least as far as we can see into that century, that aerospace is one of those areas, and that a nation with a stake in any of these technologies gives it up only at its peril. We have enjoyed an enormously positive position in aerospace for a long time now, but if you look at our airlines, the airlines alone have lost as much money in the last four years as they made in the previous 60.

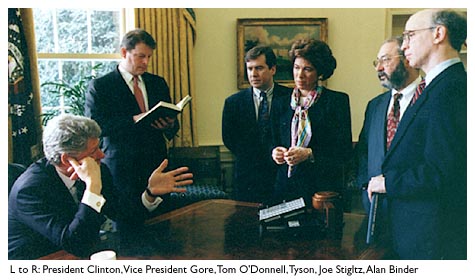

Clinton’s economic advisors

Paul Krugman

Foreign Policy Piece

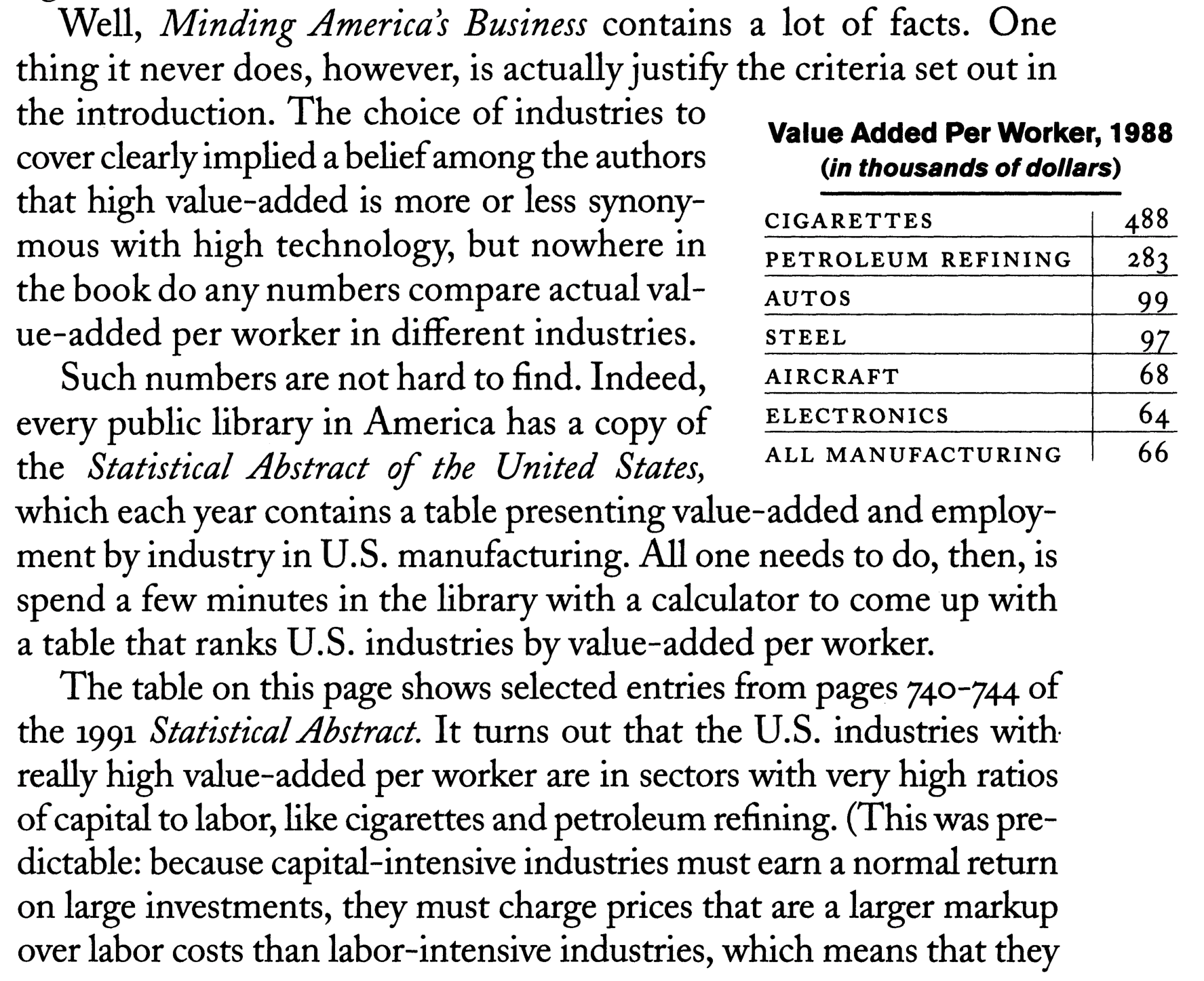

Critiques of Books

Delors and competitiveness / high technology

Trade is not important ?

Why is that not true ?

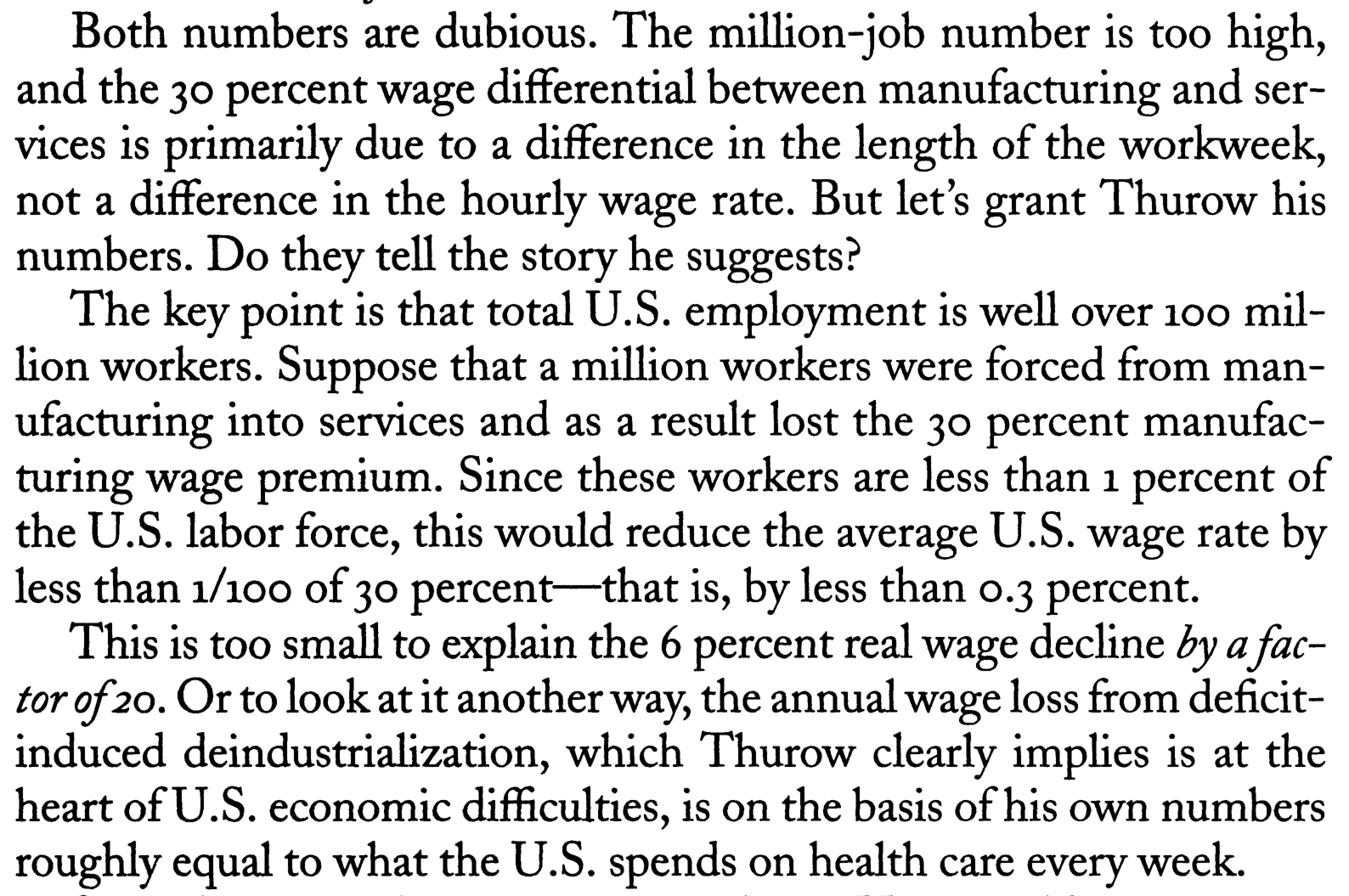

Reducing the trade surplus

Back of the envelope calculation

Facts

Free market argument

Krugman’s neoclassical argument

1994 Foreign Affair Reponses

Krugman (1994) - Competitiveness: A Dangerous Obsession ?

Responses:

Thurow (1994) - Microchips, not potato chips

Prestowitz (1994) - Playing to Win

Scharping (1994) - Rule-Based Competition

Cohen (1994) - Speaking Freely

Krugman (1994) - Proving my point.

Prestowitz (1994) - Playing to Win

Prestowitz’s response 1/4

Prestowitz’s response 2/4

Prestowitz’s response 3/4

Prestowitz’s response 4/4

Thurow (1994) - Microchips, not potato chips

Microchips, not potato chips

Disequilibrium

Jobs

Mixed economy

Dani Rodrik

Barbarians, Barbarians everywhere

Has Globalization gone too far ?

PIIE

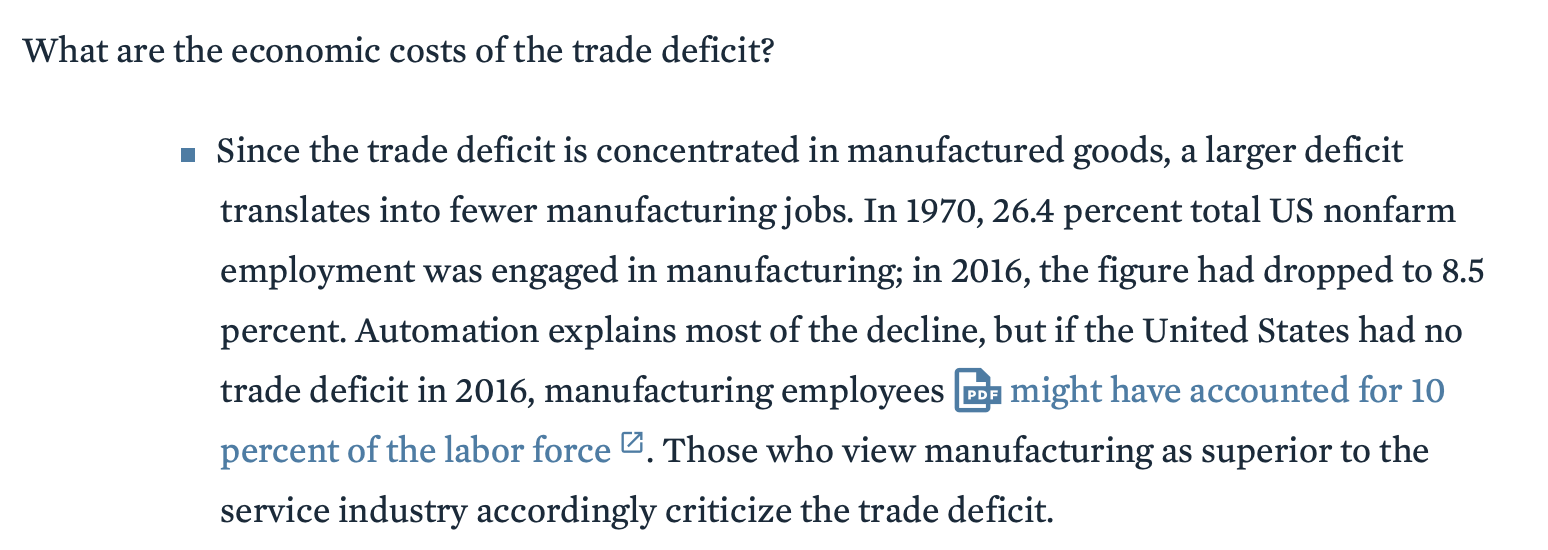

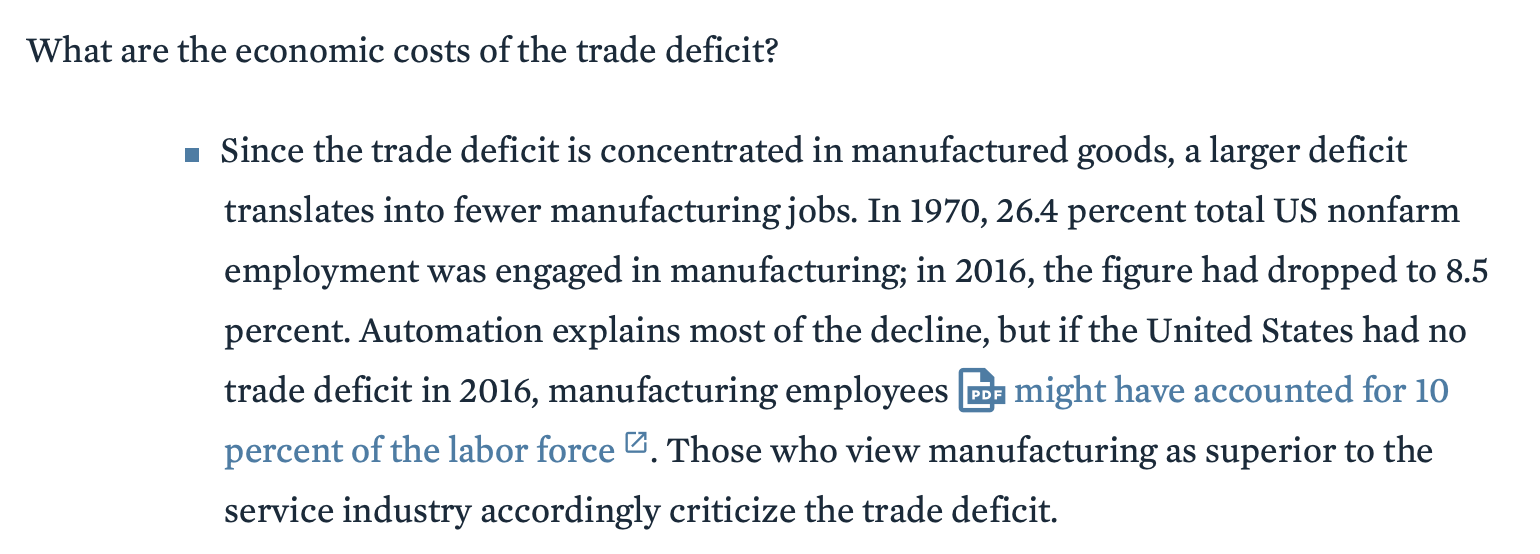

Trade Deficit Problem

- Our trade deficit problem. html

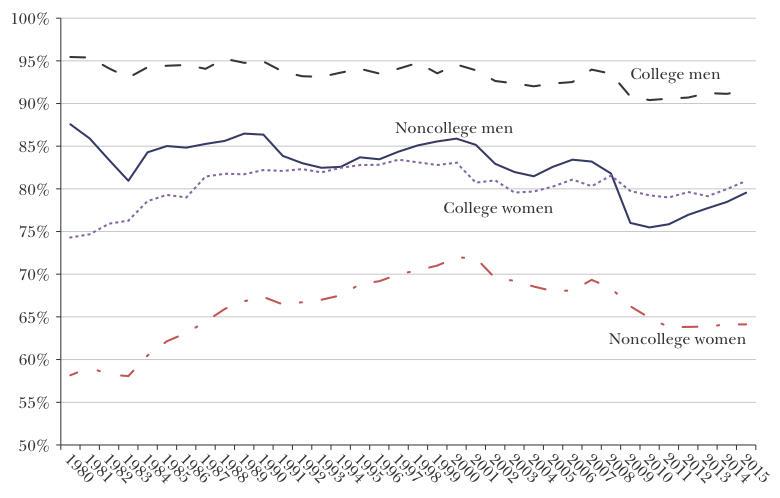

Labor Participation

Masking of Unemployment by the Housing Boom

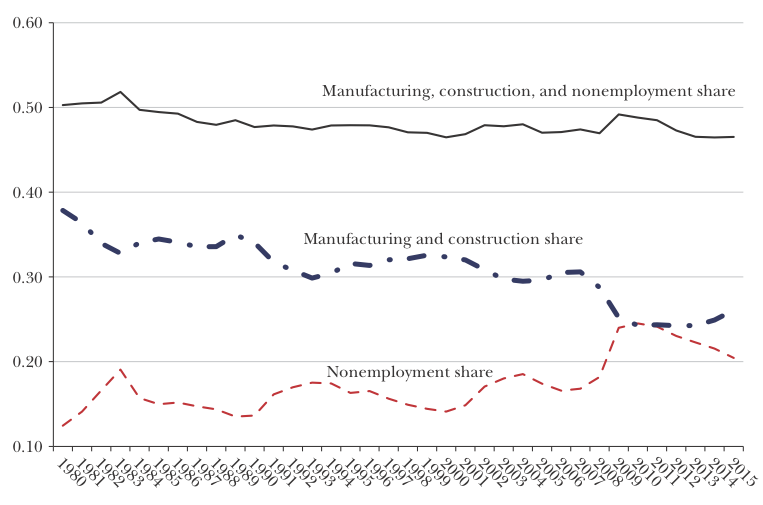

Share of Noncollege Men not Working

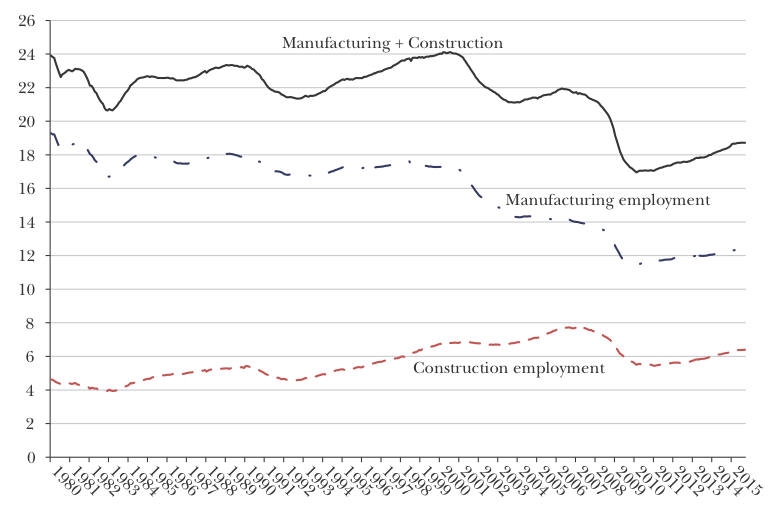

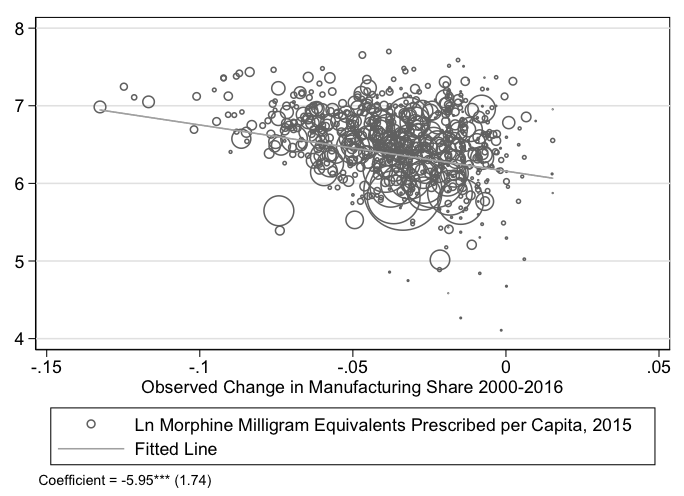

Manufacturing Decline and the Opioid Crisis

IMF’s view

Germany VS U.S.

Germany VS U.S.

Maury Obstfeld’s 2018 view

IMF: Protectionism is not the answer

Public debt and external debt

Manufacturing VS Services

Savings glut and open economy

Creditor or Debtor adjustment

Reading: “Two out of three ain’t bad.” The Economist, August 27, 2016.

According to J.M. Keynes, the problem of fixed exchange rates such as a Gold Standard was that it forced the adjustment of balance of trade imbalances onto deficit countries. Deficit countries were forced to respond to an outflow of gold by curbing the demand for imports, and cutting wages to restore export competitiveness.

Whose fault is it? Is Germany not consuming enough or U.S. consuming too much?

The Keynes plan at Bretton Woods

J.M. Keynes was proposing that creditor countries would share symmetric blame for trade imbalances.

There would both be penalties for being overly lax, just as there would be penalties for having too large a trade surplus.

However, Keynes was not able to get enough support for such creditor adjustment.

The United States (dominating power at Bretton Woods) opposed the idea for the same reason Germany resists it today: it was a country with a big surplus on its balance of trade.

The management of the Euro Area crisis

Austerity policies which were implemented in Europe after 2011, following the Greek debt crisis.

An alternative adjustment would have been to have Germany and the rest of Europe increase their aggregate demand, to boost Greece’s exports and help pay for imports.

Instead, Greece (and Spain) was forced into costly import compression through tax increases and spending cuts, which hurt internal demand a lot.

The neoclassical View

According to Robert J. Barro, Germany and Sweden have done very well macroeconomically, despite having moved to rough budget balance from 2009 to 2011.

A Keynesian economist would actually give would be to say that the reason why Germany and Sweden have done so well is that they have largely benefited from growth in their external demand, themselves due to other countries implementing Keynesian aggregate demand stimulating policies during the period.

And indeed, both Germany’s and Sweden’s net exports have substantially increased during that period, or at least they have stayed strong, as shown here there for Sweden (you can see both here).