2007 - 09 Financial Crisis

Intermediate Macroeconomics - UCLA - Econ 102

François Geerolf

December 9, 2020

Timetable

Video of Ben Bernanke - July 18, 2007

Ben Bernanke - July 18, 2007

4.4% annual first 5 months. (food and energy)

This led the Fed to leave

Worried about inflation

Ben Bernanke - Oct 7, 2008

Federal Reserve’s 2006 Jokes

Underlying cause: Savings glut problem

Inequality Problems (Eisman)

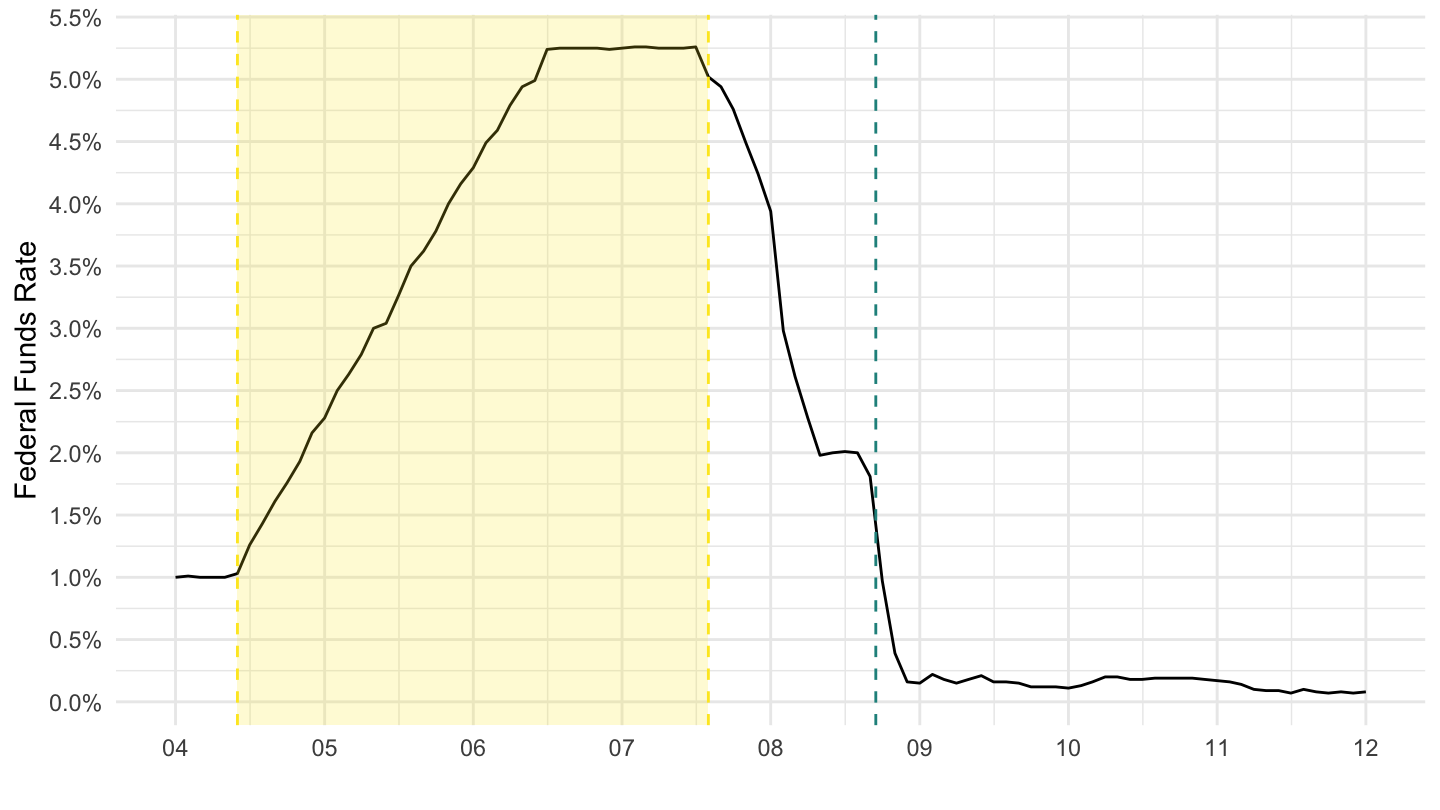

Monetary policy ?

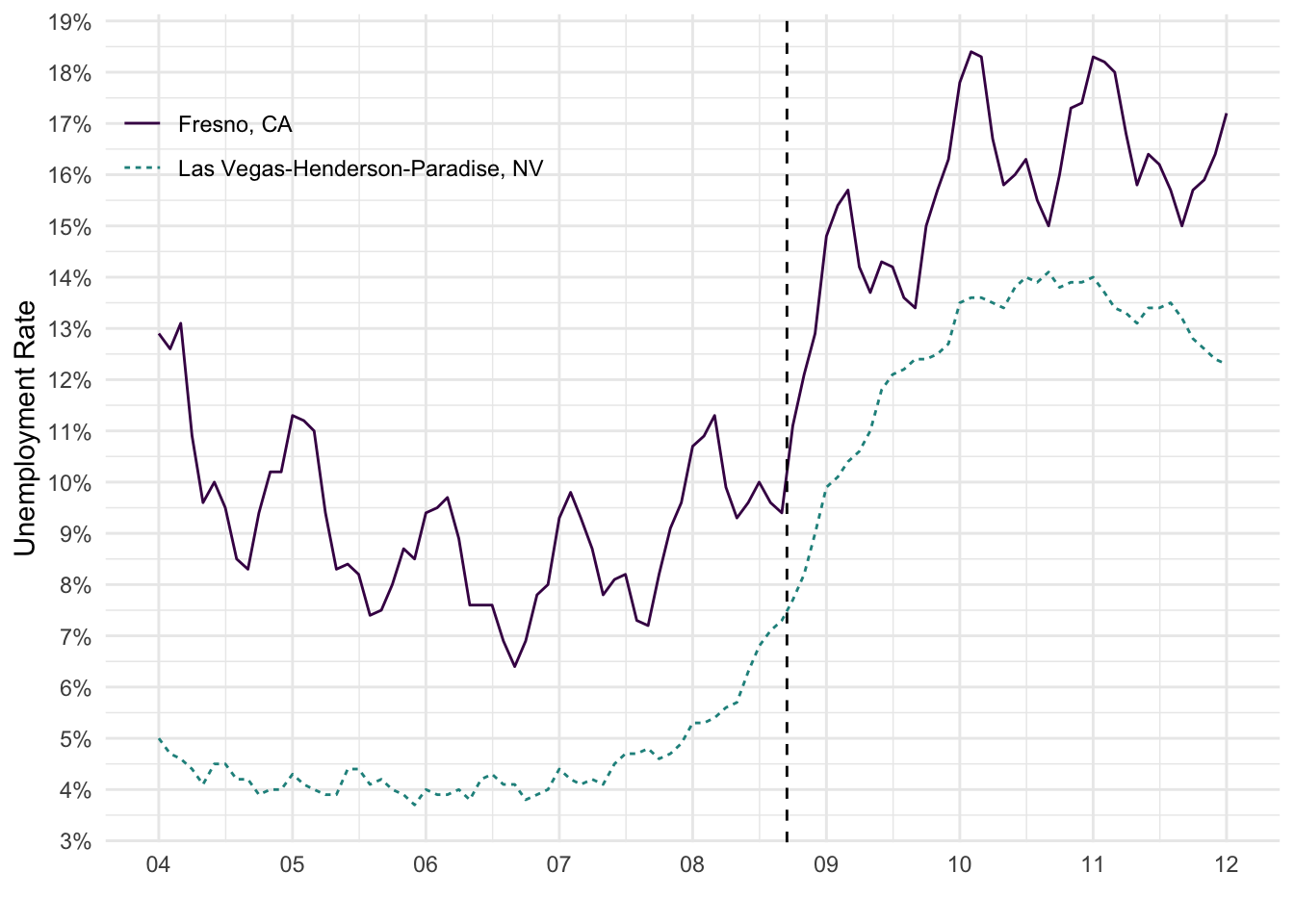

Unemployment

Important Dates

Two Important dates:

Start of the hiking cycle in June 2004, from 1% to 1.25%: https://money.cnn.com/2004/06/30/news/economy/fed_decision/.

End of the hiking cycle at 5.25%, in September 2007: https://money.cnn.com/2007/09/18/news/economy/fed_rates/index.htm

Fed Hiking Cycle

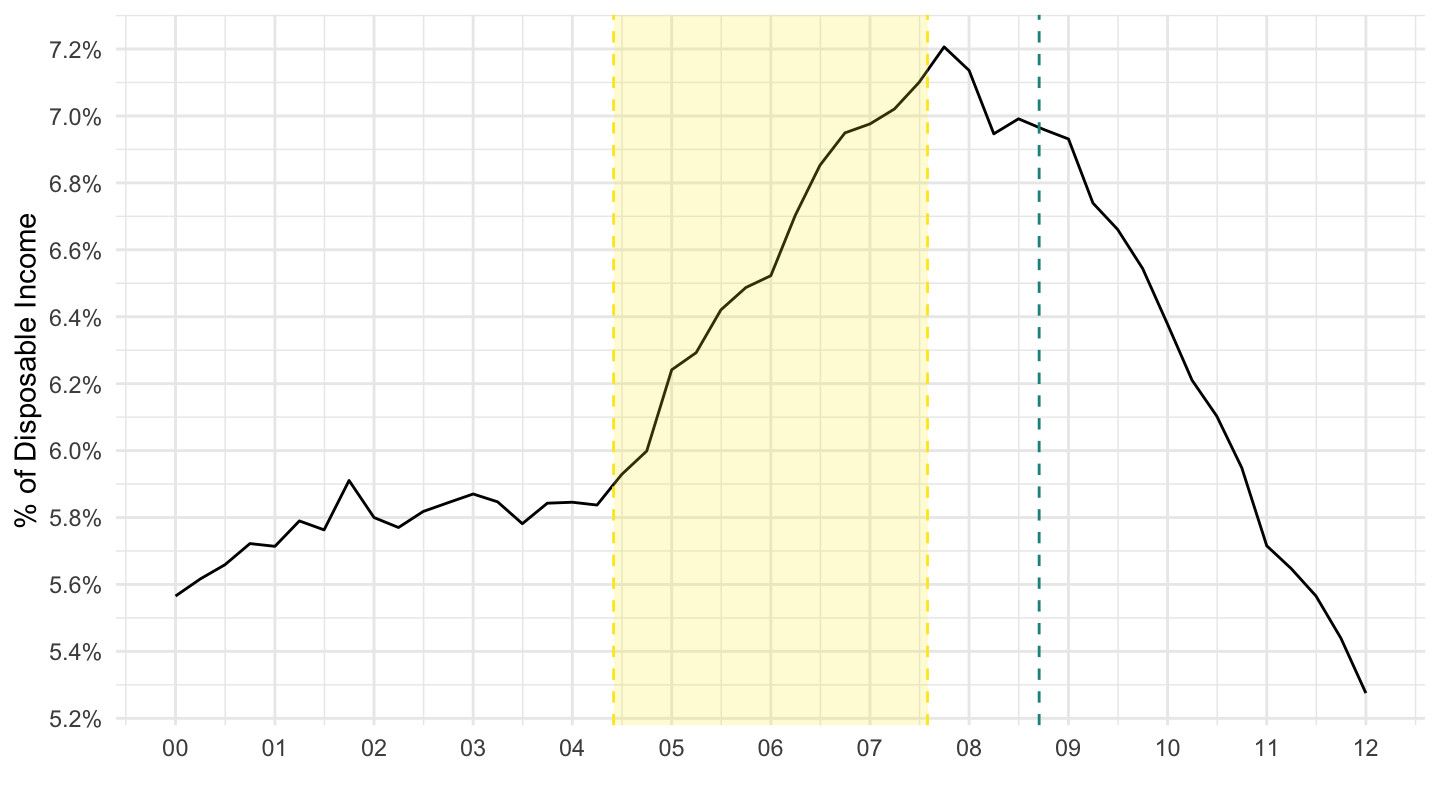

Debt Service Payments

These increases in the Federal Funds Rates caused rising mortgage payments for homeowners.

Debt Service Payments as a % of disposable income: https://www.federalreserve.gov/releases/housedebt/default.htm.

Household Debt Service and Financial Obligations Ratios.

Mortgage Debt Service Payments (% Disp Inc)

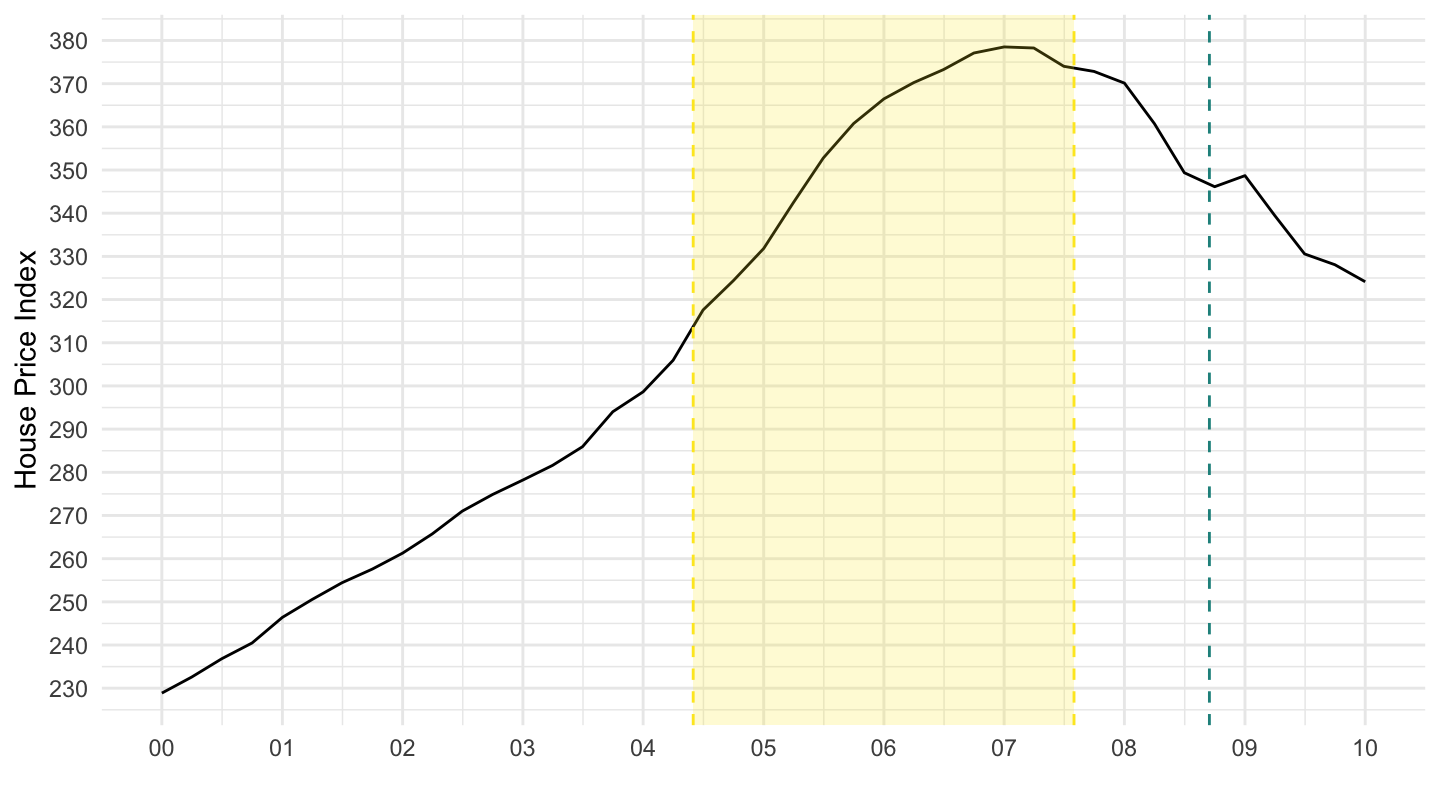

House Prices or Mortgage Payments ?

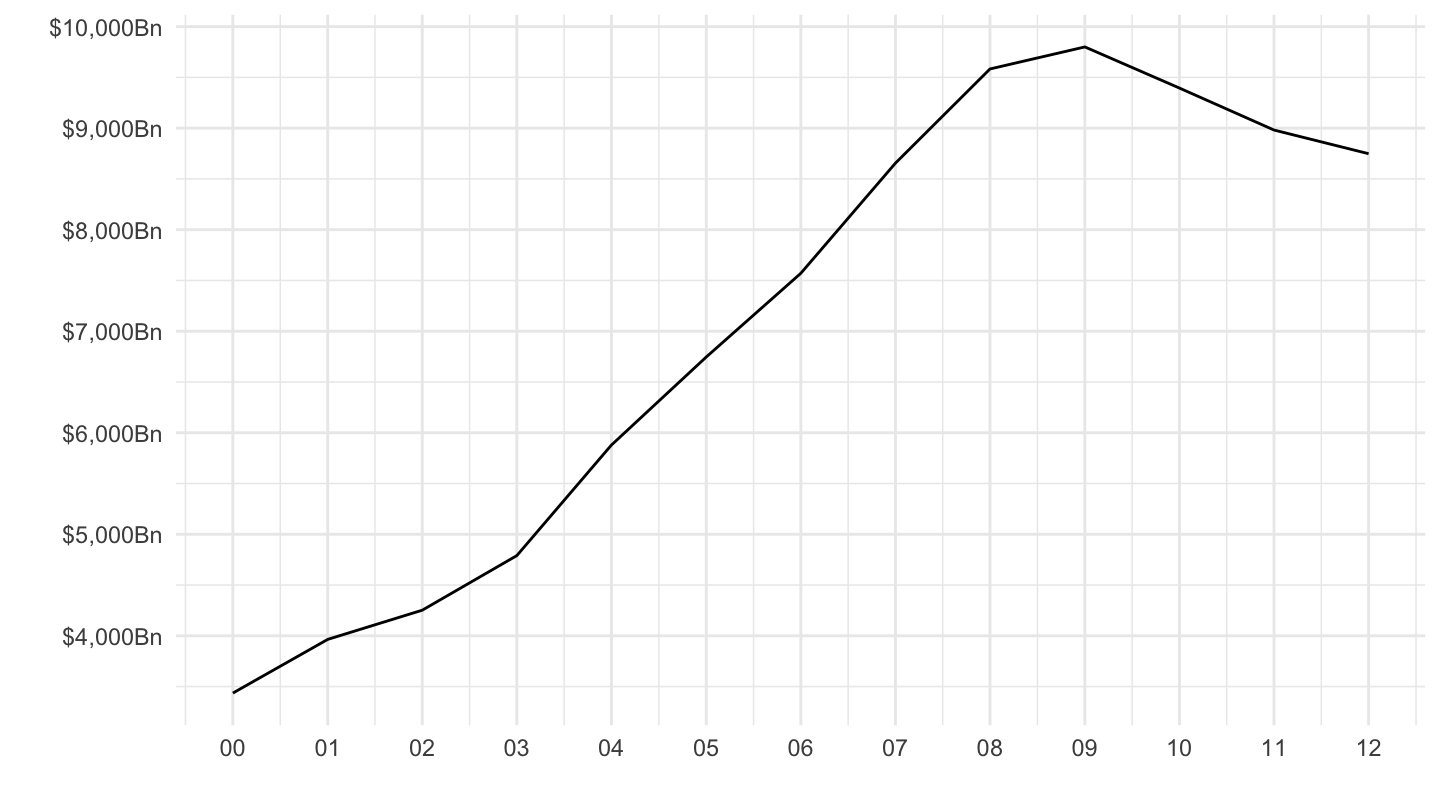

Aggregate Household Credit (New York Fed)

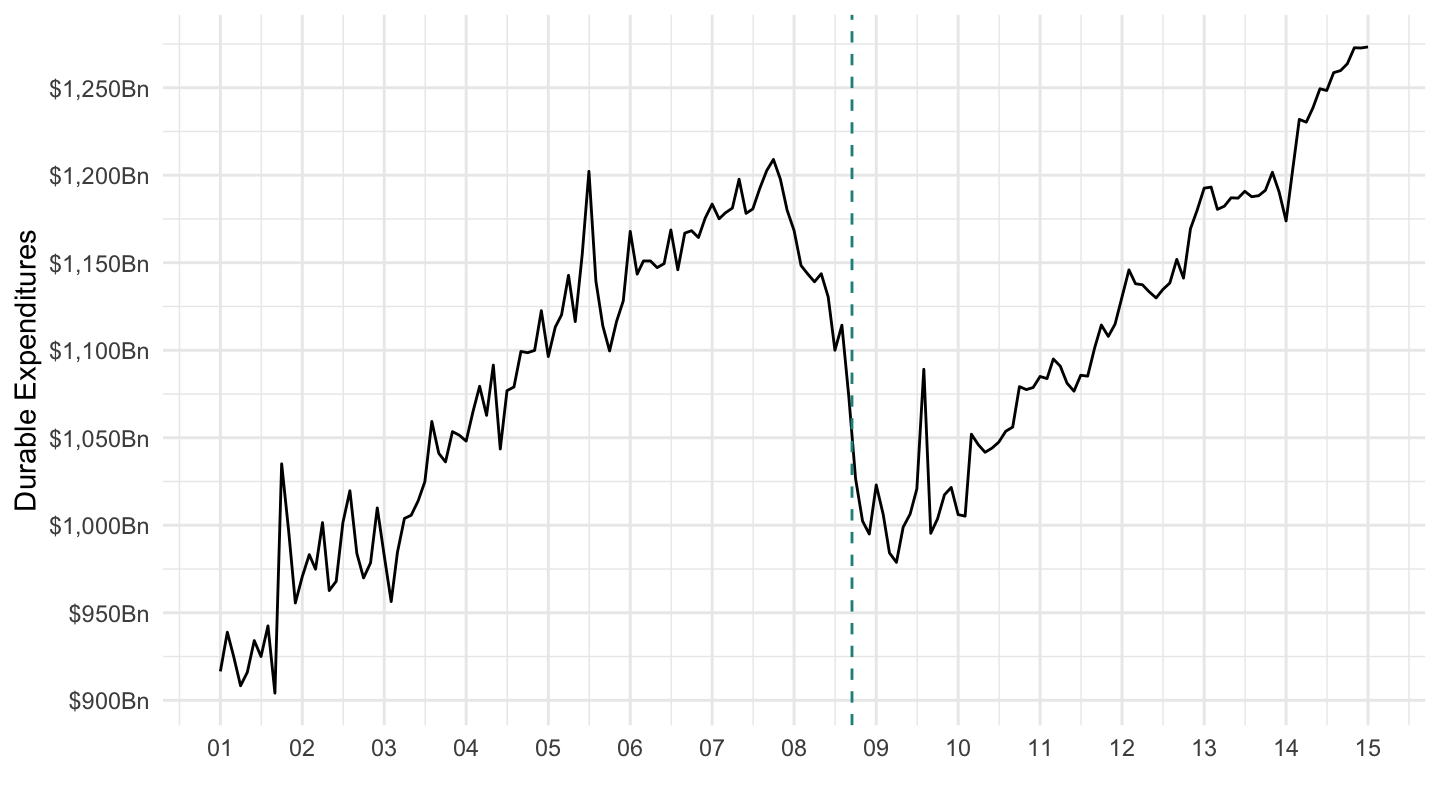

Durable Expenditure

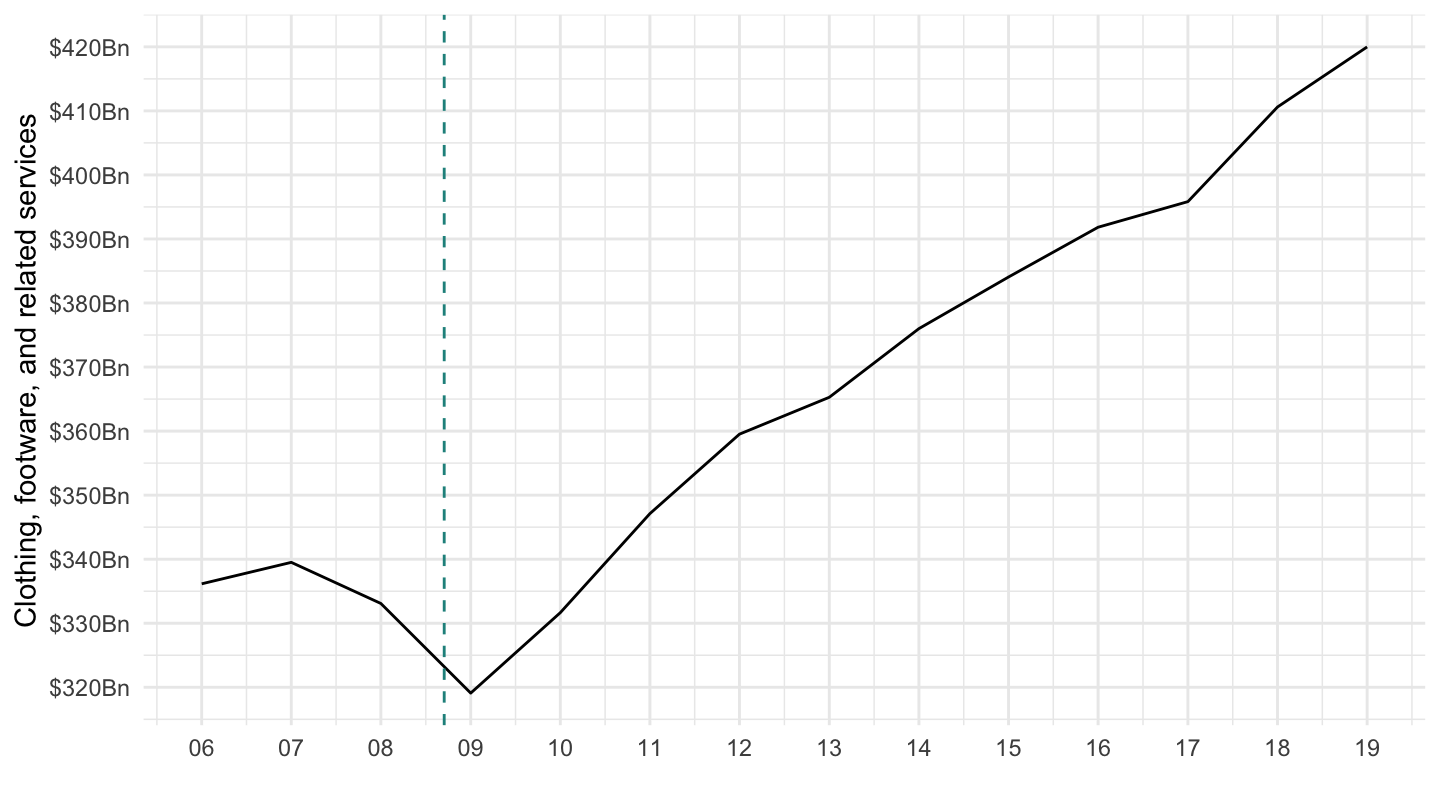

Clothing

Back to Michael Burry

Back to Square One

I started out the course with UCLA Alumni Michael Burry.

In his 2012 Commencement Speech, he was very critical:

of traditional education he had received in economics.

of mainstream economics and finance.

I hope you can know understand his views with a fresh eye.

I do not agree with everything he says, and particularly about his very critical view of government / private debt. As I told you, there’s a reason why finance is so unstable, and governments borrow so much: there is “too much” money in the world.

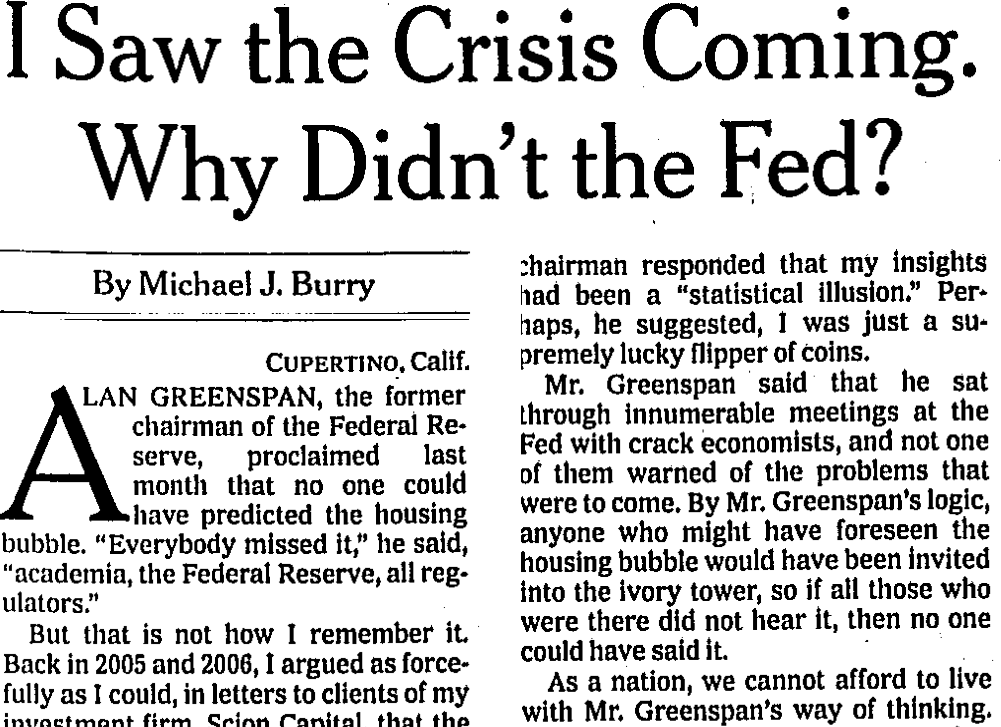

I saw the crisis coming, why didn’t the Fed ?

Video of Commencement Speech

Quote

In 2010 I published an op-ed in the New York Times posting what I thought was a valid question of the Federal Reserve, Congress, and the President. I saw the crisis coming … why did not the Fed? Never did any member of Congress, any member of government for the matter, reach out to me for an open collegial discussion on what went wrong or what could be done. Rather, within two weeks, all six of my defunct funds were audited. The Congressional Financial Finance Inquiry Commission demanded all my emails and lists of people with whom I conversed going back to 2003, and a little later the FBI showed up. A million in legal and accounting costs and thousands of hours of time wasted – all because I asked questions. It seemed they would pump me at gun point or not at all. That summer the Federal Reserve put out a paper that concluded nothing in the field of economics or finance could have predicted what happened with regards to the housing bust and subsequent economic fallout.

Michael Burry’s letter

Secreenshot

Explanations

I think Michael Burry’s right that economists missed something.

Probably, as he said, because they were too busy “moving a pile of bricks.” (that is, publishing papers in prestigious journals, instead of paying attention to what was going on in the weeds of the financial system)

However, I hope you now have a more nuanced view of Michael Burry’s other ideas on public debt. My thesis is that there’s actually a lot of money in the world, and that it explains the kinds of financial excesses we appear to observe all the time, including the 2007-2009 financial crisis.

In any case, stay tuned ! Read The Economist, the great press, be curious.