Open Economy

Intermediate Macroeconomics - UCLA - Econ 102

François Geerolf

November 30, 2020

Introduction

Introduction

Theoretical analysis: I favored the “Keynesian cross” version of Keynesian economics. (as opposed to say, IS-LM, or the Mundell-Fleming model)

This deck of slides will justify why I teach this particular version of the Keynesian model. I believe that it’s what explains the data best.

It also corresponds much more to Keynes’ original ideas I believe.

Although some implications of this type of thinking are close to mercantilism (e.g. Hobson) - which have been historically opposed to free trade.

Data

Exchange Rates

Current Accounts

Current Accounts

Net International Investment Positions

Effets of Fiscal Policy on Current Accounts

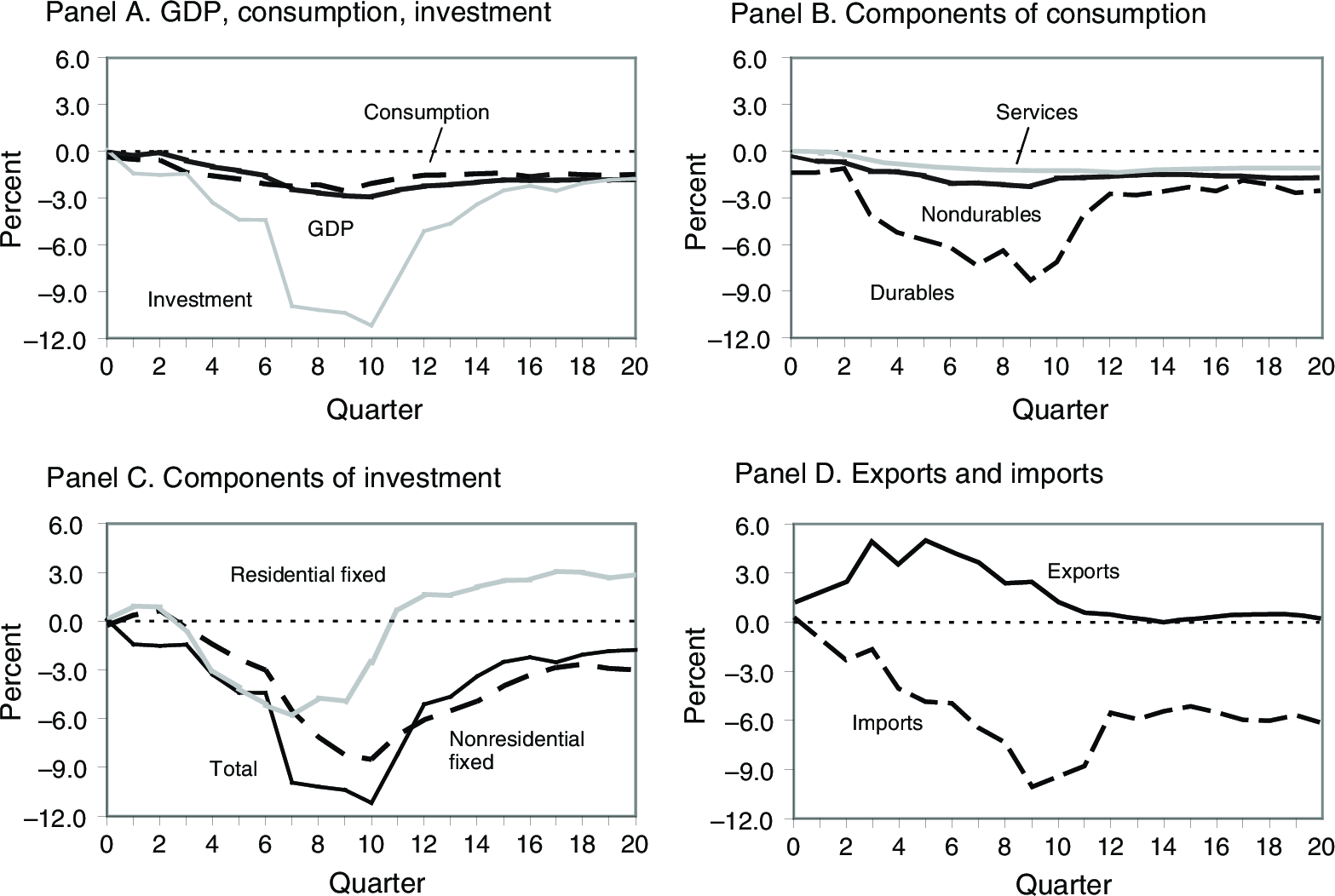

Idea

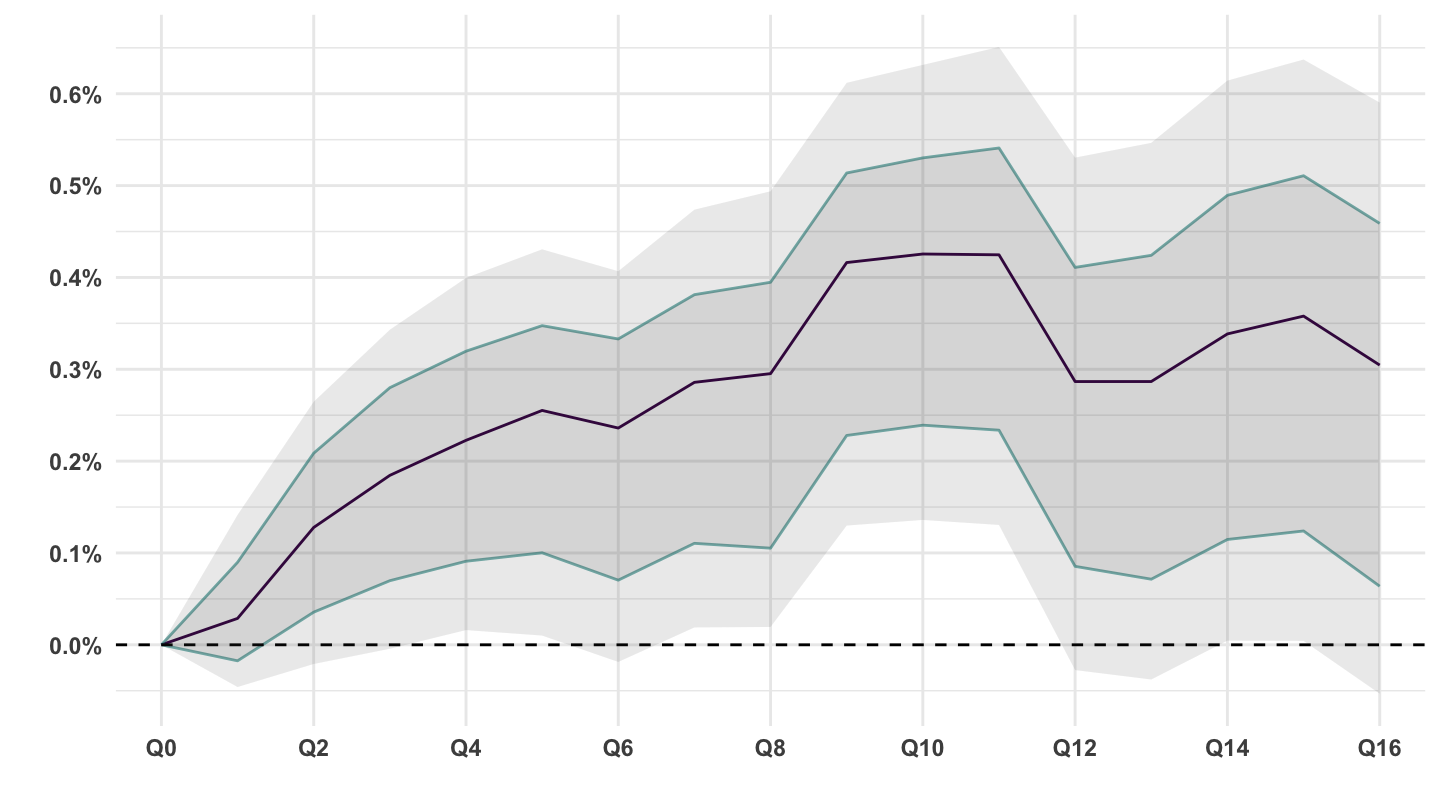

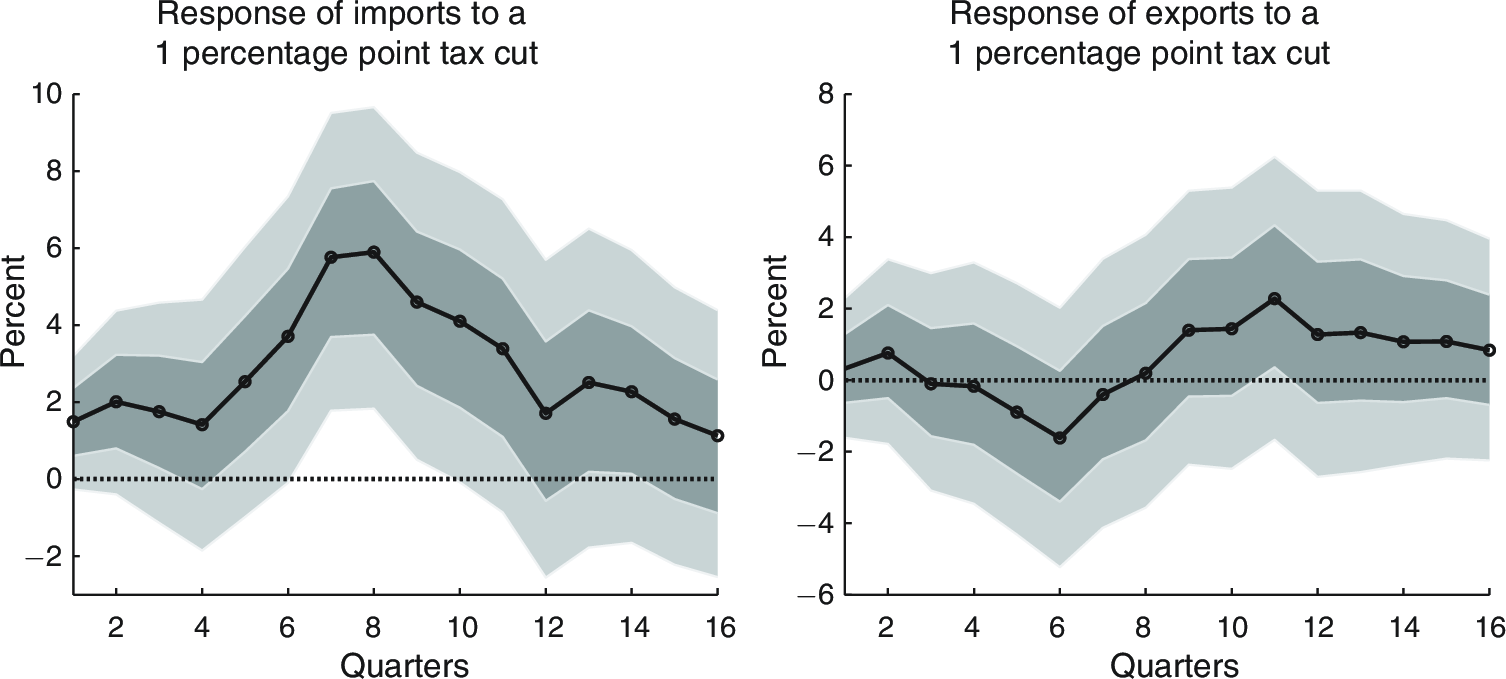

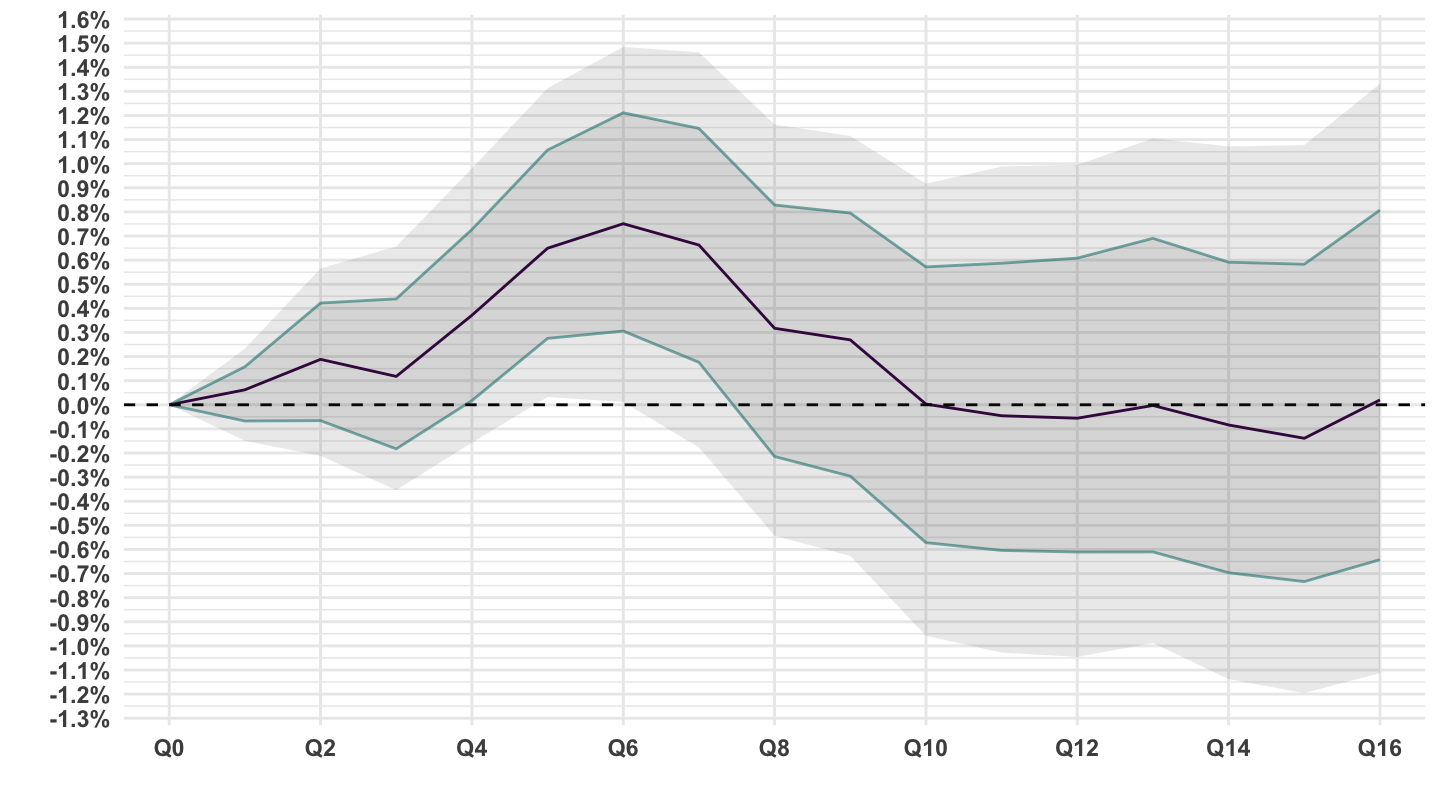

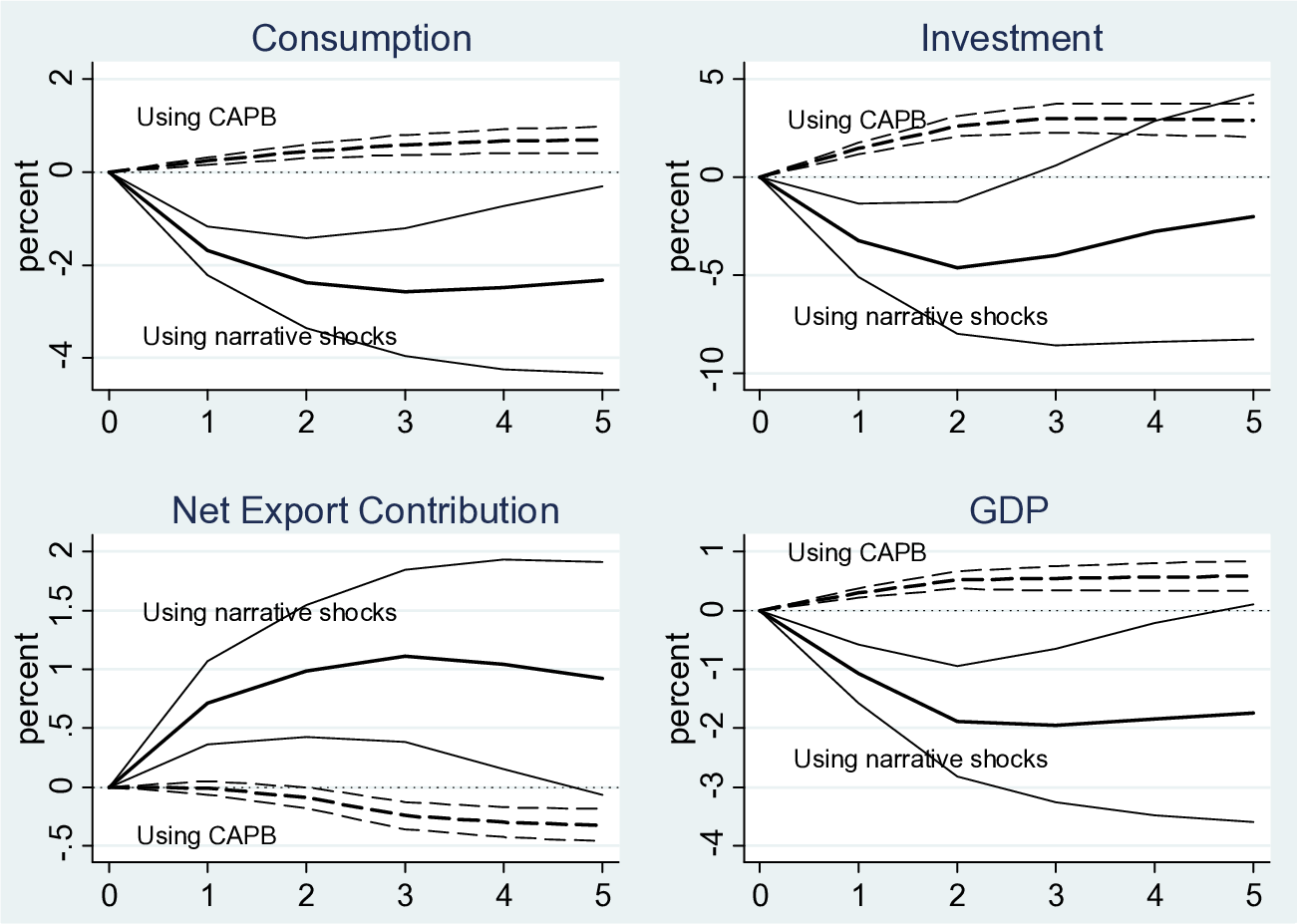

An Empirical method is used to isolate “fiscal shocks” using the narrative record.

I trace out the cumulative response to a 1% of GDP increase in taxes. (so a recessionary shock)

According to the model we’ve seen, it should lead to: lower investment, lower consumption, lower imports, and unchanged exports.

I will show you data coming from multiple different studies: Romer and Romer (2010) on the United States, Cloyne (2013) on the United Kingdom, Guajardo et al. (2014) on a sample of OECD Economies.

Romer, Romer (2010) - Paper

Romer, Romer (2010) - Replication

Cloyne (2013) - Paper

Cloyne (2013) - Replication

Guajardo et al. (2014)

Some U.S. Data

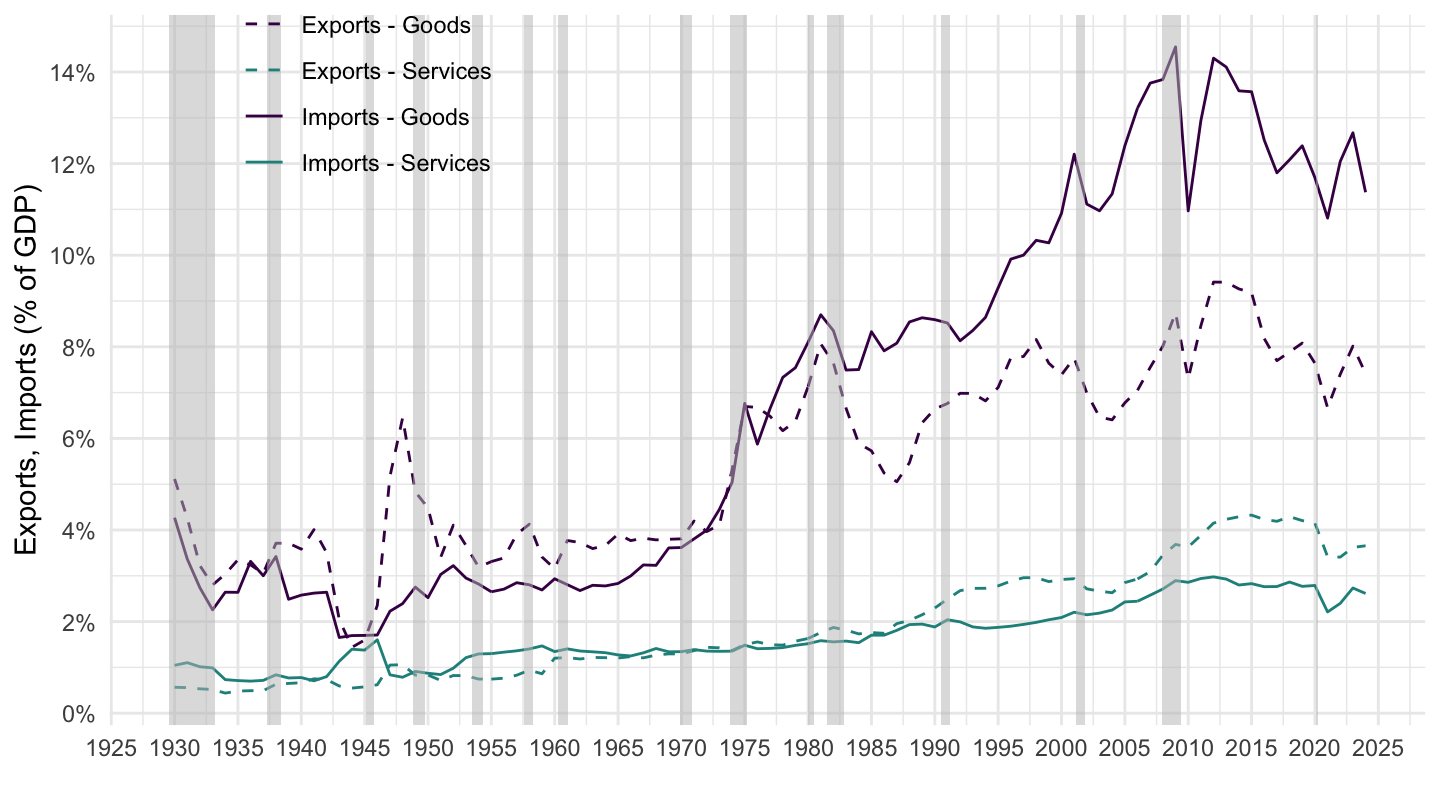

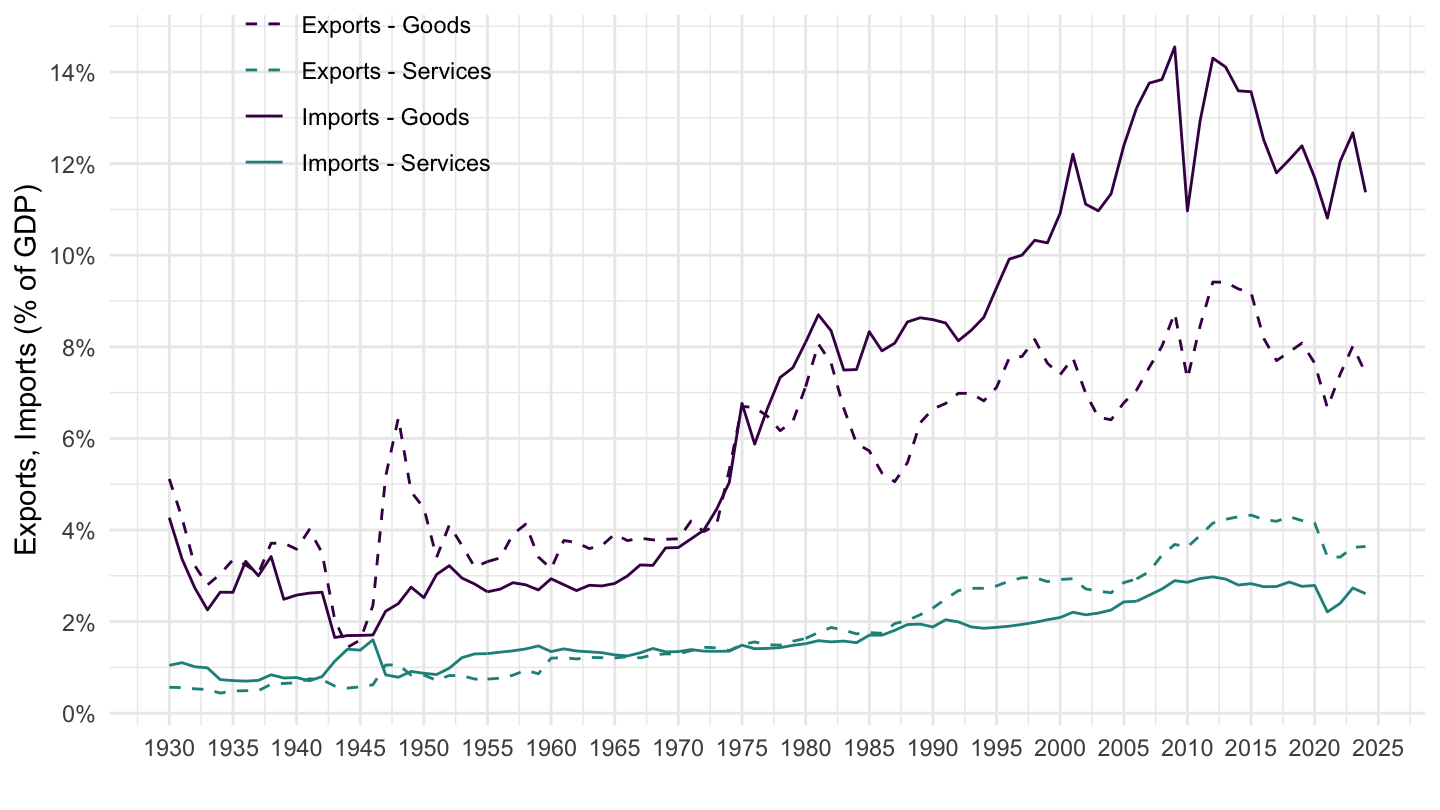

Exports, Imports (% of GDP)

Exports, Imports, Goods and Services (% of GDP)

Net Exports (% of GDP)

Exports in Goods and Services (Source: OECD)

Quotes from Keynes

Open economy

Four main sources of information:

Chapter 10 in The General Theory.

Proposals for a Revenue Tariff - March 7, 1931.

On the Eve of Gold Suspension - Sept 10, 1931.

Chapter 23 in The General Theory. (Keyes (1936))

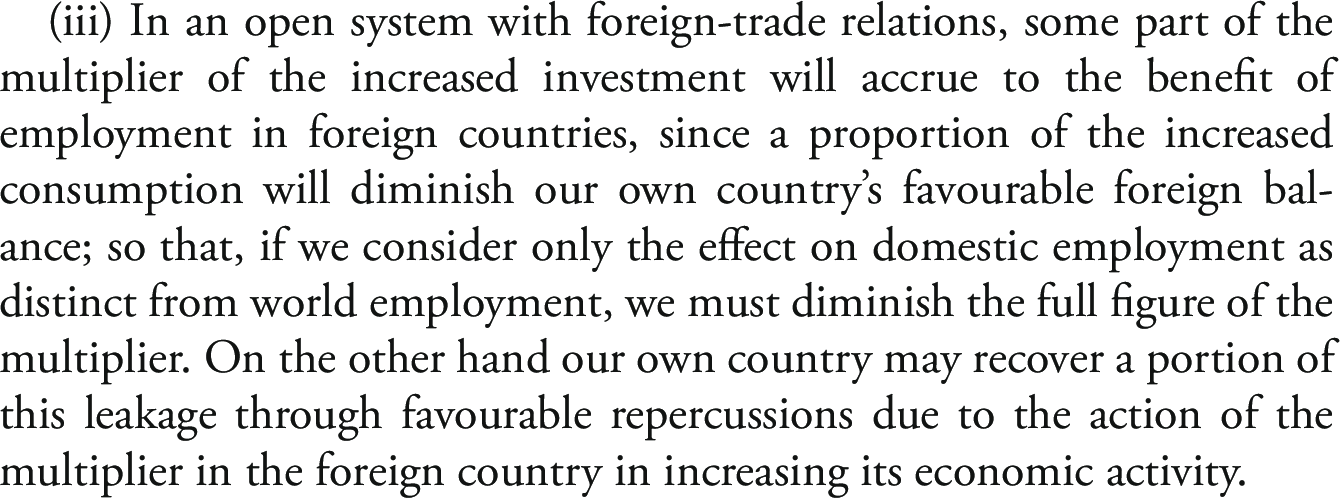

Keyes (1936) - Chapter 10

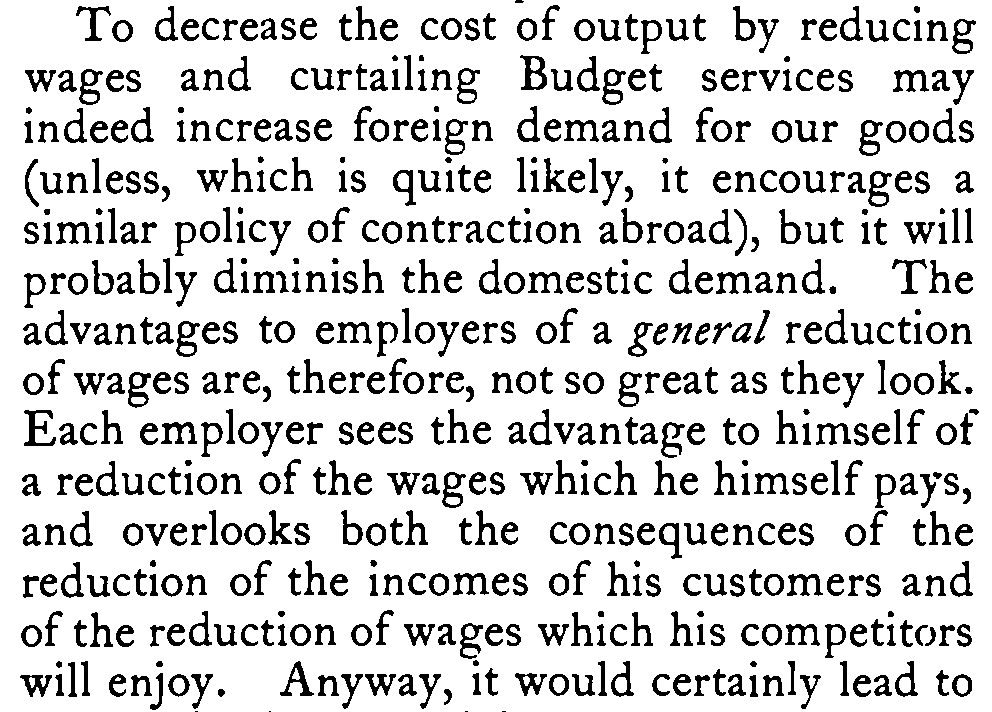

Keyes (1931) - Proposals for a Revenue Tariff

Keyes (1931) - On the Eve of Gold Suspension

Chapter 23 of the General Theory

Keynes: Protectionist Policies?

In terms of the model we wrote: the idea is to influence \(m_1\): the propensity to import. Why? Because when you do a stimulus, you stimulate other countries too. By introducing a tariff, you may make other countries’ traded goods more expensive, and favor your own ones.

Of course, the problem is that it distorts trade, and can lead to crony capitalism (as some specific firms ask to be exempted from tariffs).

An alternative way to influence \(m_1\) is to do a devaluation: if prices do not move immediately in response, then you also make your own products more competitive by doing so. (as I said we’ve abstracted from exchange rate considerations)

Hobson - Imperialism

Surplus or Debtor Countries ?

A question of balance

Compulsory for the debtor, voluntary for the creditor

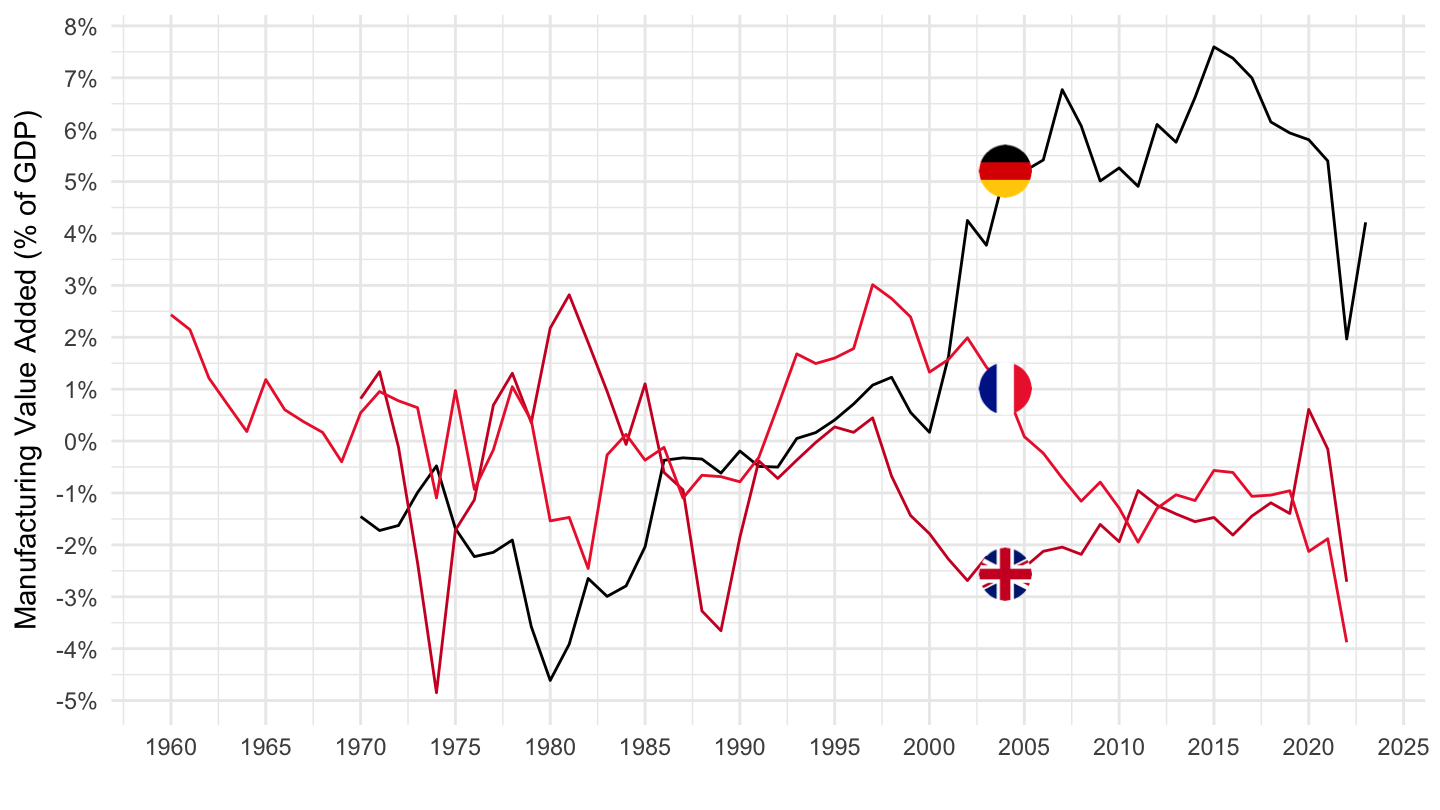

Graph

Compulsory for the debtor, voluntary for the creditor

Compulsory for the debtor, voluntary for the creditor