Inflation, Monetary Policy

Intermediate Macroeconomics - UCLA - Econ 102

François Geerolf

December 2, 2020

Important Data about monetary policy

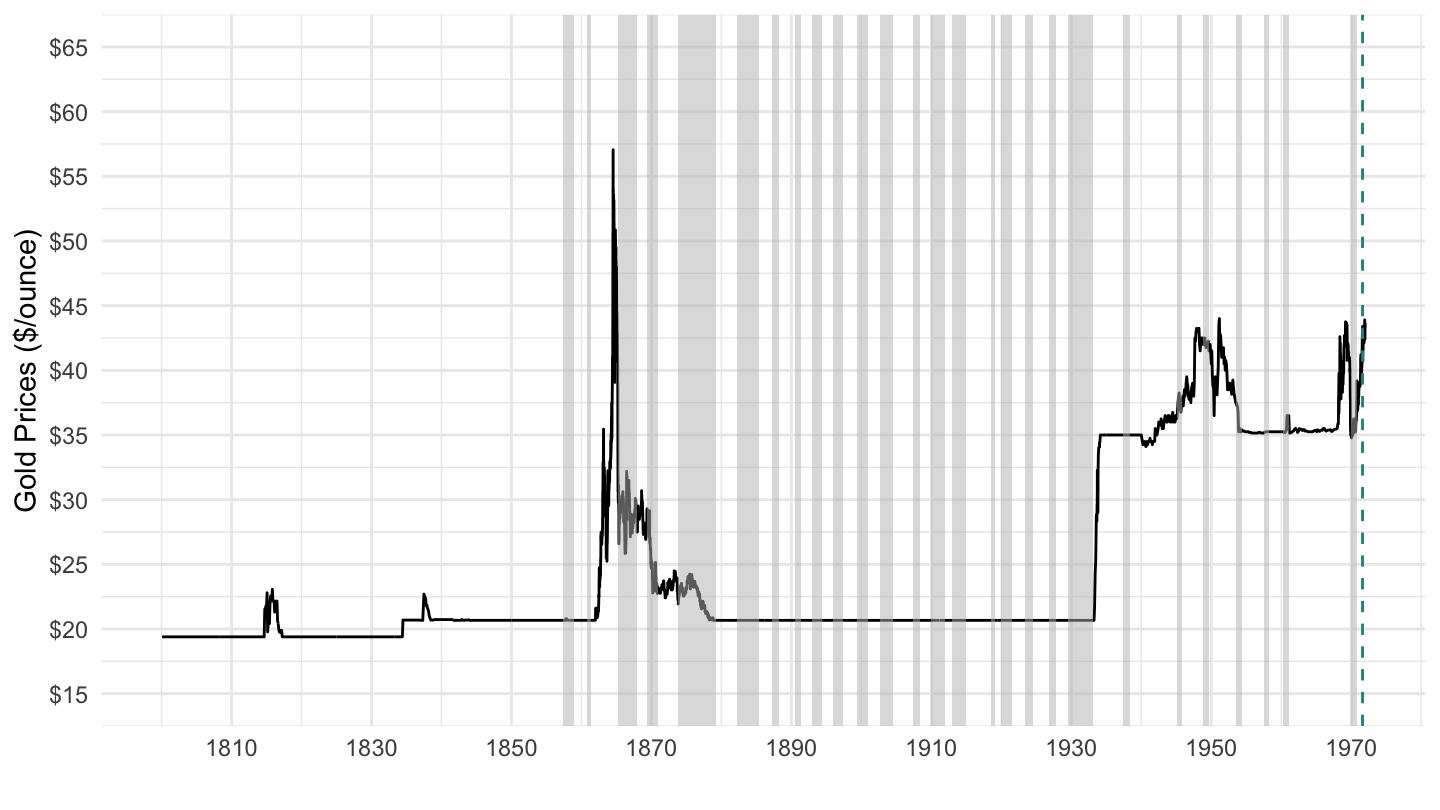

Gold Prices ($/Ounce) 1800-1972

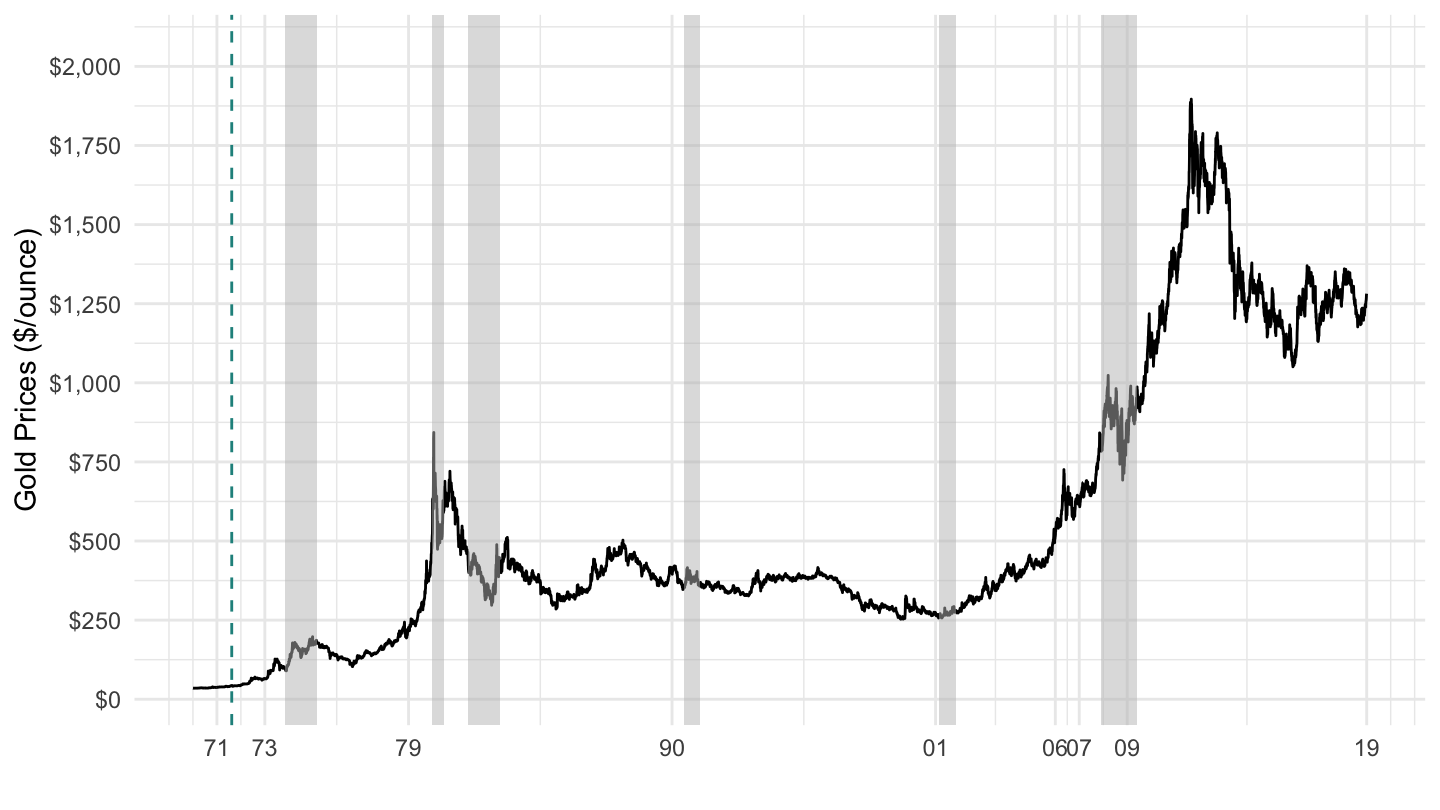

Gold Prices ($/Ounce) 1970-2019

Gold Prices ($/Ounce) 1970-2019

Nixon Address, August 15, 1971

End of Bretton Woods

The end of Bretton Woods between 1971 and 1973 \(=\) start of fiat money.

Inflation targeting vs. exchange-rate targeting (and even better: Gold standard)

Now central banks have a target for inflation. Sometimes also have a “full employment” mandate, but targeting inflation is usually their most important task.

Of course the dynamics of inflation has considerably changed since.

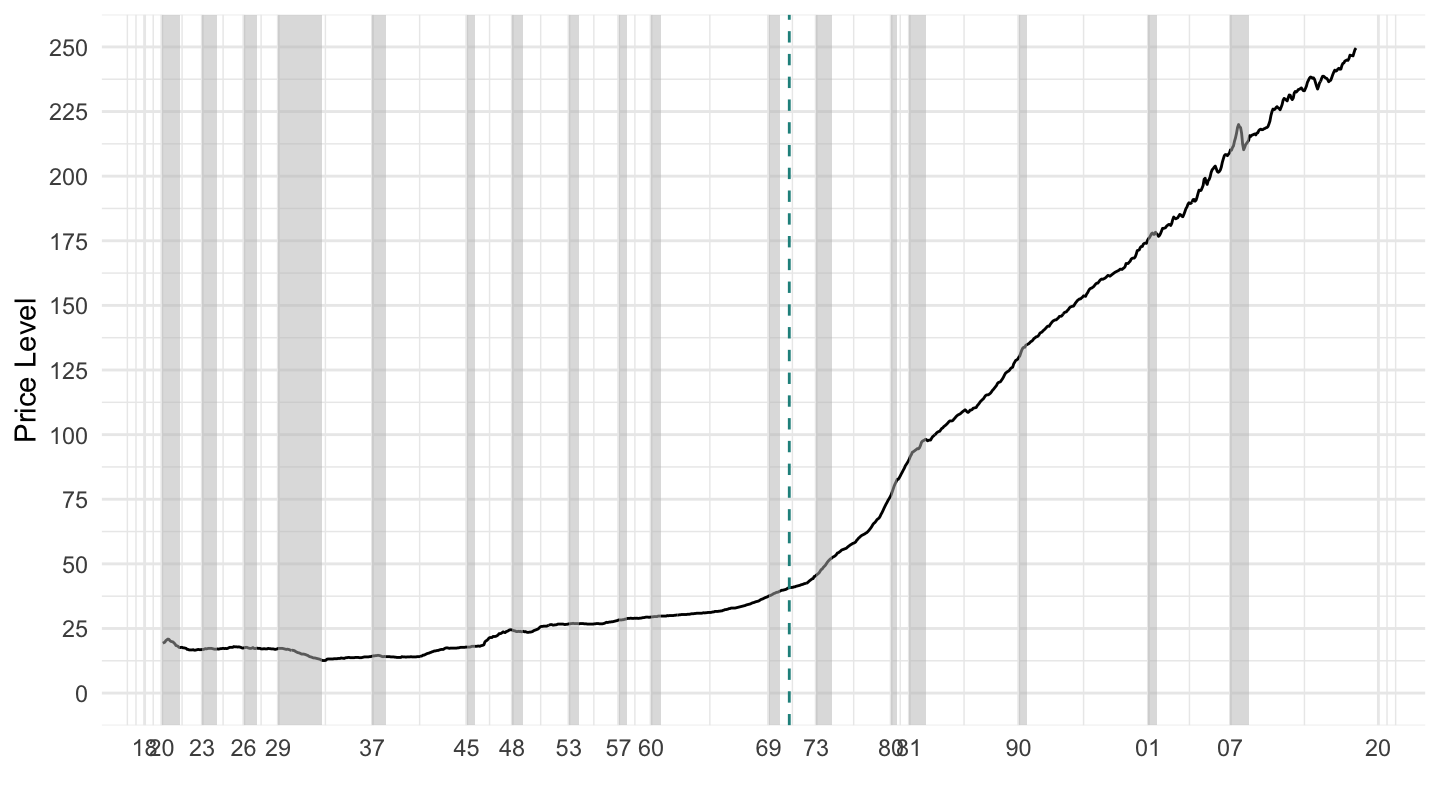

U.S. Price Level 1920-2019

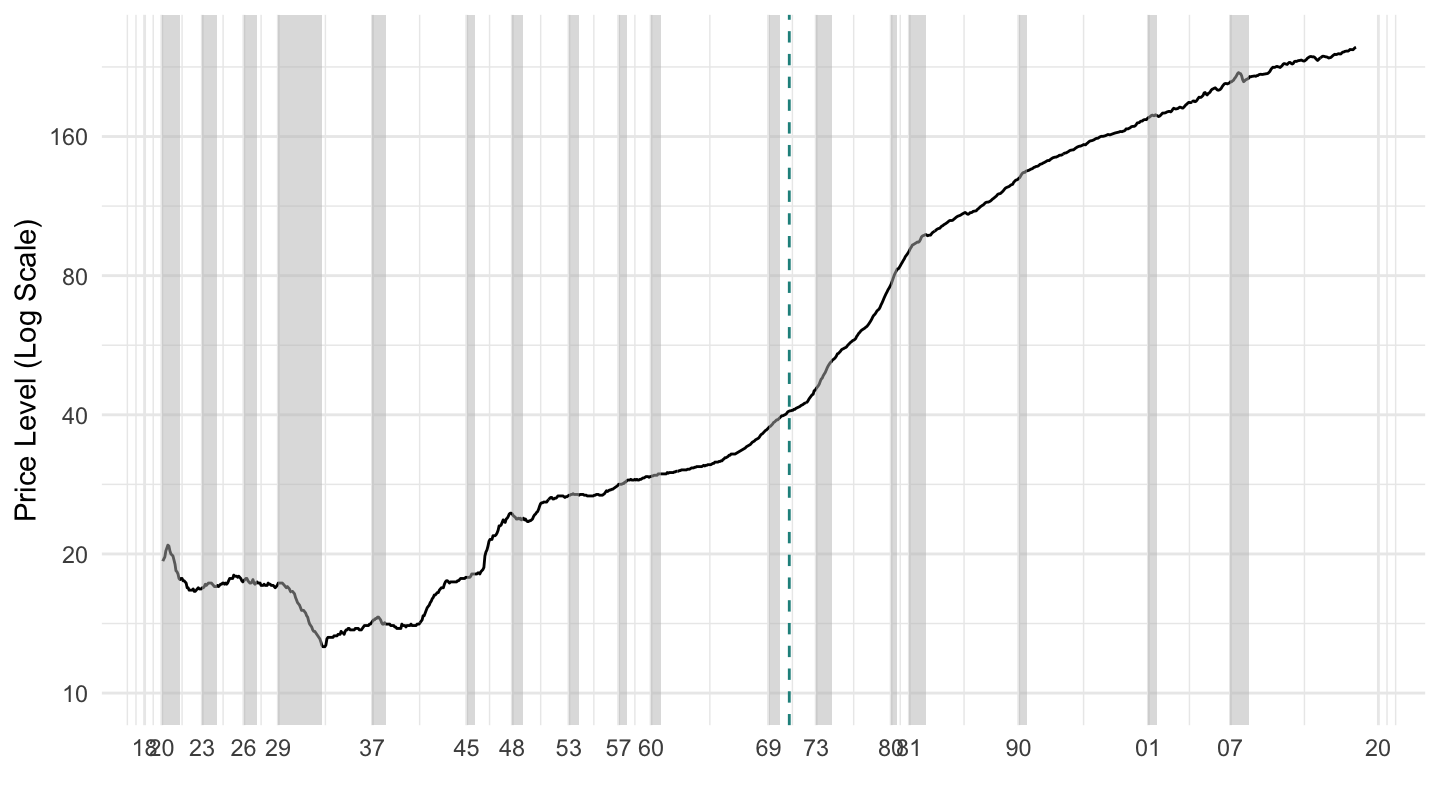

U.S. Price Level 1920-2019 (Log Scale)

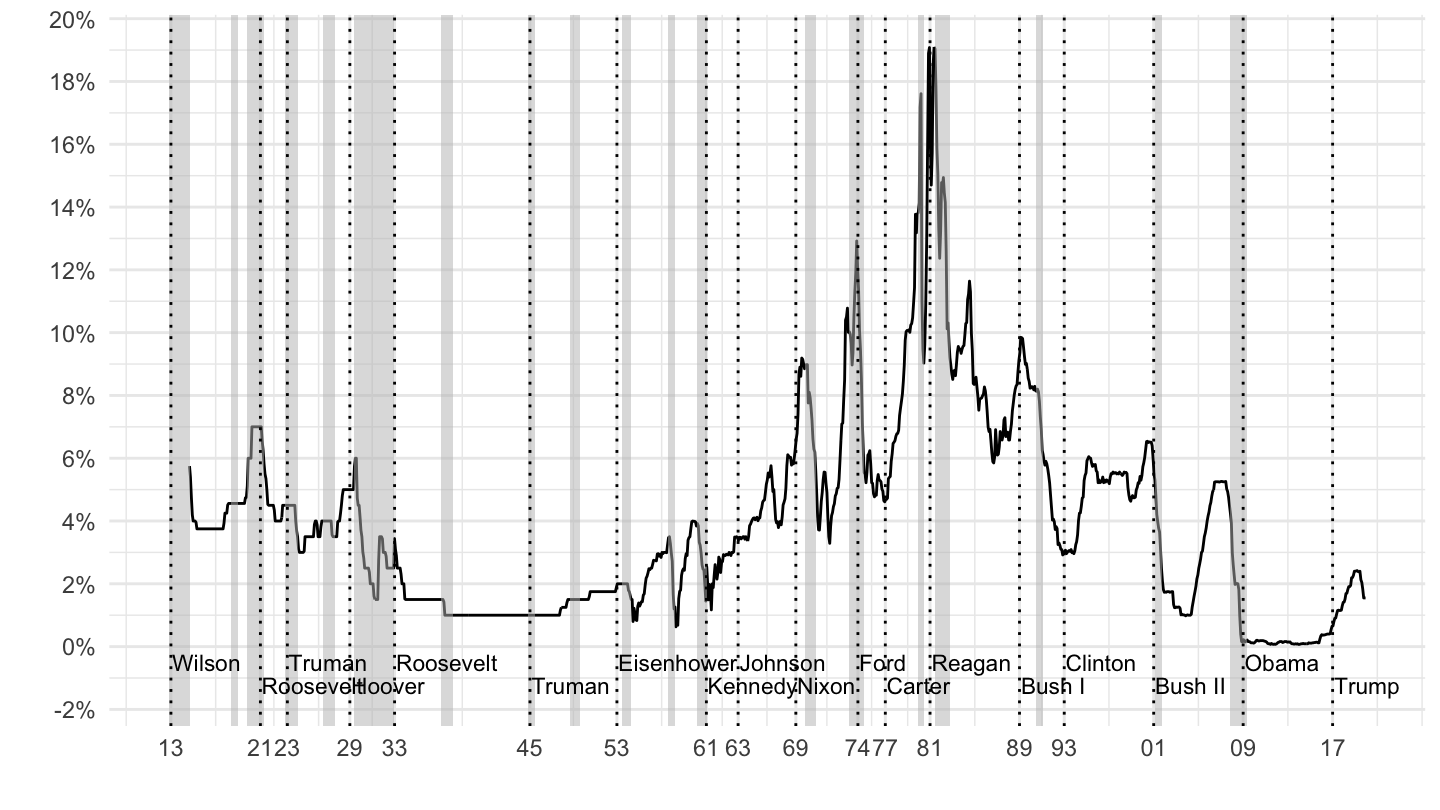

U.S. Fed Funds Rate / Discount Rate (1914-2019)

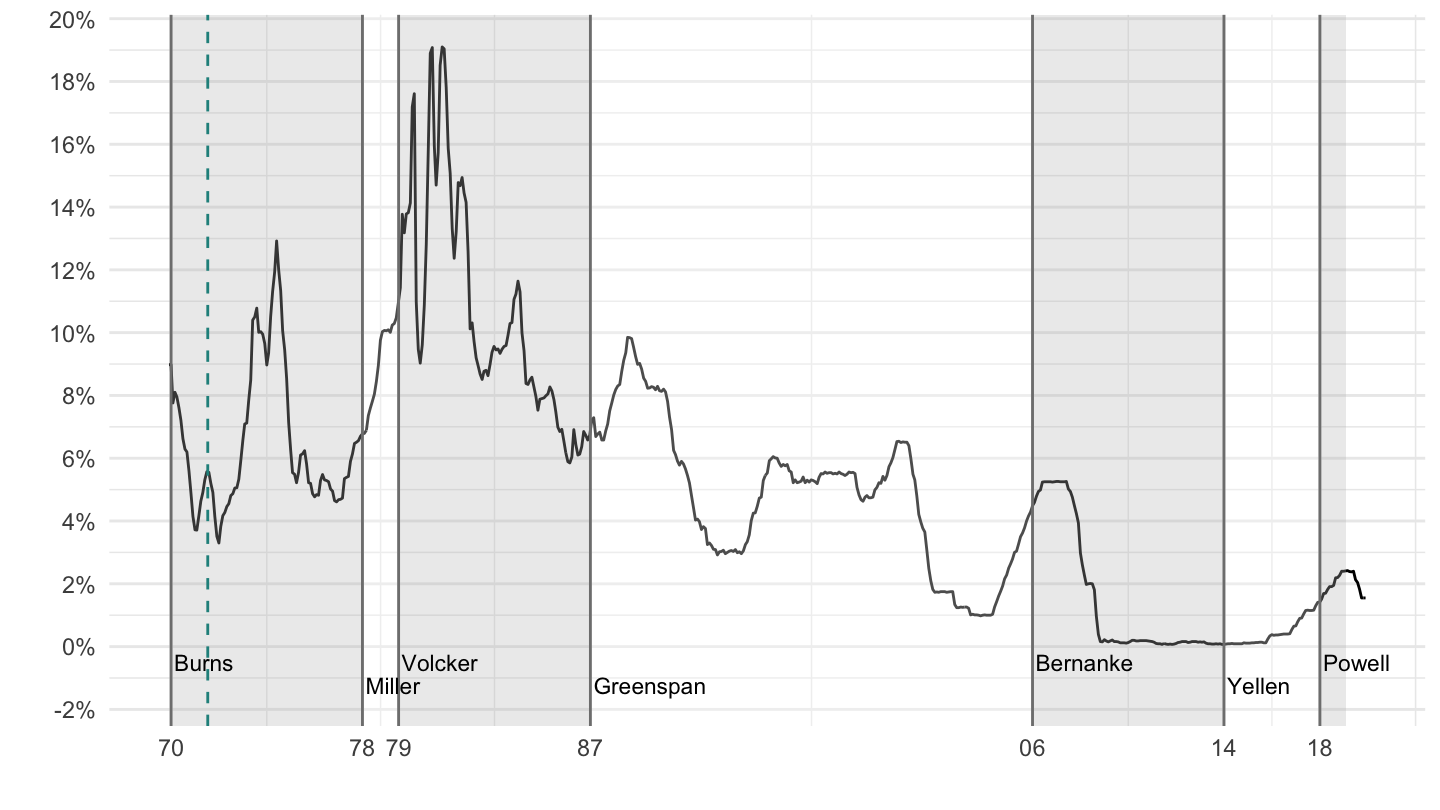

Fed Chairmen / Chairwomen

Fears of hyperinflation

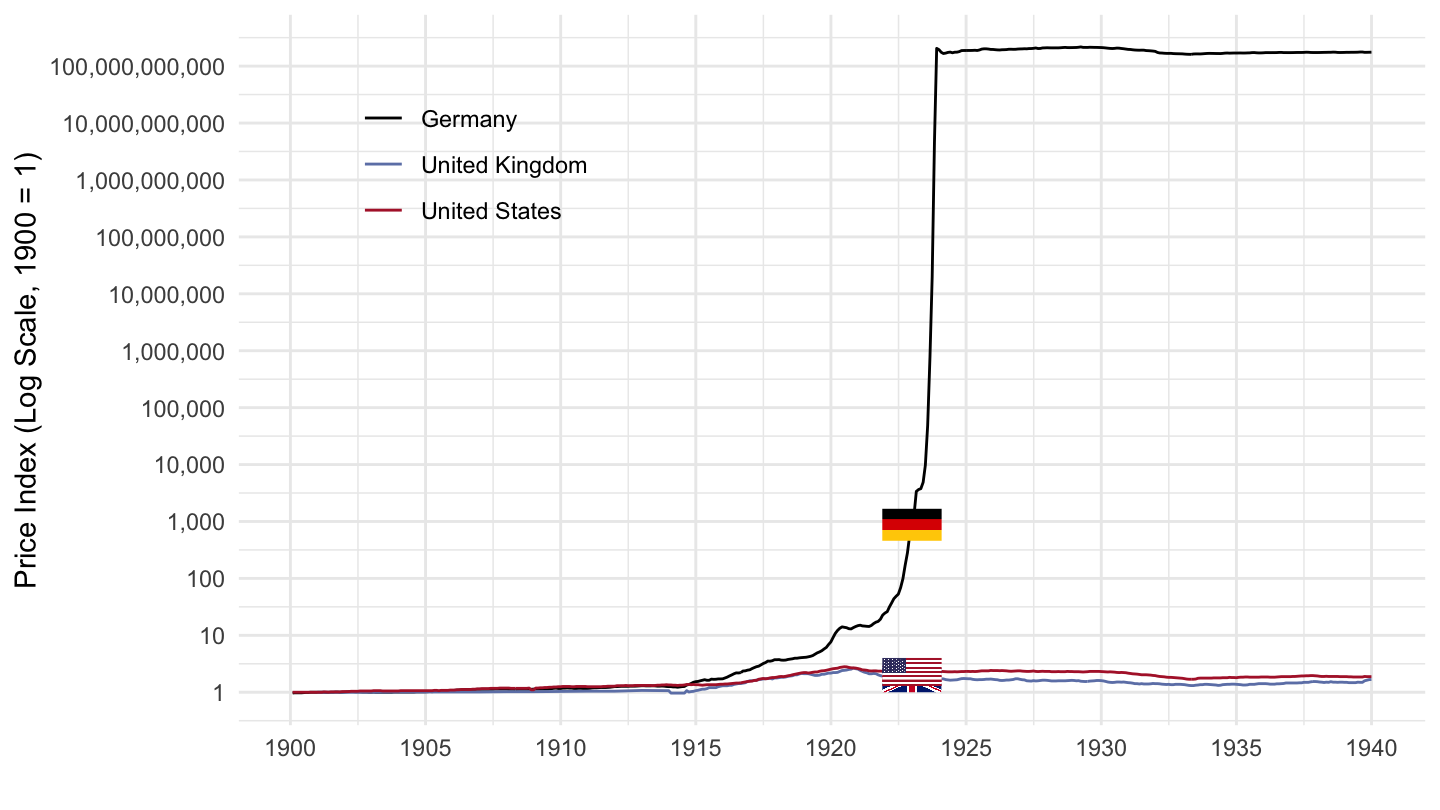

German Hyperinflation: Price Index

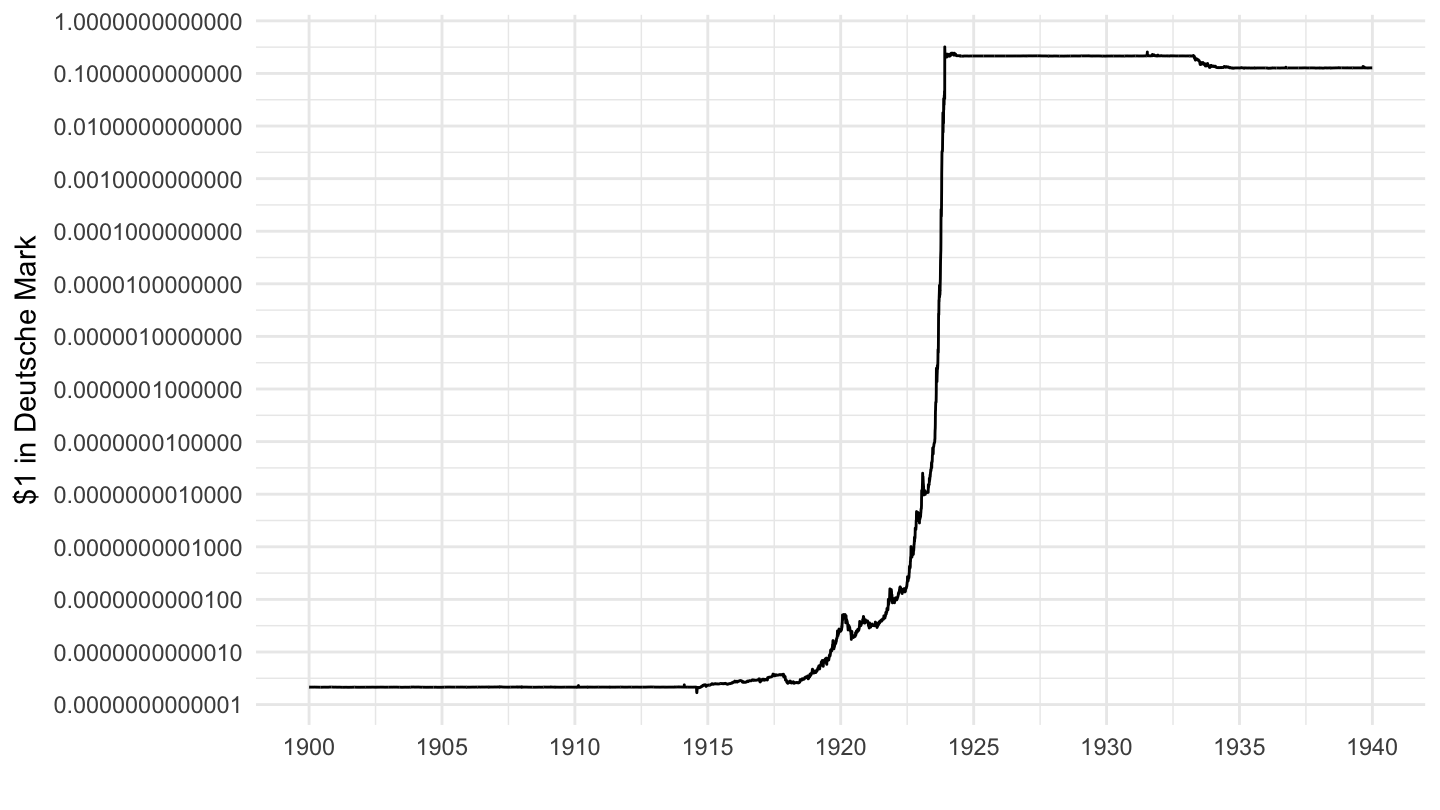

German Hyperinflation: Exchange Rates

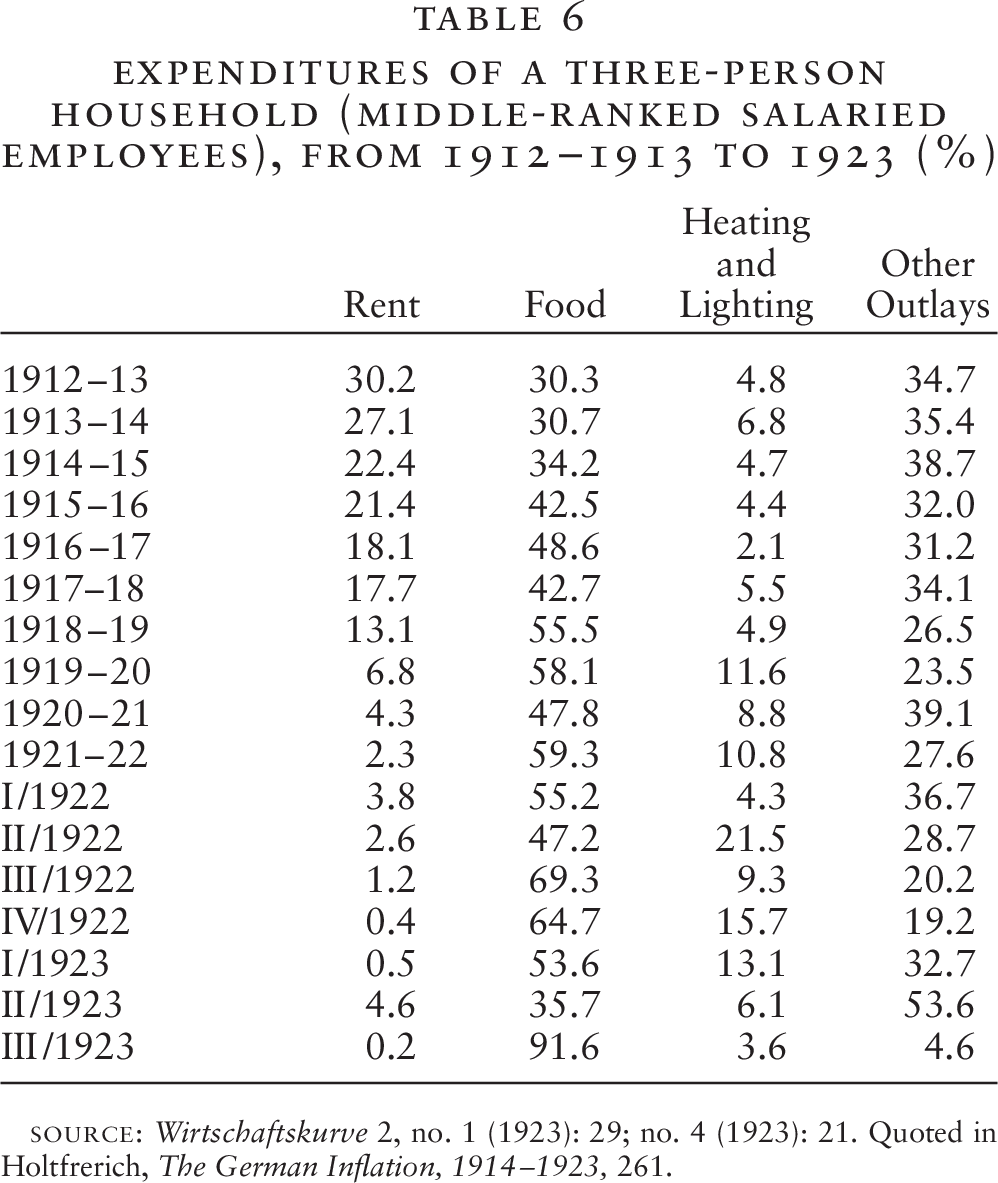

German Hyperinflation in the 1920s

German Hyperinflation in the 1920s

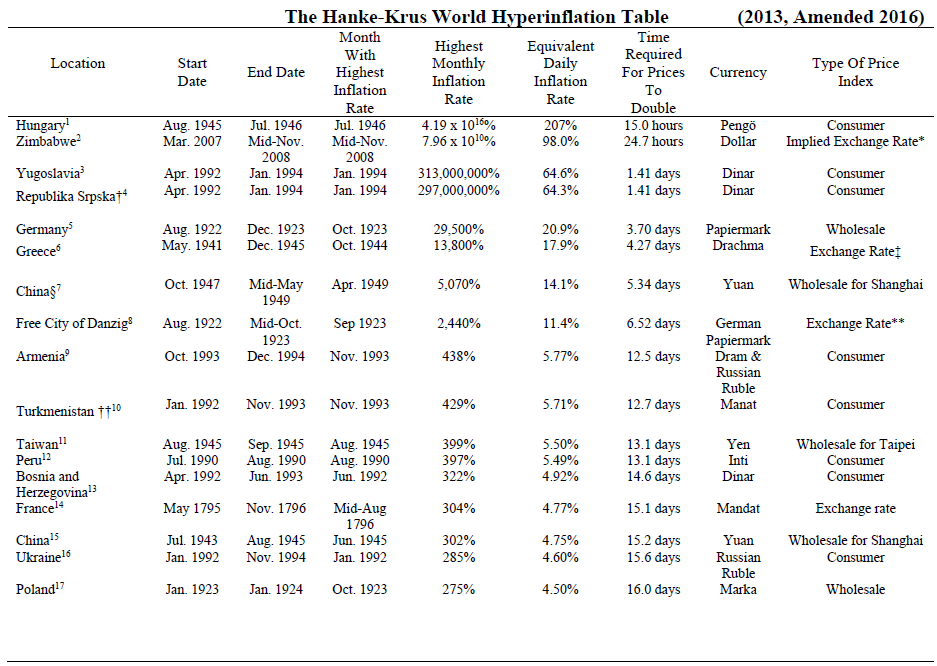

Other Hyperinflations

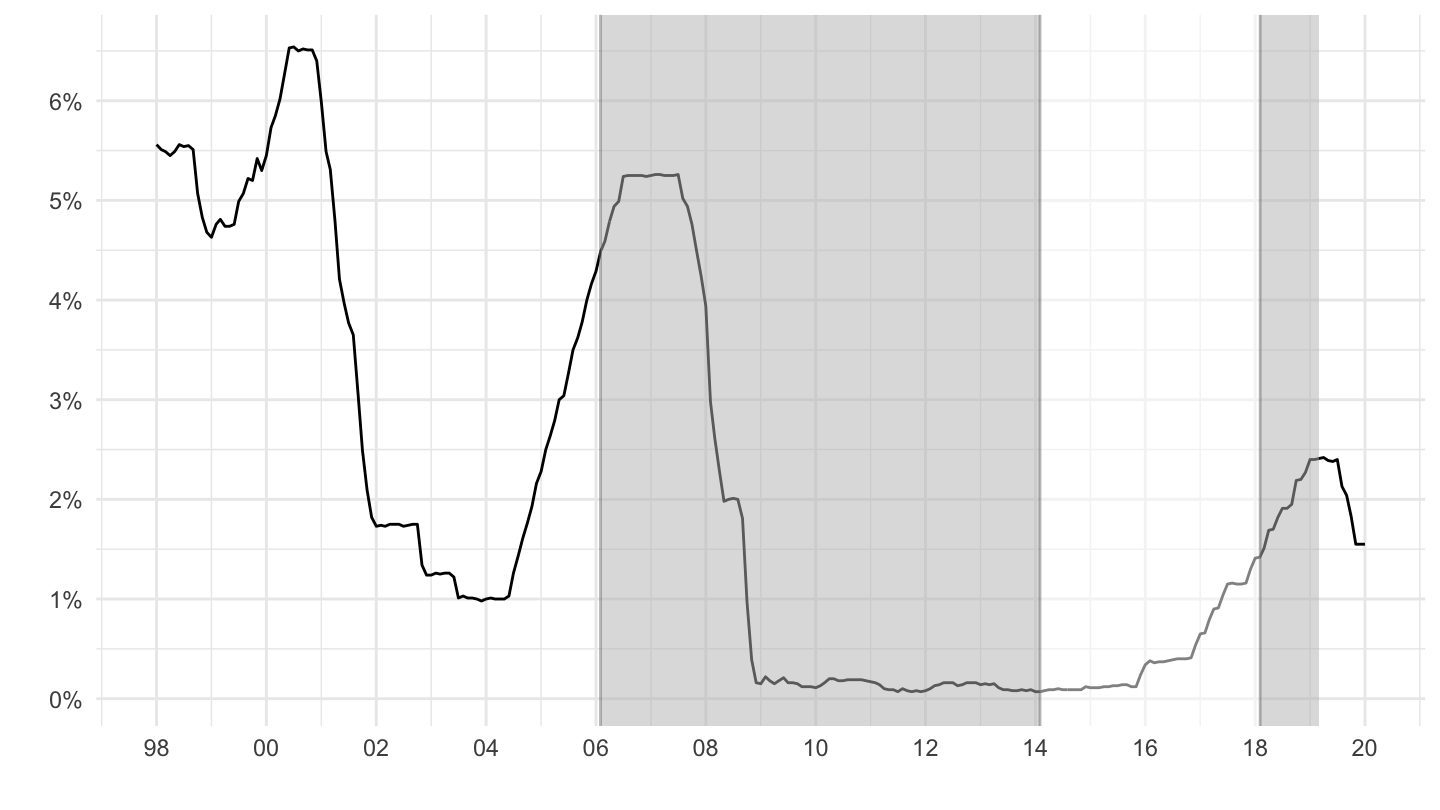

Housing and Monetary Policy: 2000-2015

Low Federal Funds Rates

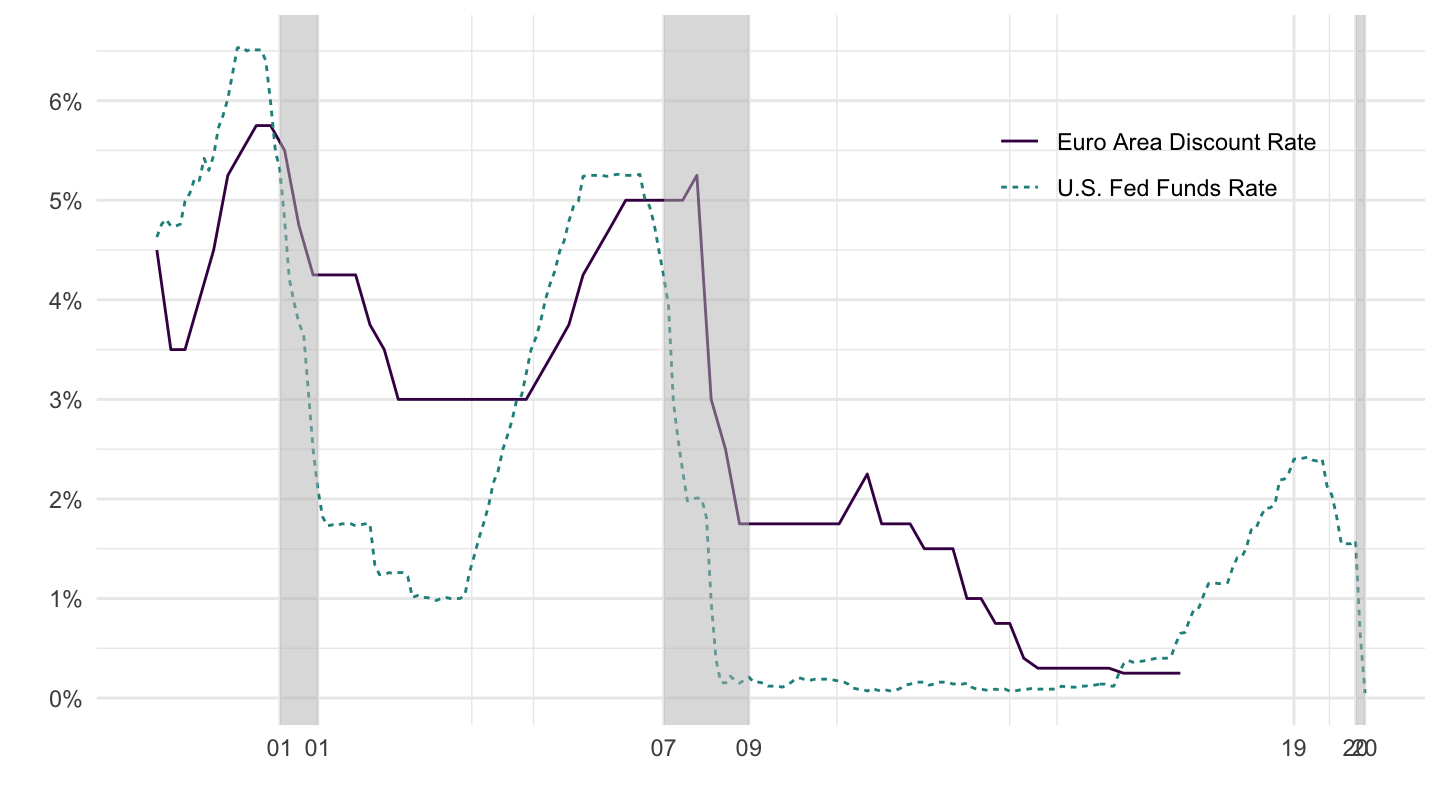

Fed VS ECB

Trichet rate increase

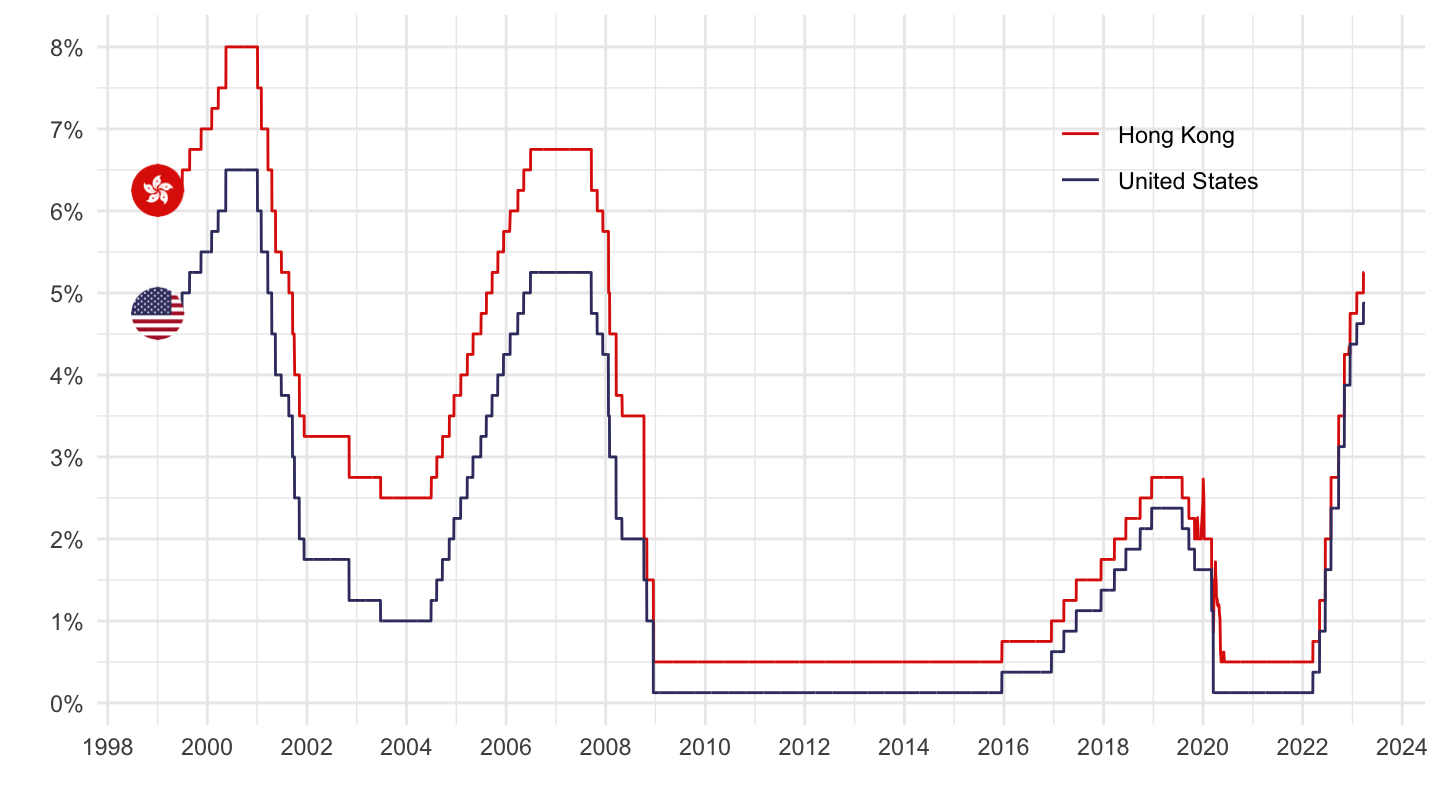

Hong Kong and Fed

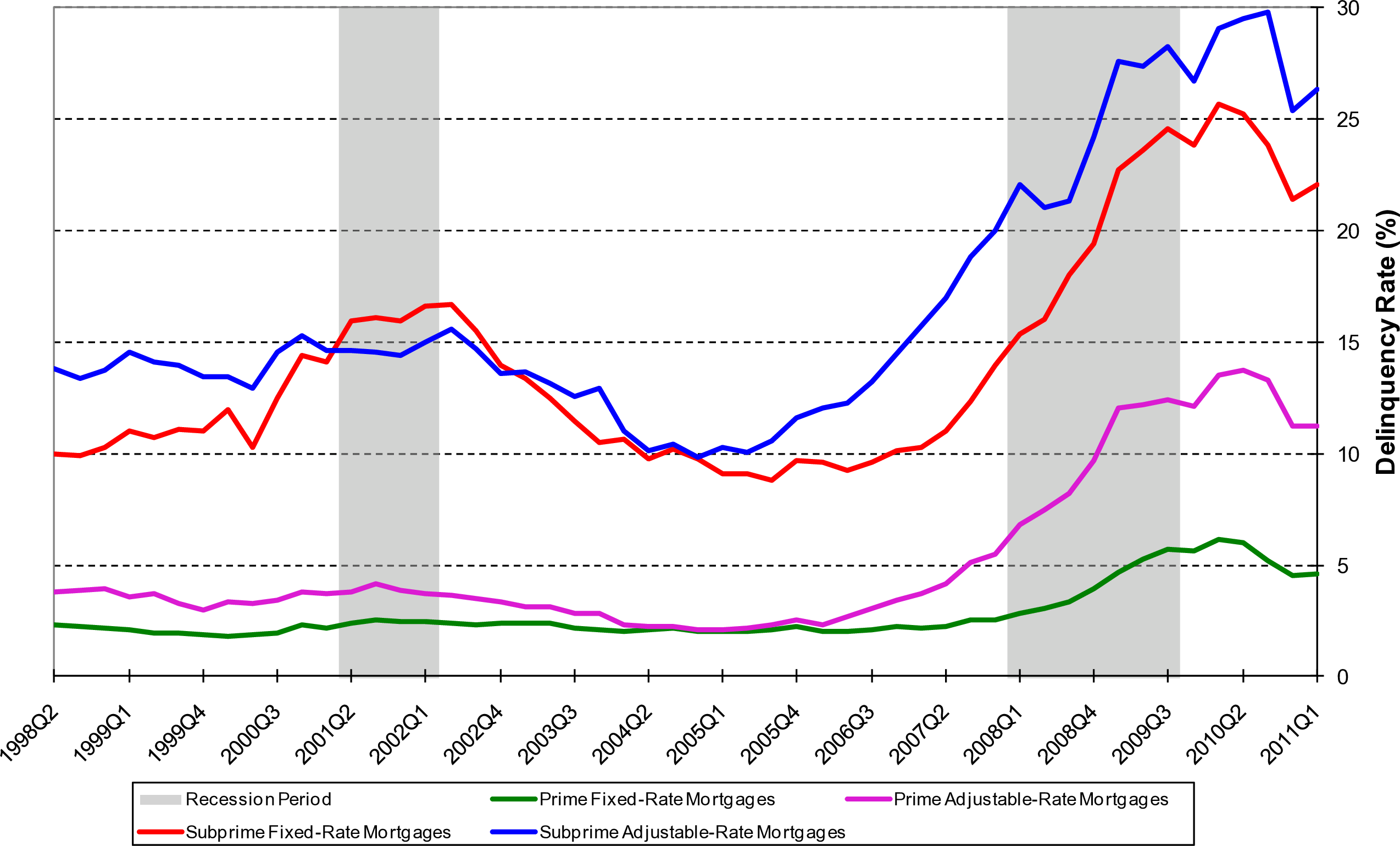

Delinquency Rates on Mortgages: Prime, Subprime, Adjustable, Fixed

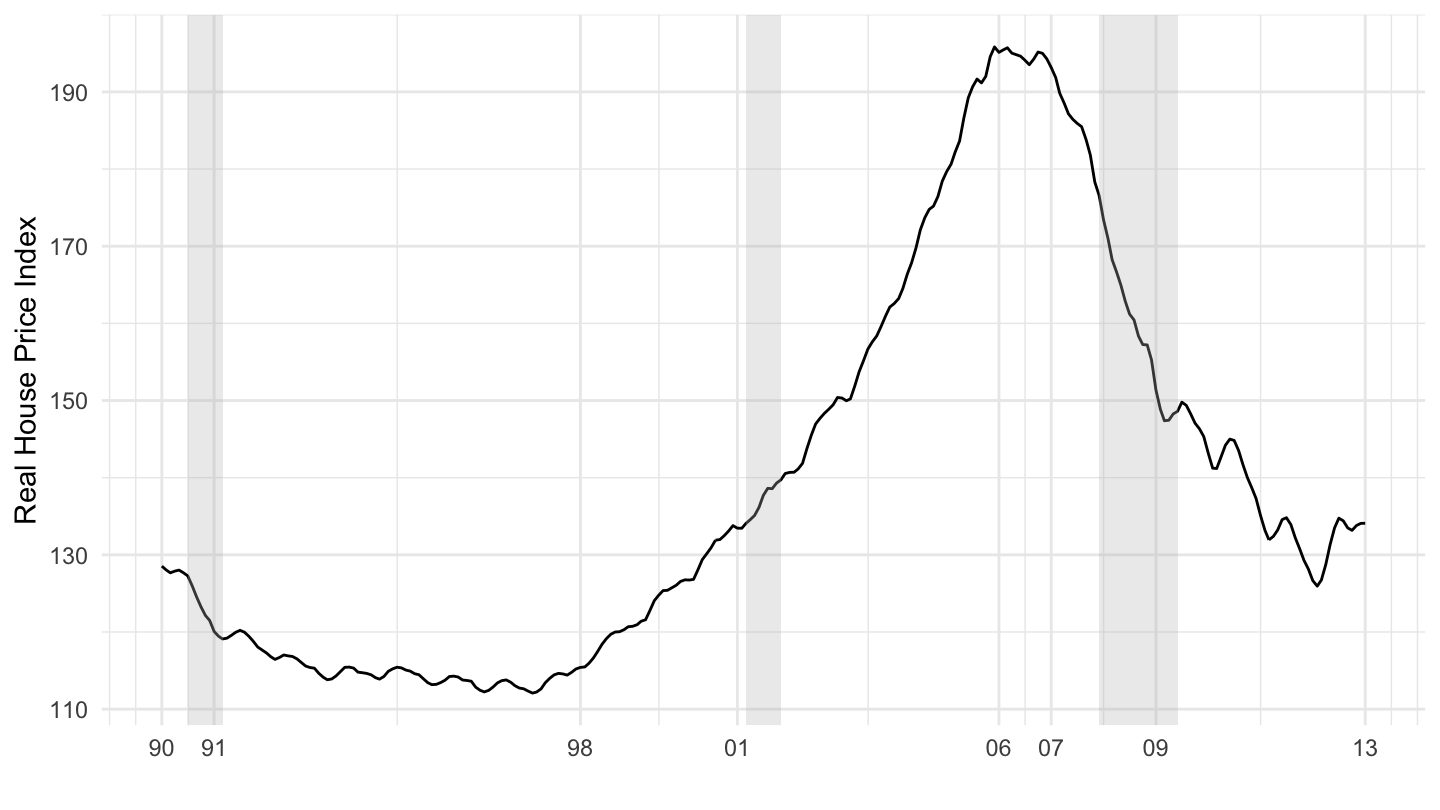

U.S. Real House Prices (1990-2013). Source: Shiller

Current Monetary Policy Issues

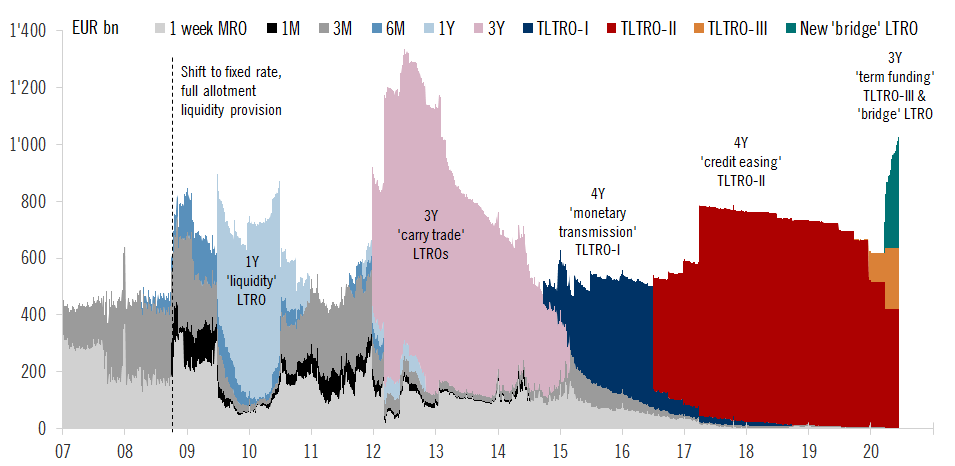

QE: Long Term Refinancing Operations

QE: Long Term Refinancing Operations

Bitcoin

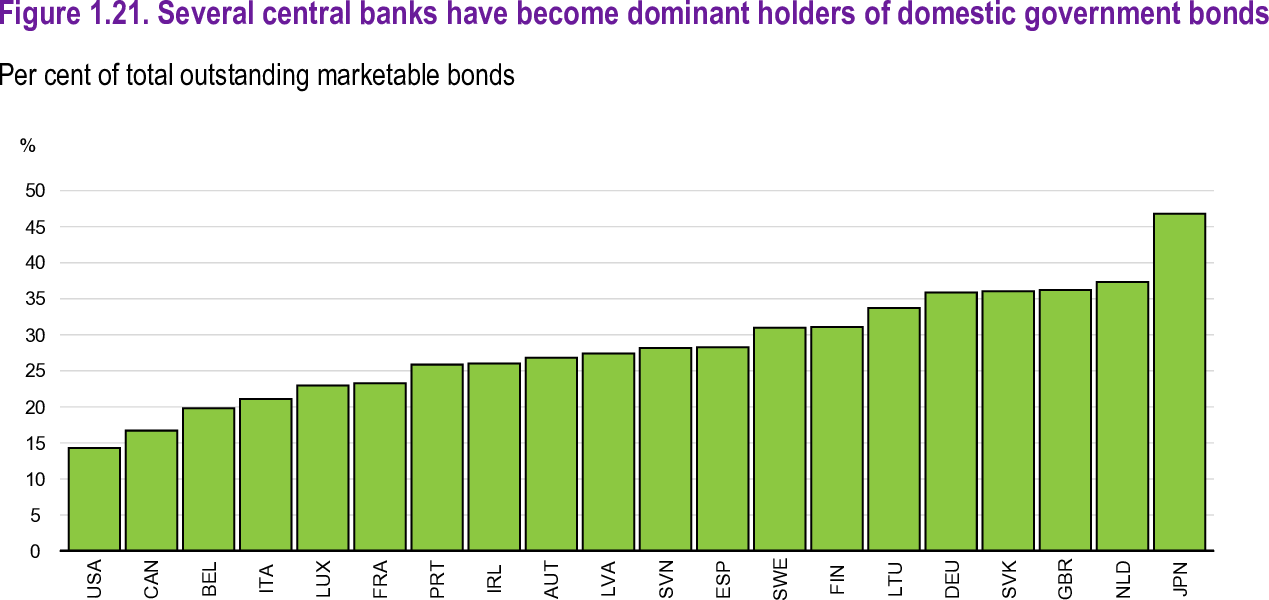

Central bankers have become dominant holders of gvnt’ bonds