Main result

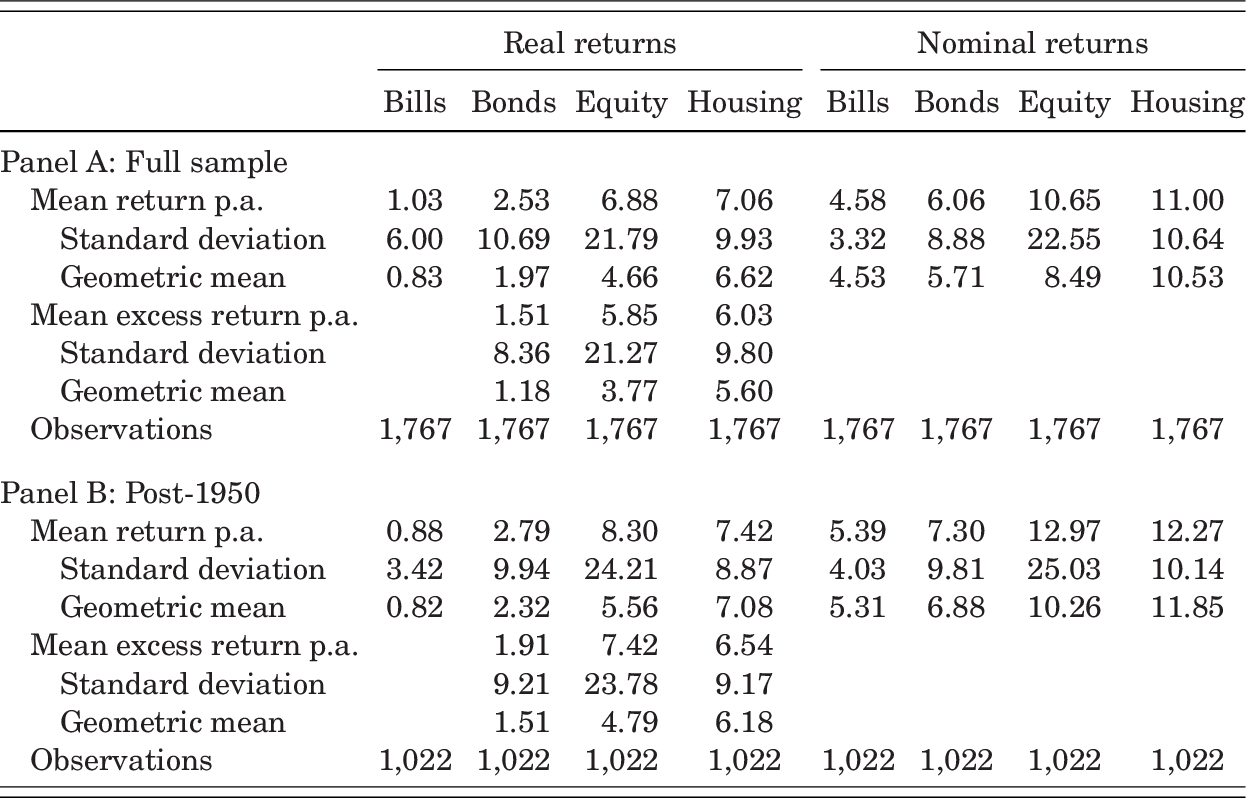

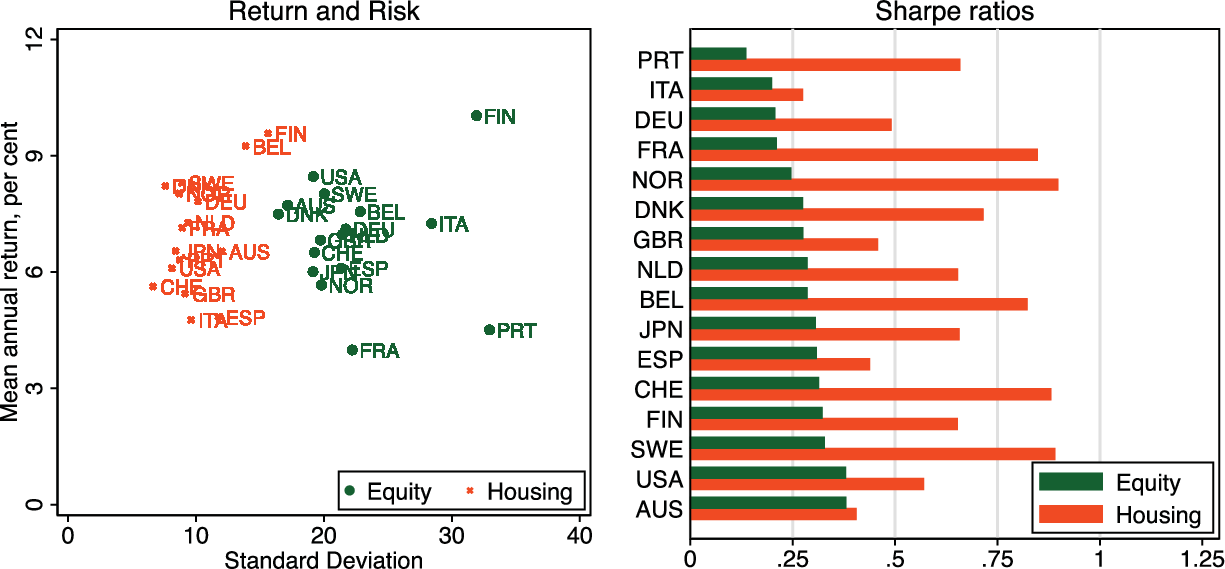

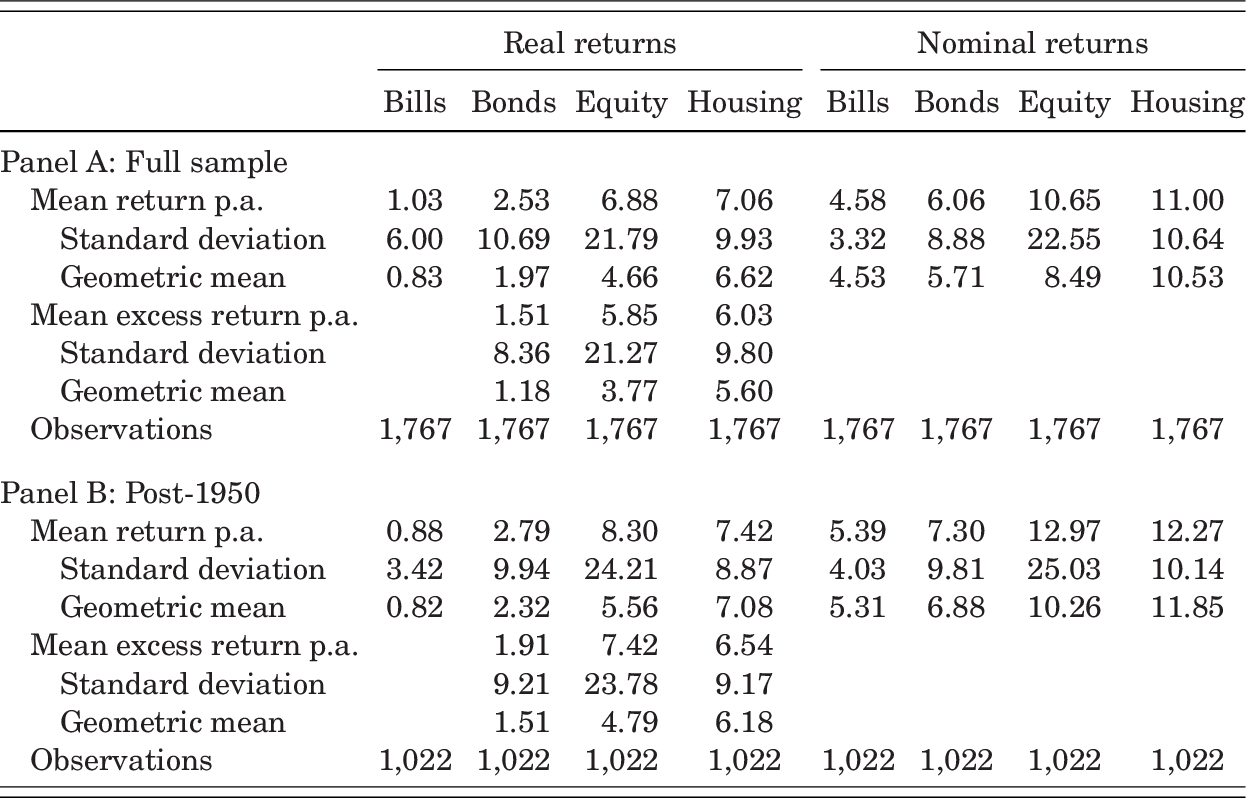

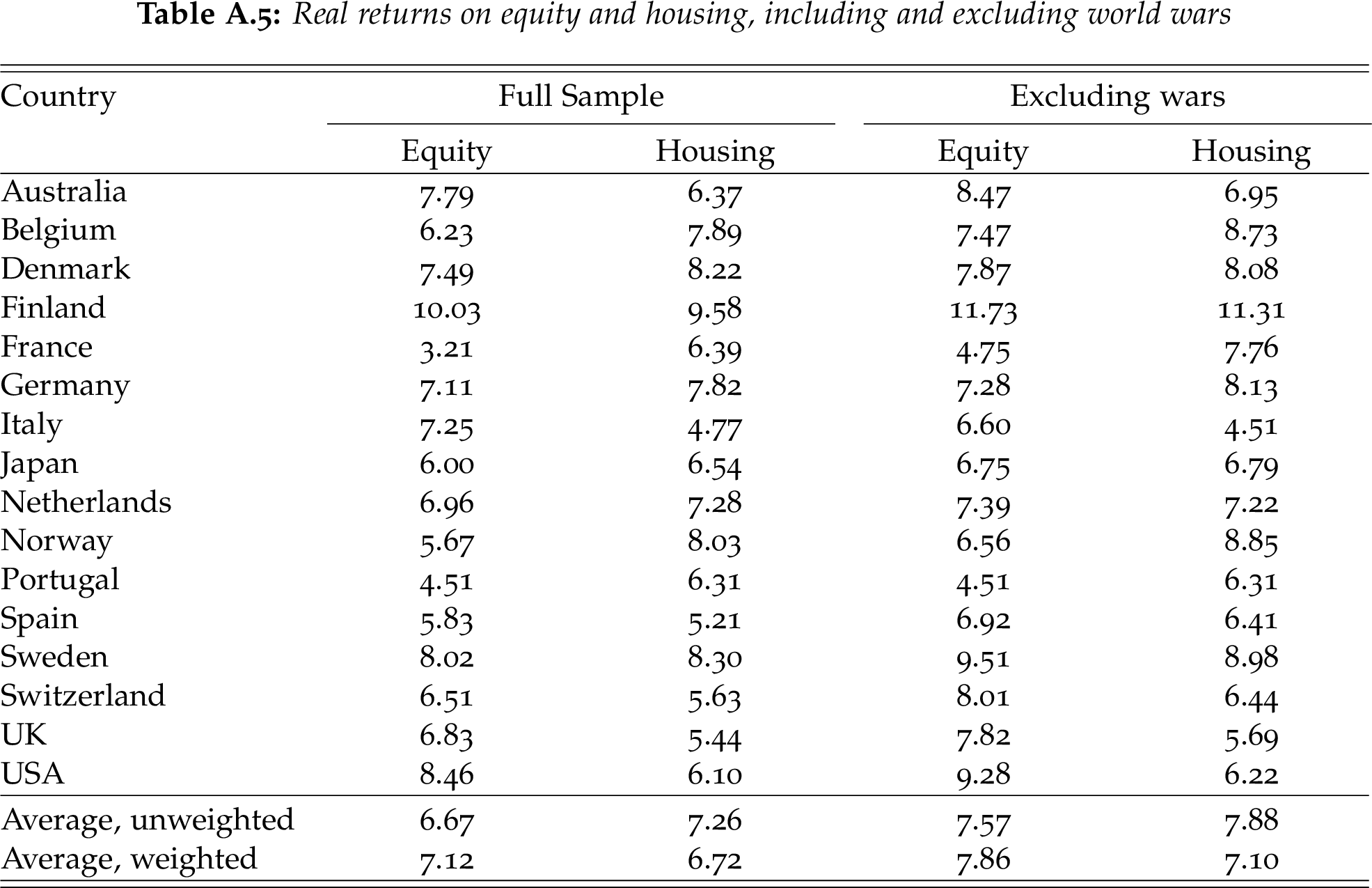

Most interesting result: housing has a much higher sharpe ratio than equities.

Return is roughly similar, but it’s much less risky.

To me it’s another “blow” to the CAPM, which as we now know does not work at all to explain the cross-section of assets.

We are back to one fundamental question: why do bonds have such low returns compared to housing / stocks?

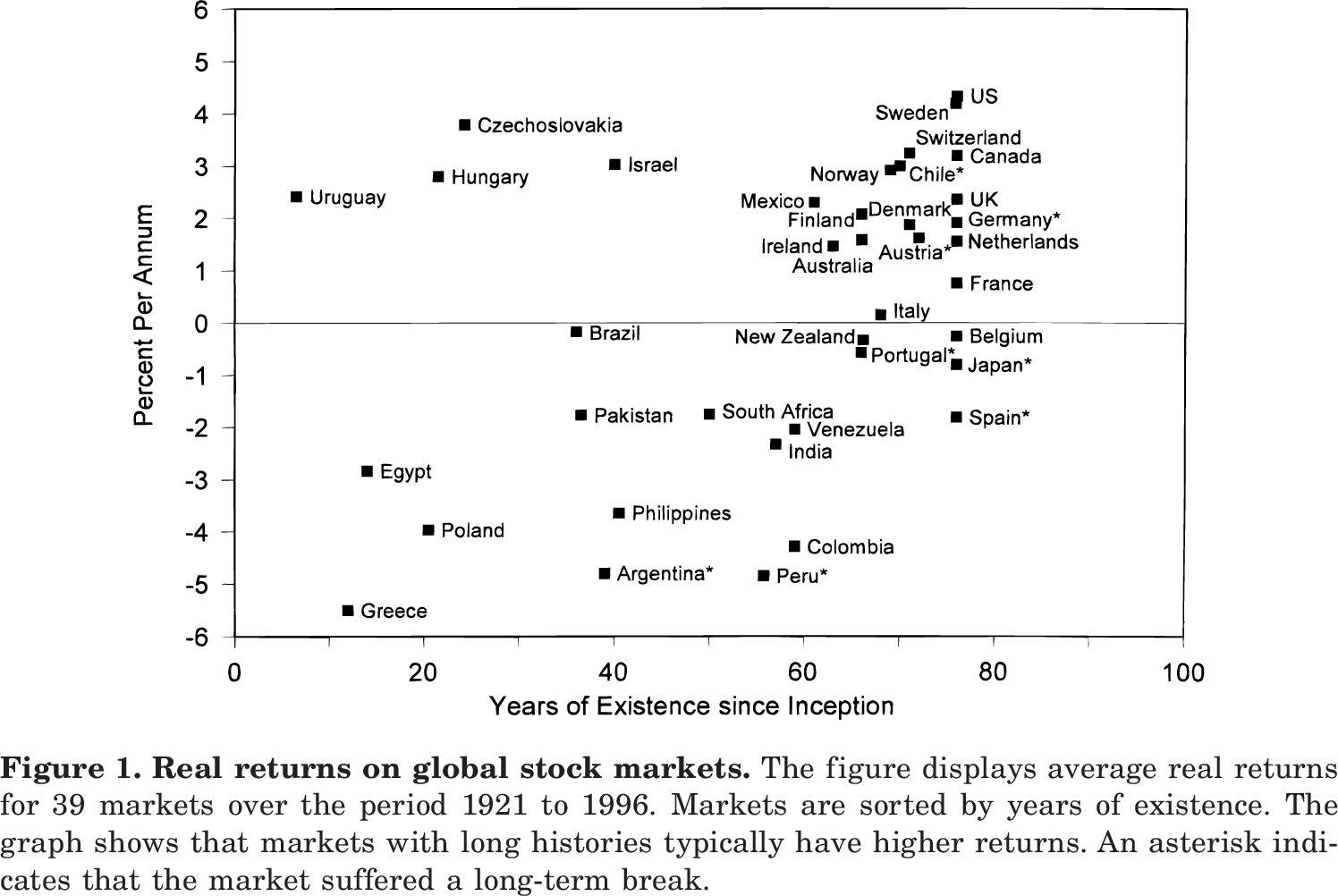

Question: is the preformance we measure one that was to be expected or not?

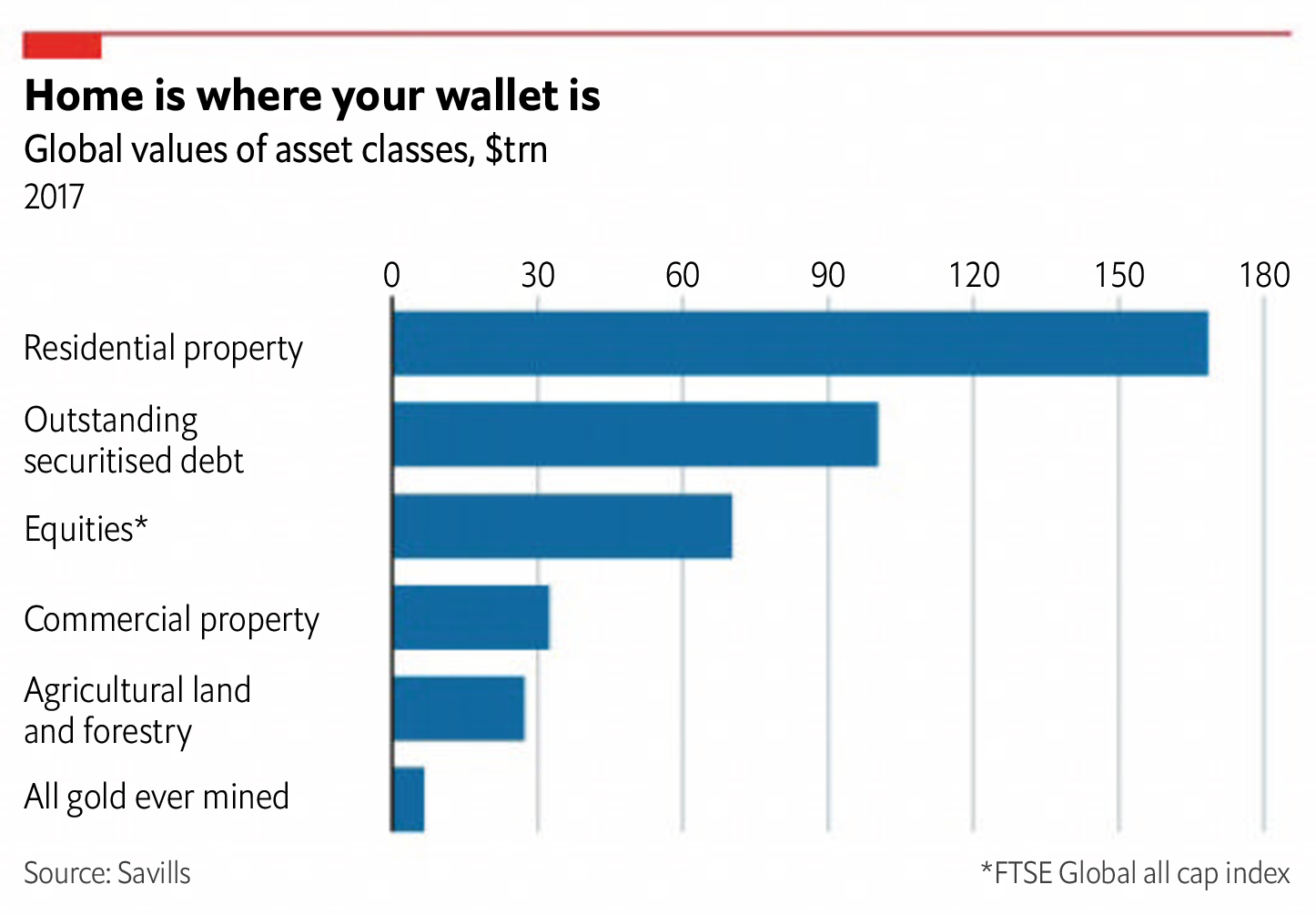

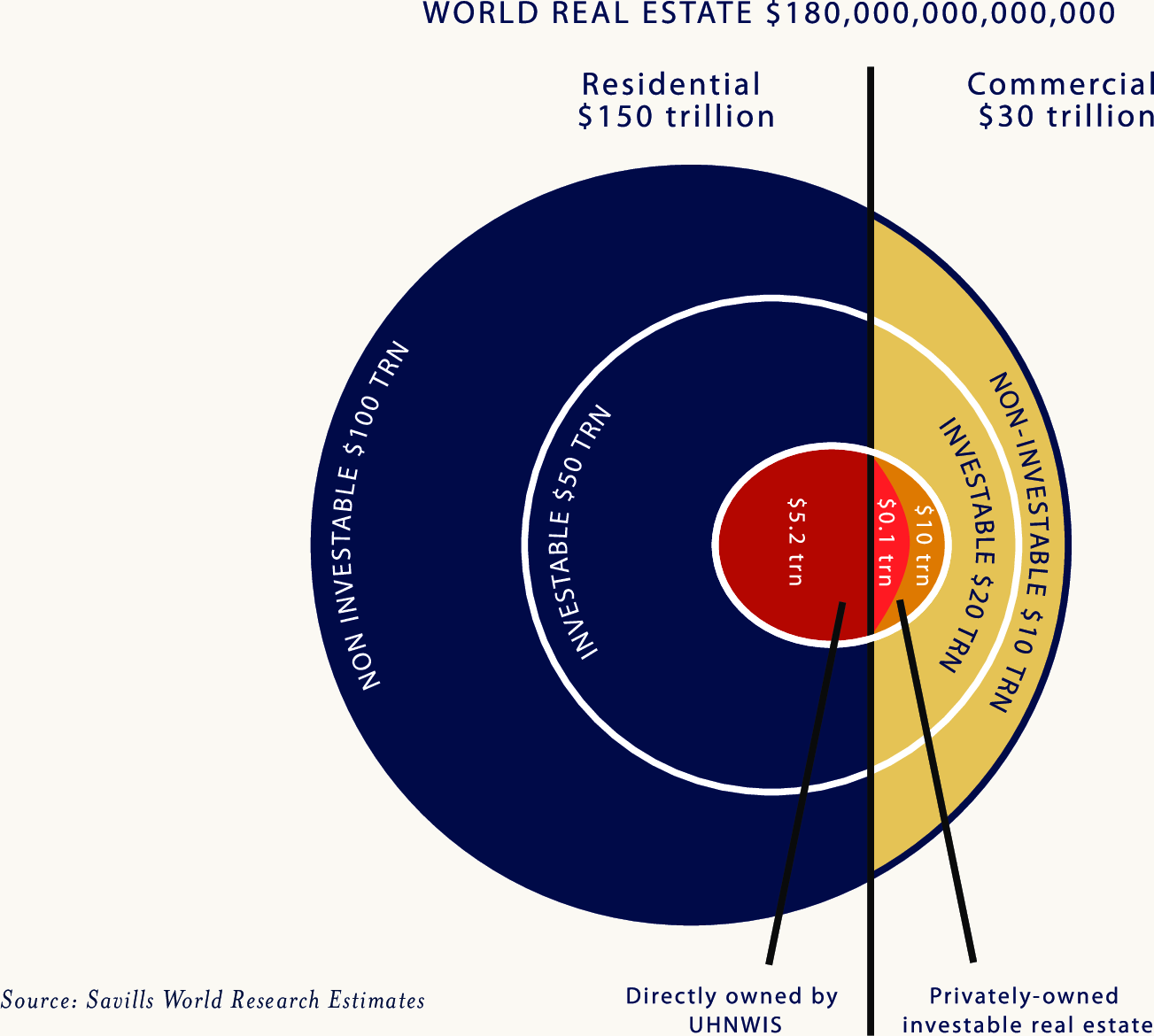

If one wants to transfer resources into the future, how can one do this? Here’s the list:

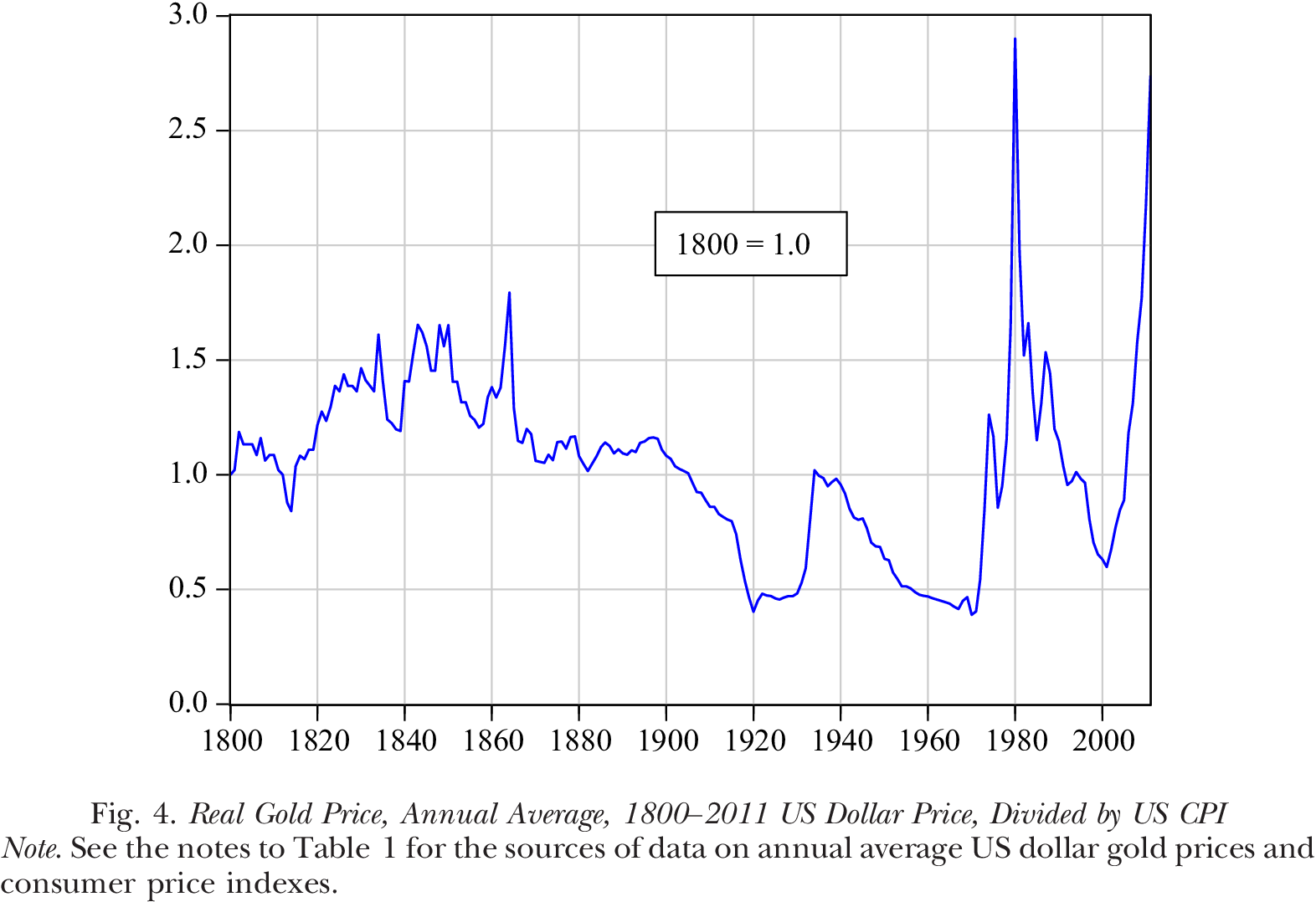

Gold.

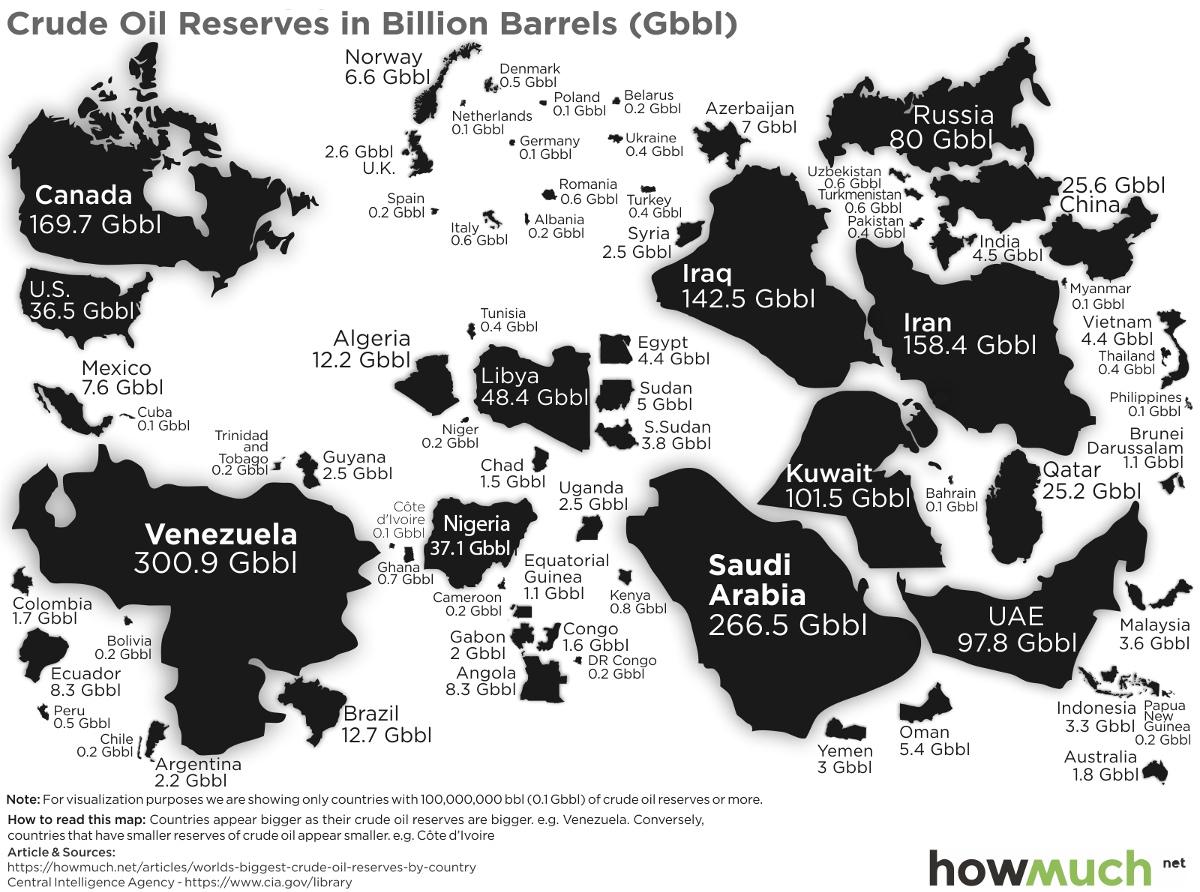

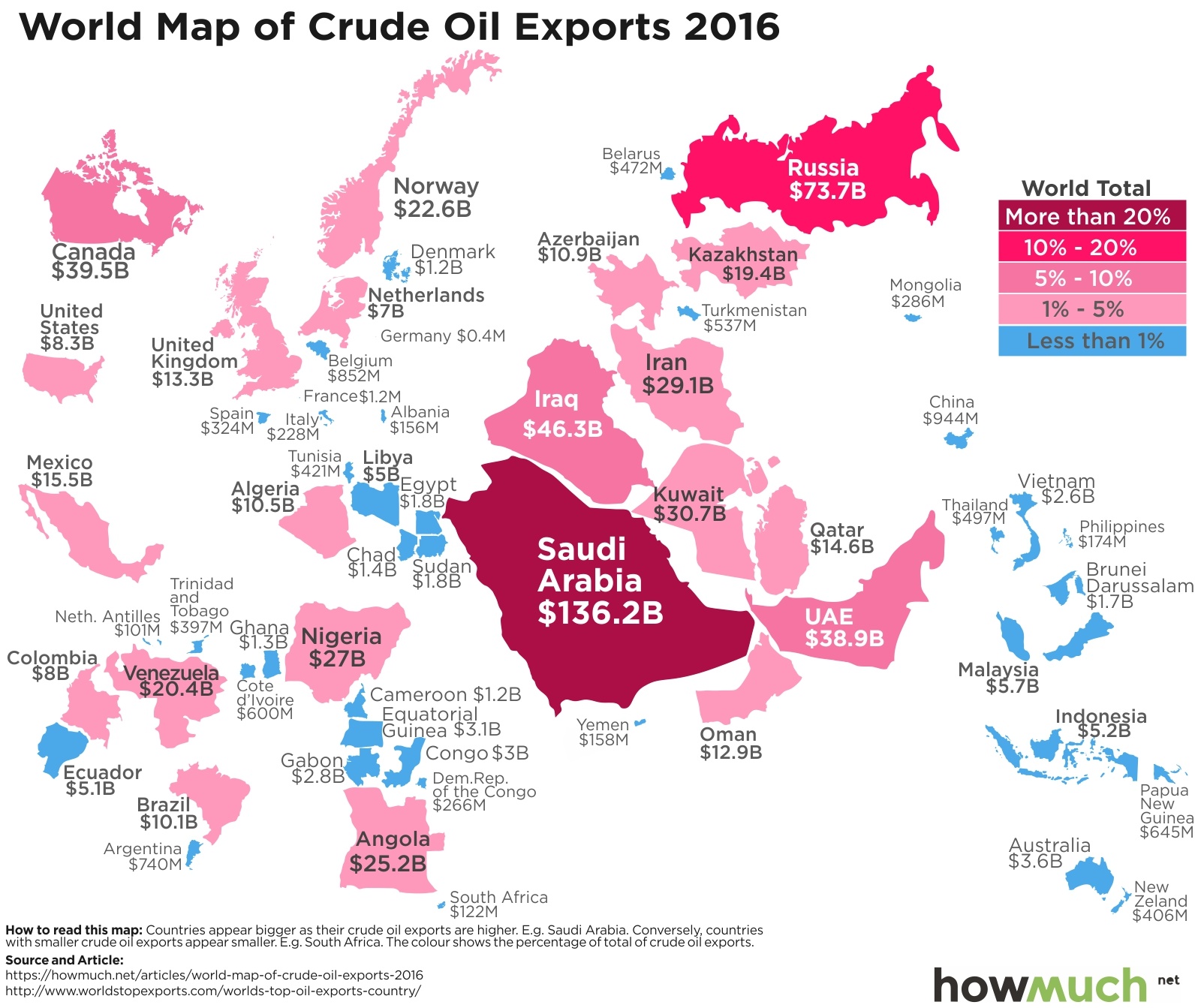

Oil.

Residential property.

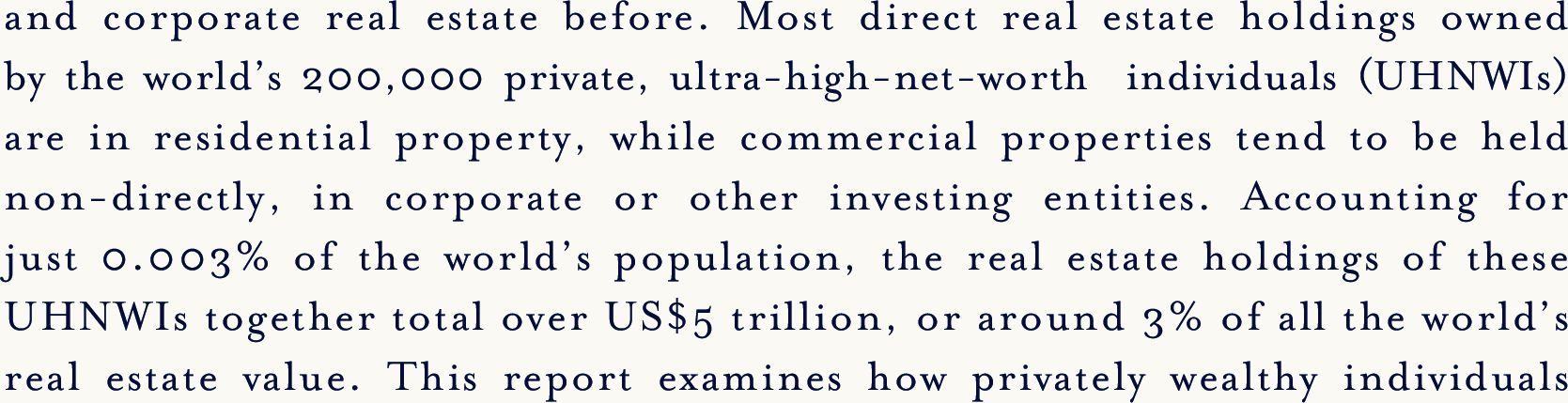

1.73 trillion barrels in soil.

World uses 95 million barrels per day = 34 billion barrels per year.

Enough to last another 50 years.

Say value is $65/Barrel: \[\boxed{\text{Proven Oil Reserves} = 112 \text{ Tn Dollars}}\].